Yesterday, the American indices performed differently. Both S&P 500 and NASDAQ 100 dropped heavily, but the Dow Jones Industrial Average was much stronger and showed mixed sentiment. During today’s Asian trading session all three of them went up, but this morning they started falling. From the data front, the Fed Chairman Jerome Powell will make a speech in the afternoon. Anyway, let’s move on to the analysis, S&P 500 first:

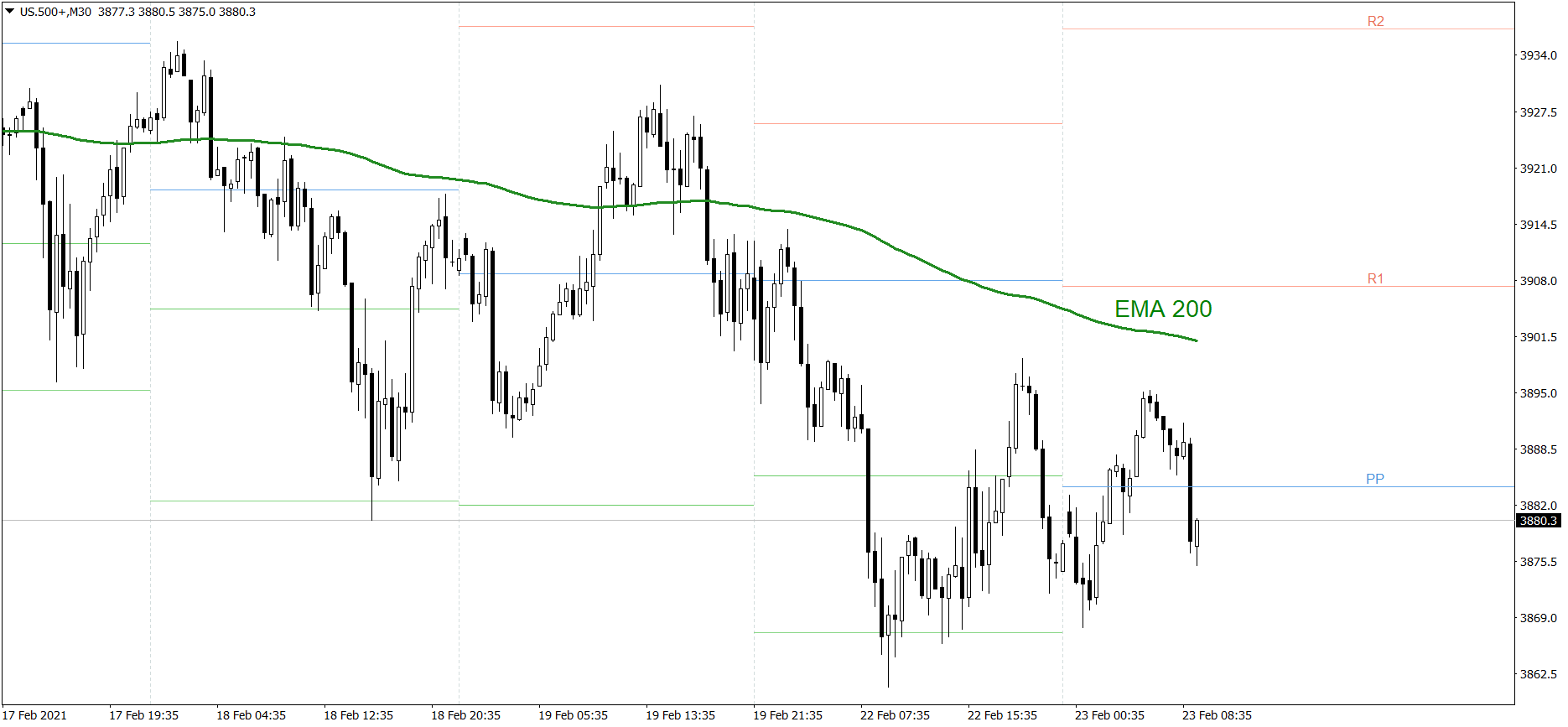

S&P 500

The S&P 500 dropped heavily yesterday. The price finished the day significantly below the S1 support level. During today’s Asian trading session it rose strongly, but this morning the price started falling once again. If the buyers don’t generate some serious appetite pretty soon, the price could even fall to 3850 today. But if they do, the price might rise to the EMA 200 and 3900 level today.

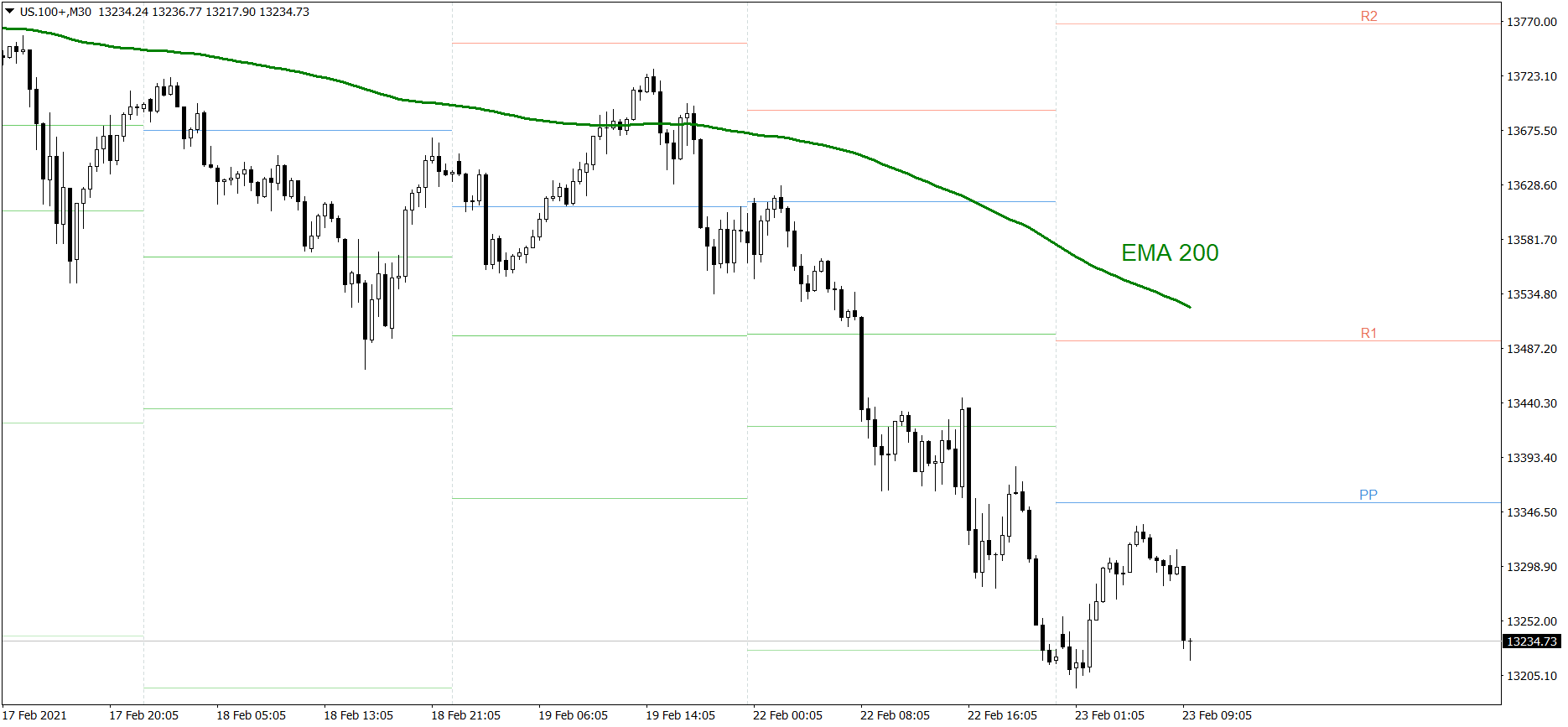

NASDAQ 100

The bears took complete control over the market yesterday. NASDAQ 100 shockingly dropped to the S3 support level. During today’s Asian trading session it rose strongly, but this morning the price started falling once again. If the buyers don’t generate some serious appetite pretty soon, the price could even fall to 13000 today. But if they do, the price might rise above the Pivot Point.

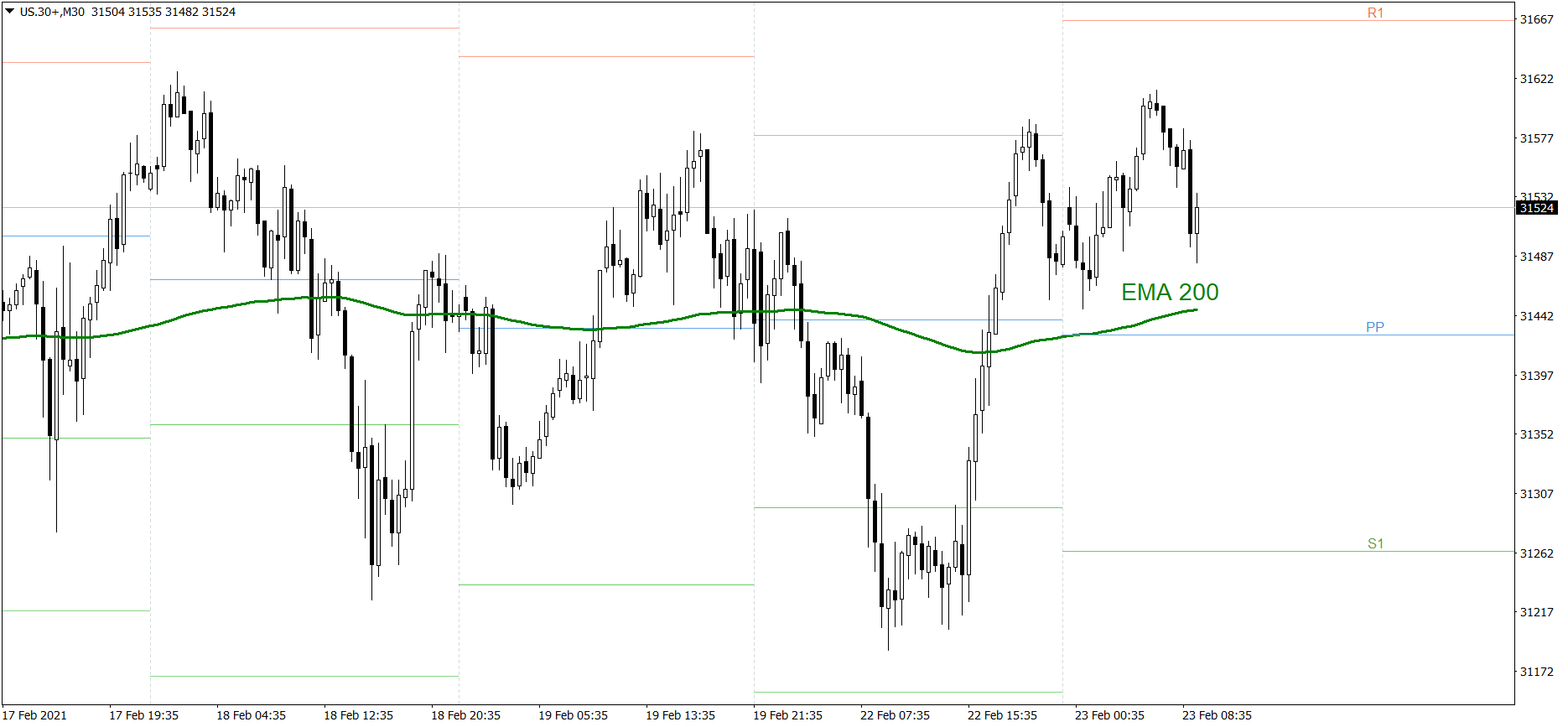

Dow Jones Industrial Average

The DJIA index was much stronger than the other two indices yesterday. First the price dropped below the S1 support level, but then it rose strongly above the EMA 200 and the Pivot Point. During today’s Asian trading session it significantly went up, but this morning the price started falling. If the buyers generate some sufficient demand, the price might even rise to the R1 resistance level and set the new all-time high. However, if the bears take control over the market, the price could drop below the EMA 200 and the Pivot Point.