On Friday, the American indices dropped heavily. The S&P 500 and the Dow Jones Industrial Average finished the last session of the week below their S2 support levels and the NASDAQ 100 went down below the EMA 200. Today, all three of them are showing mixed sentiment. What can they do next? Let’s try to answer that question in analysis, S&P 500 first:

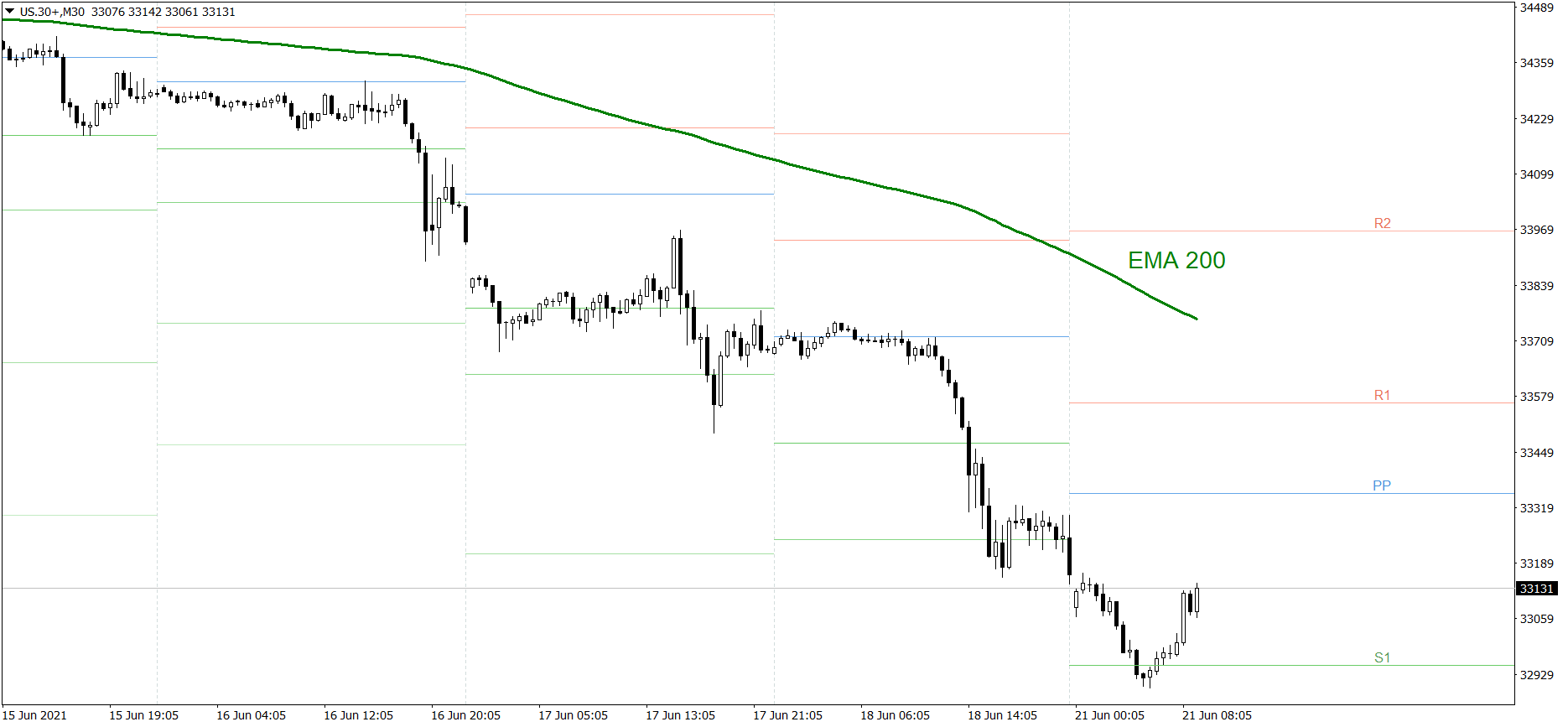

S&P 500

The S&P 500 dropped deeply on Friday. The price finished the last session of the week below the S2 support level. Today, during the Asian trading session, the price went down to the S1, but then it started rising. If the buyers continue generating sufficient demand, the price might go up above the Pivot Point today. But if the bears show their strength once again, the price could beat the S1 in the next hours.

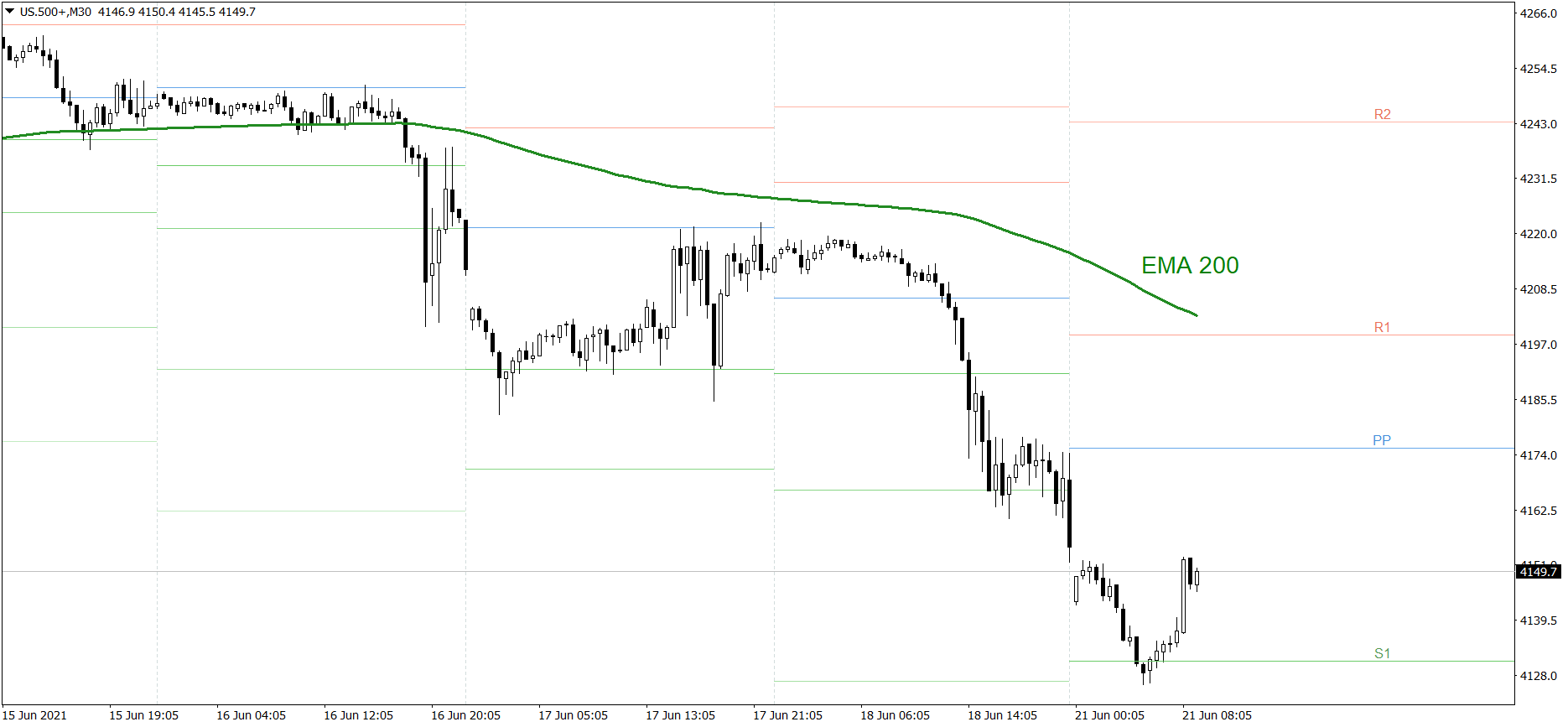

NASDAQ 100

NASDAQ 100 also dropped significantly on Friday. The price finished the session below the Pivot Point and the EMA 200. Today, during the Asian trading session, the price went down below 14000, but then it started rising. Right now it is above the EMA 200. If the buyers continue generating sufficient demand, the price might go up above the Pivot Point today. But if the bears show their strength once again, the price could fall to the S1 support level.

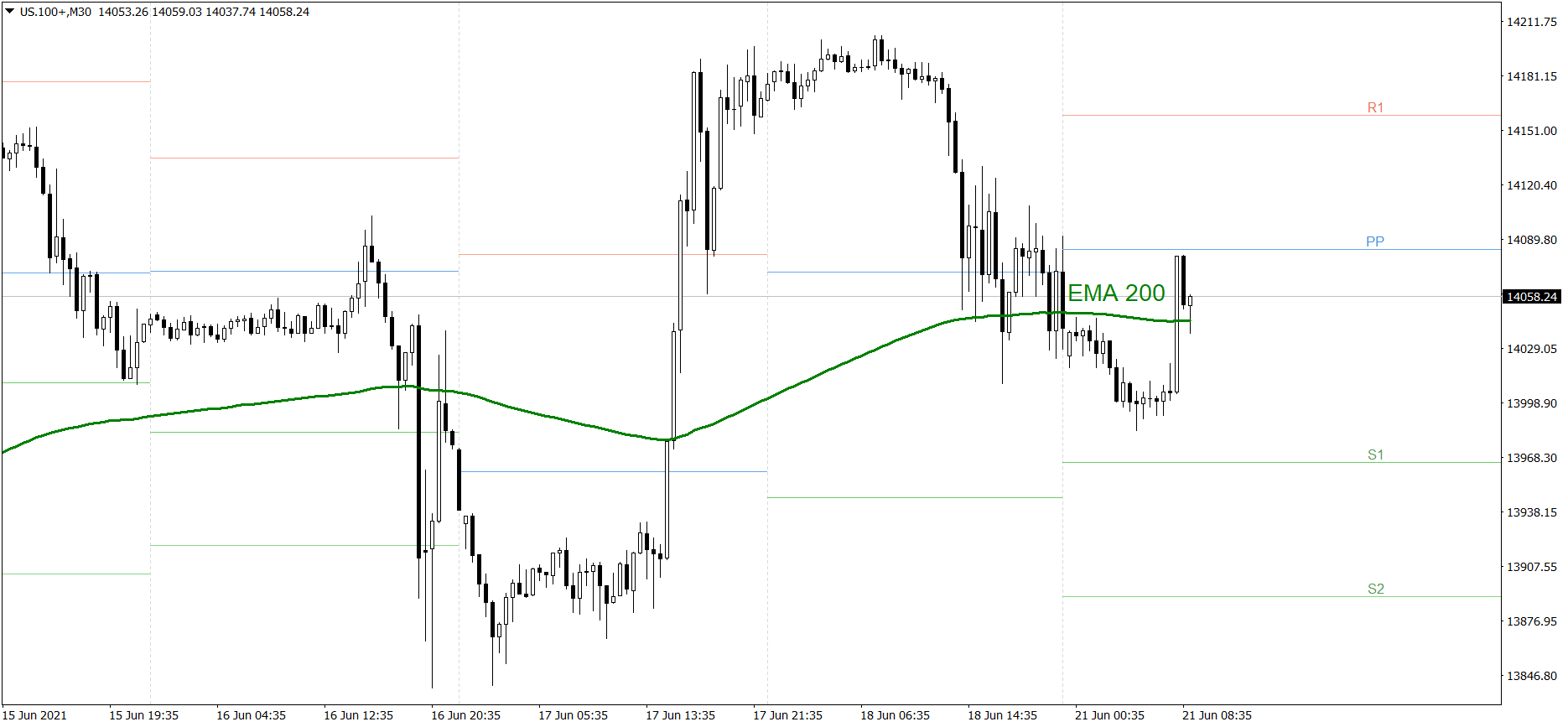

Dow Jones Industrial Average

The DJIA index went down heavily on Friday as well. The price finished the last session of the week below the S2 support level. Today, during the Asian trading session, the price attacked the S1, but then it started rising. If the buyers continue generating sufficient demand, the price might go up above the Pivot Point today. But if the bears show their strength once again, the price could beat the S1 and 33000 in the next hours.