Yesterday, the American indices rose strongly, because of the Fed’s monetary policy meeting. Both S&P 500 and Dow Jones Industrial Average set their new all-time highs. However, all three of them are falling heavily today. From the data front, weekly initial jobless claims and Philadelphia Fed manufacturing index in March will be published. Anyway, let’s move on to the analysis, S&P 500 first:

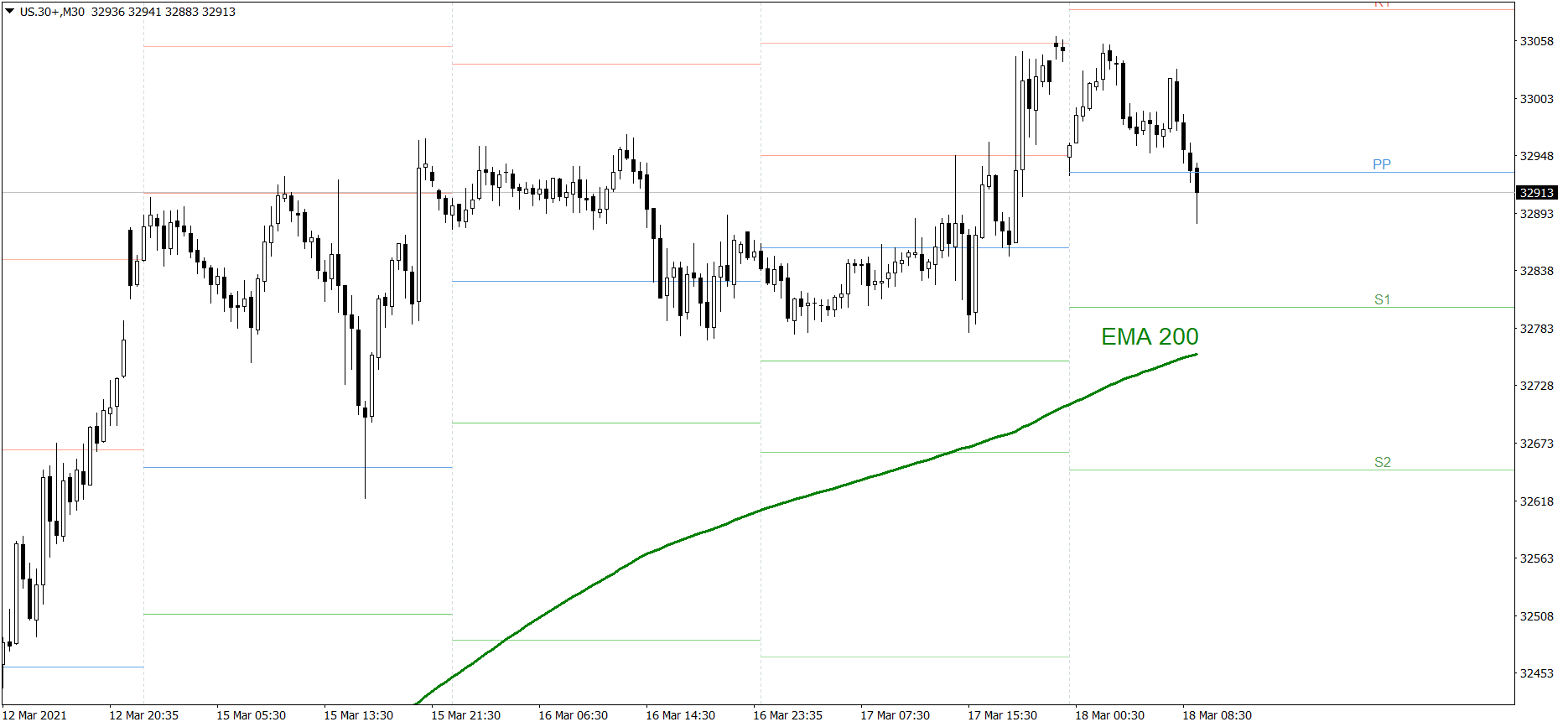

S&P 500

Yesterday’s session was very interesting. First, the S&P 500 dropped to the S2 support level. However, when the Fed’s monetary policy meeting started, the price rose strongly and set the new all-time high. The price is falling heavily today, though. Right now it’s testing the S1. If the buyers don’t generate some serious appetite there, the price could even drop to the S2. But if they do, the price might rise above the Pivot Point.

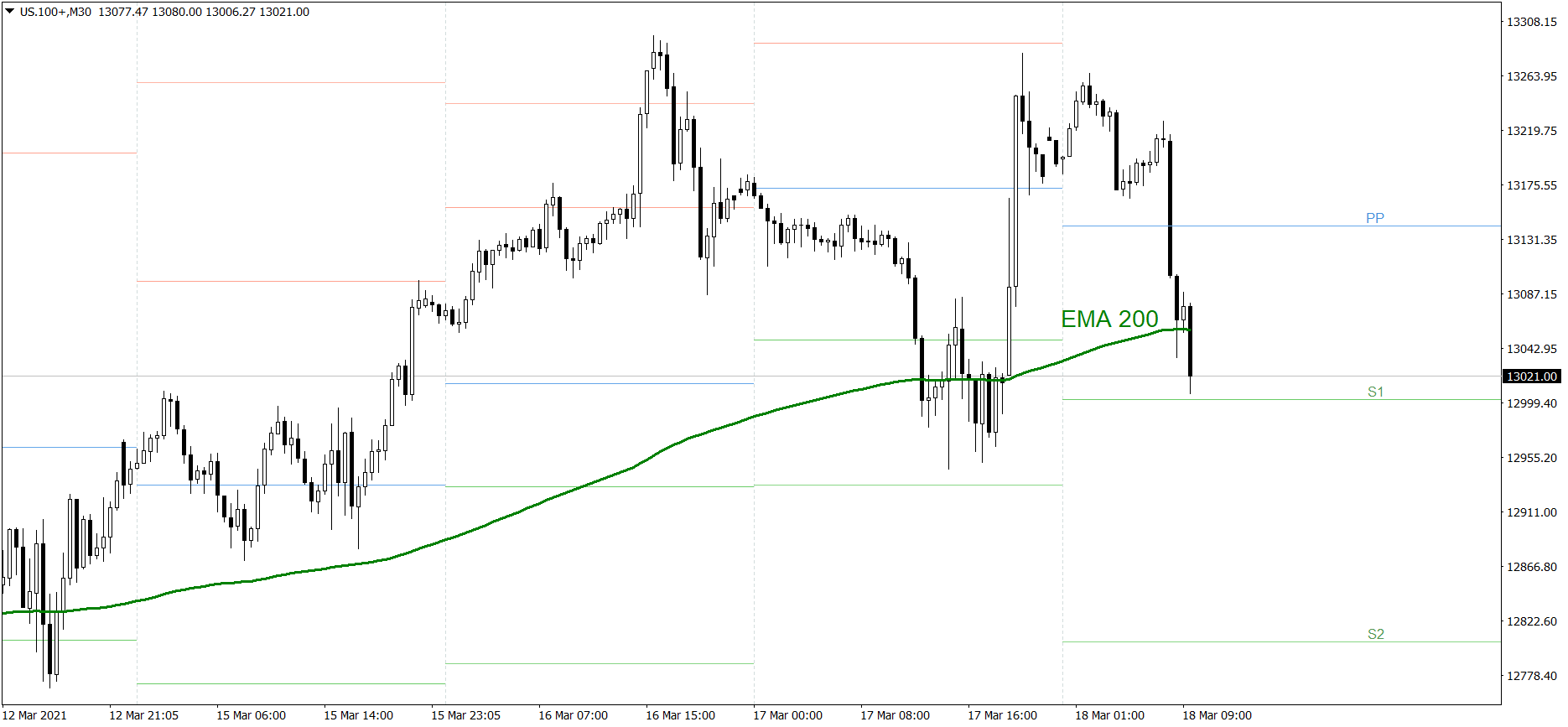

NASDAQ 100

NASDAQ 100 looked similar to the S&P 500 yesterday. First the price dropped below the S1 support level and the EMA 200. However, when the Fed’s monetary policy meeting started, the price rose strongly and finished the day above the Pivot Point. The index is falling heavily today, though. Right now it’s getting close to the S1. If the buyers don’t generate some serious appetite there, the price could even drop to the S2. But if they do, the price might rise above the Pivot Point.

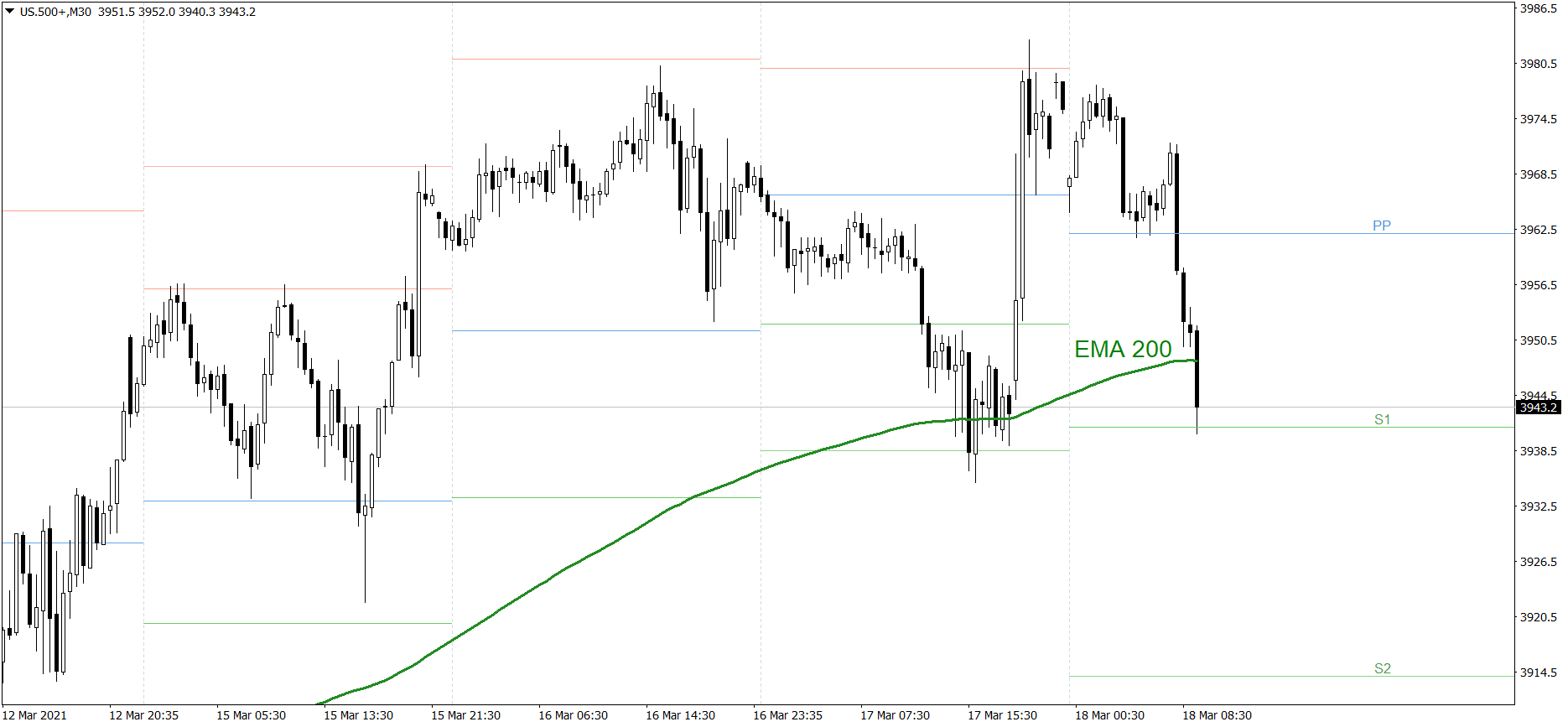

Dow Jones Industrial Average

The DJIA index was definitely the strongest one yesterday. The price rose strongly, set the new all-time high and finished the day above 33000 for the first time ever. However, it is falling heavily today. If the buyers don’t generate some serious appetite soon, the price could even drop below the S1 support level and reach the EMA 200. But if they do, the price might return above 33000.