Yesterday, the American indices performed differently. Dow Jones Industrial Average rose, S&P 500 showed mixed sentiment and NASDAQ 100 dropped. Today all three of them are going down, though. From the data front, some important publications will be released in the US, such as building permits in January, Philadelphia Fed manufacturing index for the February and weekly initial jobless claims. Anyway, let’s move on to the analysis, S&P 500 first:

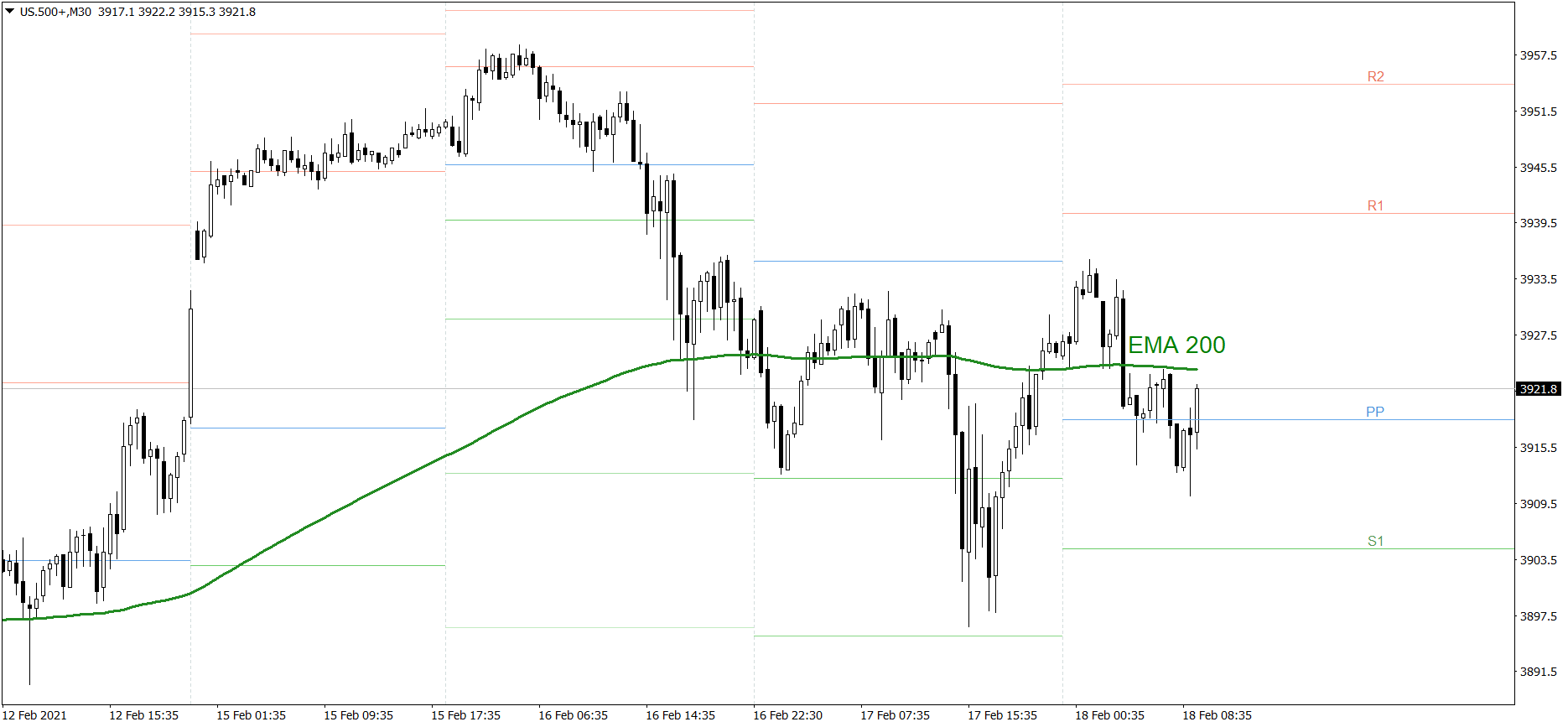

S&P 500

The S&P 500 showed mixed sentiment yesterday. In the afternoon the price dropped below 3900, but then it managed to rise and finished the day above the EMA 200. During today’s Asian trading session the price went down once again, but this morning it started rising. It’s getting close to the EMA 200 right now. If the bulls show their strength and beat it, the price might rise even more and test the R1 resistance level today. But if they fail, the price could fall below 3900.

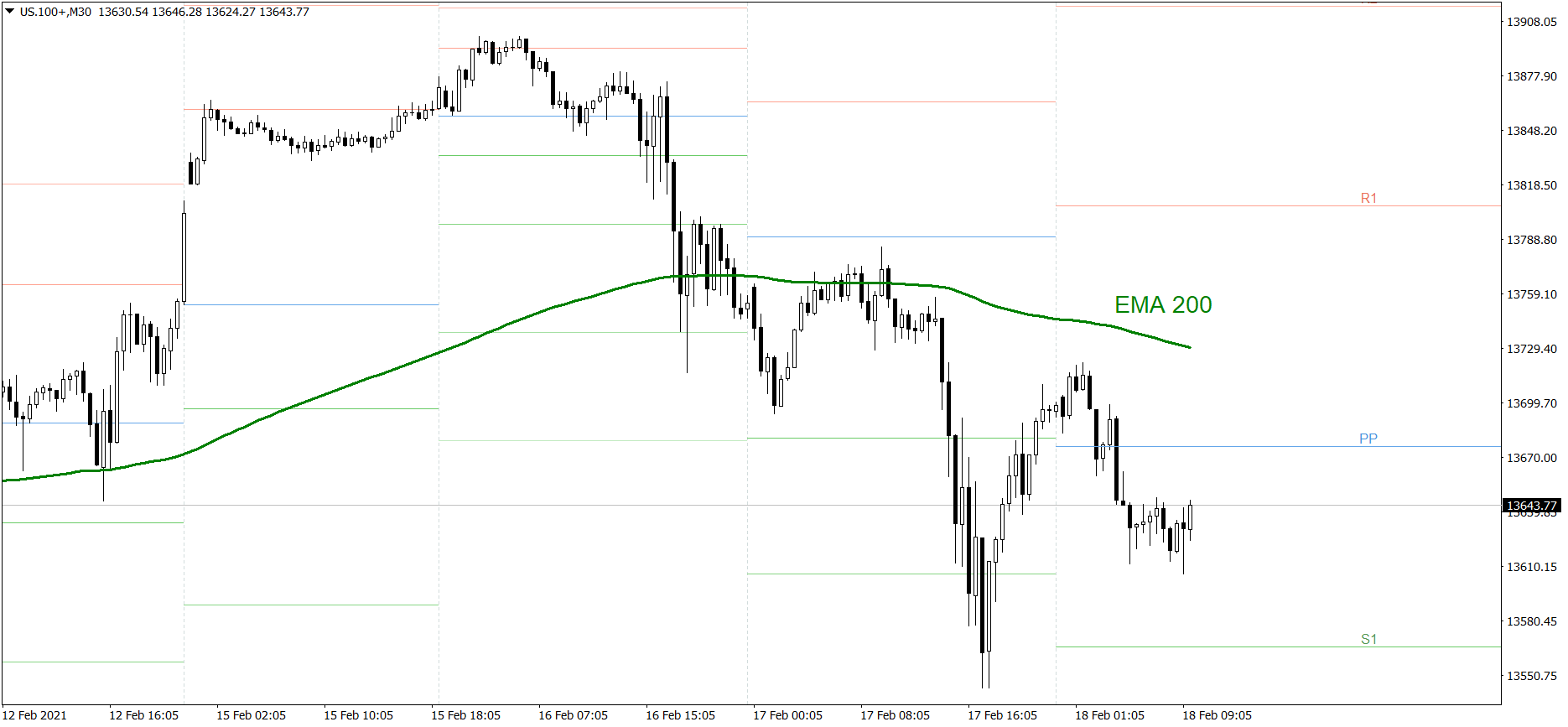

NASDAQ 100

Yesterday wasn’t the best session for the NASDAQ 100. The price dropped below the S2 support level, then it managed to rise and finished the day slightly above the S1. Today it is going down once again. If the bulls don’t generate some serious appetite pretty soon, the price could fall below the S1. But if they do, the price might rise to the EMA 200.

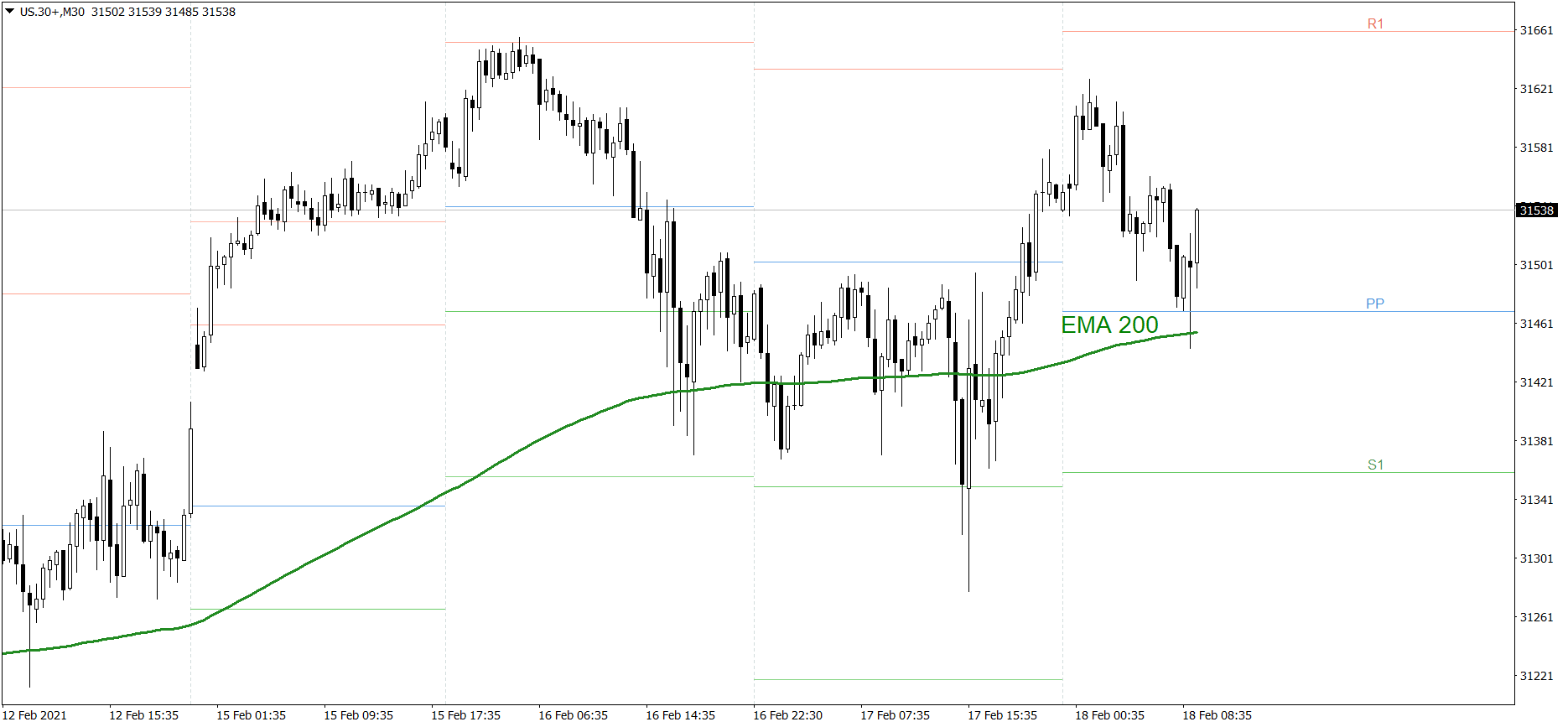

Dow Jones Industrial Average

The DJIA index is definitely the strongest one this week. Yesterday the price significantly went up. During today’s Asian trading session the price dropped a bit and tested the EMA 200, but this morning it started rising. If the buyers continue generating sufficient demand, the price might reach the R1 resistance level today. But if the bears counterattack, the price could fall below the EMA 200.