Yesterday, the American indices performed differently. The S&P 500 showed mixed sentiment, the NASDAQ 100 managed to rise significantly and the Dow Jones Industrial Average dropped slightly. Today all three of them are falling slowly. From the data front, all eyes will be focused on the Fed’s monetary policy decision today. Markets may expect the Fed to increase the QE programme in order to counter the recent rapid rise in long-term yields that threaten normal recovery as access to cheap liquidity diminishes. This means that volatility in the late afternoon might be extreme. Anyway, let’s start the analysis, S&P 500 first:

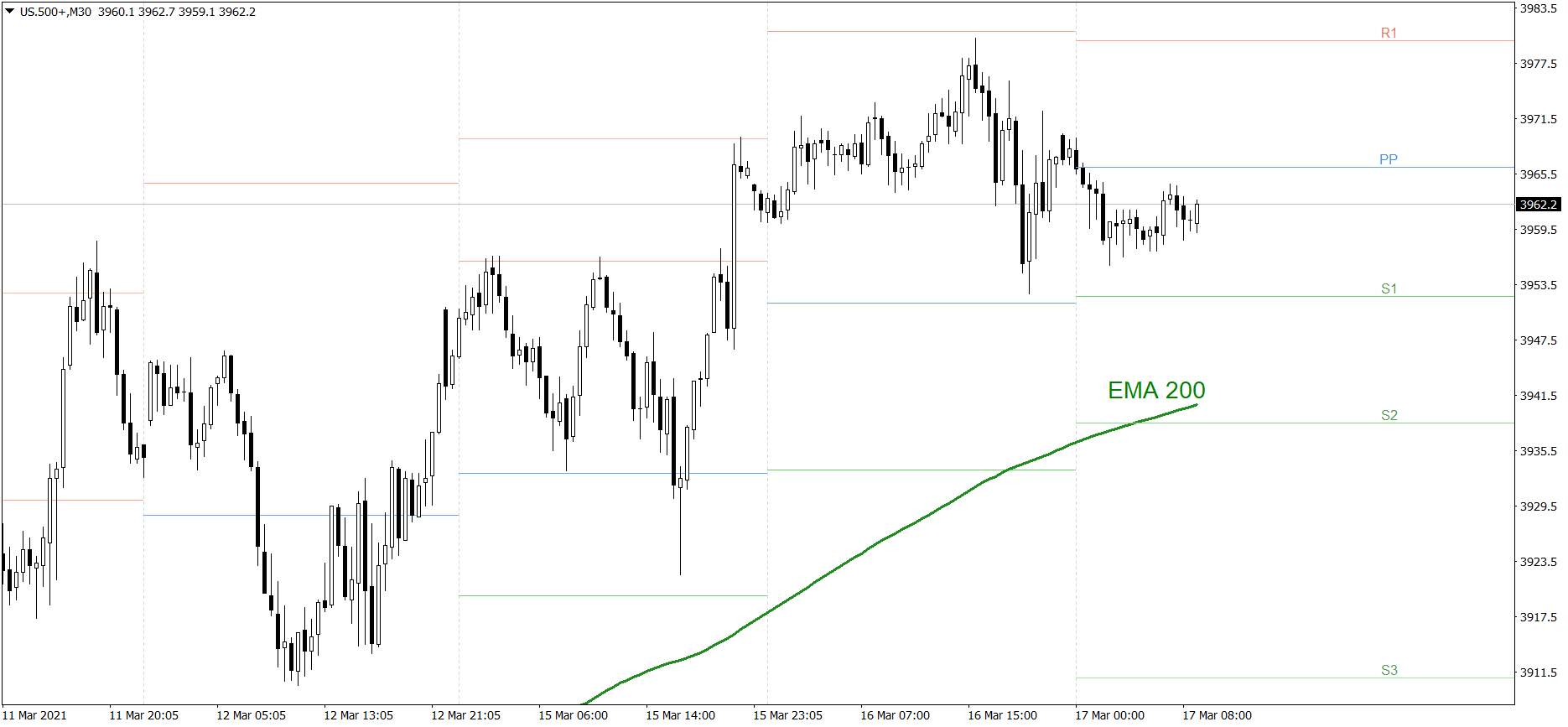

S&P 500

The S&P 500 showed mixed sentiment yesterday. First the price went up and set the new all-time high, then it dropped a bit. In the end nothing has really changed after yesterday’s session. However, the price is slightly going down today. If the buyers don’t generate some strong appetite soon, the price could fall below the S1 support level. But if they do, the price might even rise to the R1 resistance level.

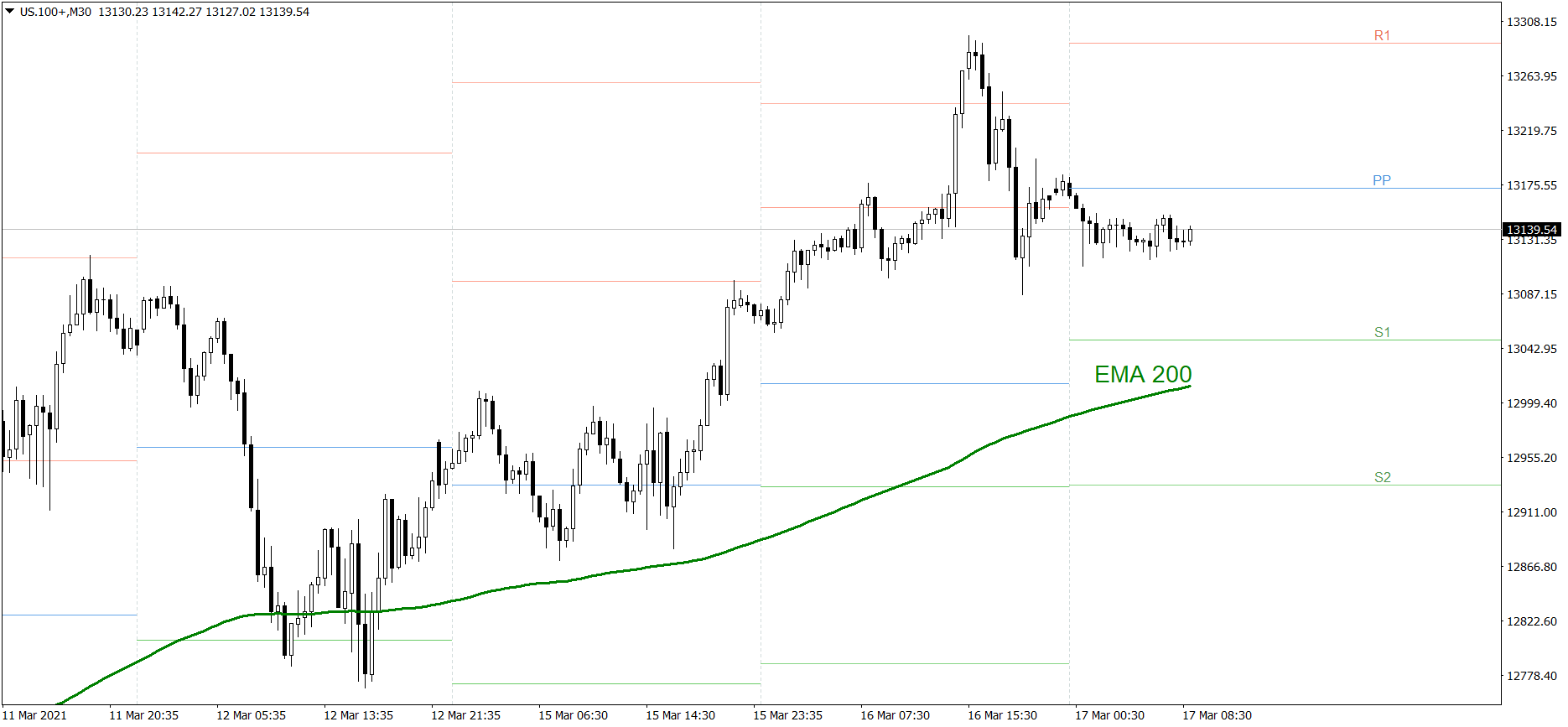

NASDAQ 100

Yesterday was a good bullish session for the NASDAQ 100. First the price rose above the R2 resistance level. Then, in the afternoon, it dropped a bit, but the index still finished the day above the R1. Today, the price is slowly going down, though. If the buyers don’t generate some strong appetite soon, the price could reach the S1 support level today. But if they do, the price might even rise to the R1.

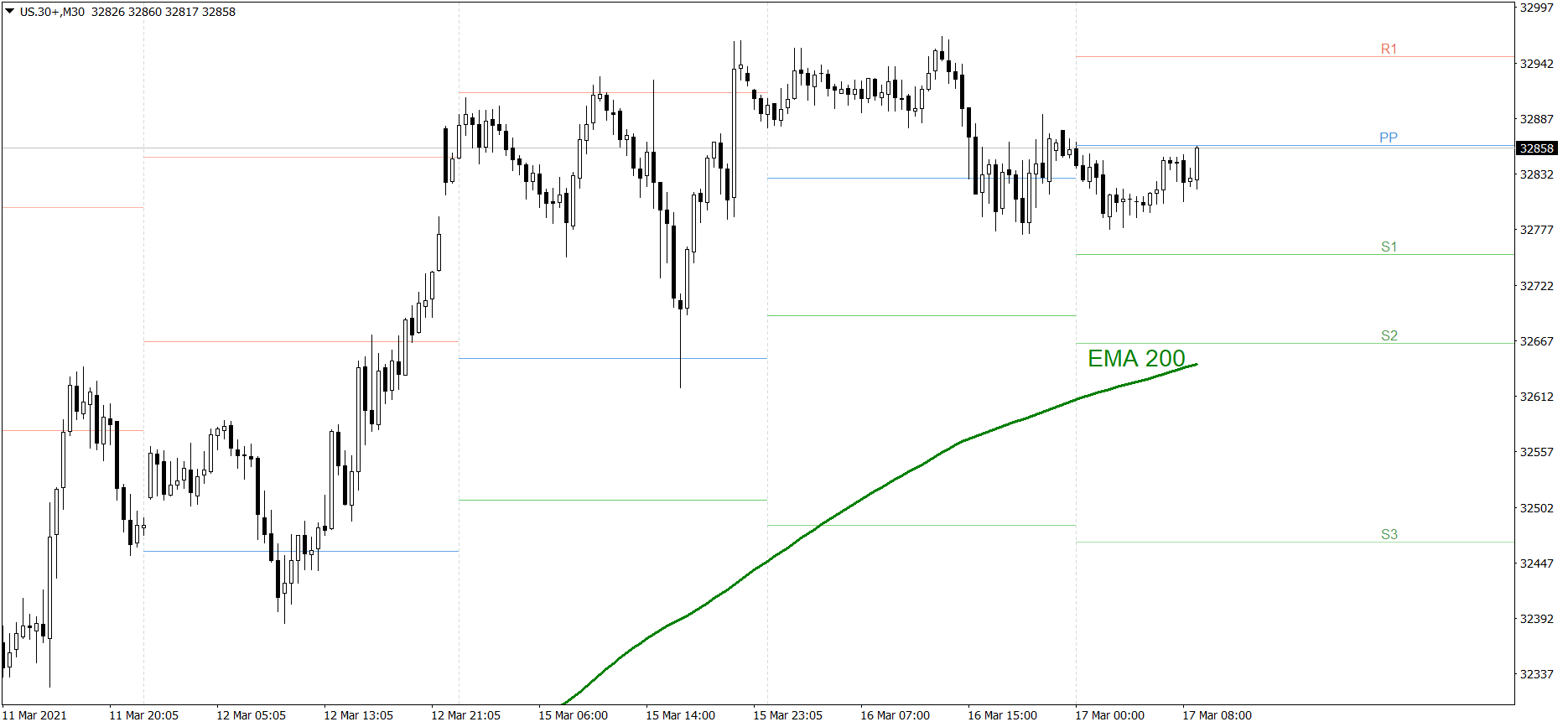

Dow Jones Industrial Average

The DJIA index was the weakest one yesterday. The price dropped a bit, but it still finished the day above the Pivot Point. During today’s Asian trading session, the price dropped even more, but this morning it started rising. If the buyers continue generating sufficient demand, the price might rise to the R1 resistance level today. But if they fail, the price could even drop to the S2 support level and the EMA 200.