Yesterday the market was closed in the US, because of Presidents’ Day, but the American indices opened significantly higher after the weekend, then went up a bit and set the new all-time highs. Today they are showing mixed sentiment. What can they do next? Let’s try to answer that question in an analysis, S&P 500 first:

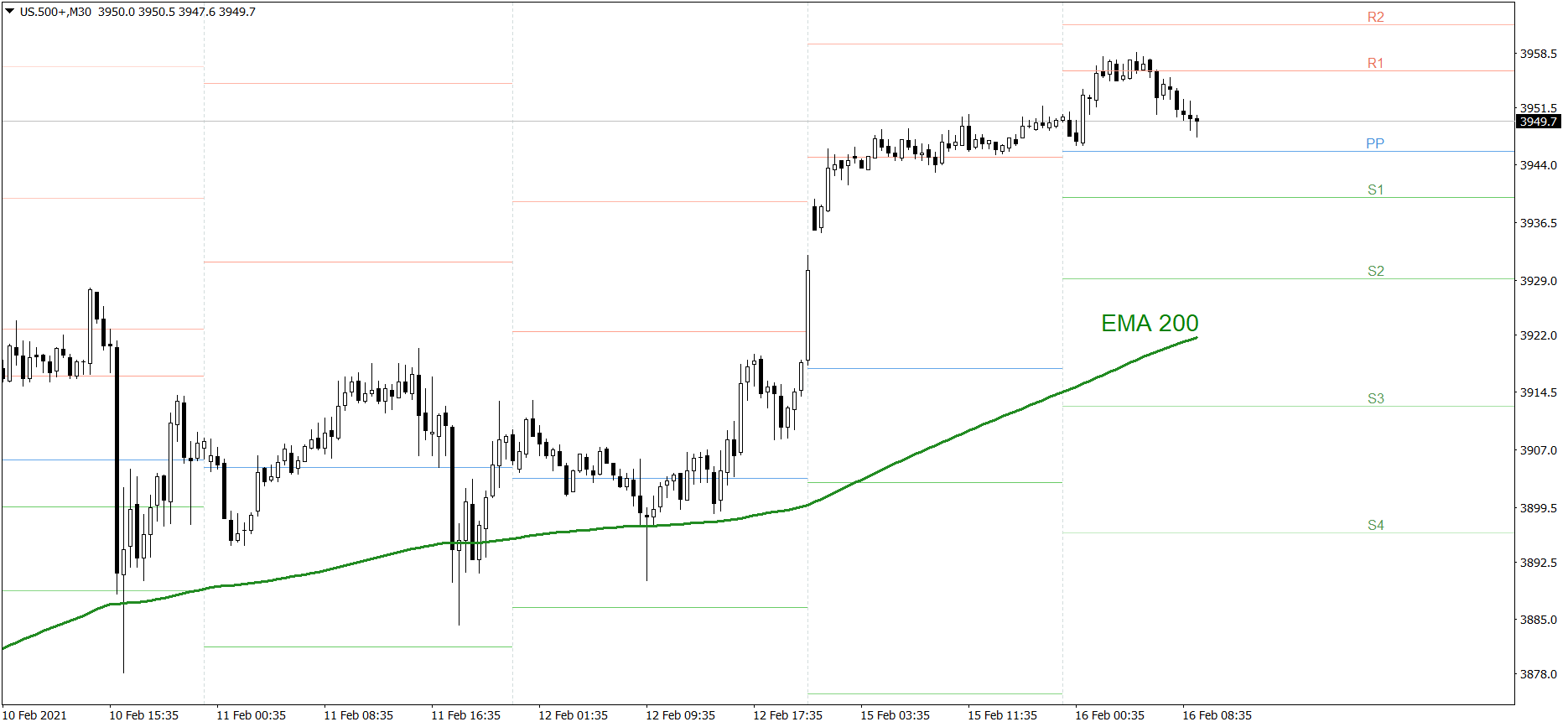

S&P 500

The S&P 500 opened much higher after the weekend. Then it slightly went up and finished the day above the R1 resistance level, setting the new all-time high. During today’s Asian trading session, the price tested the R1. However, this morning it started falling and right now it is getting close to the Pivot Point. If the bulls generate some real appetite, the price might reach the R2 today. But if the bears are stronger today, the price could fall below the S1 support level.

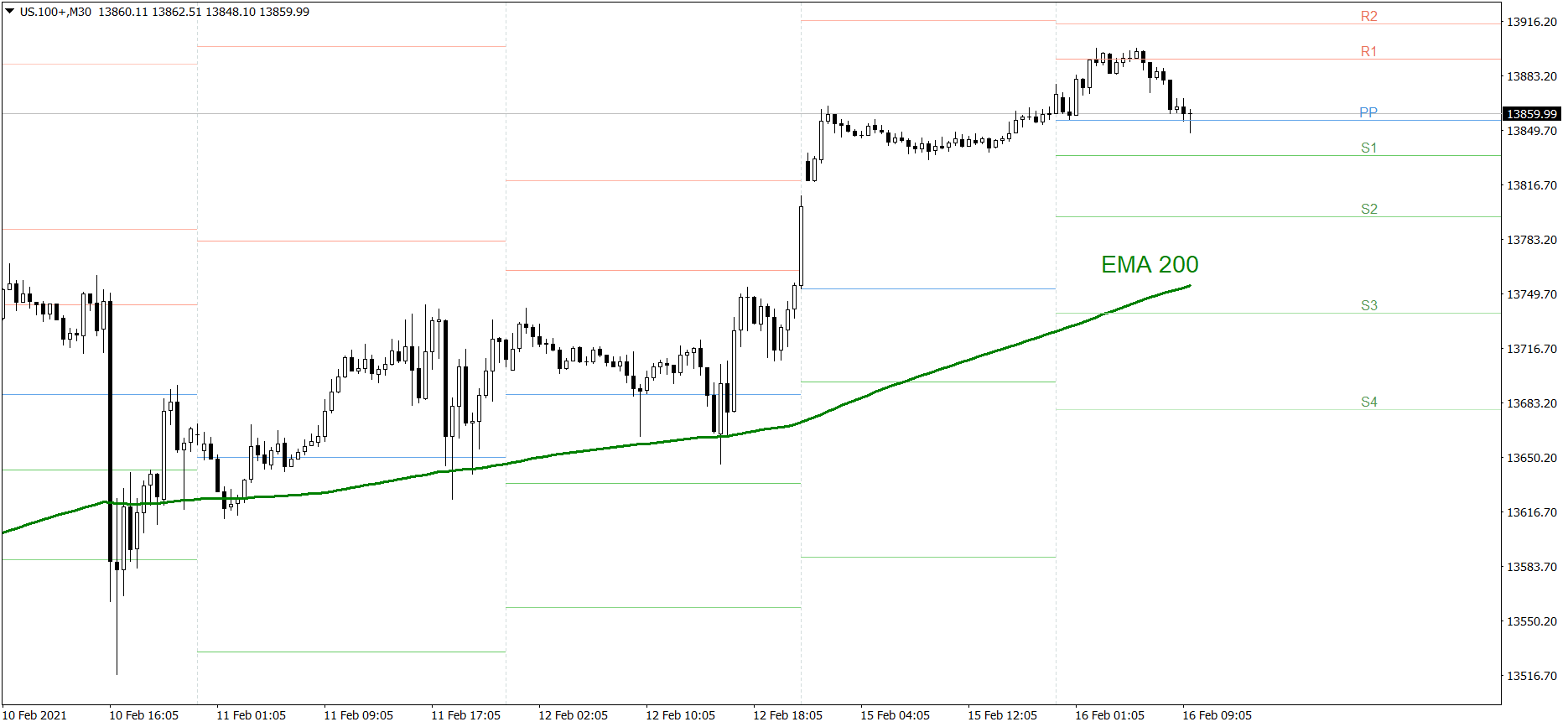

NASDAQ 100

NASDAQ 100 also opened significantly higher after the weekend. Then it slightly went up and finished the day above the R1 resistance level, setting the new all-time high. During today’s Asian trading session, the price tested the R1. However, this morning it started falling and right now it is getting close to the Pivot Point. If the bulls generate some real appetite, the price might reach the R2 today. But if the bears are stronger today, the price could fall to the S2 support level.

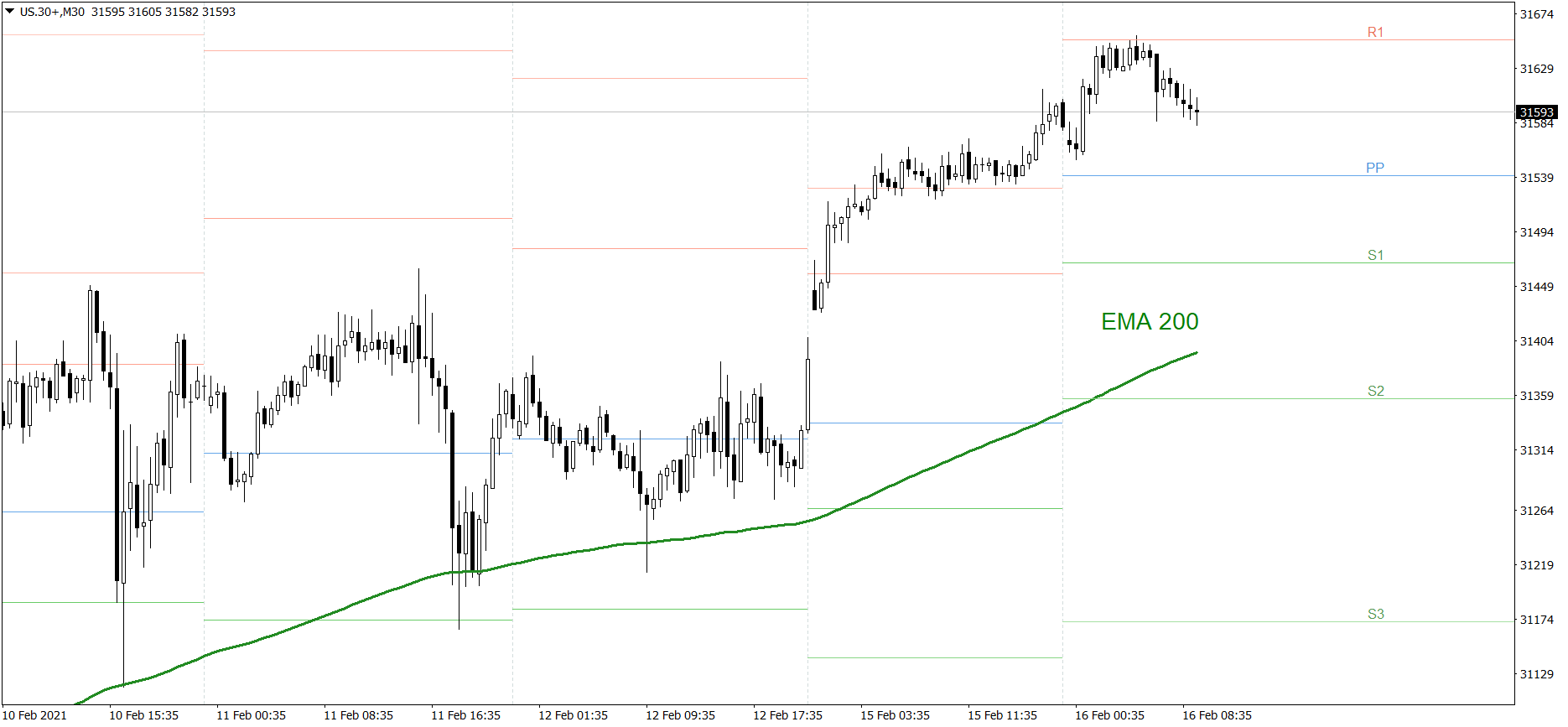

Dow Jones Industrial Average

The DJIA index was even stronger yesterday. First, the price opened much higher after the weekend. Then it significantly went up and finished the day above the R2 resistance level, setting the new all-time high. During today’s Asian trading session, the price tested the R1. However, this morning it started falling. If the bulls generate some real appetite once again, the price might rise above the R1 today. But if the bears show their strength today, the price could fall to the S1 support level.