Yesterday, the American indices performed differently. NASDAQ 100 was the strongest one, it rose above 13990 and set the new all-time high. S&P 500 also went up significantly and set the new all-time high. However, the Dow Jones Industrial Average dropped. Today, the S&P 500 and NASDAQ 100 are rising slowly and the DJIA index is showing mixed sentiment. With little economic data releases of note, today’s focus will be on a number of major central bank speakers. In particular, US Federal Reserve Chairman Jerome Powell is scheduled to speak in the afternoon. Anyway, let’s start the analysis, S&P 500 first:

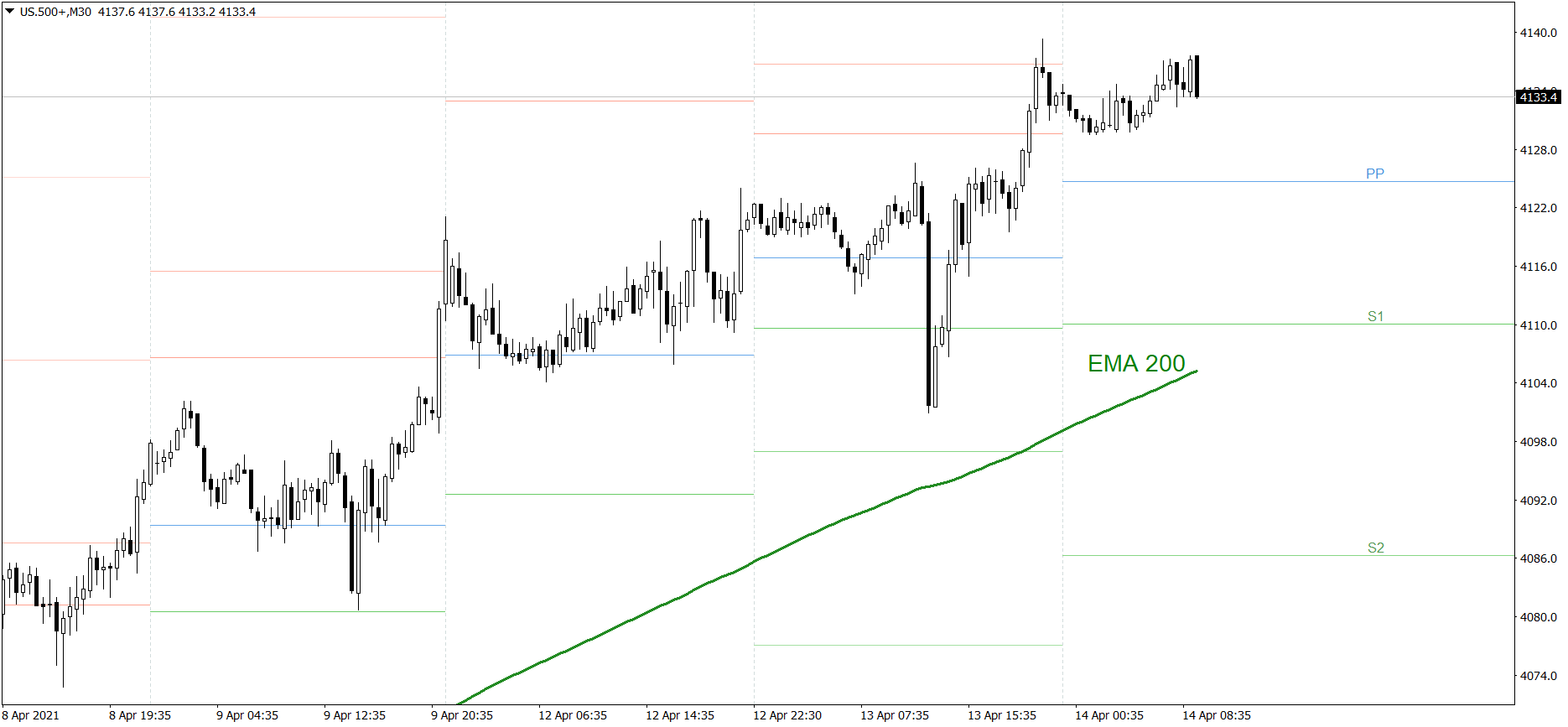

S&P 500

That was a very interesting session yesterday. First the S&P 500 dropped below the S1 support level, then it rose significantly, set the new all-time high and finished the day close to the R2 resistance level. Today the price is rising slowly, but the volatility is rather low. If the buyers continue generating sufficient demand, the price might reach 4150 today. But if the bears counterattack, the price could fall below the Pivot Point.

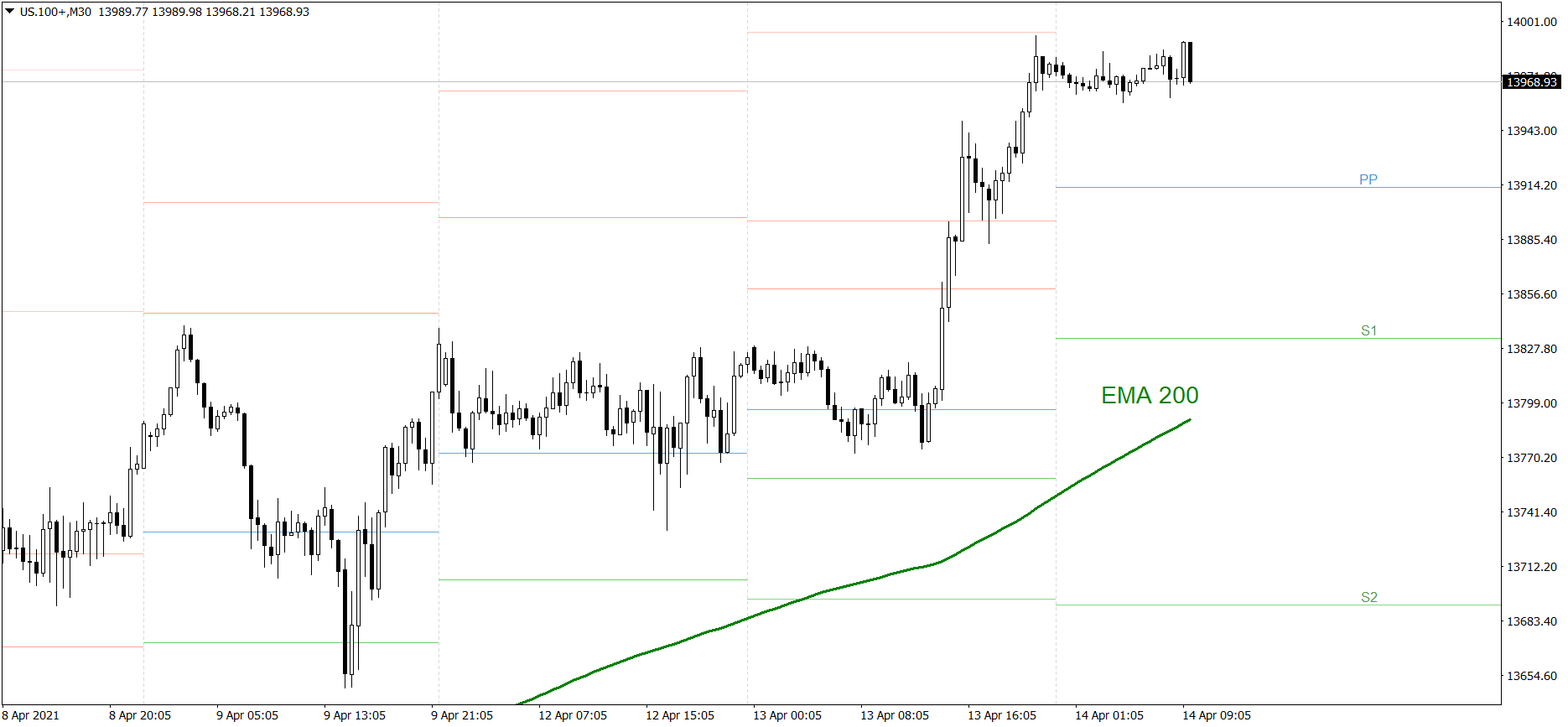

NASDAQ 100

Yesterday was a fantastic bullish session for the NASDAQ 100. The price rose strongly, set the new all-time high and finished the day a little below the R3 resistance level. Today it is showing mixed sentiment. If the buyers are able to generate some strong appetite once more, the price will successfully attack 14000 and stay above that level. But if the bears show their strength, the price could drop to the Pivot Point.

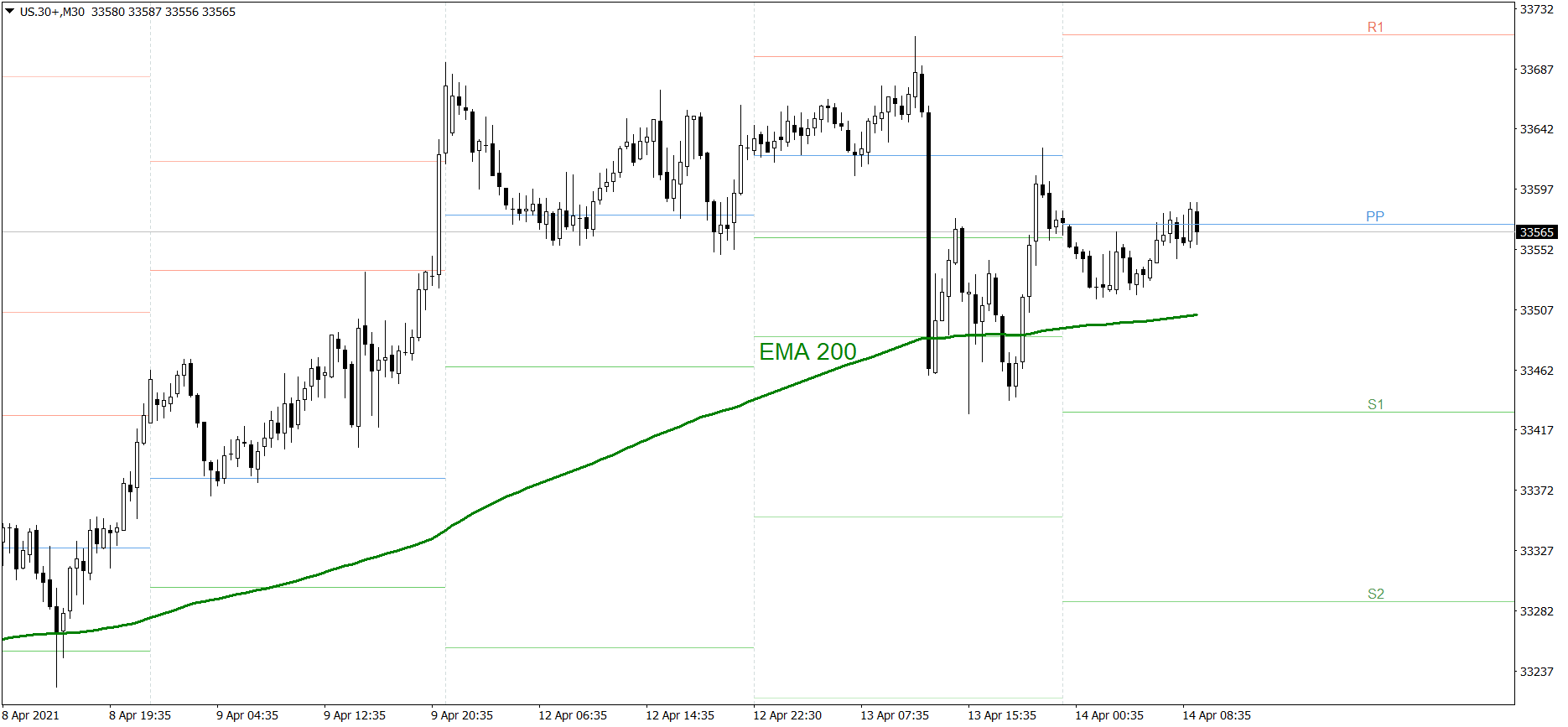

Dow Jones Industrial Average

The DJIA index was much weaker yesterday. However, it set the new all-time high and tested the R1 resistance level first. Then, it dropped deeply and finished the session at the S1 support level. Today it is showing mixed sentiment. If the buyers are able to generate some strong appetite, the price might reach the R1 today. But if the bears show their strength once again, the price could fall to the S1.