Yesterday, the American indices showed pretty low volatility. The prices didn’t change much, but the S&P 500 managed to set the new all-time high in the evening. Today, they are still showing mixed sentiment and the volatility is rather low. From the data front, the CPI and core CPI in March will be published in the US. Anyway, let’s move on to the analysis, S&P 500 first:

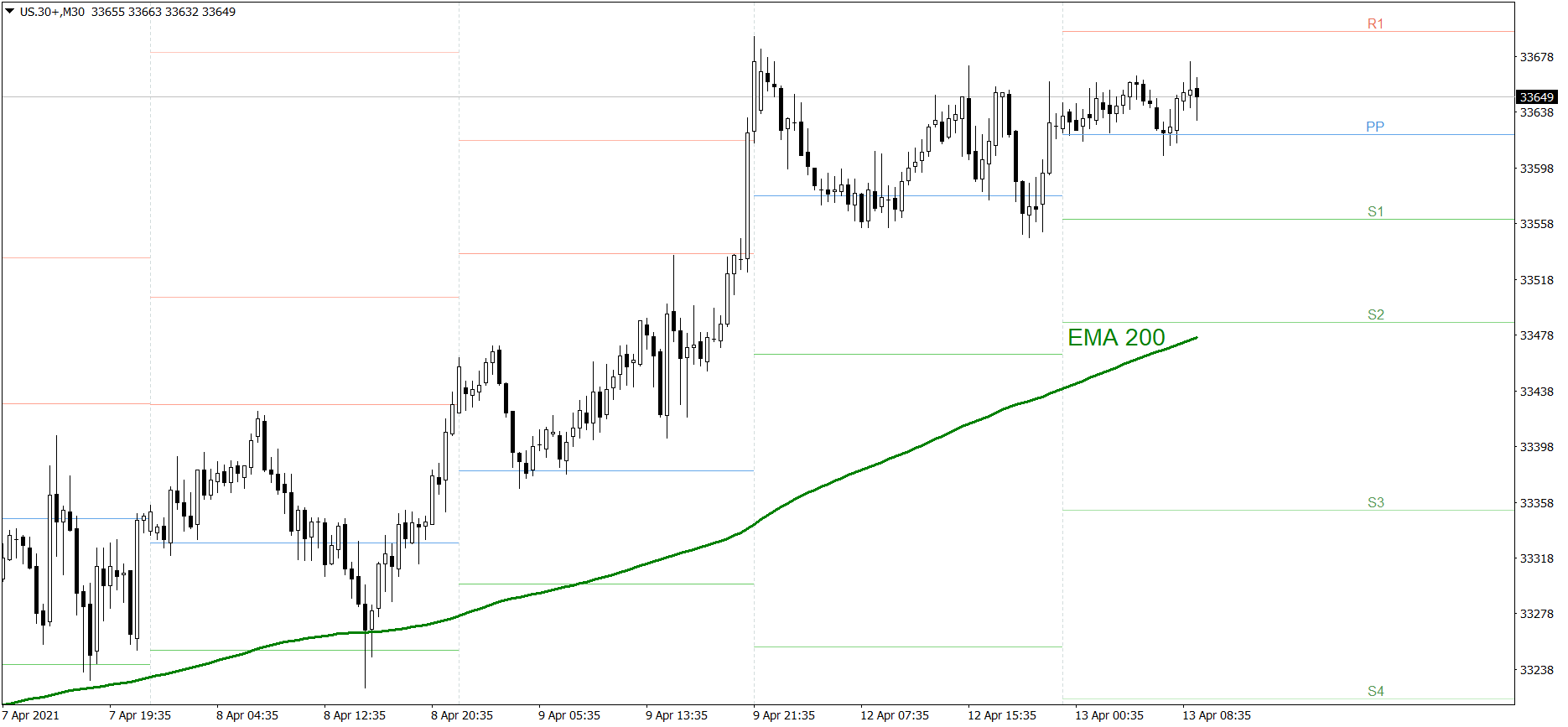

S&P 500

The S&P 500 showed mixed sentiment yesterday and the volatility was rather low. However, it managed to set the new all-time high in the evening. Today, the price is still showing mixed sentiment and the volatility isn’t impressive. If the buyers show their strength once again, the price might rise above 4130. But if the bears finally counterattack, the price could drop to the S1 support level.

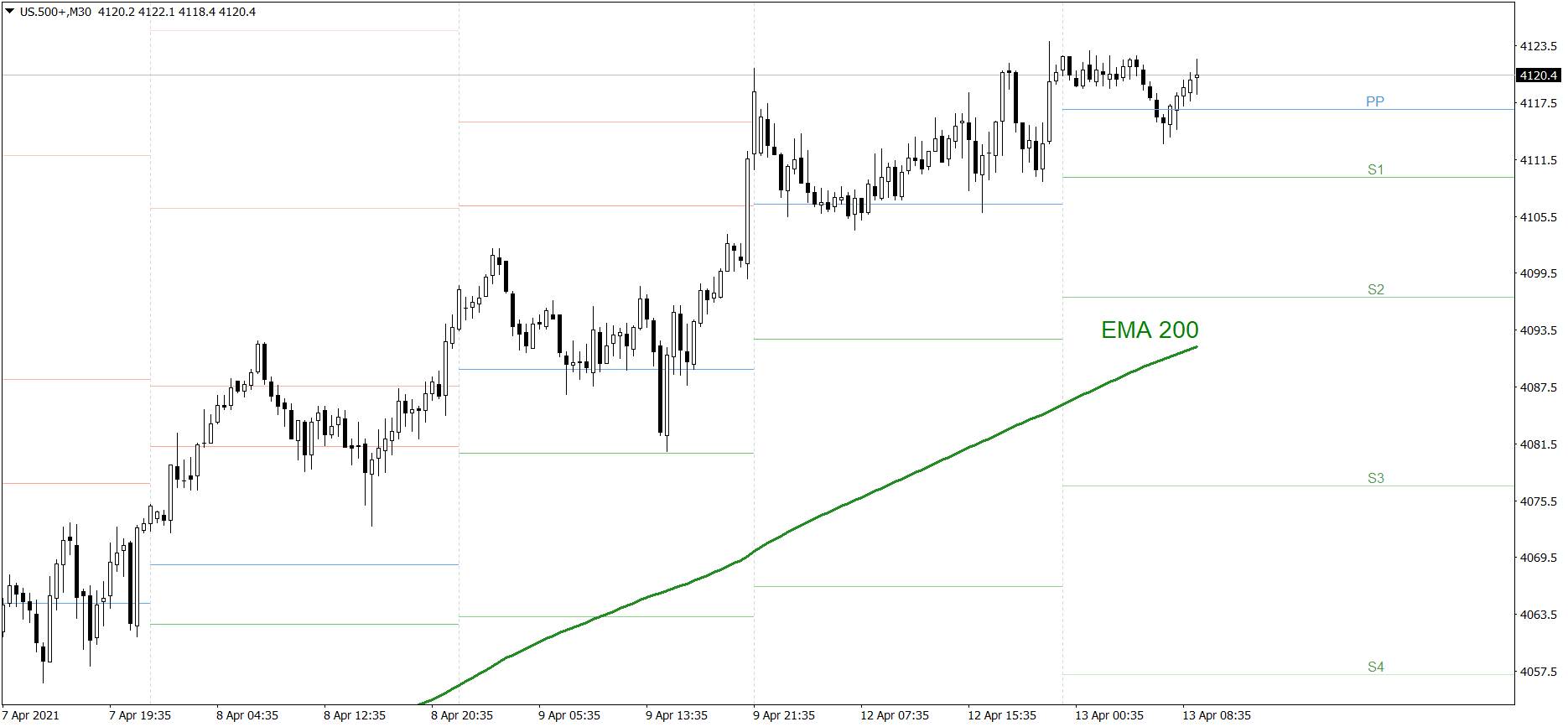

NASDAQ 100

NASDAQ 100 also showed mixed sentiment yesterday and the volatility was rather low.In the end of the day, the price didn’t change at all. Today, it is still showing mixed sentiment and the volatility isn’t impressive. If the buyers show their strength once again, the price might reach 13900 and set the new all-time high. But if the bears finally counterattack, the price could drop below the S1 support level.

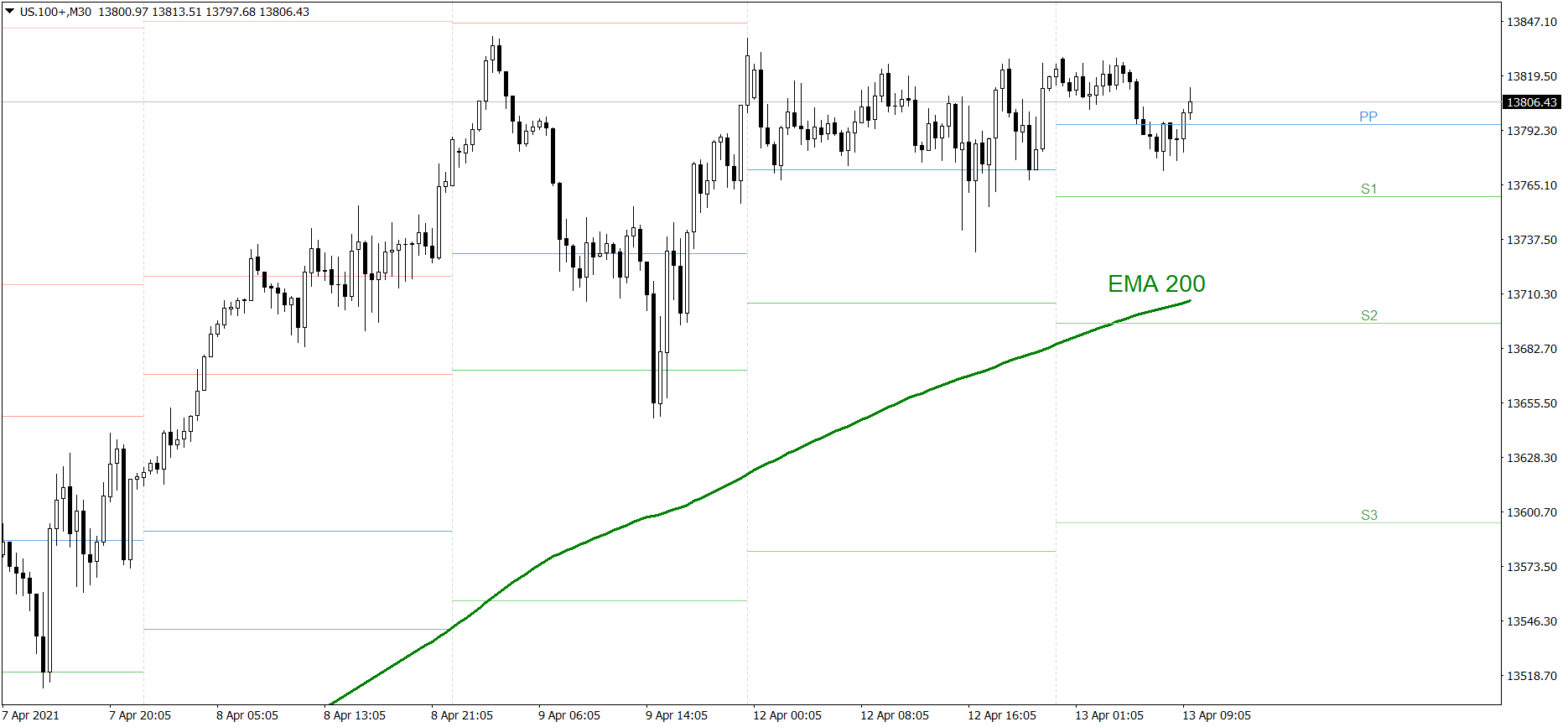

Dow Jones Industrial Average

The DJIA index showed mixed sentiment and low volatility as well. The price finished the day a little lower than it started. Today, it is still showing mixed sentiment and the volatility isn’t impressive. If the buyers show their strength once again, the price might rise above the R1 resistance level and set the new all-time high. But if the bears finally counterattack, the price could drop to the S1 support level.