Friday was a great bullish session for the American indices. All three of them rose significantly, the S&P 500 even set the new all-time high. However, the indices are going down a bit today. What can they do next? Let’s try to answer that question in an analysis, S&P 500 first:

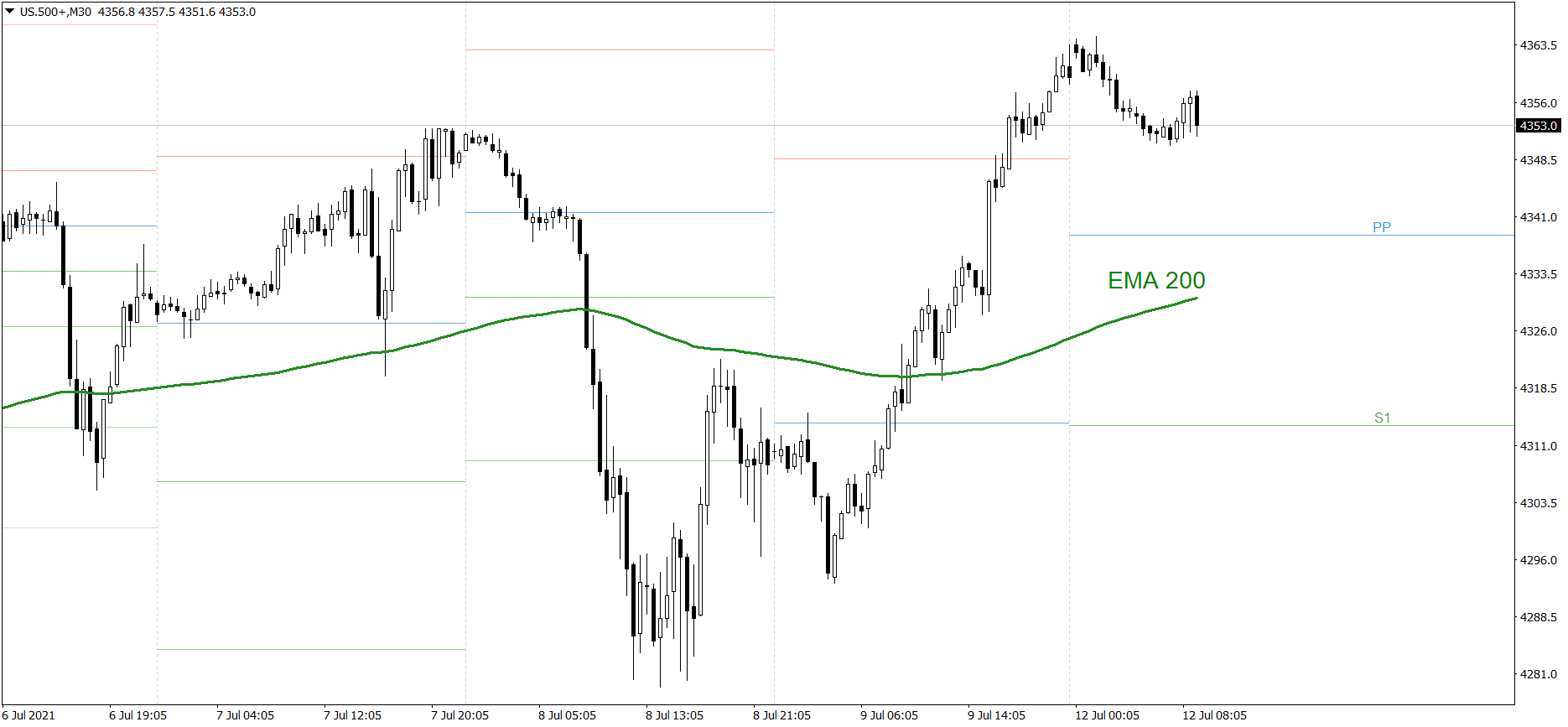

S&P 500

Friday was a great bullish session for the S&P 500. The price rose above the R1 resistance level, set the new all time high, and finished the week near 4360. However, the S&P 500 is falling today. Right now the bears are attacking 4350. If they do it successfully, the price could drop to the Pivot Point. But if the bulls counterattack, the price might rise significantly and set the new all-time high.

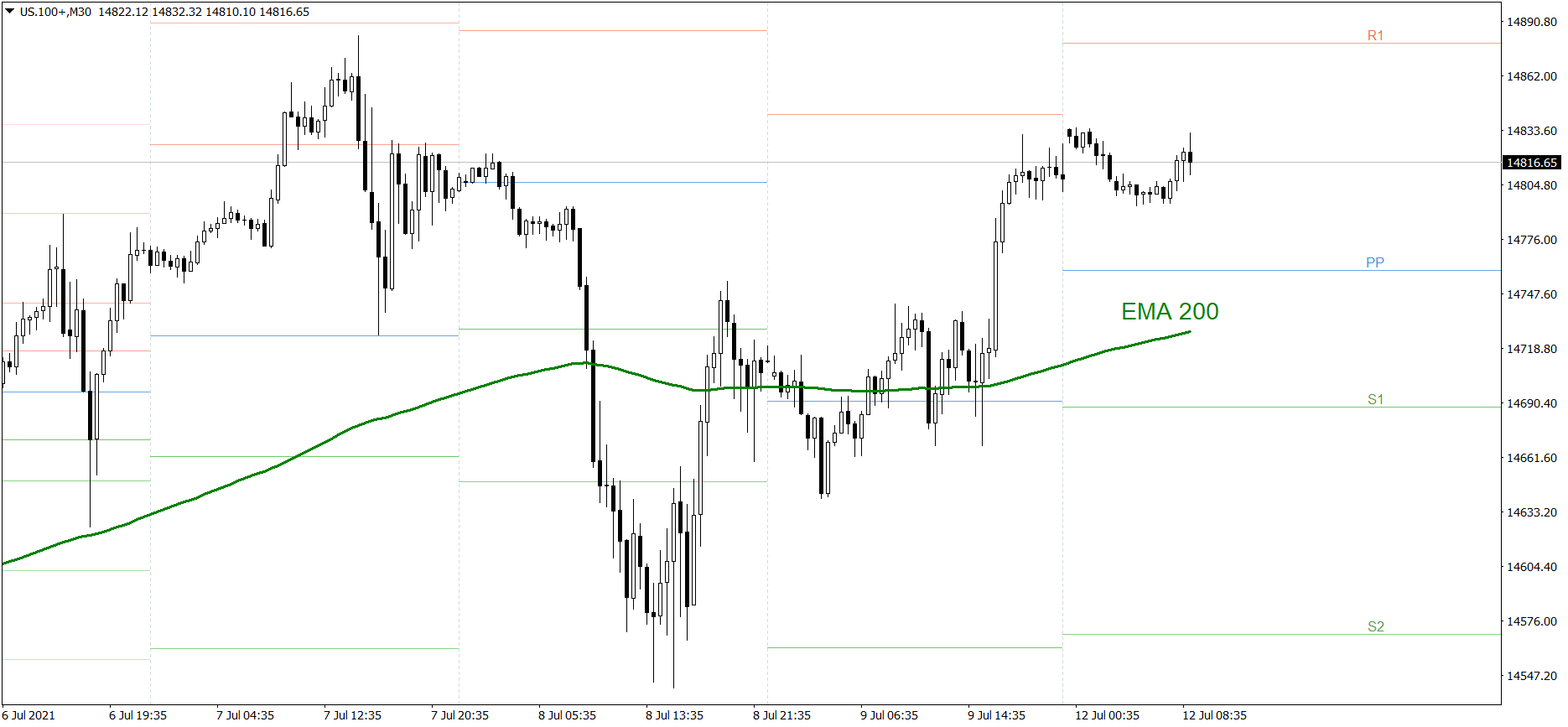

NASDAQ 100

NASDAQ 100 also rose significantly on Friday. The price finished the session above 14800. After the weekend it opened even higher, but then it started going down a bit, though. If the buyers don’t generate some serious appetite soon, the price could drop to the EMA 200. But if they do, the price might rise to the R1 resistance level and set the new all-time high.

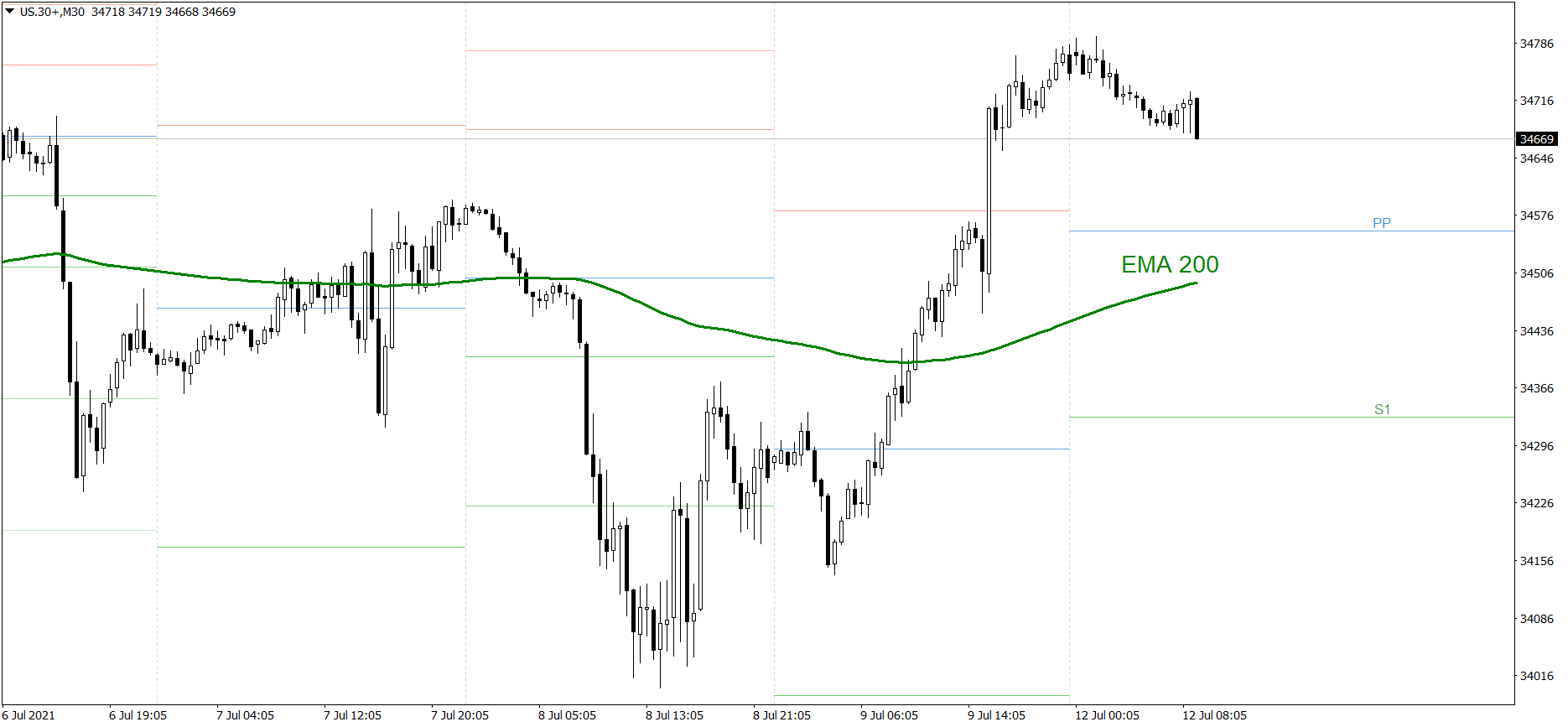

Dow Jones Industrial Average

The DJIA index rose strongly on Friday as well. The price finished the session high above the R1 resistance level. However, it is going down today. If the buyers don’t generate some serious appetite soon, the price could drop to the EMA 200. But if they do, the price might rise above 34800 and even set the new all-time high.