On Friday, the American indices rose strongly once again. The S&P 500 and the Dow Jones Industrial Average finished the last session of the week above their R2 resistance levels and set their new all-time highs. NASDAQ 100 was slightly weaker, but it also rose significantly. Today, the S&P 500 and the DJIA index are falling and NASDAQ 100 is showing mixed sentiment. What can they do next? Let’s try to answer that question in an analysis:

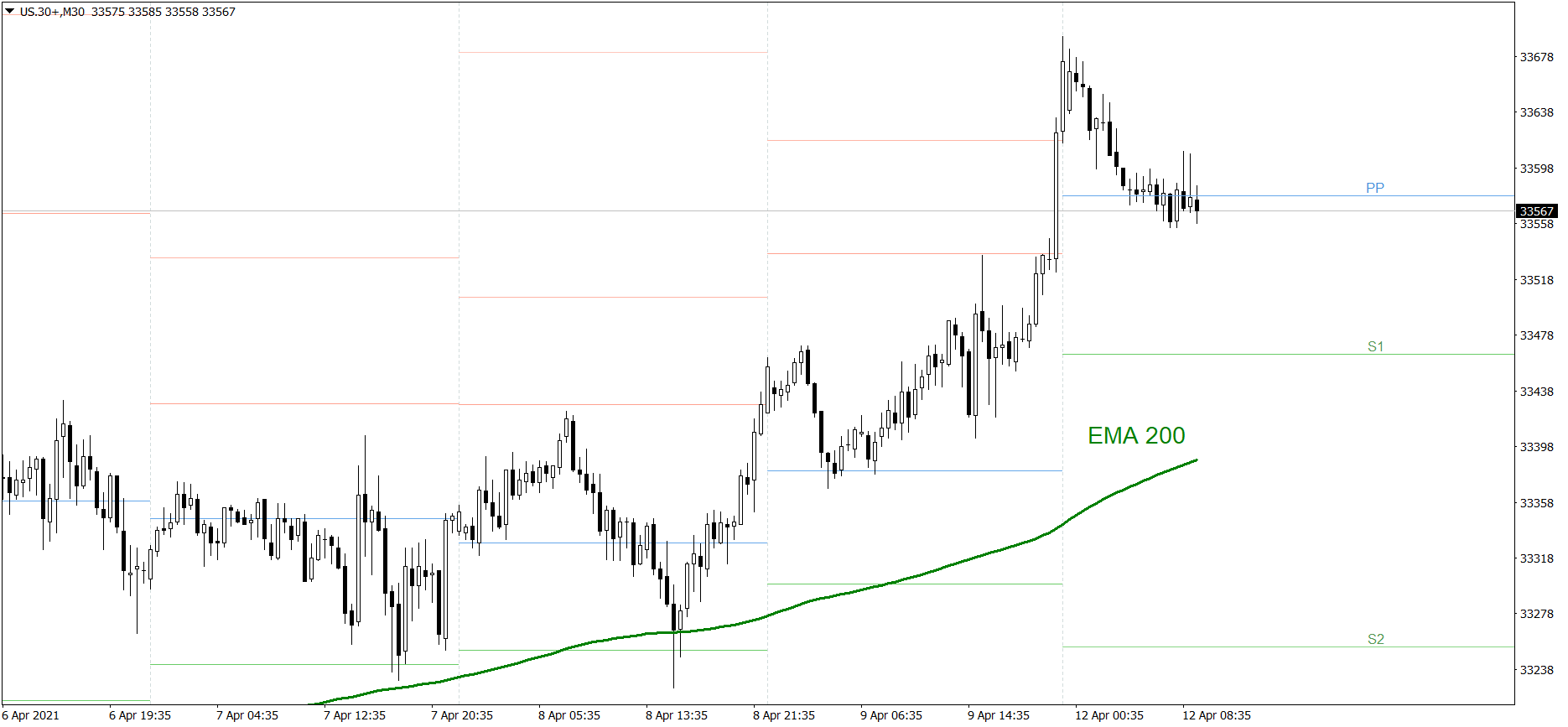

S&P 500

Friday was a great bullish session for the S&P 500. The price rose above the R2 resistance level and set its new all-time high. However, it dropped significantly during today’s Asian trading session. Right now the bulls are trying to defend the Pivot Point. If they do it successfully, the price might bounce and even reach 4125 today. But if they fail, the price could fall to the S1 support level.

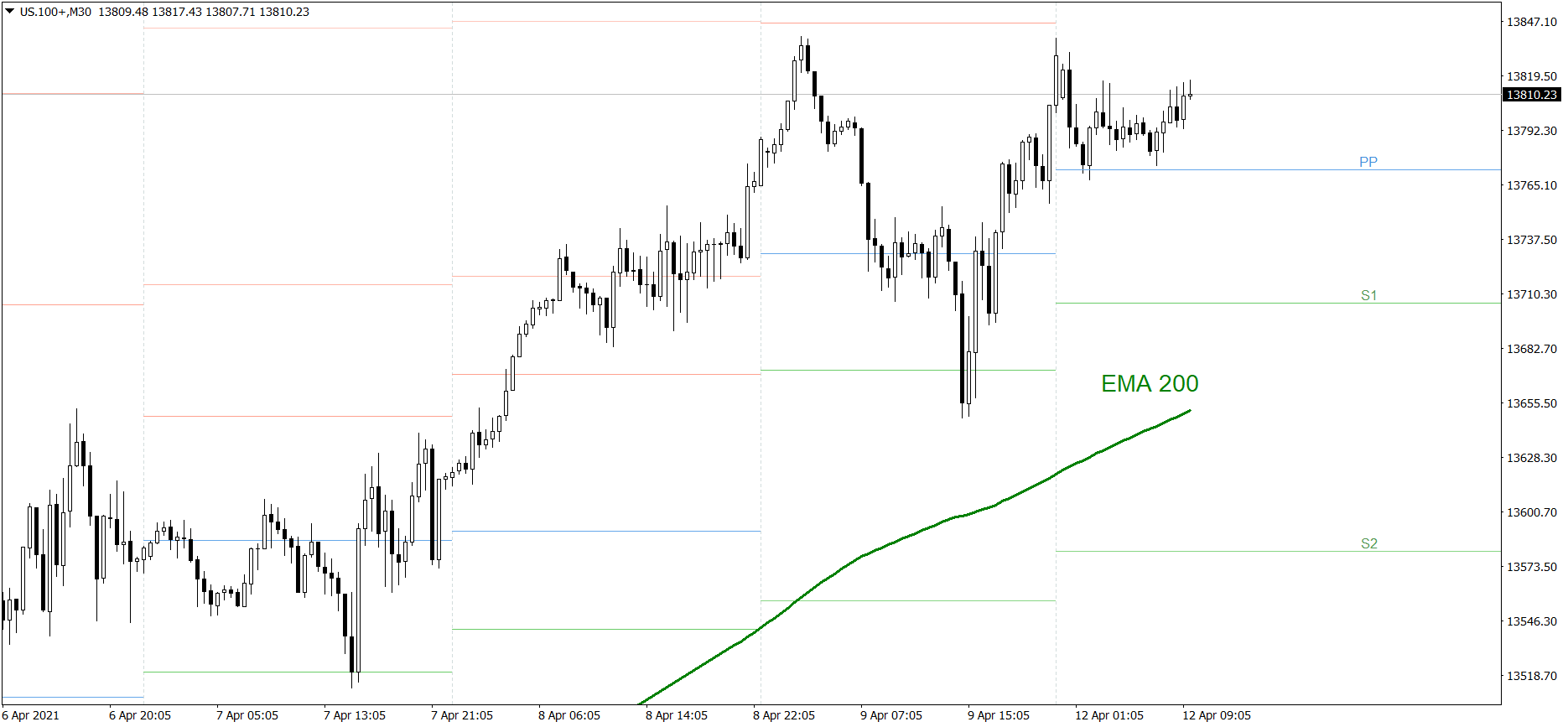

NASDAQ 100

NASDAQ 100 showed very high volatility on Friday. First, the price dropped below the S1 support level. Then, in the afternoon, it managed to rise strongly and it finished the week above 13800. Today, the price is showing mixed sentiment. If the buyers show their strength once again, the price might even rise to 13900 and set the new all-time high. But if the bears take control over the market, the price could fall to the S1.

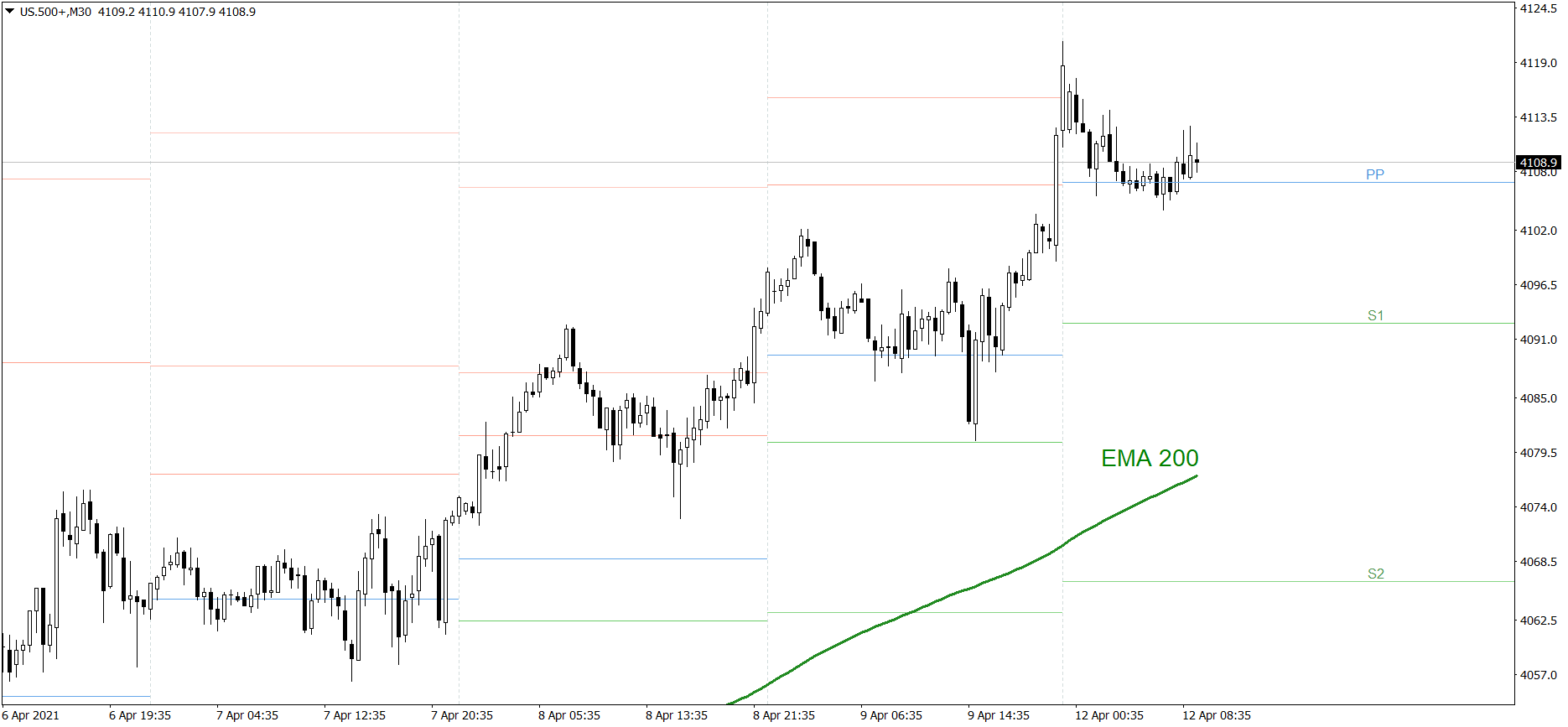

Dow Jones Industrial Average

The DJIA index was also very strong on Friday. The price rose high above the R2 resistance level and set its new all-time high. However, it is falling significantly today. Right now the price is below the Pivot Point. If the buyers don’t generate some serious appetite soon, the price could drop to the S1 support level. But if they do, the price might even reach 33800 today.