Yesterday, the American indices performed differently once more. This time, the S&P 500 and the Dow Jones Industrial Average rose significantly and the NASDAQ 100 dropped a bit. The S&P 500 set the new all-time high and finished the session at the R1 resistance level. The DJIA index was even stronger and went up high above the R1. Today, the S&P 500 and the Dow Jones Industrial Average are rising even more and the NASDAQ 100 is showing mixed sentiment. From the data front, the ISM manufacturing PMI index in June and weekly initial jobless claims will be published. Anyway, let’s start the analysis, S&P 500 first:

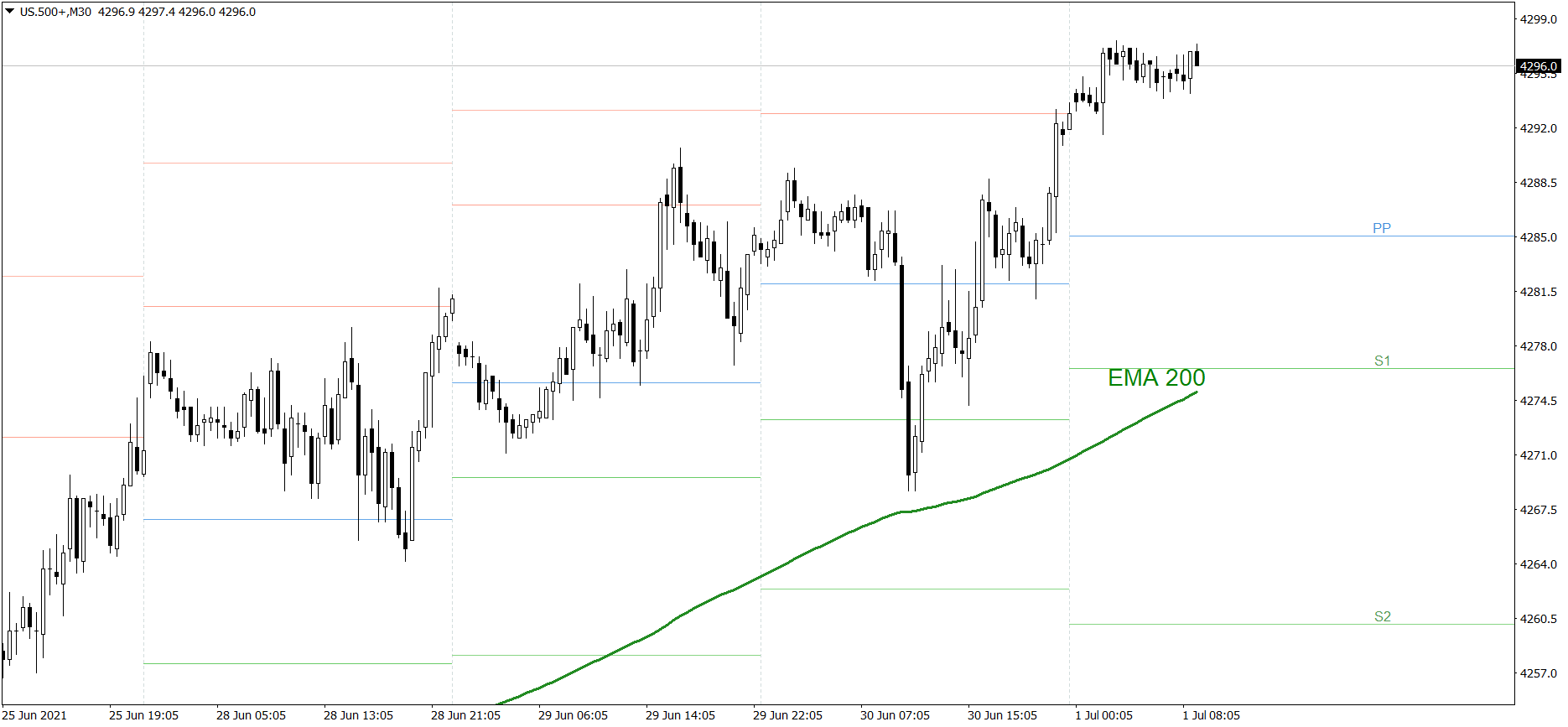

S&P 500

Yesterday was another good bullish session for the S&P 500. The price set the new all-time high and finished the session at the R1 resistance level. Today, the price is rising even more and getting closer and closer to 4300. If the buyers continue generating firm demand, the price might successfully attack that level today. But if the bears counterattack, the price could drop below 4290.

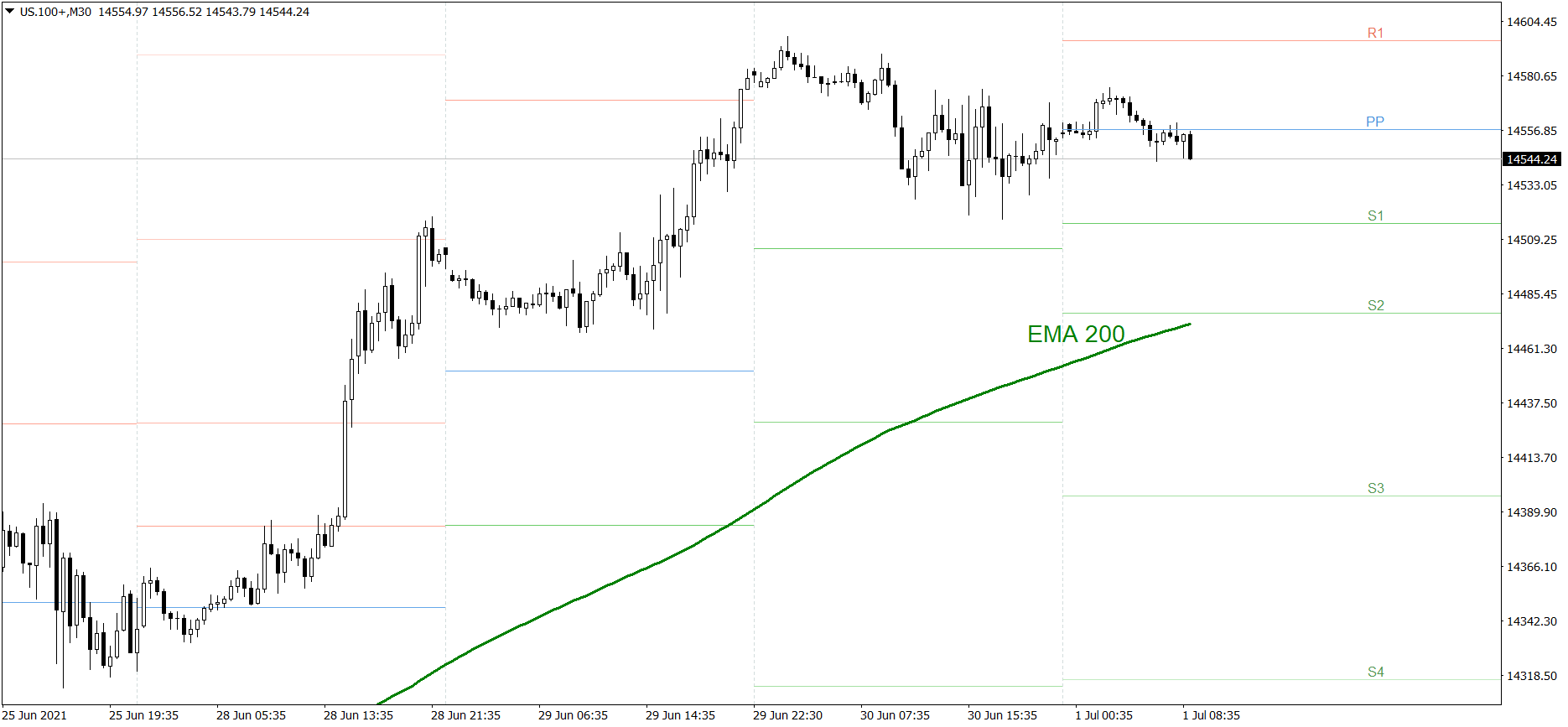

NASDAQ 100

NASDAQ 100 was much weaker yesterday. The price dropped a bit and finished the session a little above the Pivot Point. Today, it is showing mixed sentiment and the volatility is rather low. If the buyers take control over the market, the price might reach the R1 resistance level today. But if the bears show their strength, the price could fall to the S1 support level.

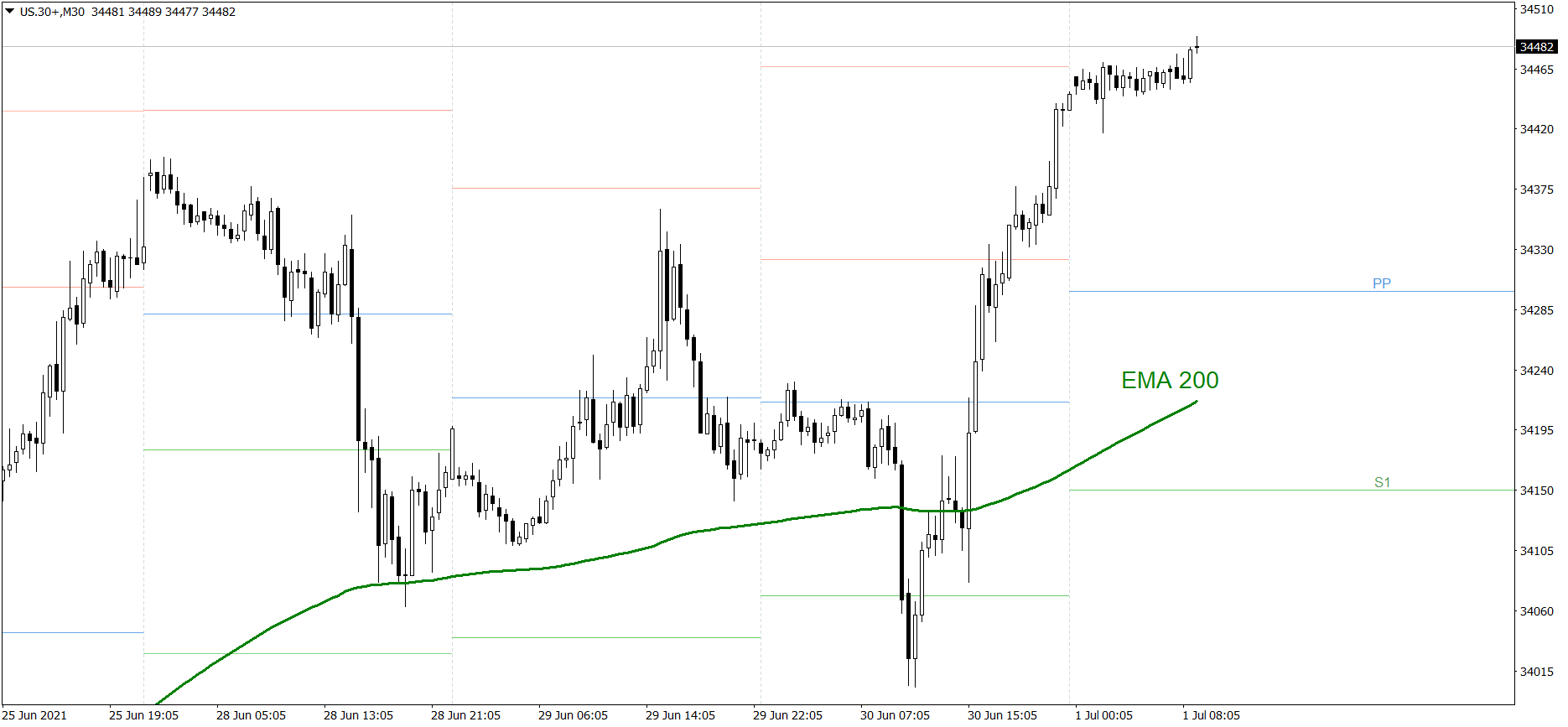

Dow Jones Industrial Average

The DJIA index was the strongest one yesterday. The price rose high above the R1 resistance level. Today, it is rising even more. If the buyers continue generating firm demand, the price might rise to 34600 today. But if the bears counterattack, the price could drop below 34400.