Yesterday, the American indices showed mixed sentiment and the volatility was quite low. NASDAQ 100 was the weakest and the Dow Jones Industrial Average the strongest. During today’s Asian trading session all three of them dropped a bit, but this morning they started going up. From the data front, the weekly initial jobless claims will be published in the US. Anyway, let’s move on to the analysis, S&P 500 first:

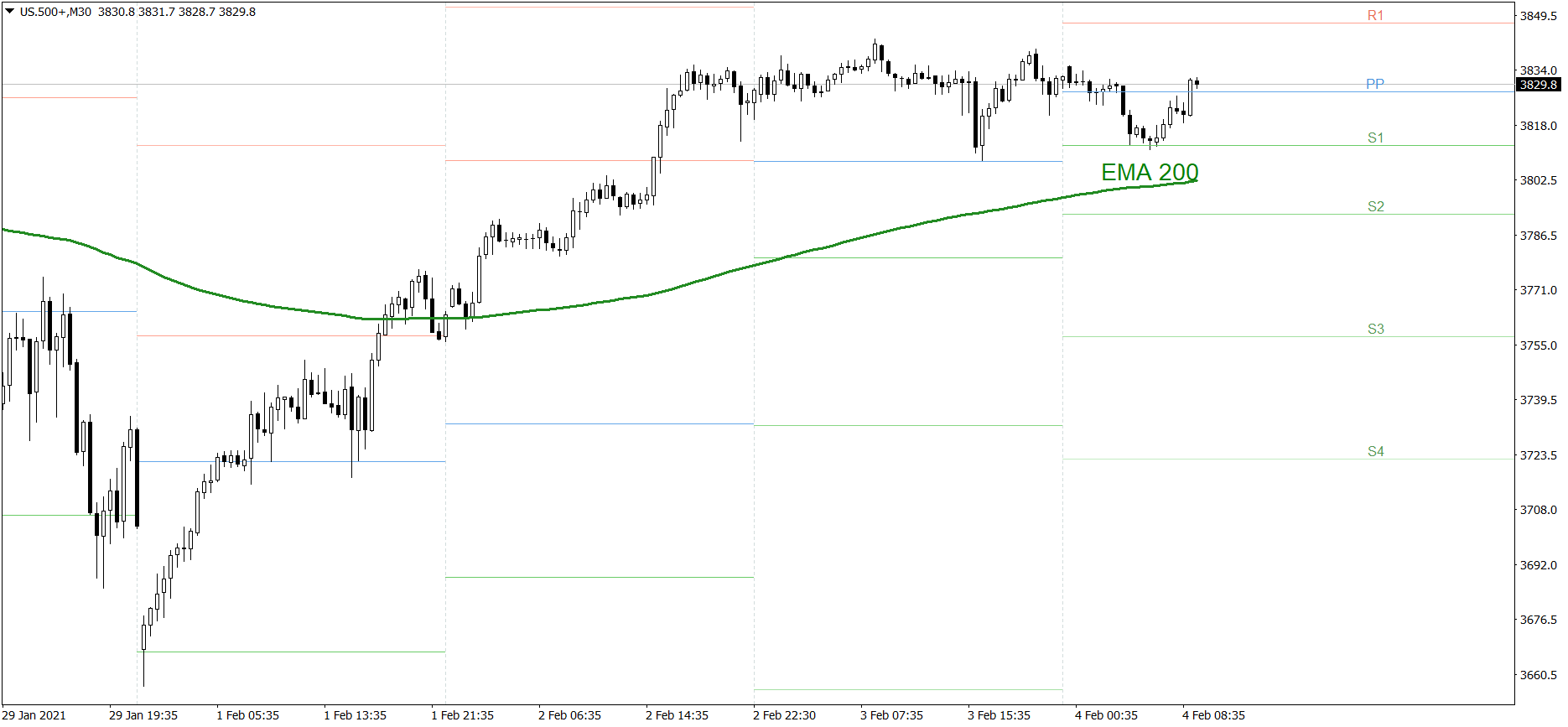

S&P 500

S&P 500 showed mixed sentiment yesterday. First the price dropped and tested the Pivot Point, then it managed to rise a bit. In consequence the price didn’t really change after that session. During today’s Asian trading session it fell to the S1 support level, but this morning it started going up. If the buyers continue generating sufficient demand, the price might rise and hold above 3850 for the rest of the day. But if the bears take control over the market, the price could drop below 3800.

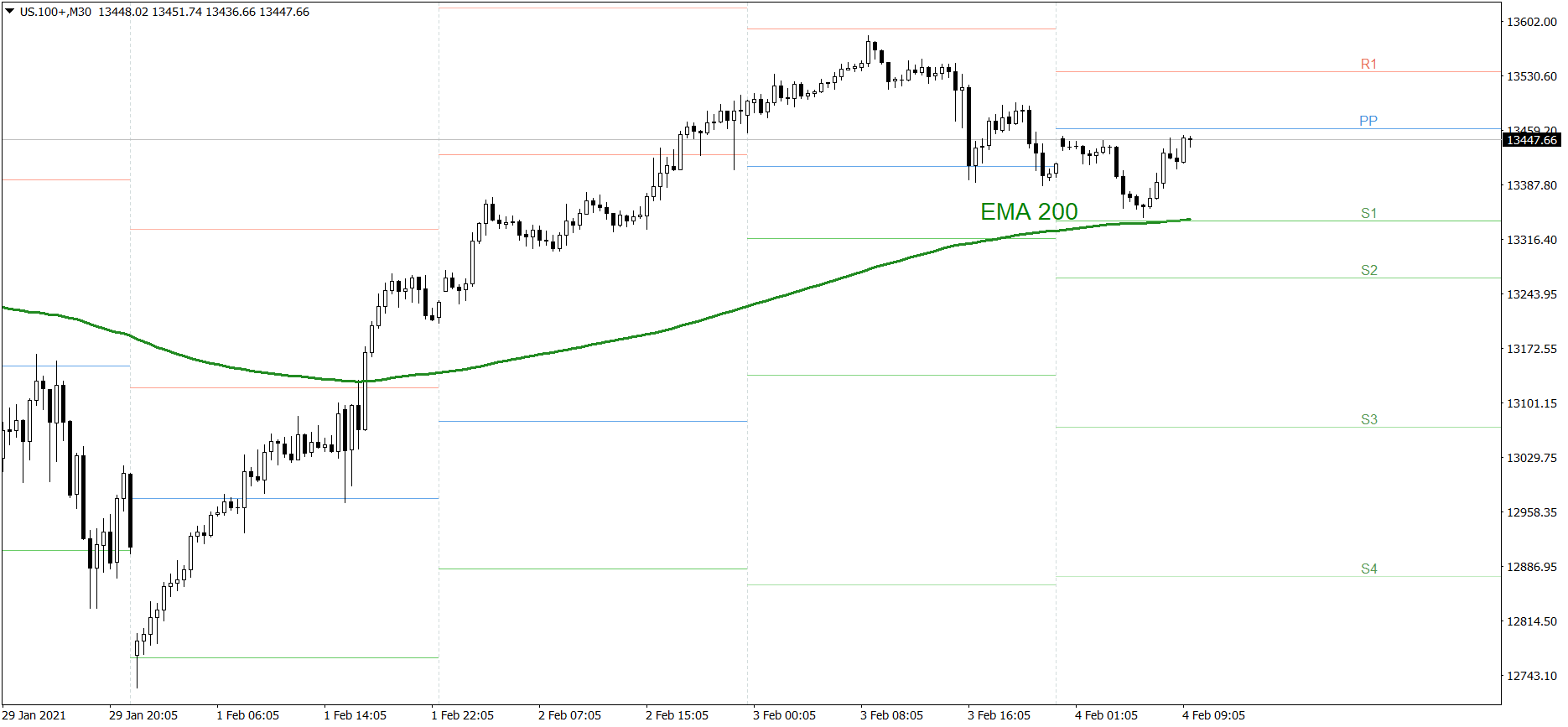

NASDAQ 100

NASDAQ 100 dropped a bit yesterday. First the bulls tried to test the R1 resistance level, but they failed, and in consequence the price dropped to the Pivot Point. During today’s Asian trading session, the bears tested the S1 support level and the EMA 200. After that, the price bounced and now it is still rising. If the buyers continue generating sufficient demand, the price might reach 13600 today. But if the bears counterattack once again, the price could even drop below the S2.

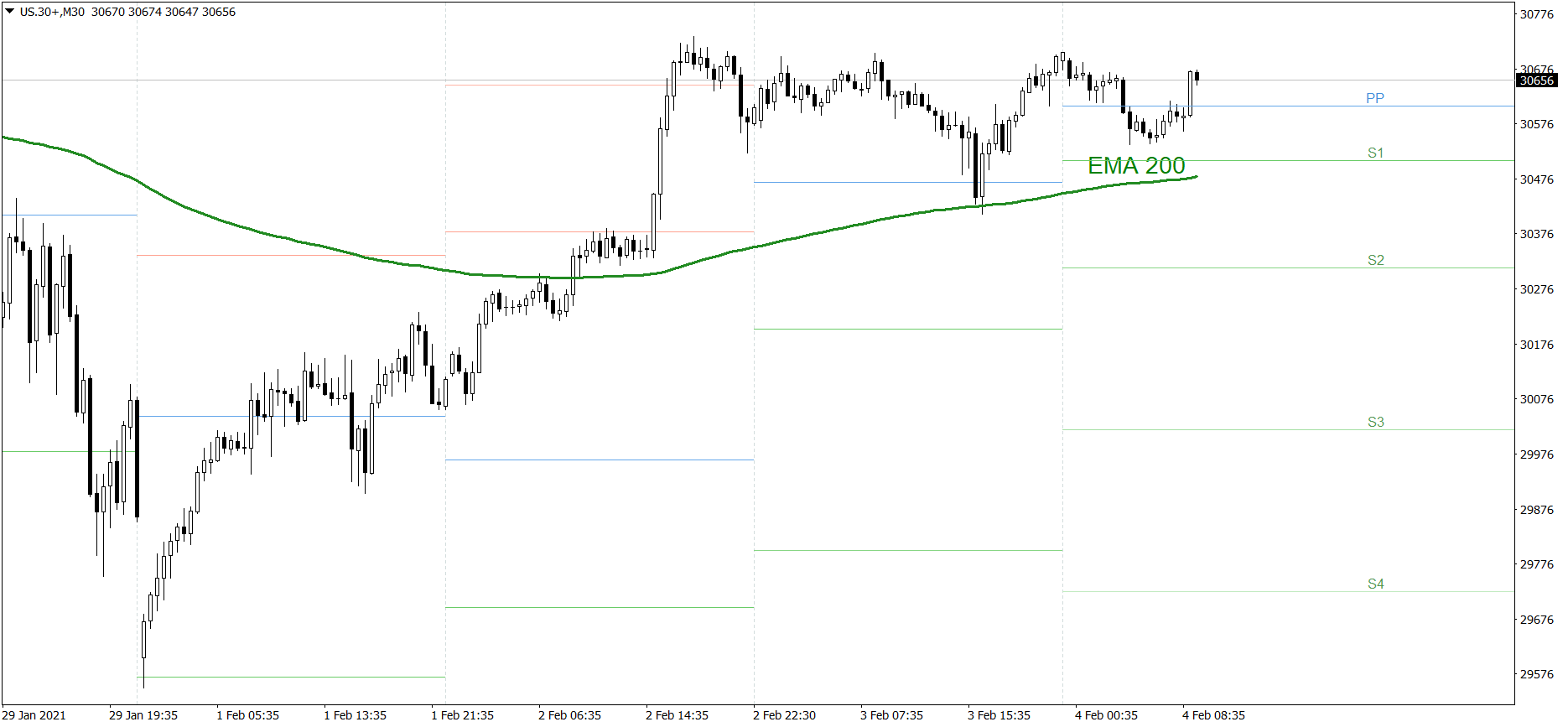

Dow Jones Industrial Average

The DJIA index also showed mixed sentiment yesterday. First the price dropped and tested the EMA 200, then it managed to rise a bit. In consequence the price finished the day a little higher than it started. During today’s Asian trading session it fell below the Pivot Point, but this morning it started going up. If the buyers continue generating sufficient demand, the price might reach 30800. But if the bears take control over the market, the price could drop below the EMA 200.