Yesterday was a good, bullish session for the American indices. All three went up strongly, S&P 500 and NASDAQ 100 even finished the session above their R1 resistance levels. What’s more, they are still rising today. How far can they go? Let’s try to answer that question in an analysis, S&P 500 first:

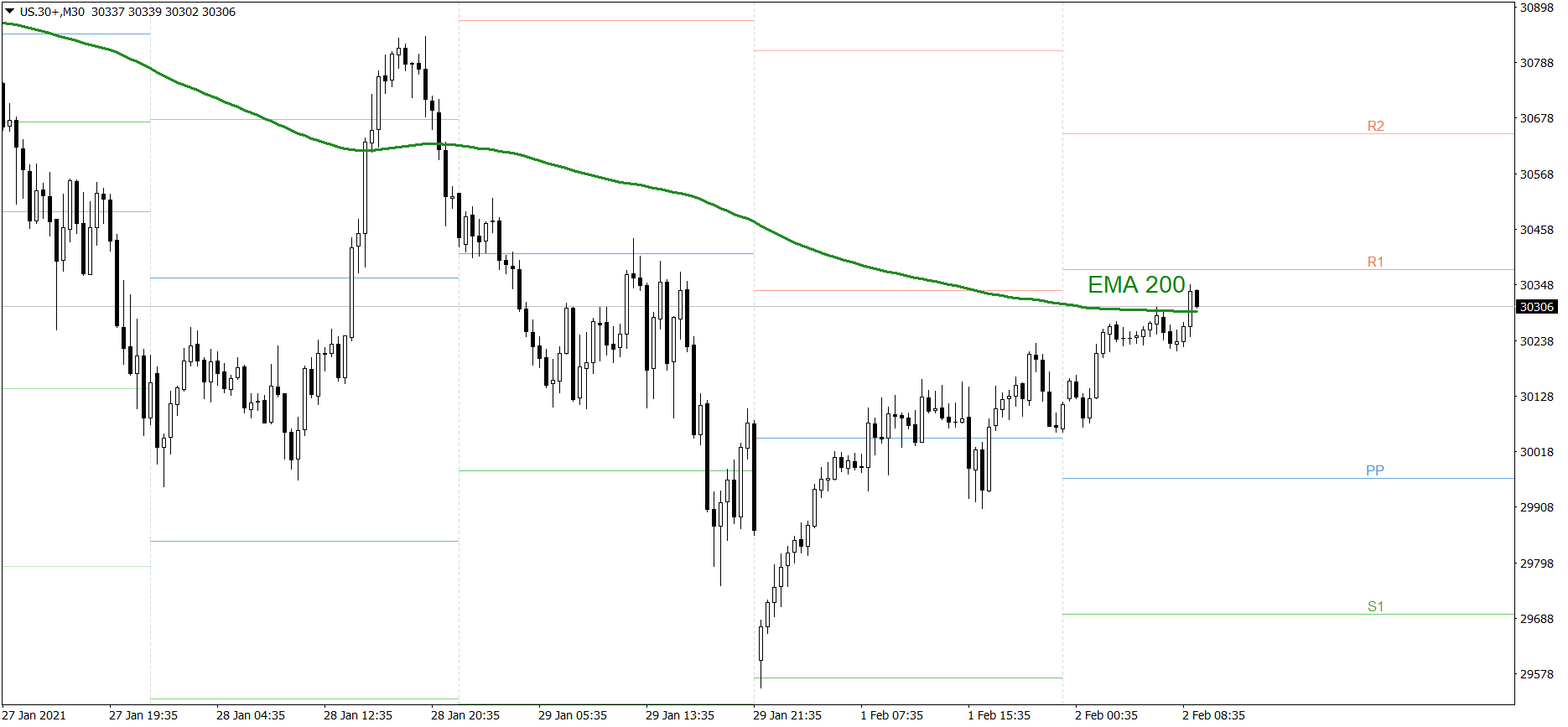

S&P 500

Yesterday was a great session for the S&P 500. The price was rising the whole Monday and it finished the session above the R1 resistance level, on the EMA 200. Today the price is going up even more. It seems that it will return to the 3800 level very soon. If the buyers are able to still be generating firm demand, the price should attack the R1 and hold above it. However, if the bears are able to counterattack, the price could drop to the Pivot Point, but it doesn’t seem to be very likely today.

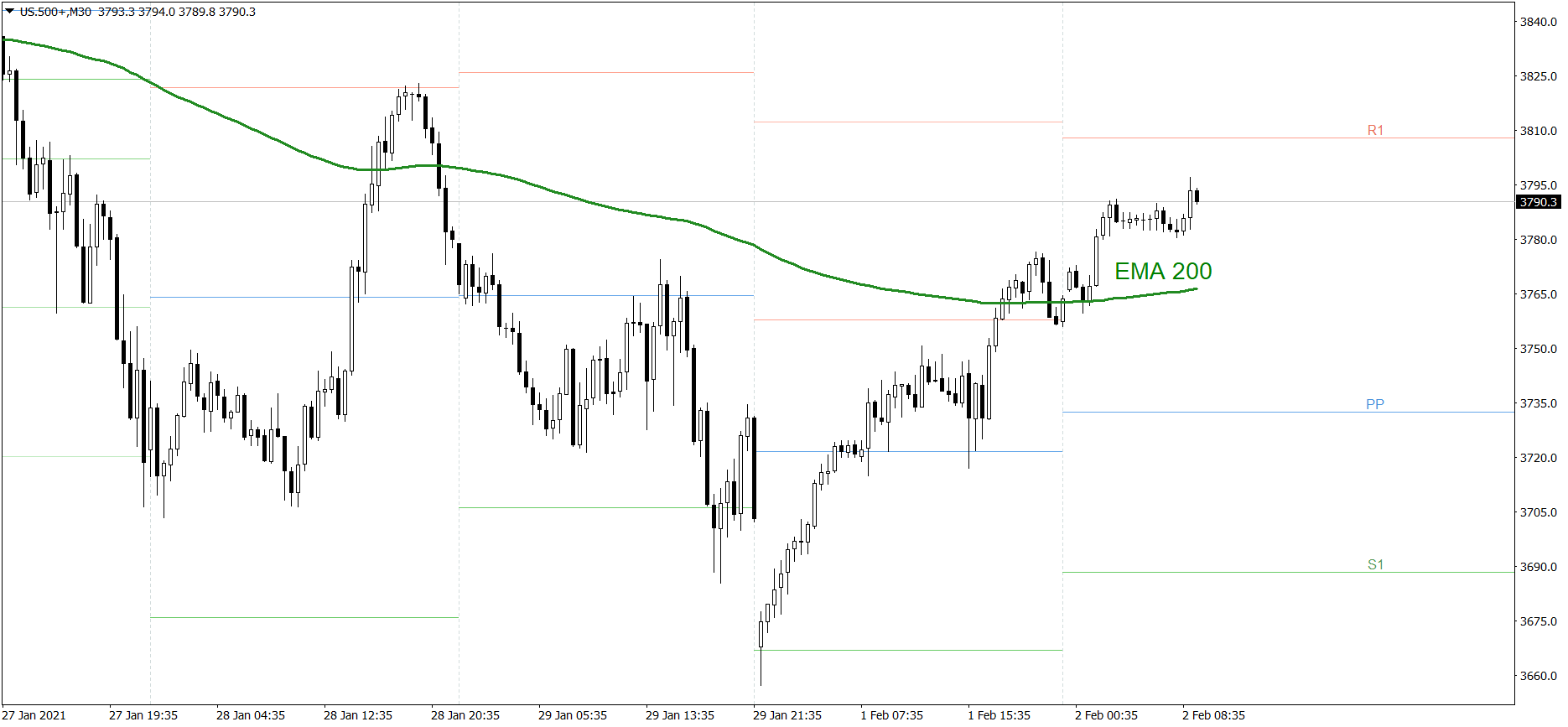

NASDAQ 100

NASDAQ 100 was even a bit stronger than the S&P 500 yesterday. The price was rising the whole Monday and it finished the session high above the R1 resistance level. Today the price is rising even more. If the buyers are able to still generate firm demand, the price might rise above the R1 and even test 13500. However, if the bears are able to counterattack, the price could drop to the EMA 200, but it doesn’t seem to be very likely today.

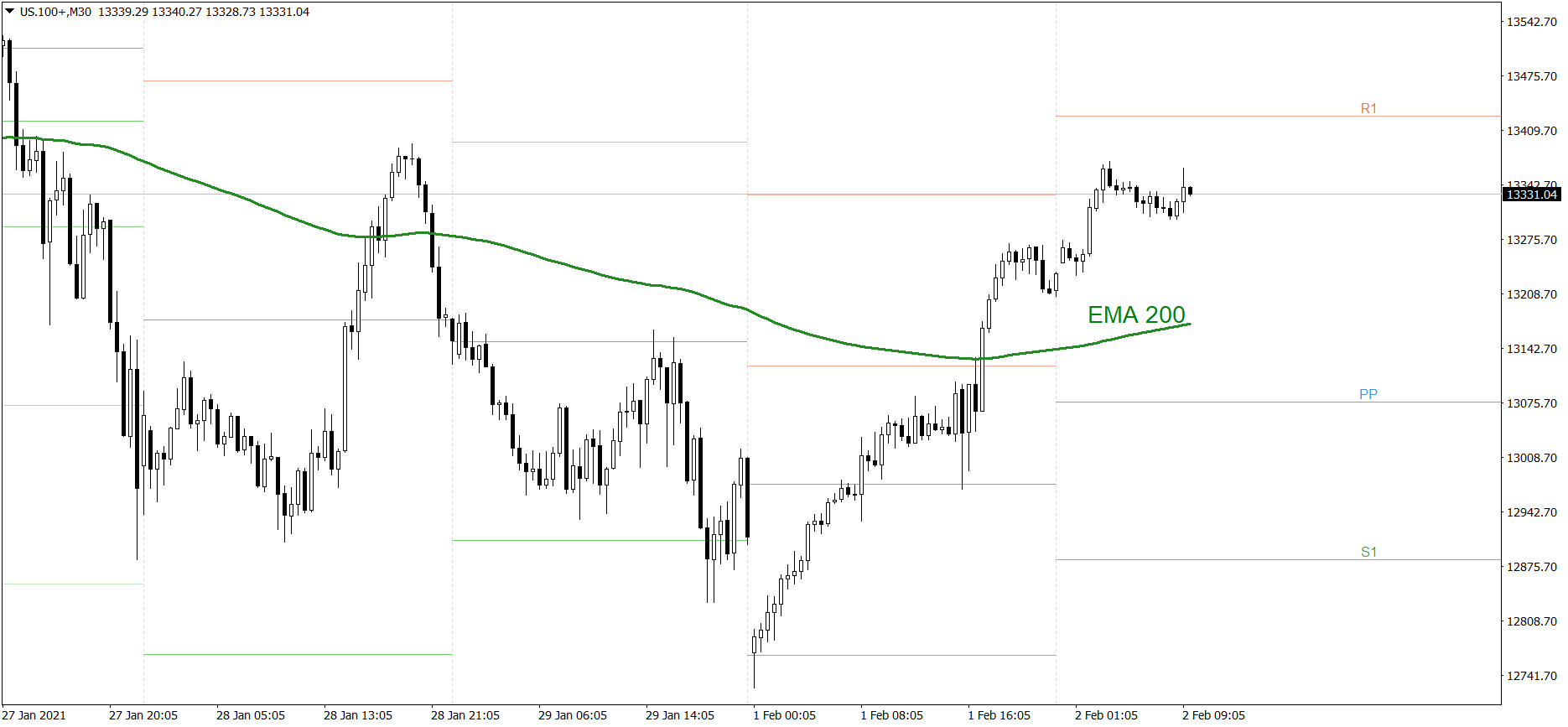

Dow Jones Industrial Average

The DJIA index was much weaker than the other two indices. However, it still went up above Pivot Point and 30000. Today the price is rising even more. It has already crossed the EMA 200. If the buyers are able to still generate firm demand, the price might even test the R2 resistance level today. But if the bears counterattack, the price could drop to the Pivot Point.