Yesterday, booth EURUSD and GBPUSD showed mixed sentiment. However, these currency pairs are deeply going down today. From the data front, all eyes will be focused on the Federal Reserve that will make an update on monetary policy. As no rate hikes are insight till 2023, markets will be primarily interested in the path of asset purchases. Taking into account the tax initiatives of the White House administration, the Fed has more reasons to maintain the easing bias in monetary policy, so there is a risk that the meeting outcome will be USD negative. Anyway, let’s start the analysis:

EURUSD

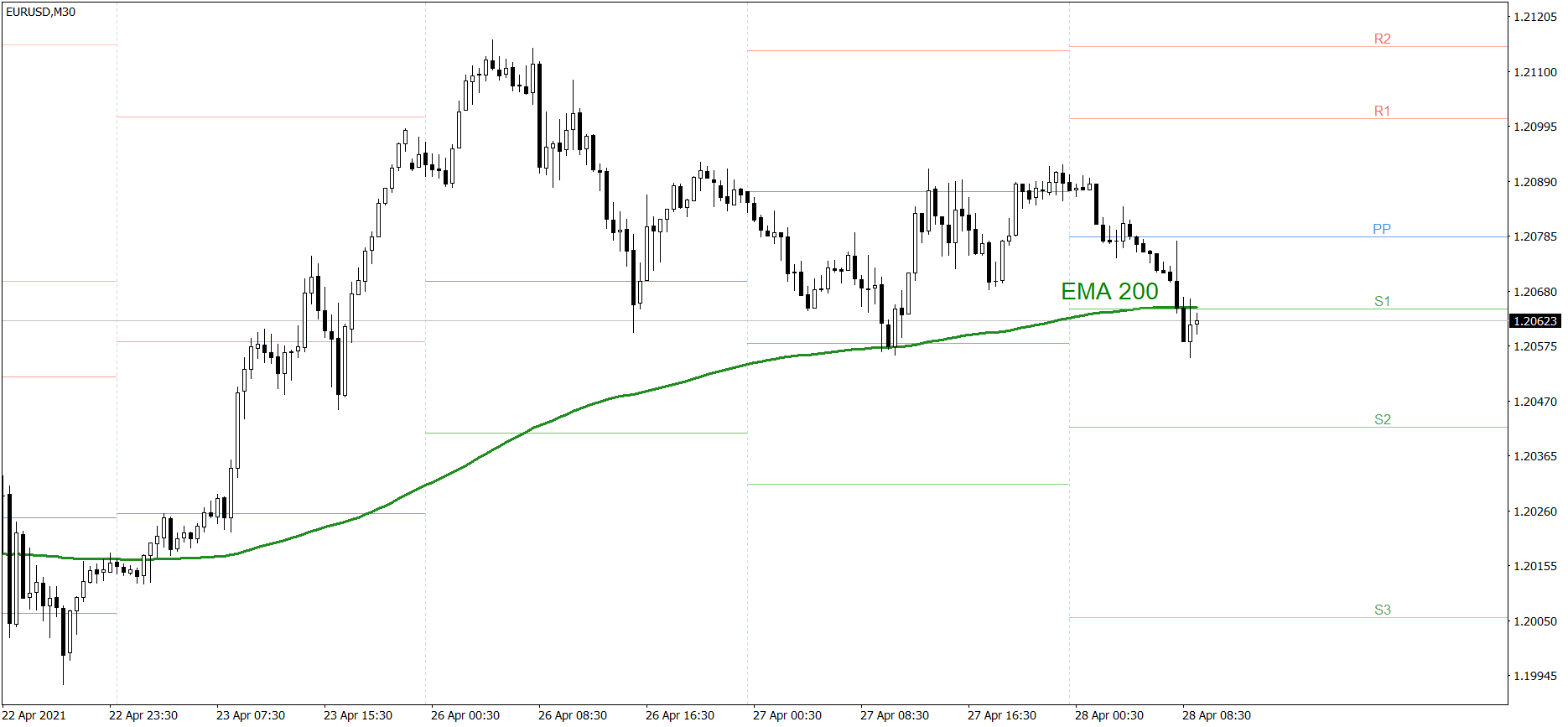

The EURUSD showed mixed sentiment yesterday. First the price dropped and tested the S1 support level and the EMA 200. Then it rose and finished the day a little above the Pivot Point. Today, the price is falling, though. Right now it is below the S1 and the EMA 200. If the buyers don’t generate some serious appetite soon, the price could even drop to the S2. But if they do, the price should return above the Pivot Point.

GBPUSD

The GBPUSD also showed mixed sentiment yesterday. However, the bulls managed to finish the day a little above 1.39. Today, the price is falling deeply, though. If the buyers don’t generate some serious appetite soon, the price could drop to 1.385. But if they do, the price might return above the EMA 77.