Yesterday, the US dollar showed weakness once again. Both EURUSD and GBPUSD significantly went up. However, during today’s Asian trading session they showed mixed sentiment and the volatility was rather low. From the data front, the CPI and core CPI inflation reports from January will be published in the Eurozone. Also, the Fed Chairman Jerome Powell will make a speech in the afternoon. Anyway, let’s start the analysis:

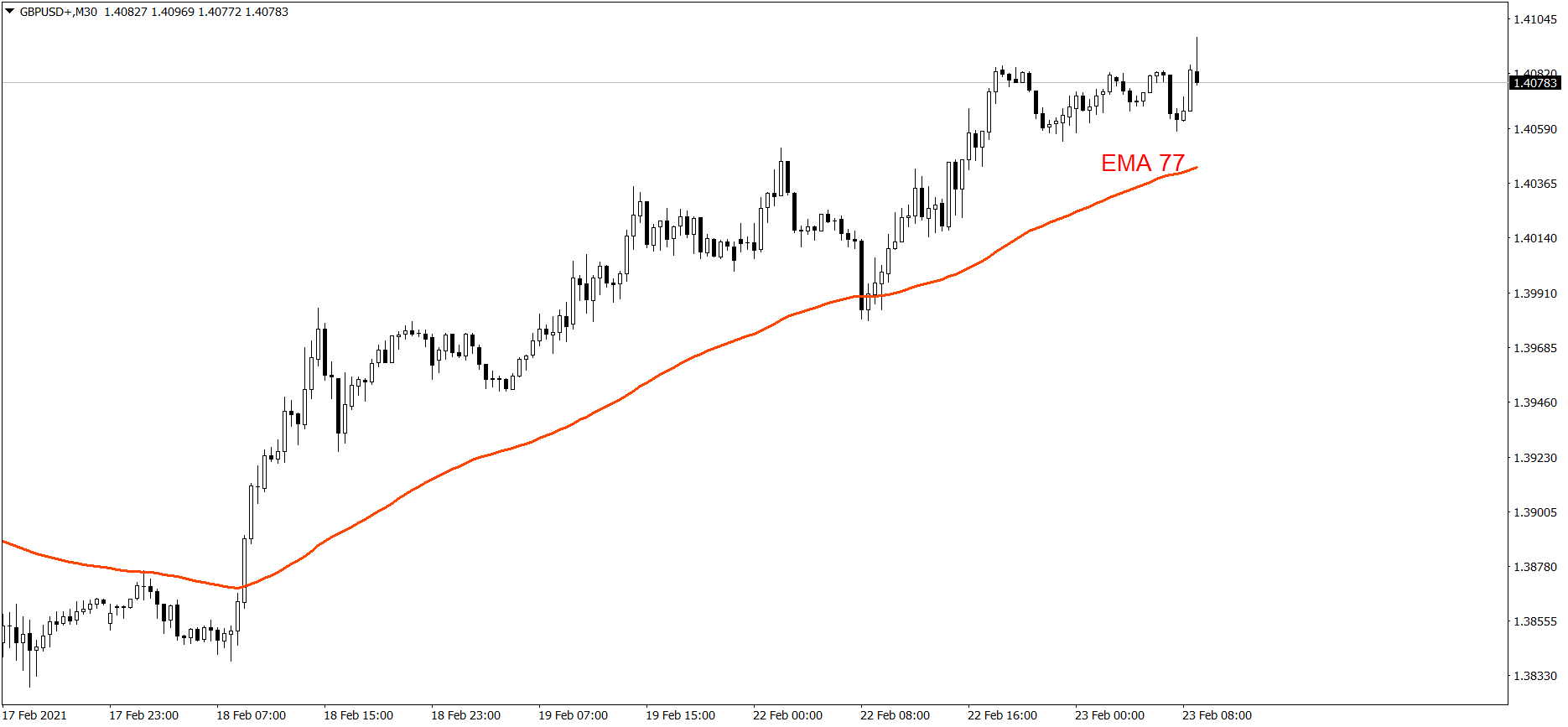

EURUSD

The EURUSD significantly went up yesterday. The price finished the day above the R1 resistance level. However, it is showing mixed sentiment today and the volatility is rather low. If the buyers start generating some sufficient demand once again, the price might even rise to 1.22 today. But if the bears take control over the market, the price could drop below the Pivot Point.

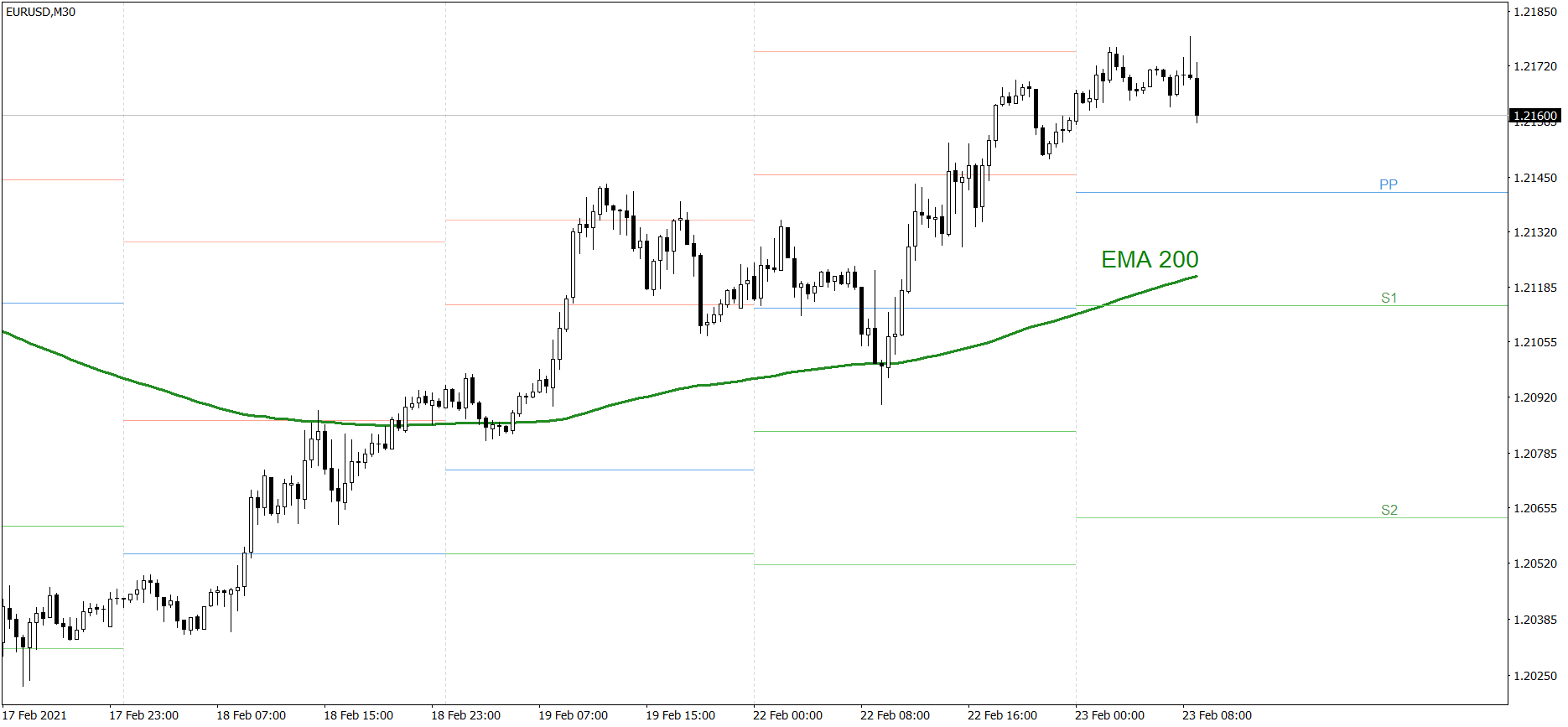

GBPUSD

The GBPUSD also rose significantly yesterday. The price finished the day near 1.407. Today, it is showing mixed sentiment with low volatility, though. If the buyers start generating some sufficient demand once again, the price might attack 1.41 and hold above it for the rest of the day. But if the bears take control over the market, the price could drop to the EMA 77.