Yesterday, both EURUSD and GBPUSD showed mixed sentiment and the volatility was rather low. Today, the GBPUSD is still showing mixed sentiment, but the EURUSD is going up. From the data front, all eyes will be focused on the European Central Bank (ECB), who is announcing its latest monetary policy decision. Lower yields on EU sovereign bonds mean that the ECB has less incentive to increase asset purchases. The ECB is expected to take a wait-and-see attitude, as uncertainty is still high due to the virus but not enough to add more credit stimulus. Anyway, let’s start the analysis:

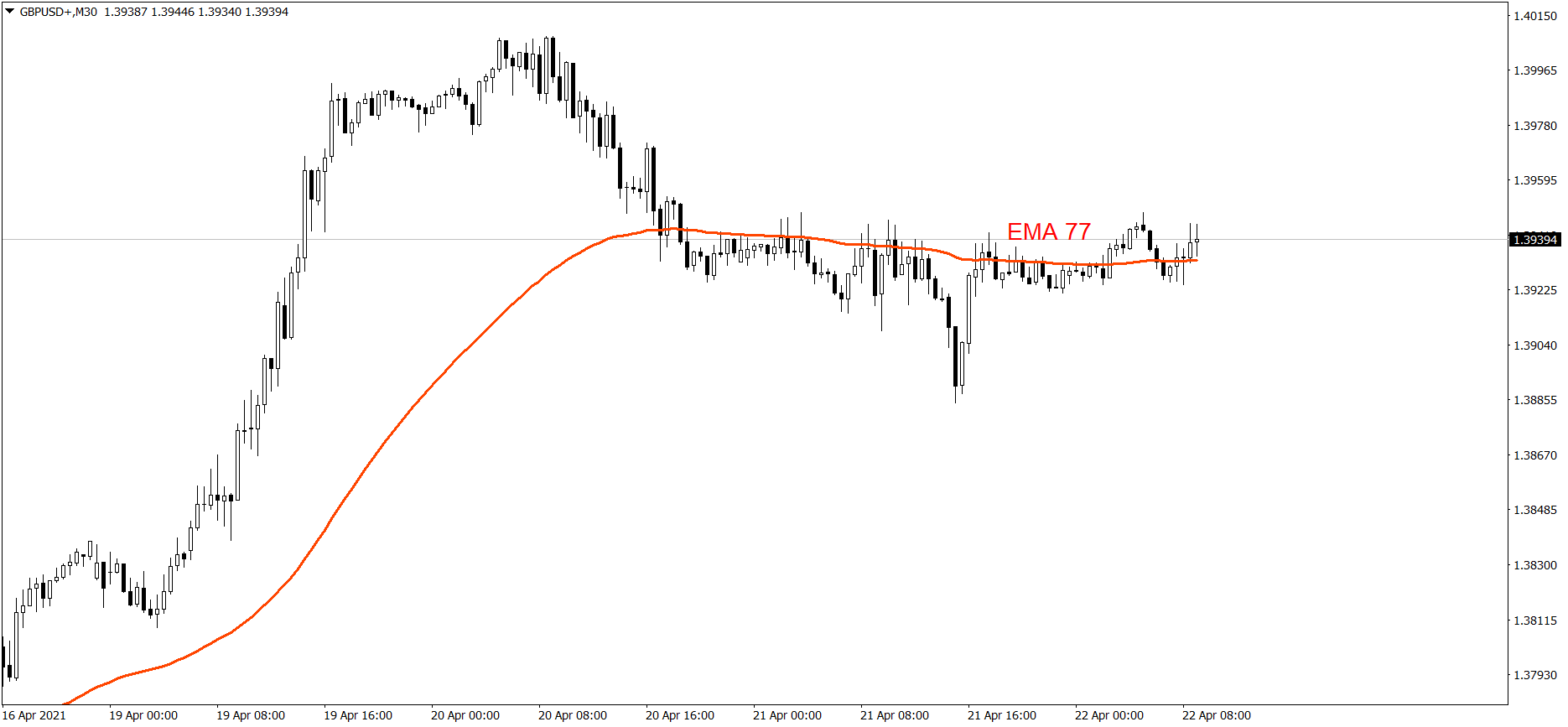

EURUSD

The EURUSD showed mixed sentiment yesterday. First the price dropped below the S1 support level and tested 1.20, then it went up in the afternoon and finished the day at the same level, where it began. However, the price is rising today. If the buyers continue generating firm demand, the price might even reach the R2 resistance level. But if the bears counterattack, the price could fall to the S1.

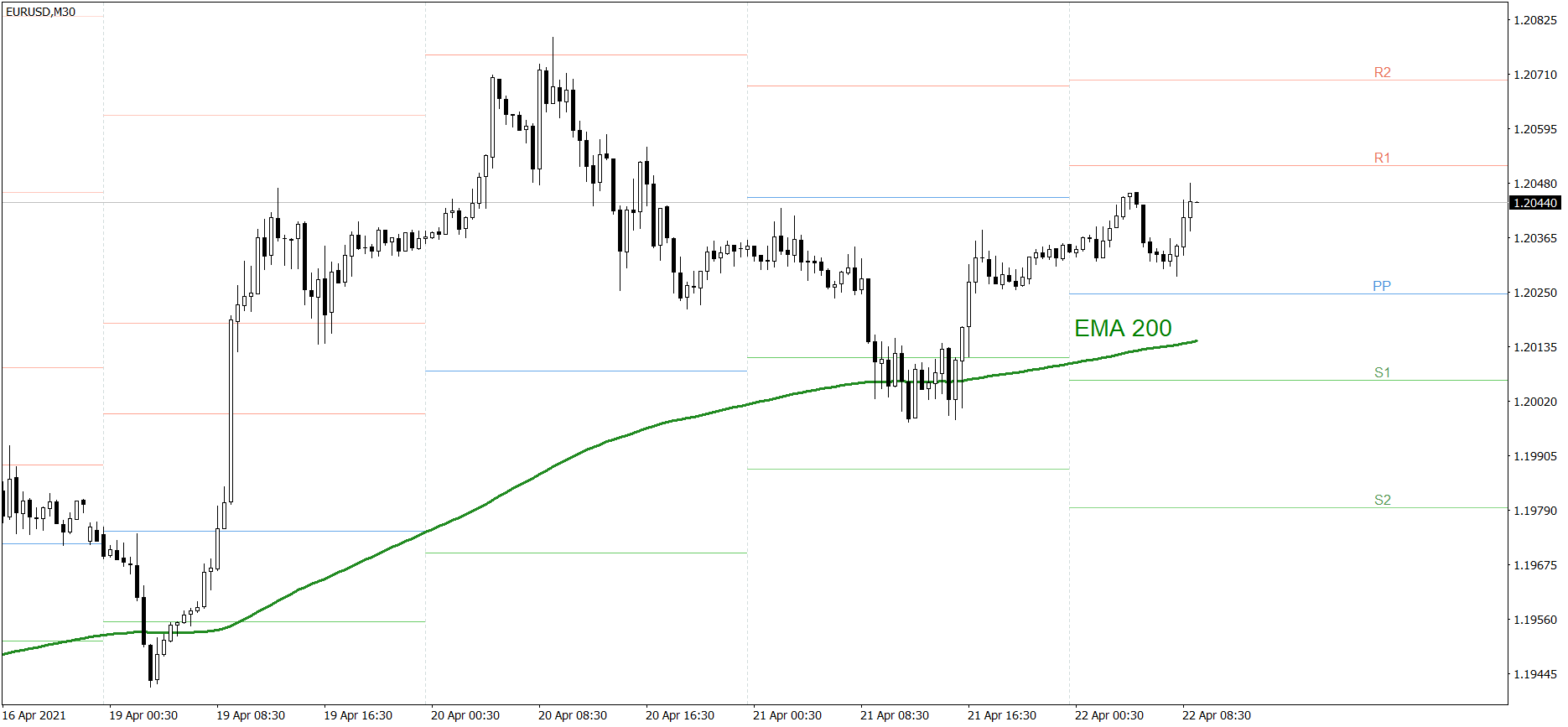

GBPUSD

The GBPUSD also showed mixed sentiment yesterday. First the price dropped below 1.39, but then it quickly returned above it and finished the session at the same level, where it began. Today, it is still showing mixed sentiment and the volatility is really low. If the buyers take control over the market, the price might even reach 1.40. But if the bears show their strength, the price could fall below 1.39 once again.