Yesterday’s session was very interesting. The volatility was completely extreme, because of the Fed’s monetary policy meeting. Both EURUSD and GBPUSD rose strongly. The EURUSD finished the day above the R2 resistance level and the GBPUSD got close to 1.40. Today, the volatility is still really high and the EURUSD is falling and the GBPUSD is showing mixed sentiment. From the data front, all eyes will be focused on the decision by the Bank of England on interest rate and the QE programme. Anyway, let’s start the analysis:

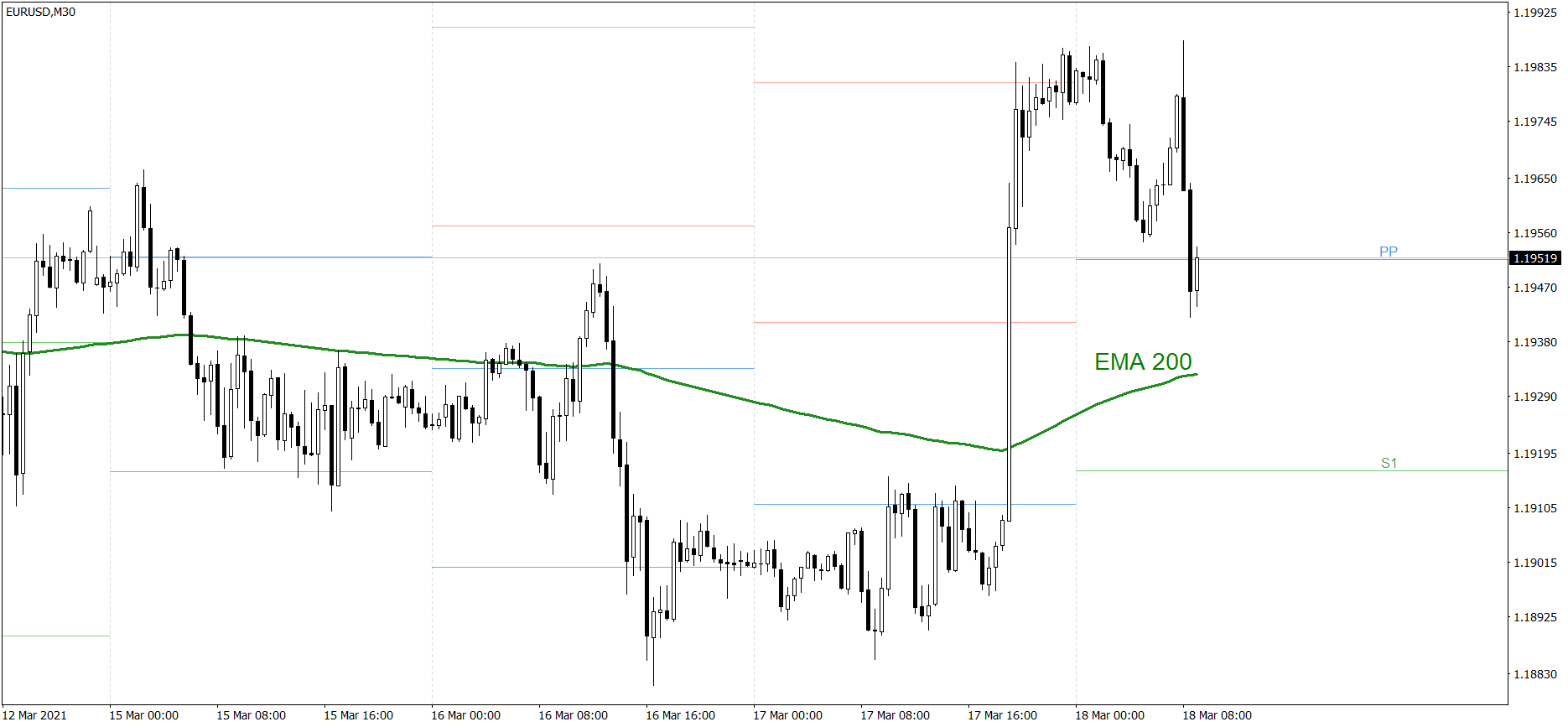

EURUSD

Yesterday was a completely extraordinary session. The EURUSD showed mixed sentiment before the Fed’s monetary policy meeting, which took place in the late afternoon. When it started, the price rose strongly and finished the day above the R2 resistance level. However, the price is going down today. Right now, it’s at the Pivot Point. If the buyers don’t generate some serious demand soon, the price could drop below the EMA 200. But if they do, the price might even reach 1.20.

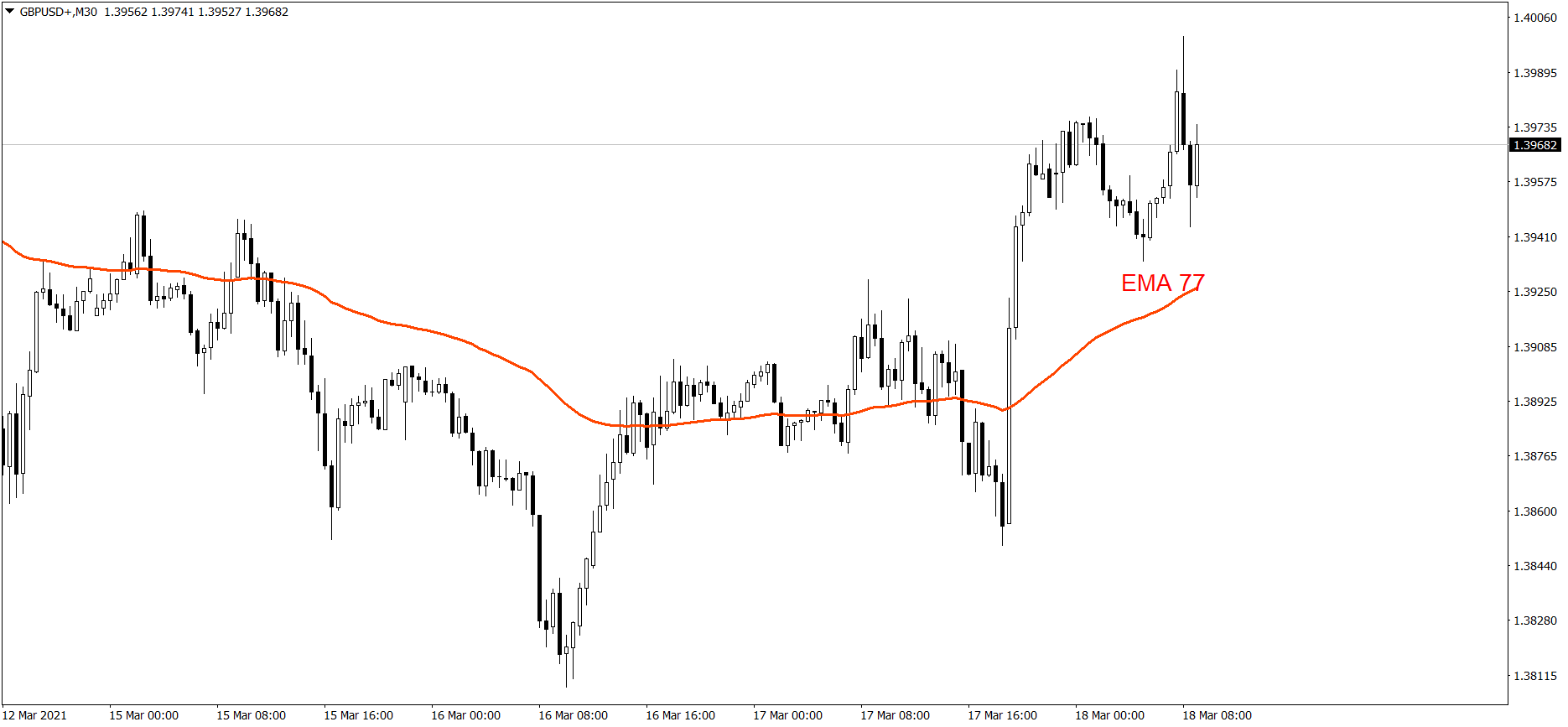

GBPUSD

Yesterday, the GBPUSD also strongly went up. Before the start of the Fed’s monetary policy meeting, the price had been falling, but after that It went up extremely. In the end, the price finished the day above 1.396. Today, it is showing mixed sentiment. The volatility is still pretty high, though. If the buyers take control over the market once again, the price might rise above 1.40. But if the bears show their strength this time, the price could drop below the EMA 77.