On Friday, the US dollar showed its strength once again. Both EURUSD and GBPUSD went down. Moreover, they are still falling today. Today, the economic calendar is quite uneventful so investors will keep an eye to the development of trends that worried investors last week. Jerome Powell’s speech and strong February NFP report are likely to provide more fuel to the rally in US long-term interest rates, so what is the US dollar is likely to do? Let’s try to answer that question in the analysis:

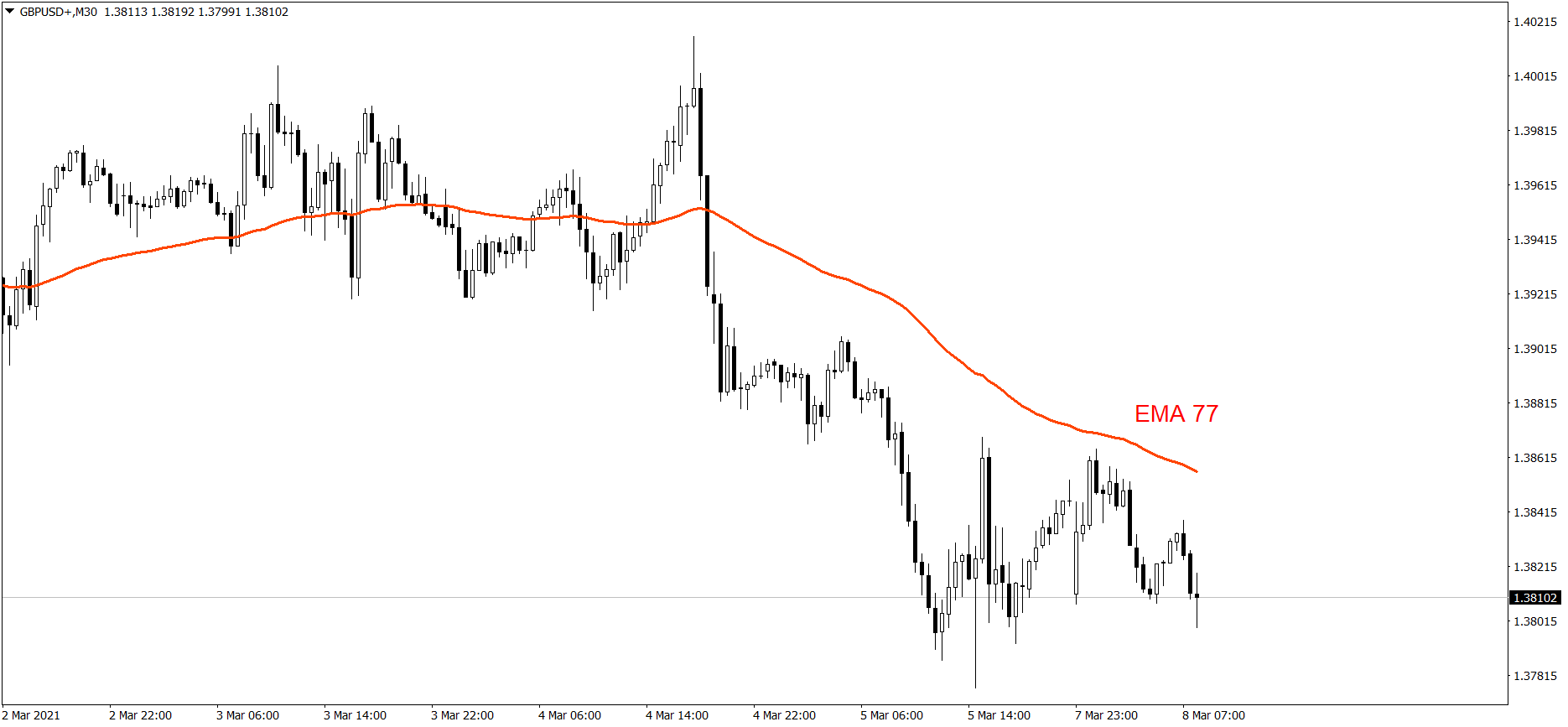

EURUSD

On Friday, the EURUSD dropped one more time last week. The price finished the session at the S1 support level. Today it is going down even more. Right now the bears are attacking today’s S1. If the buyers don’t defend it successfully and generate some serious appetite, the price could even fall near 1.185 today. But if they do, the price might rise above the Pivot Point.

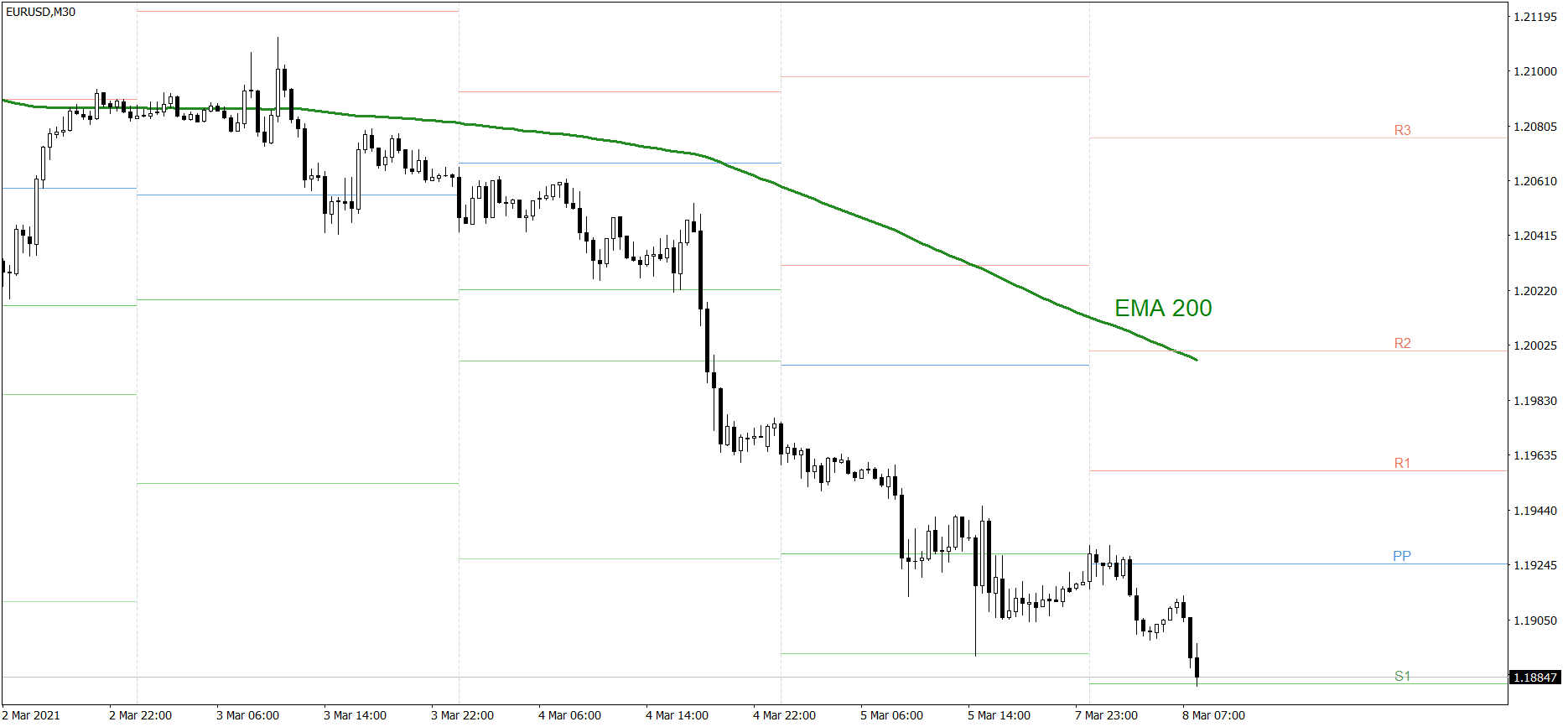

GBPUSD

The GBPUSD also dropped a bit on Friday. The price finished the week slightly below 1.385. After the weekend, the price opened significantly lower. After that. it quickly rose above 1.385, then it started falling once again. Right now the bears are getting close to 1.38. If the buyers don’t defend it successfully and generate some serious appetite, the price could fall below 1.375 today. But if they do, the price might rise to the EMA 77.