During the last session of the month both EURUSD and GBPUSD showed mixed sentiment. Today, the situation is a bit different. The EURUSD is still showing mixed sentiment with low volatility, but the GBPUSD is rising significantly. From the data front, the markets will be closely watching releases of manufacturing activity indices (PMI) in the Eurozone, UK and US. The publications are expected to indicate that expansion moderates in the manufacturing sectors, which were a foundation for synchronized global economic recovery in late 2020. Anyway, let’s start the analysis:

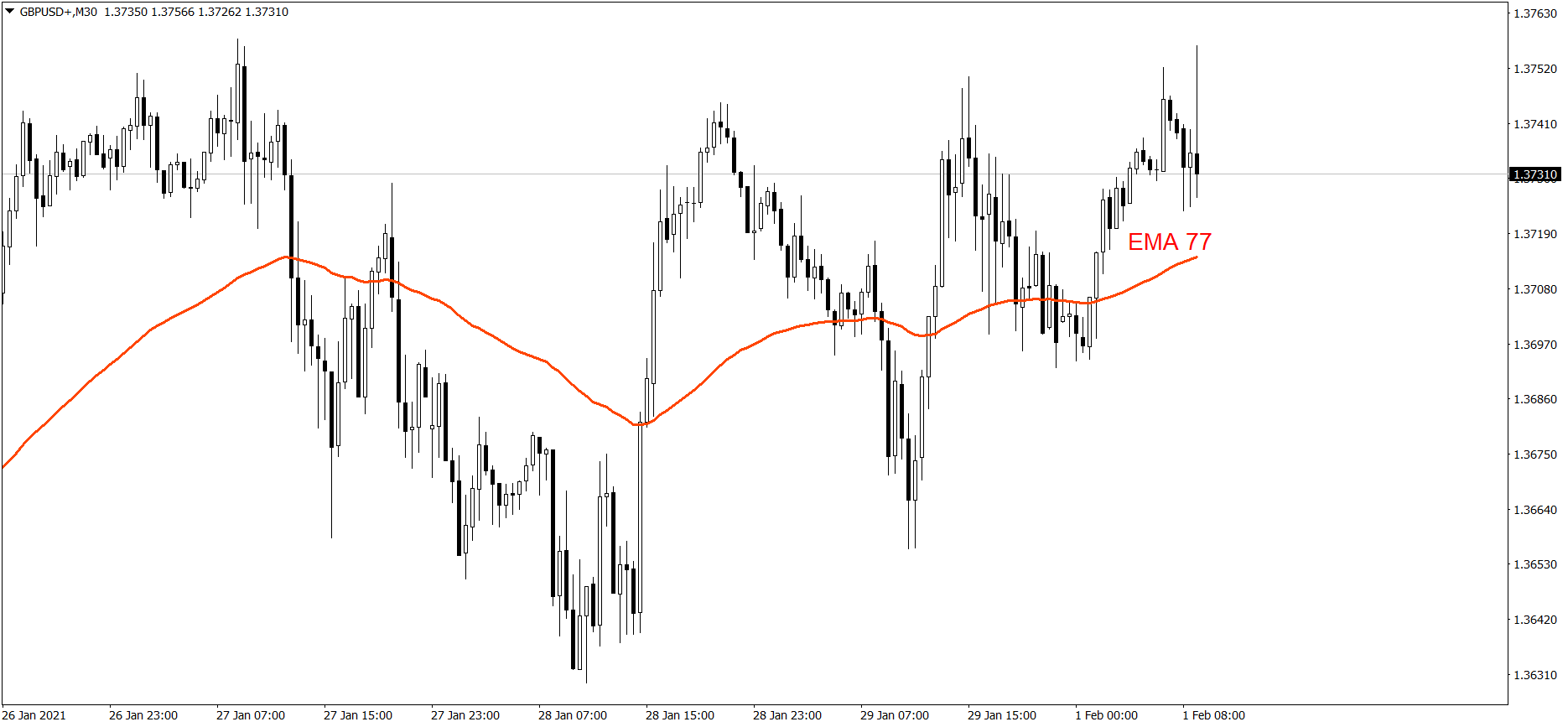

EURUSD

The EURUSD showed mixed sentiment during the last session of the month. In the early afternoon the price tested the R1 resistance level, but the bulls weren’t strong enough to beat it, so the price dropped a bit. It finished the month a little above the EMA 200, though. During today’s Asian trading session the price showed mixed sentiment and low volatility, but after the start of the European trading session, it went down. If the buyers don’t generate sufficient demand pretty soon, the price could fall below the S1 support level and 1.21. But if they do, the price should return above the EMA 200 and the Pivot Point.

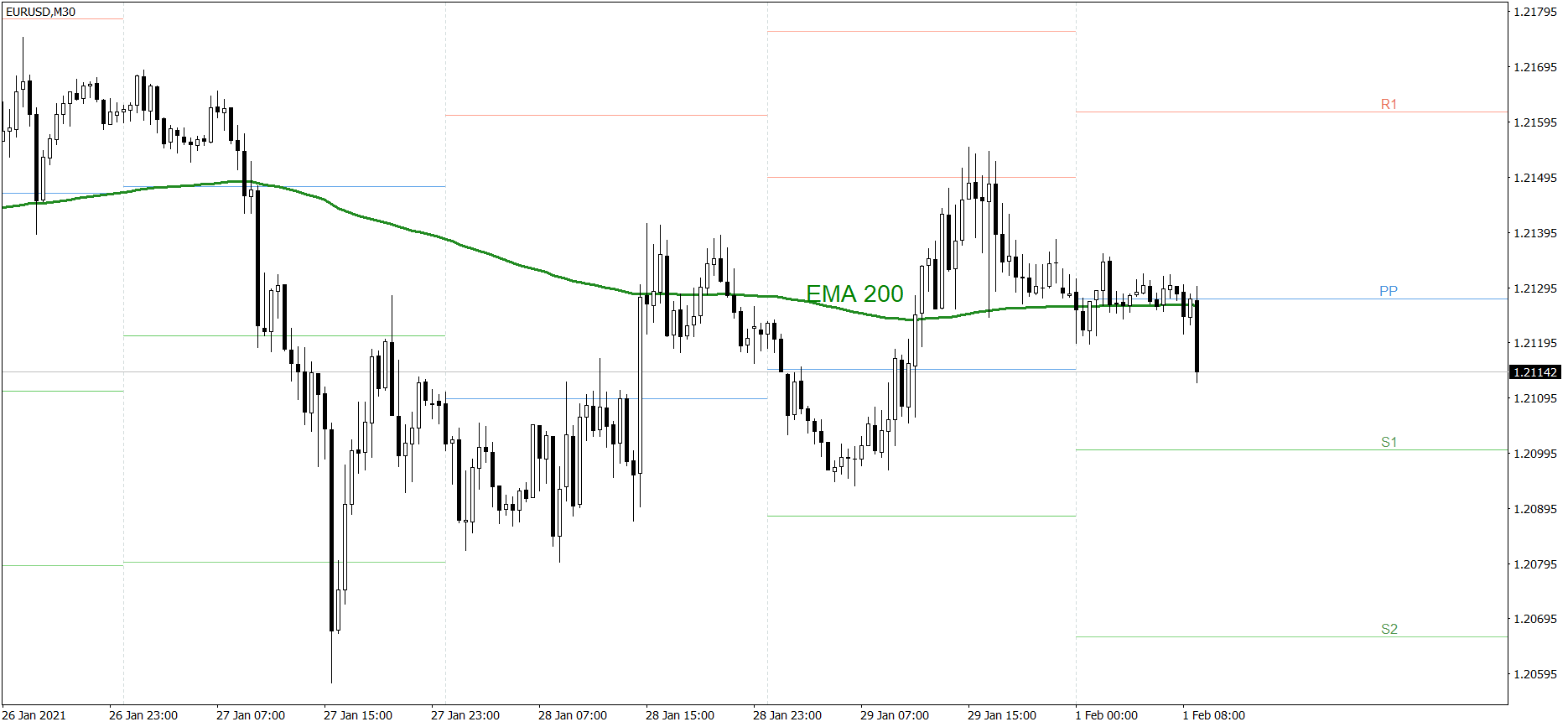

GBPUSD

The GBPUSD also showed mixed sentiment during the last session of the month. The price finished it on 1.37, slightly below the EMA 77. However, it is strongly rising today. If the buyers continue generating firm demand, the price might cross 1.375 and hold above it for the rest of the day. But if the bears counterattack, the price could drop below 1.37.