Yesterday the American indices performed differently. The Dow Jones Industrial Average rose strongly and set the new all-time high. However, the NASDAQ 100 dropped significantly and finished the session a little above the S1 support level. And the S&P 500 didn’t decide to go either way and showed mixed sentiment. Today, all three of them are falling, though. From the data front, the CPI in July will be published. Anyway, let’s start the analysis, S&P 500 first:

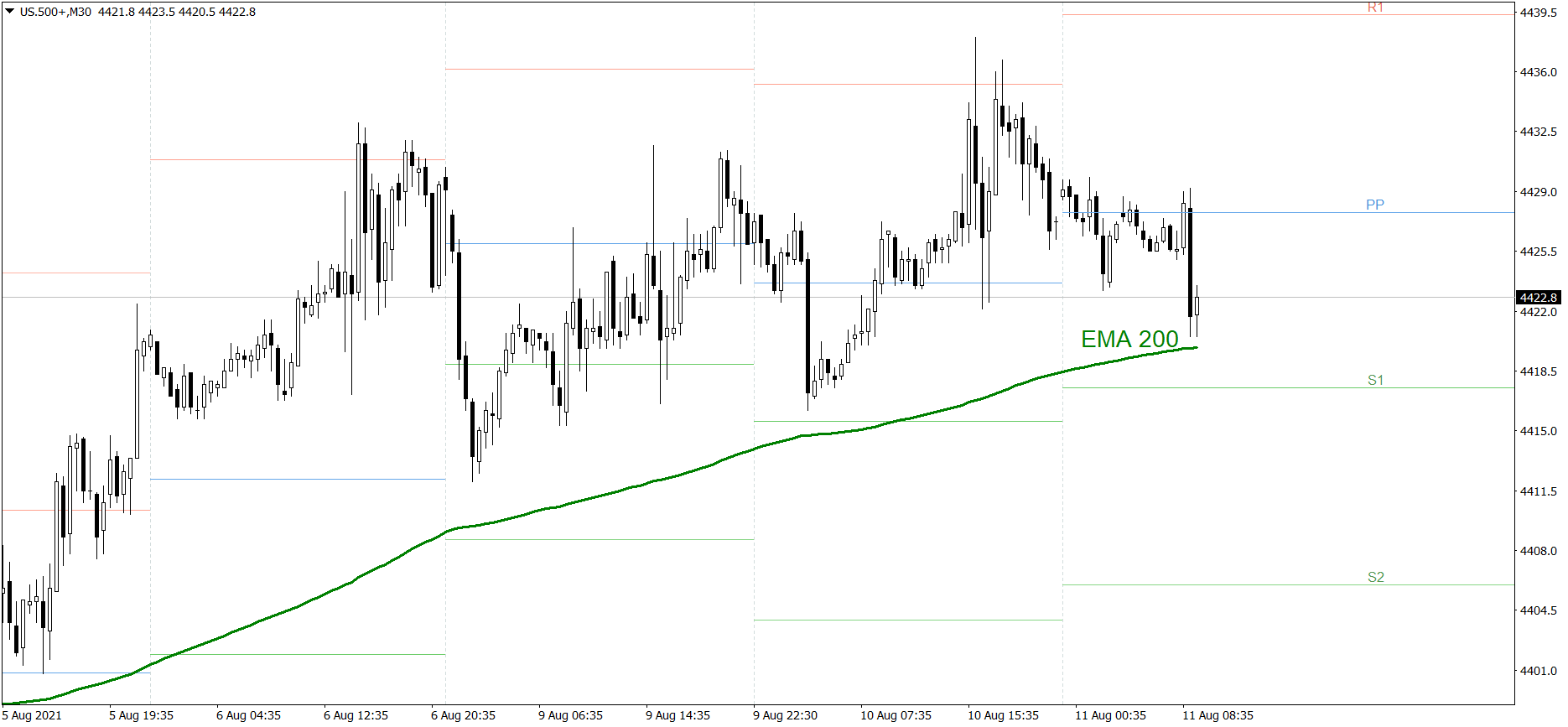

S&P 500

The S&P showed mixed sentiment yesterday. First the price dropped and almost tested the S1 support level. Then it rose strongly, set the new all-time high and tested the R1 resistance level. In the late afternoon it started going down once more. In the end the price finished the session a little below 4430. Today, the price is falling even more. Right now it is getting close to the EMA 200. If the buyers don’t generate some serious appetite soon, the price could drop below the S1. But if they do, the price might return above the Pivot Point.

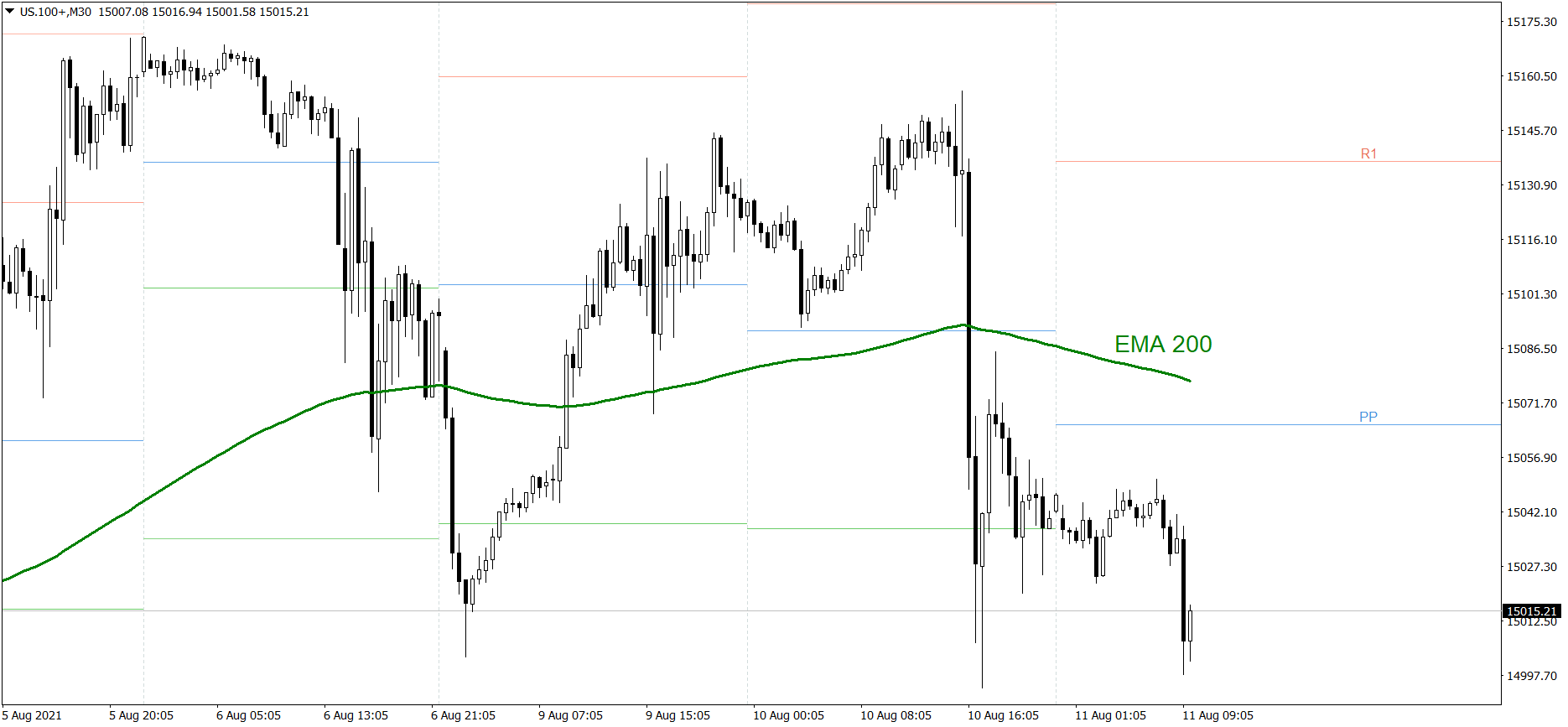

NASDAQ 100

NASDAQ 100 was the weakest one yesterday. The price dropped significantly and finished the session a little above the S1 support level. Today, it is falling even more. Right now the bulls are trying to defend 15000. If they do it successfully, the price might bounce and rise above the Pivot Point. But if they fail, the price could even go down to 14900.

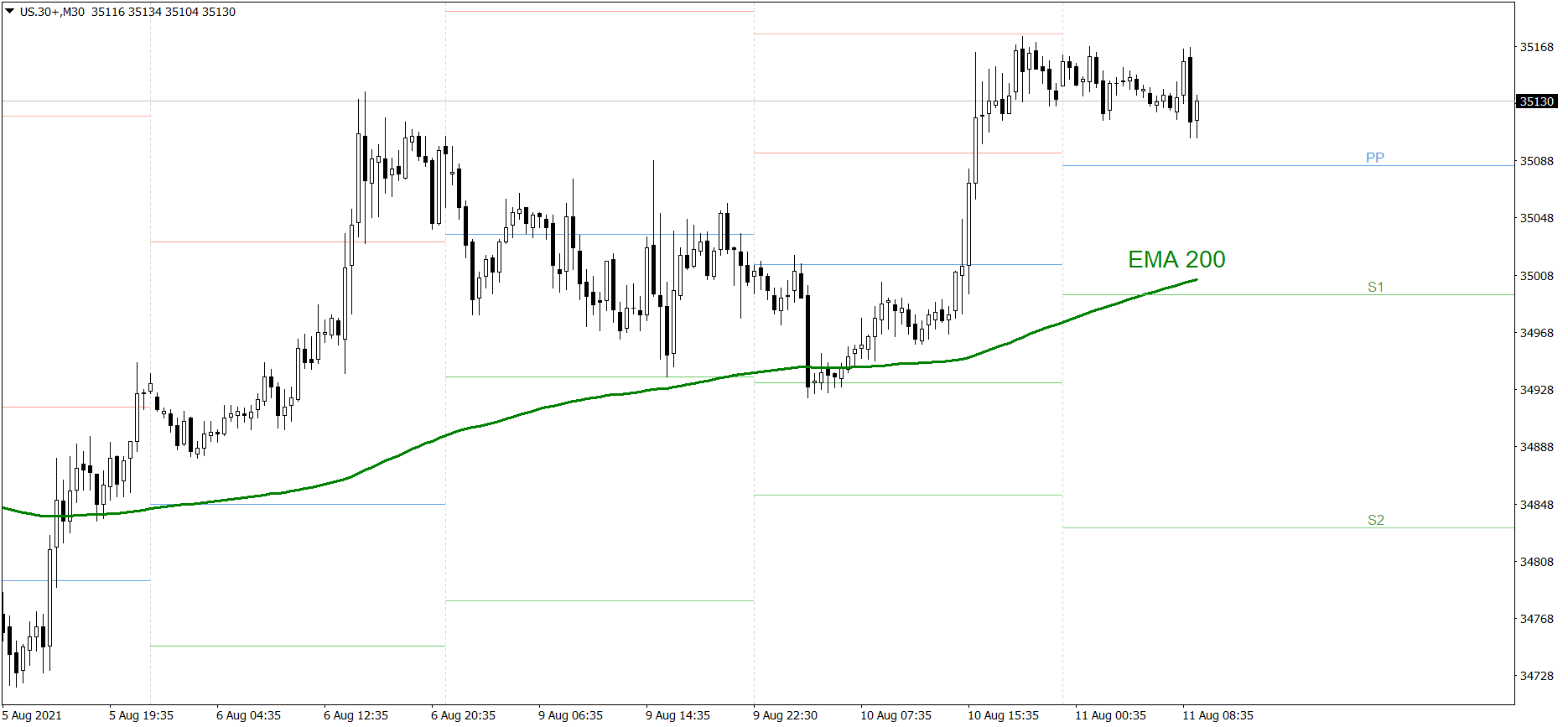

Dow Jones Industrial Average

The DJIA index was definitely the strongest one yesterday. The price rose strongly, set the new all-time high and finished the session high above the R1 resistance level. However, it is going down today, but only a little. If the buyers don’t generate some serious appetite, the price could even drop to the EMA 200. But if they do, the price might set the new all-time high and rise above 35250.