Yesterday was another great bullish session. All three American indices finished the day near their R2 resistance levels. However, they are going down today. From the data front, the ADP nonfarm employment change in March and the GDP in Q4 will be published. Anyway, let’s start the analysis, S&P 500 first:

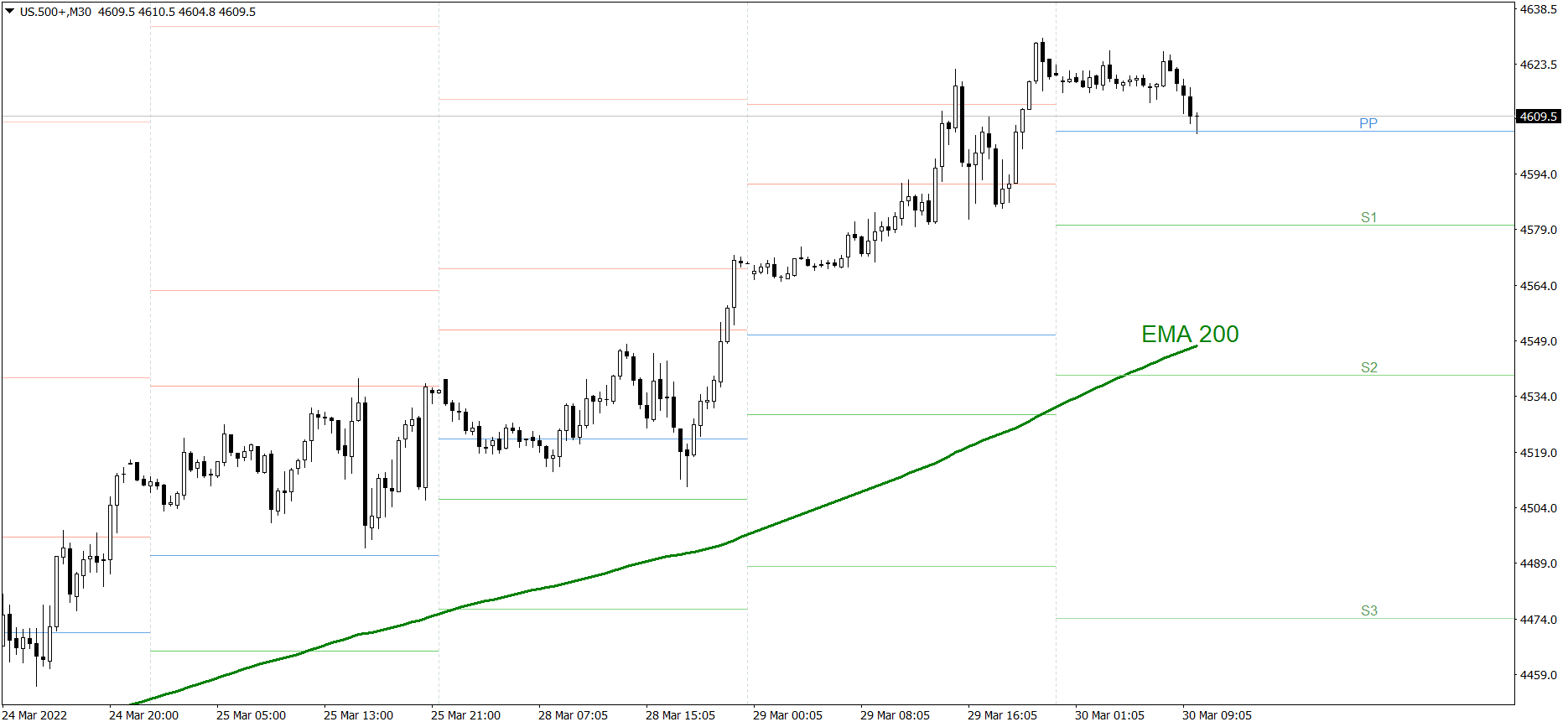

S&P 500

Yesterday was another impressive bullish session. The S&P 500 rose strongly and finished the session above the R2 resistance level, at 4620. However, the price is going down today. Right now the bulls are trying to defend the Pivot Point. If they do it successfully, the price might bounce and reach 4640. But if they fail, the price could fall below 4590 and maybe even reach the S1 support level.

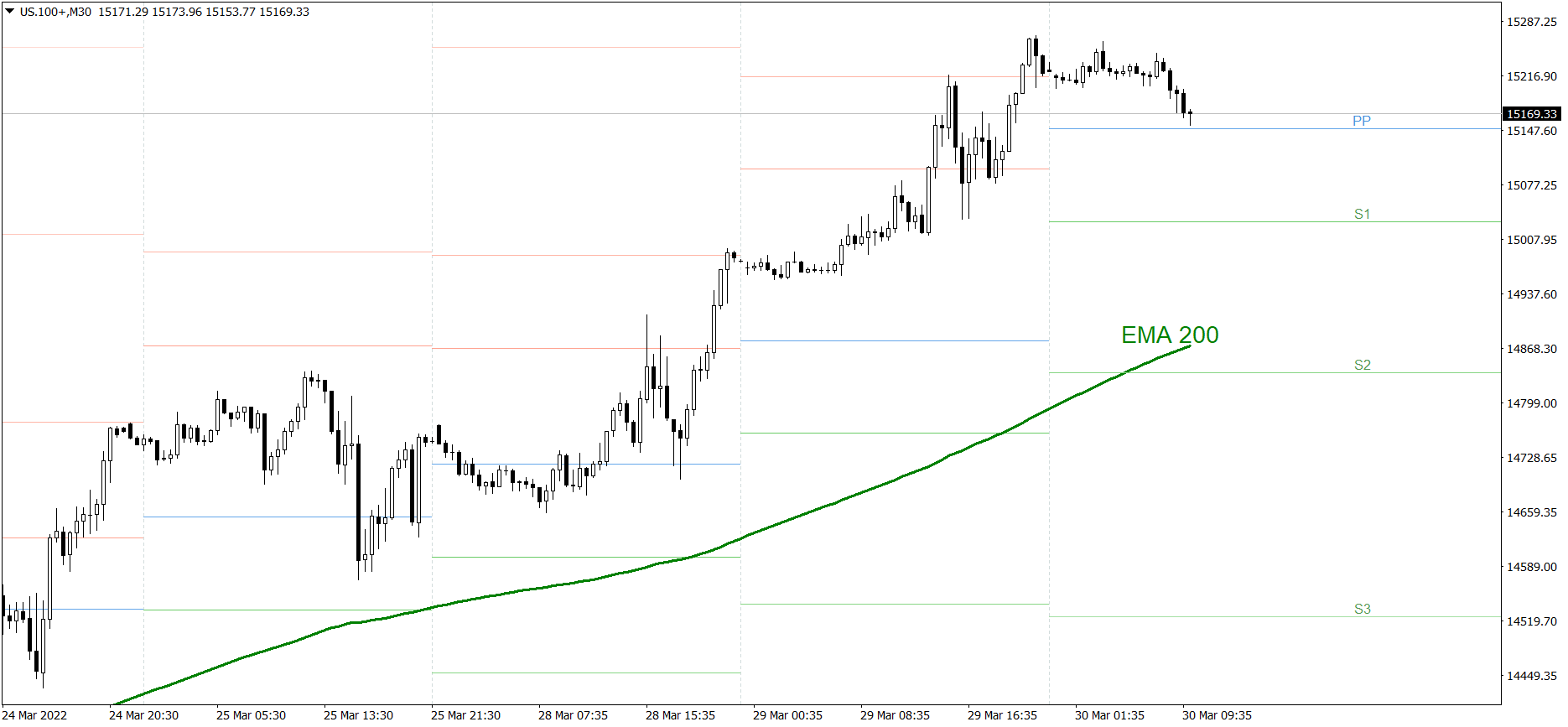

NASDAQ 100

NASDAQ 100 also rose strongly yesterday. The price finished the session at the R2 resistance level, slightly above 15200. However, the price is going down today. Right now the bulls are trying to defend the Pivot Point. If they do it successfully, the price might bounce and reach 15300. But if they fail, the price could fall below 15100.

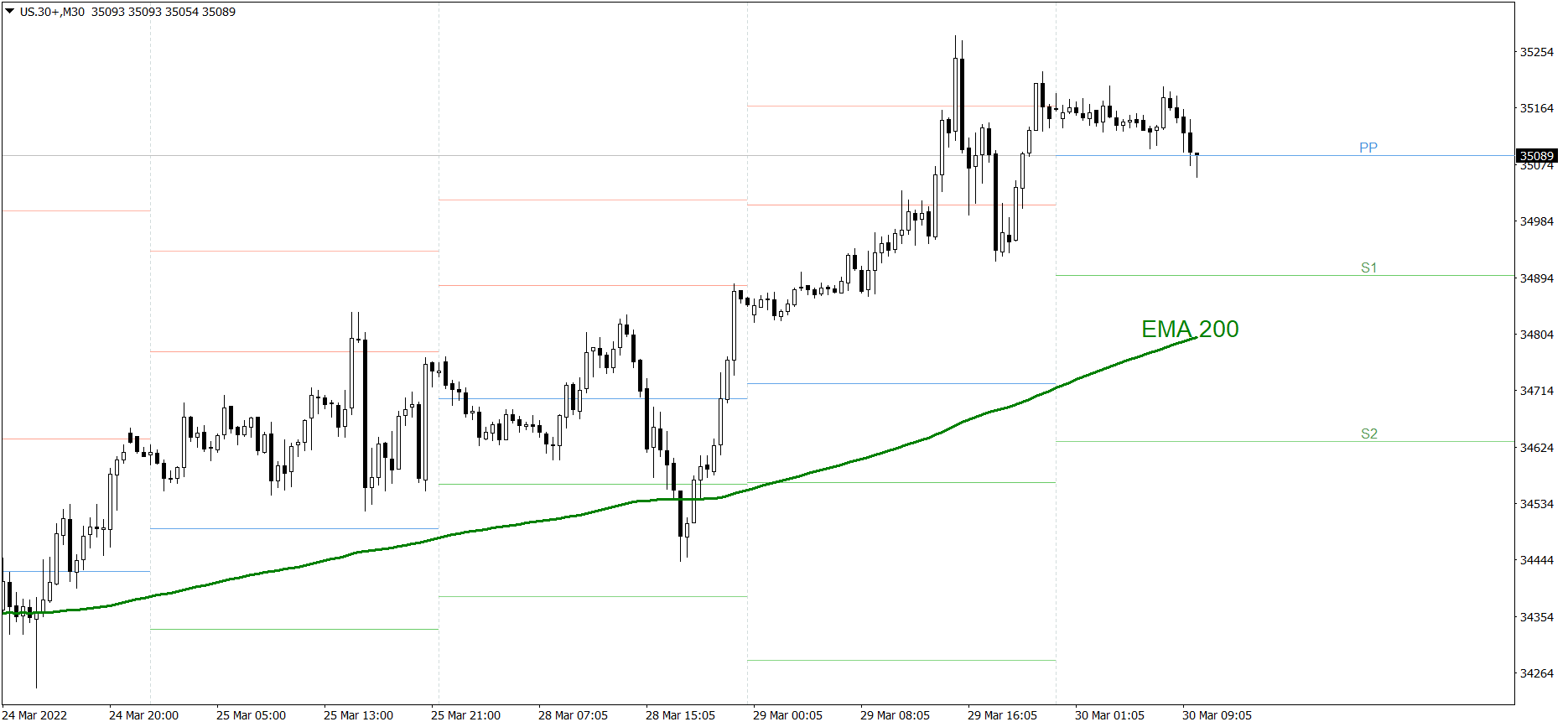

Dow Jones Industrial Average

The DJIA index rose strongly as well. The price finished the session at the R2 resistance level, slightly above 35100. However, the price is going down today. Right now the bulls are trying to defend the Pivot Point. If they do it successfully, the price might bounce and reach 35300. But if they fail, the price could go down to 34900 and even reach the S1 support level.