Friday was a shocking session for the American indices. All three of them finished the week extremely low – much lower than the last three. However, all they are rising today. What can they do next? Let’s try to answer that question in an analysis, S&P 500 first:

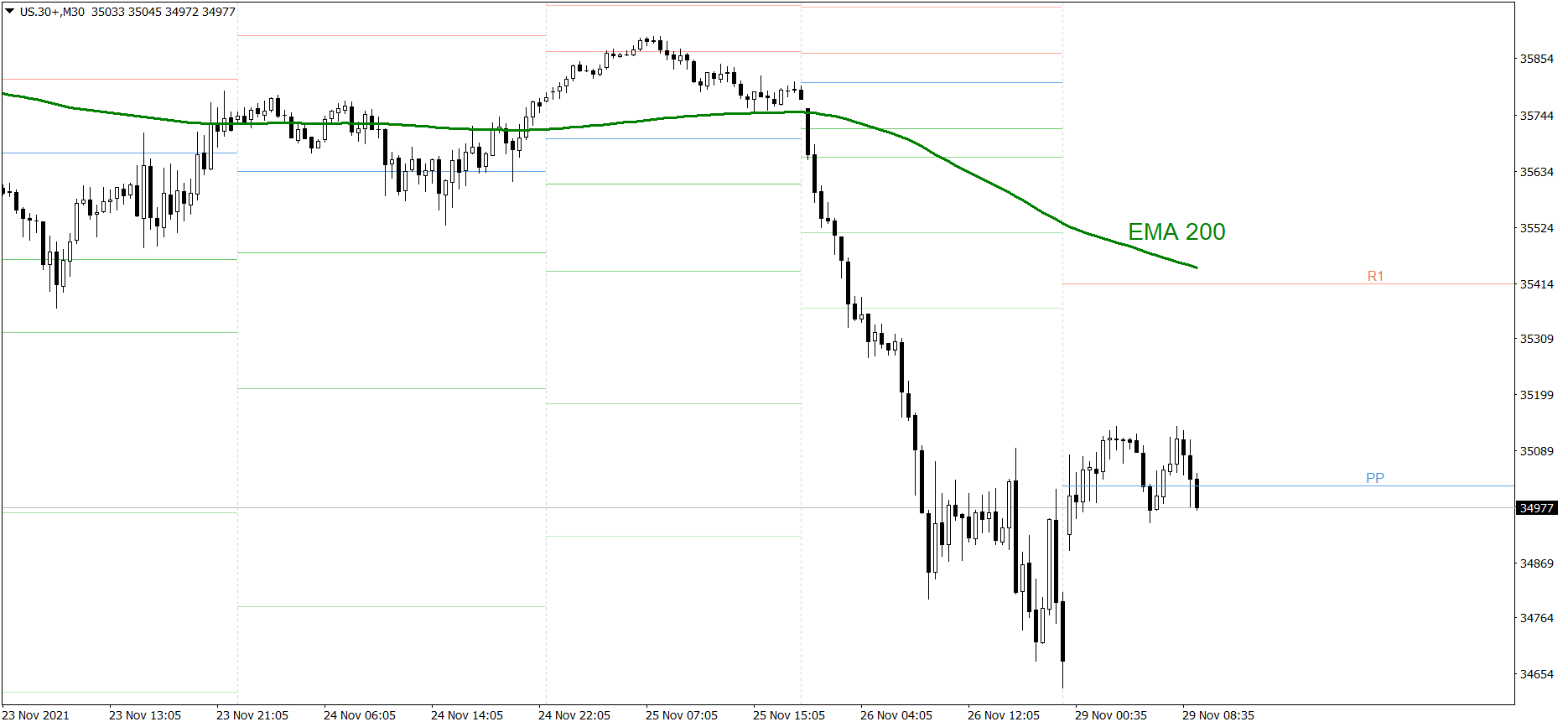

S&P 500

Friday was a shocking session. The S&P 500 dropped 125 pips and finished the week a little below 4580. However, after the weekend it opened 27 pips higher and has been rising since then. The price is already above the Pivot Point and 4620. If the buyers continue generating firm demand, the price might reach the R1 resistance level today. But if they fail, the price could return below 4600.

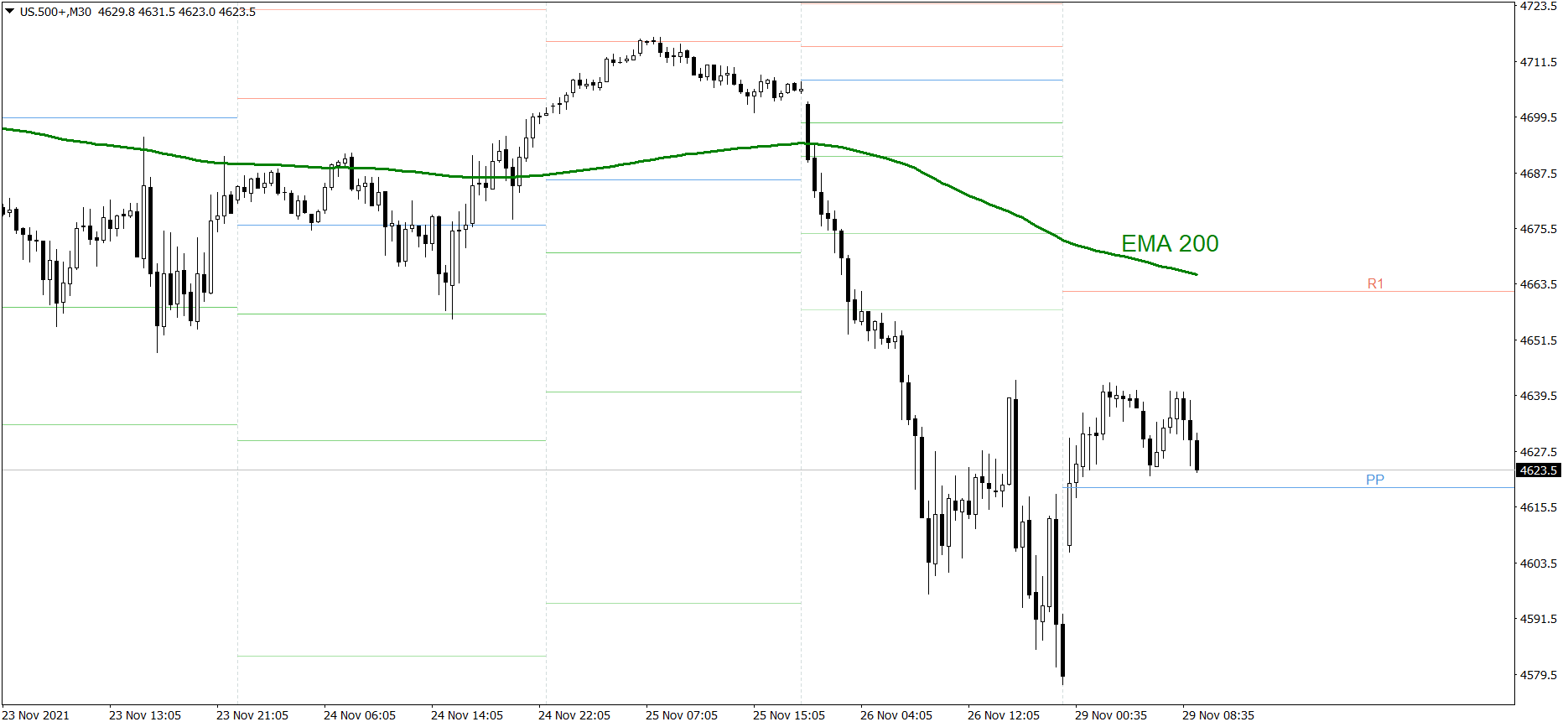

NASDAQ 100

NASDAQ 100 also dropped shockingly on Friday. The price went down 360 pips and finished the week slightly above 16000. However, after the weekend it opened 50 pips higher and has been rising since then. The price is already above the Pivot Point and 16190. If the buyers continue generating firm demand, the price might reach the R1 resistance level today. But if they fail, the price could return below the Pivot Point and 16100.

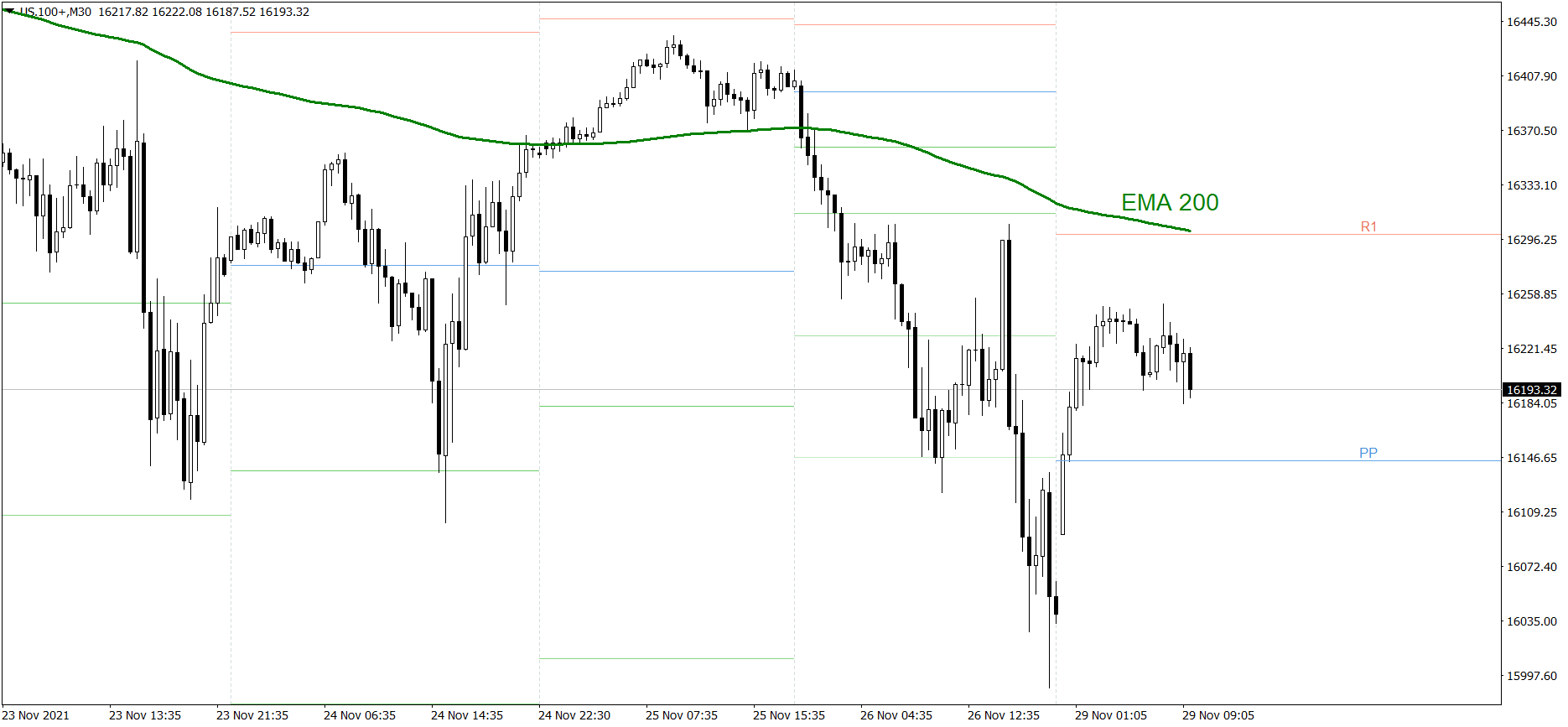

Dow Jones Industrial Average

The DJIA index went down heavily on Friday as well. The price dropped more than 1000 pips and finished the week below 34700. However, after the weekend it opened 250 pips higher and has been rising since then. If the buyers continue generating firm demand, the price might rise high above 35000 and the Pivot Point. But if they fail, the price could return below 34700.