Yesterday the American indices showed mixed sentiment. Today all three of them are slowly rising, though. From the data front, core durable goods orders in September will be published. Anyway, let’s move on to the analysis, S&P 500 first:

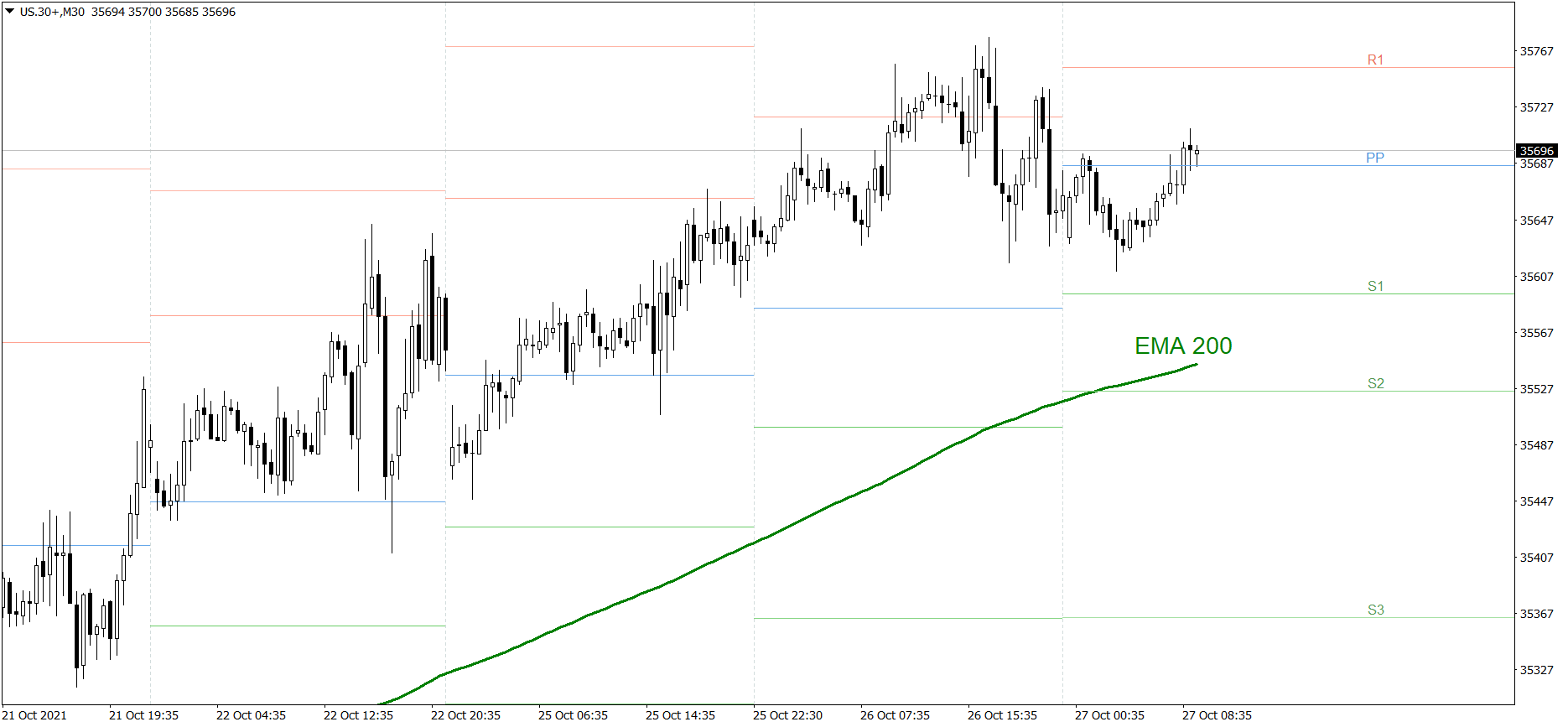

S&P 500

Yesterday the S&P 500 showed mixed sentiment. First the price rose high above the R1 resistance level and set the new all-time high. Then, in the afternoon, it dropped and finished the session exactly at the same level as it started. Today the price is rising slowly. Right now the bulls are attacking the Pivot Point. If they do it successfully, the price might go up above the R1 and 4580 today. But if they fail, the price could fall below 4560.

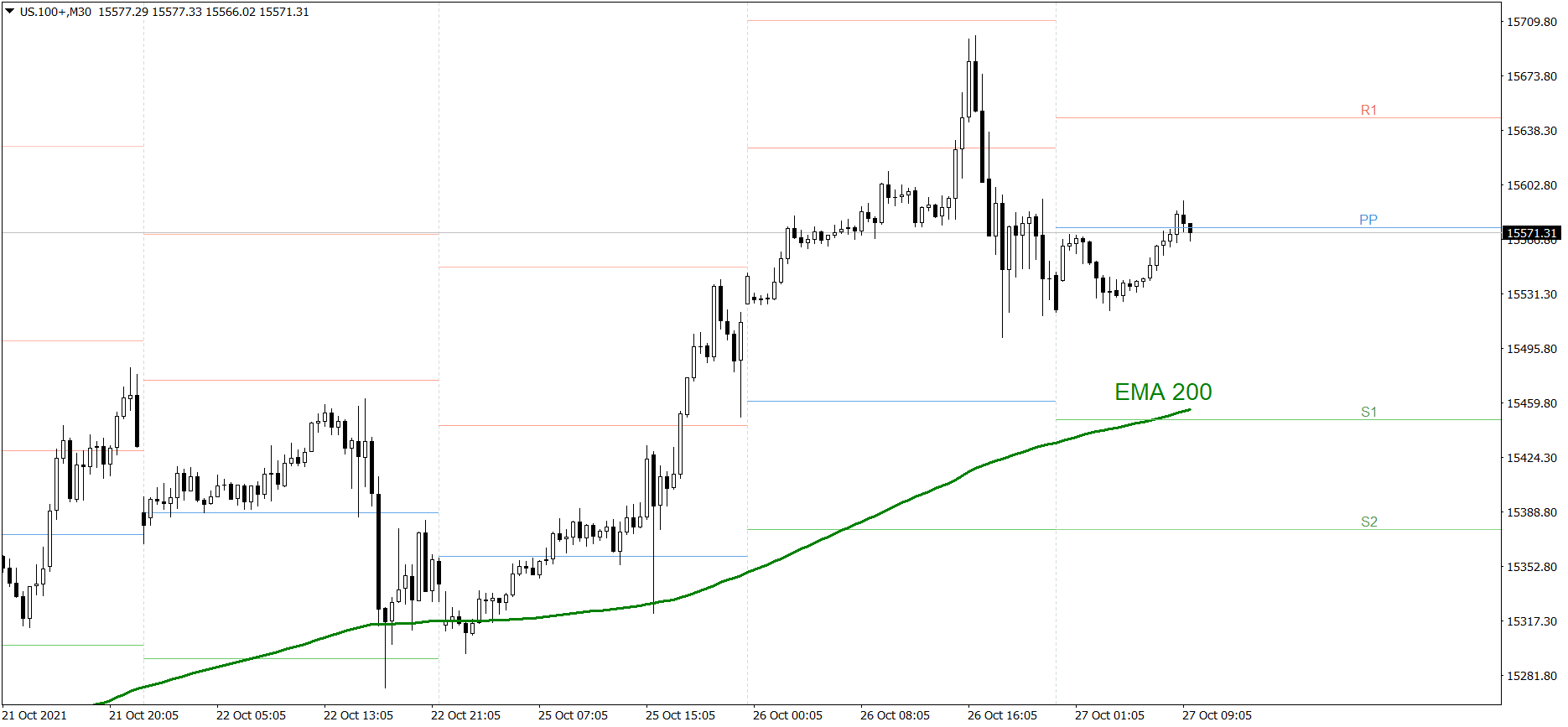

NASDAQ 100

NASDAQ 100 also showed mixed sentiment yesterday. First the price rose high above the R1 resistance level. Then, in the afternoon, it dropped and finished the session below 15550. Today the price is rising slowly. Right now the bulls are attacking the Pivot Point. If they do it successfully, the price might go up above the R1. But if they fail, the price could fall below 15500.

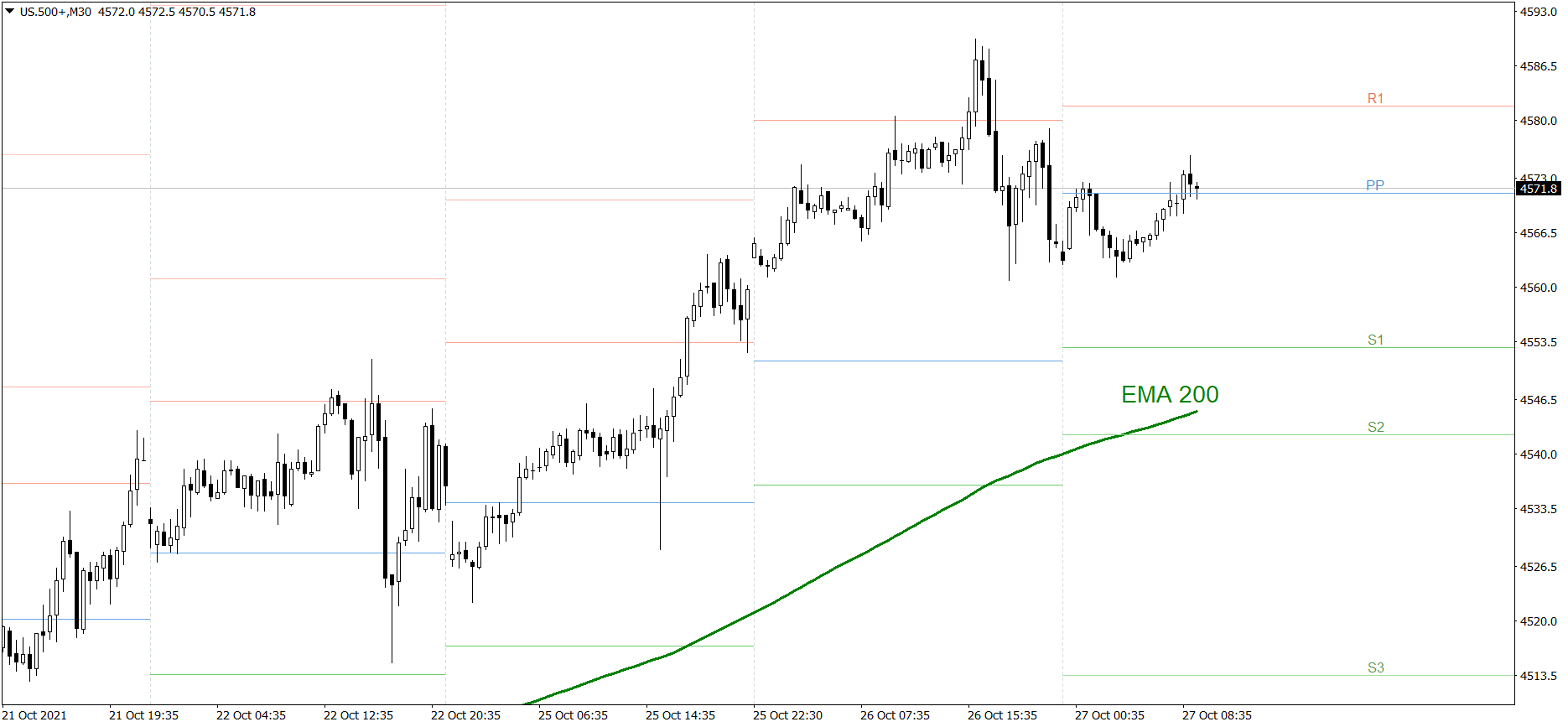

Dow Jones Industrial Average

The DJIA index showed mixed sentiment yesterday as well. First the price rose high above the R1 resistance level and set the new all-time high. Then, in the afternoon, it dropped and finished the session near 35650. Today the price is rising slowly. Right now the bulls are attacking the Pivot Point. If they do it successfully, the price might go up above the R1 and set the new all-time high. But if they fail, the price could fall to the S1 support level, below 35600.