Yesterday the American indices rose significantly. However, all three of them are going down today. From the data front, all eyes will be focused on the Jackson Hole symposium, where the Chair of the Federal Reserve – Jerome Powell will be speaking about the future US monetary policy. Anyway, let’s move on to the analysis, S&P 500 first:

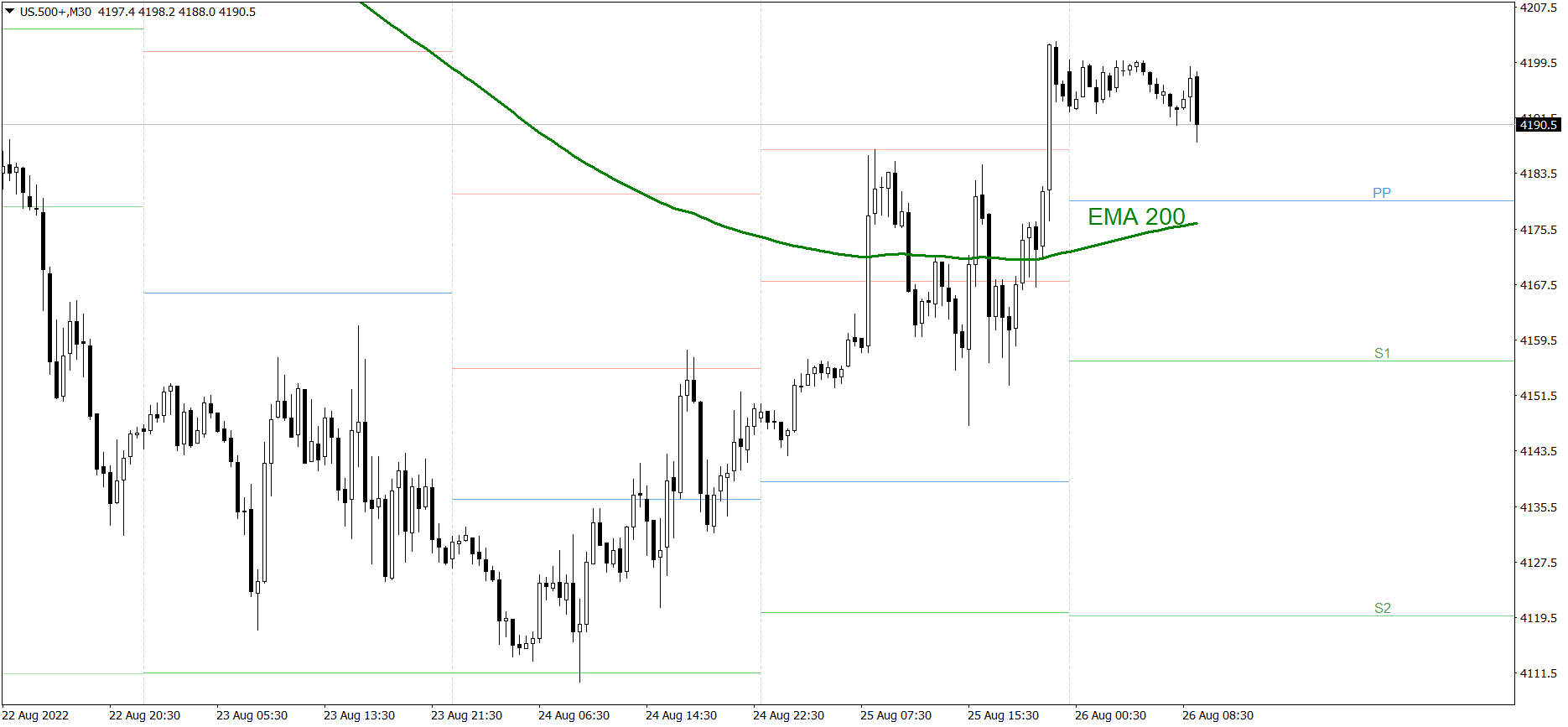

S&P 500

The S&P 500 rose strongly yesterday. The price finished the session above the R2 resistance level, a little below 4200. However, it is going down today. If the buyers don’t generate some serious appetite soon, the price could drop to 4180 and the Pivot Point. But if they do, the price might rise above 4205.

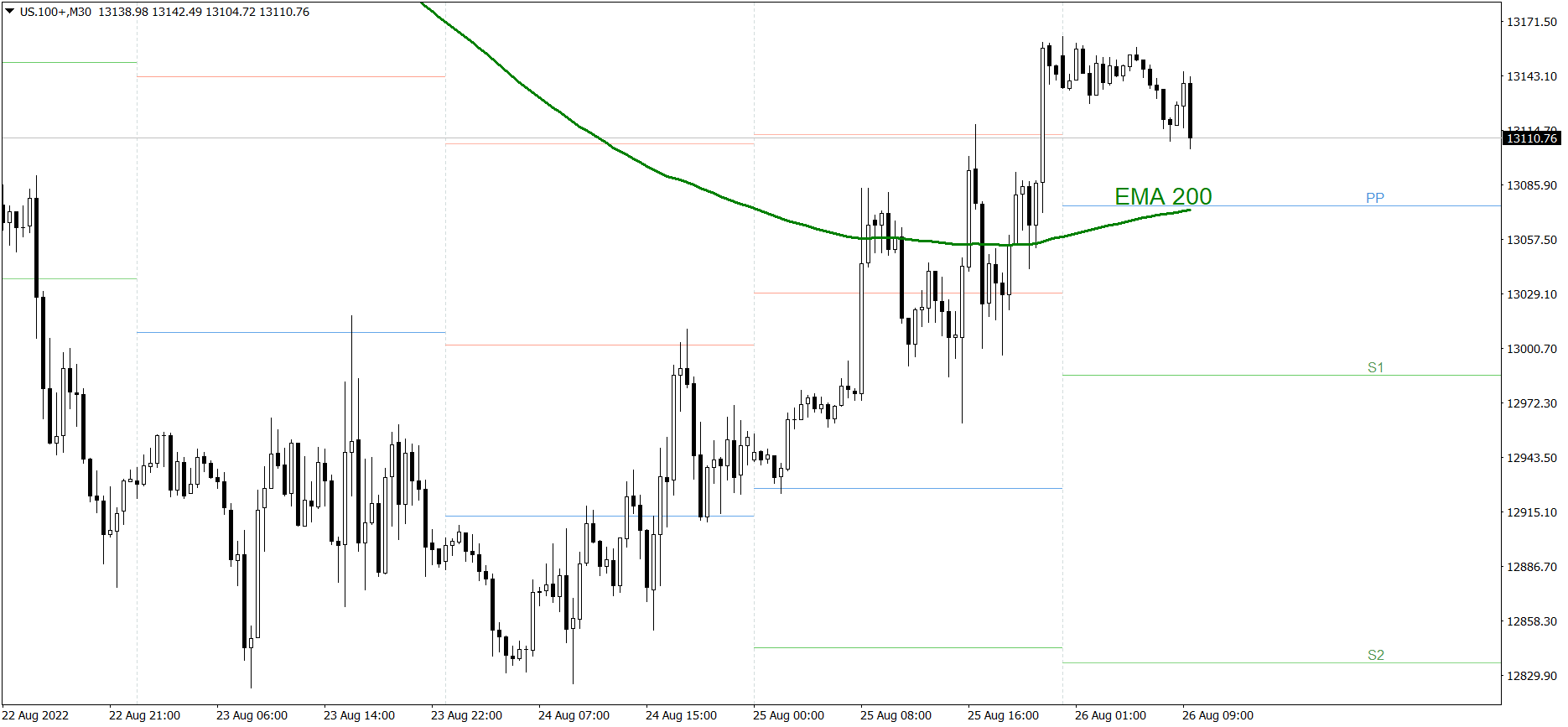

NASDAQ 100

NASDAQ 100 also rose strongly yesterday. The price finished the session significantly above the R2 resistance level, a little above 13150. However, it is going down today. If the buyers don’t generate some serious appetite soon, the price could drop to the Pivot Point and the EMA 200. But if they do, the price might return above 13150.

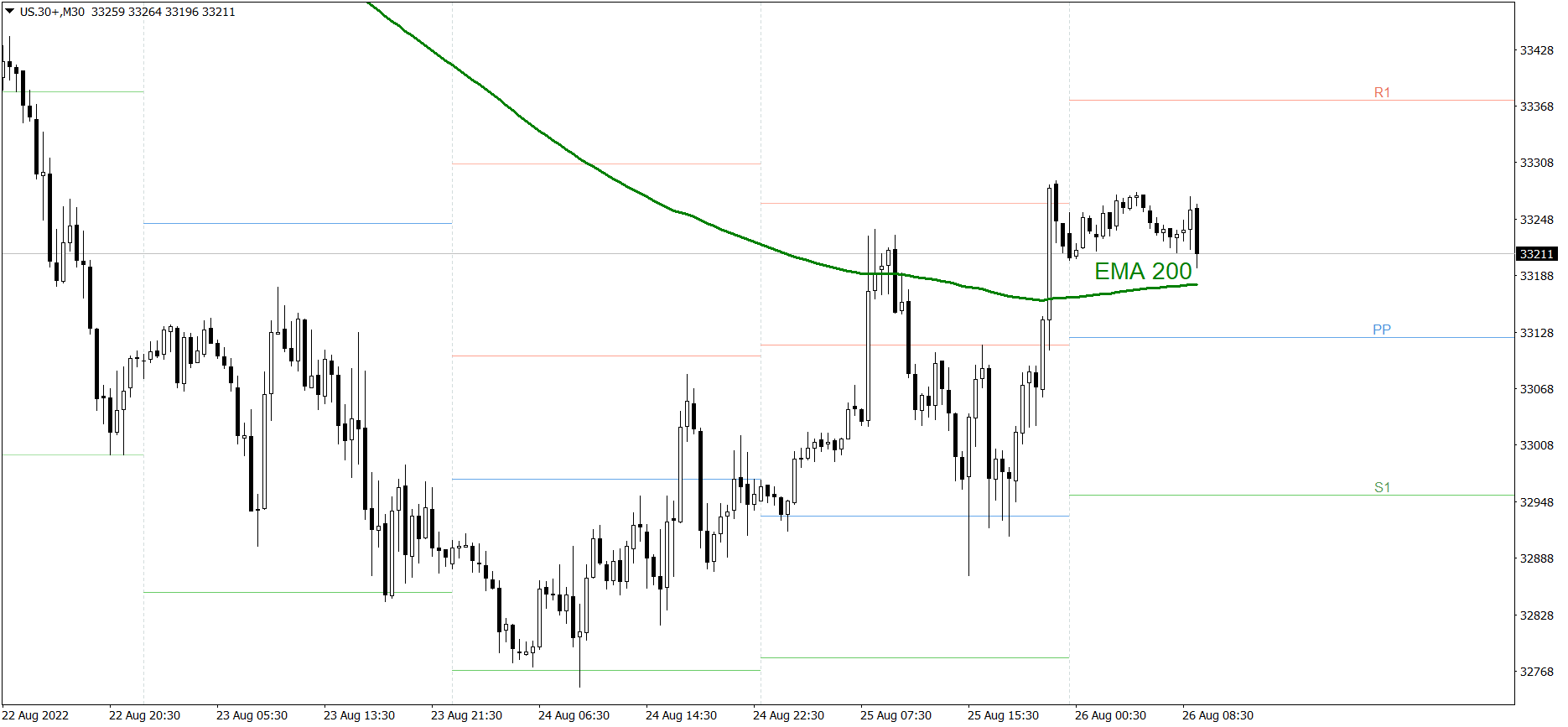

Dow Jones Industrial Average

The DJIA index rose strongly yesterday as well. The price finished the session slightly below the R2 resistance level, above 33200. Today, it is going down a bit, though. If the buyers don’t generate some serious appetite soon, the price could even drop below the Pivot Point and reach 33100. But if they do, the price might rise above 33300 and even reach today’s R1.