Yesterday the American indices performed differently. NASDAQ 100 dropped significantly, the Dow Jones Industrial Average managed to rise and the S&P 500 showed mixed sentiment. Today all three American indices are showing mixed sentiment. From the data front, the U.S. Federal Open Market Committee (FOMC) minutes from the last meeting will be published. Anyway, let’s start the analysis, S&P 500 first:

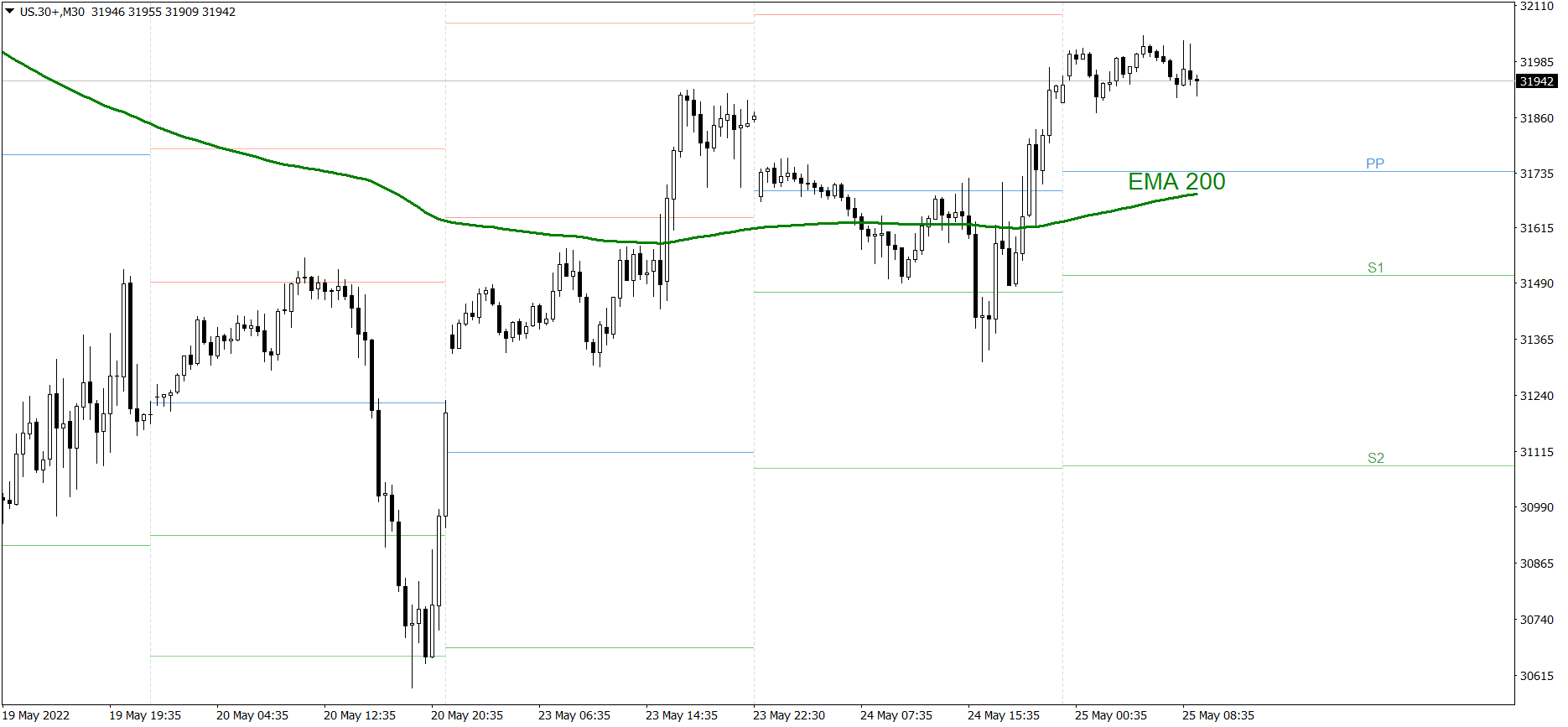

S&P 500

The S&P 500 showed mixed sentiment yesterday. First the price dropped heavily and tested the S2 support level. Then, in the afternoon, it managed to rise. In the end, the price finished the session above the EMA 200, at 3950. Today it is still showing mixed sentiment. If the buyers take control over the market, the price might go up above the R1 resistance level and reach 3980. But if the bears show their strength, the price could fall below 3930 and reach the Pivot Point.

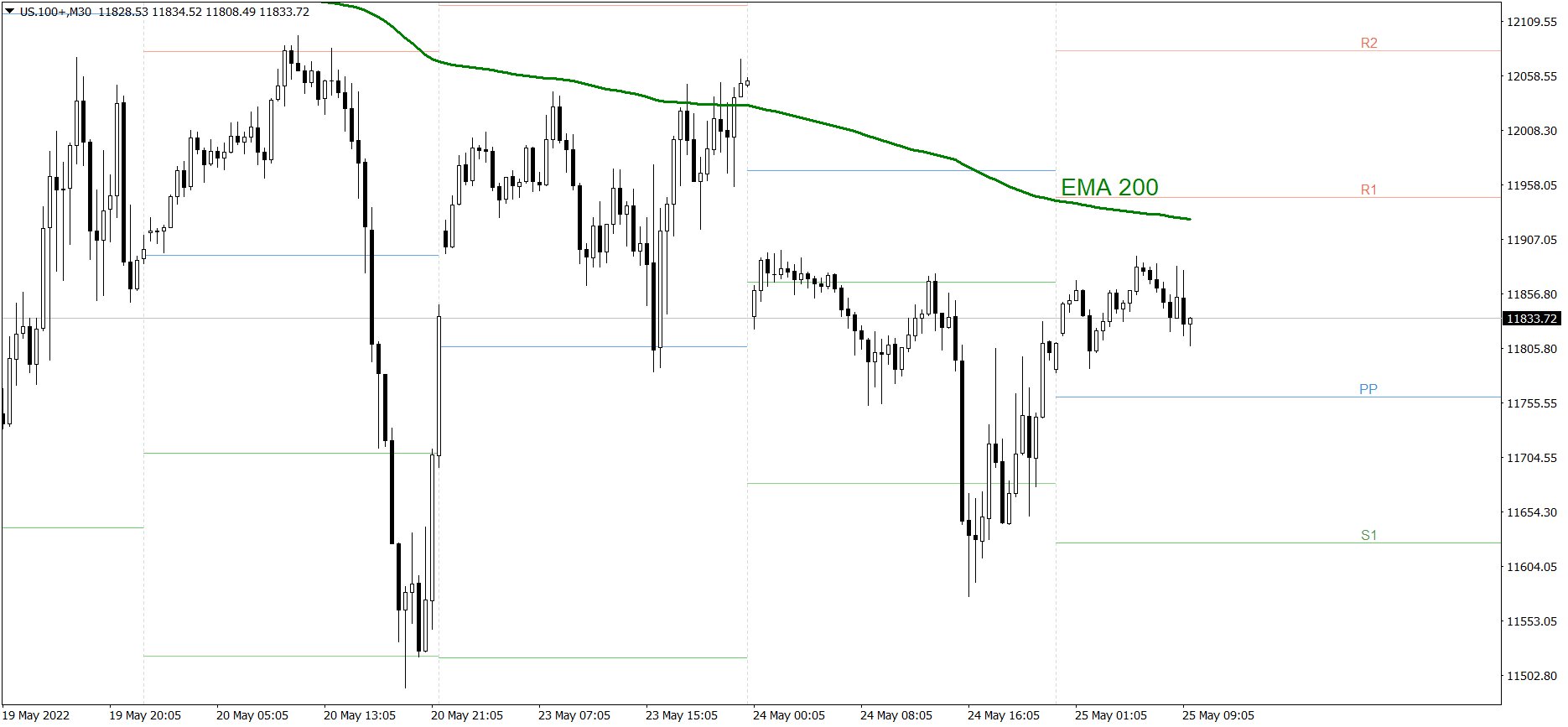

NASDAQ 100

NASDAQ 100 dropped heavily yesterday. The price finished the session below the S1 support level, at 11810. Today it is showing mixed sentiment. If the buyers take control over the market, the price might rise above the R1 resistance level and reach 11950. But if the bears show their strength once again, the price could go down below the Pivot Point and reach 11750.

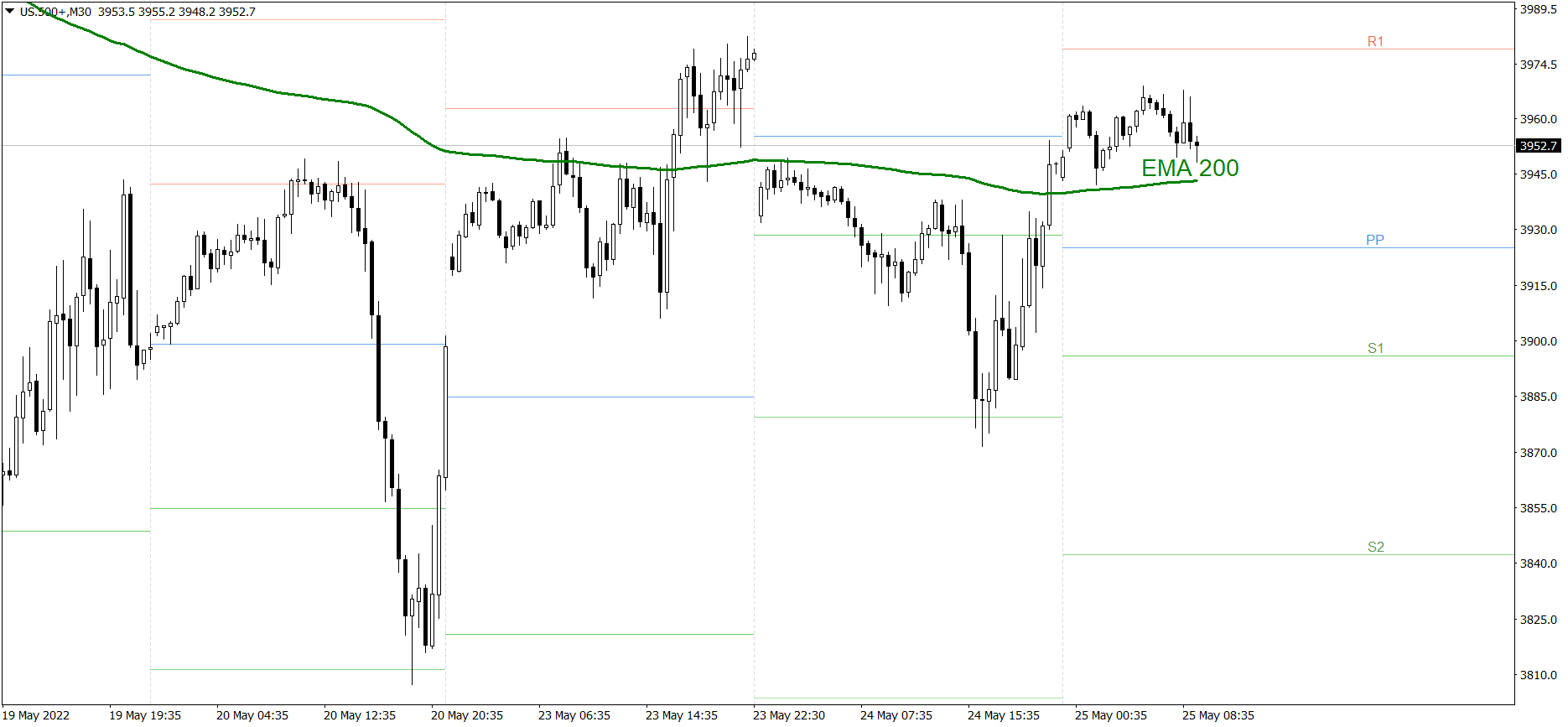

Dow Jones Industrial Average

The DJIA index managed to rise yesterday. The price finished the session above 31900. Today it is showing mixed sentiment. If the buyers show their strength once again, the price might go up above 31210 today. But if the bears take control over the market, the price could drop to the Pivot Point.