Yesterday the American indices showed mixed sentiment. Today, all three of them are rising slowly, though. From the data front, all eyes will be focused on the Federal Reserve that will make an update on monetary policy. Anyway, let’s move on to the analysis, S&P 500 first:

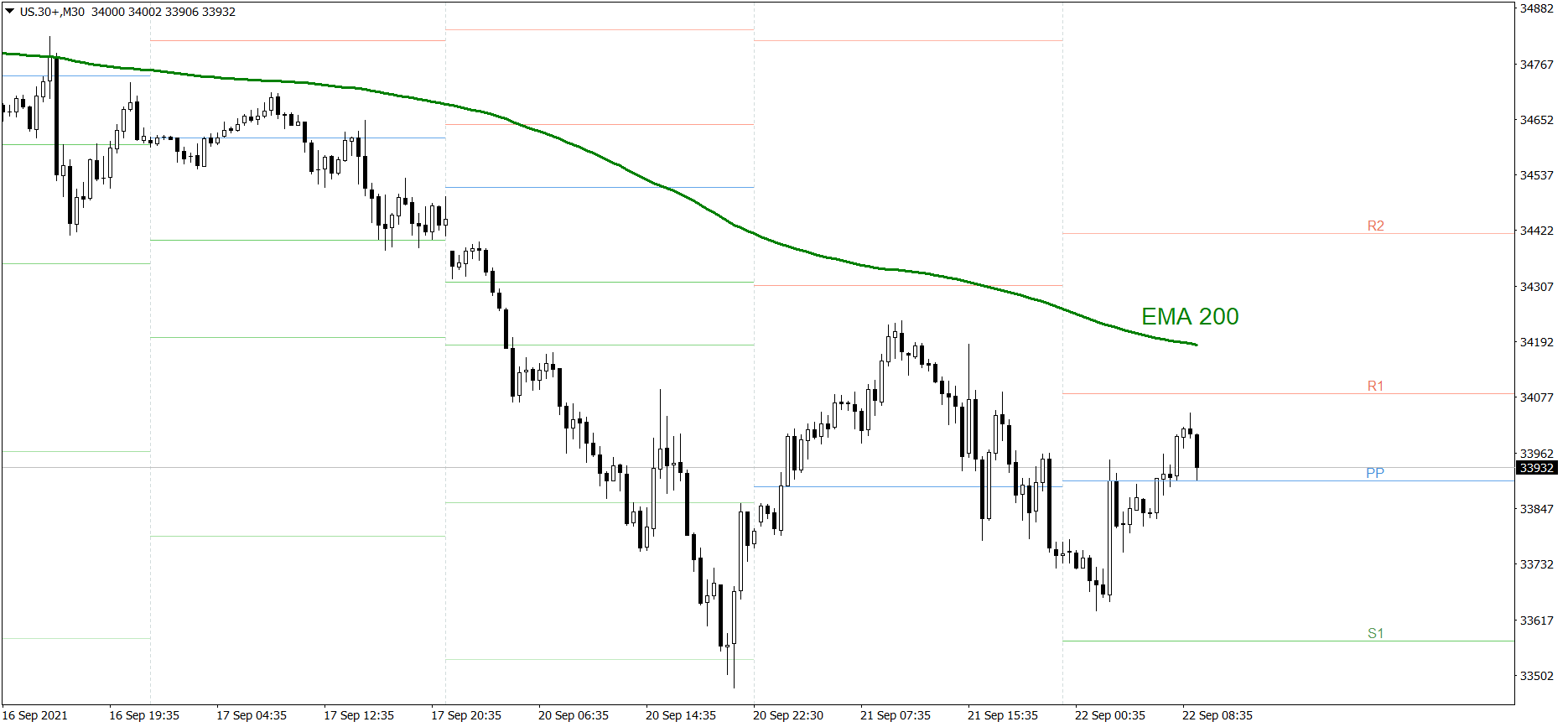

S&P 500

The S&P 500 showed mixed sentiment yesterday. The price finished the session below the Pivot Point, at 4335. Today the price is rising slowly, though. It’s already above the Pivot Point. If the buyers continue generating sufficient demand, the price might rise above the R1 resistance level today. But if the bears counterattack, the price could drop to the S1 support level.

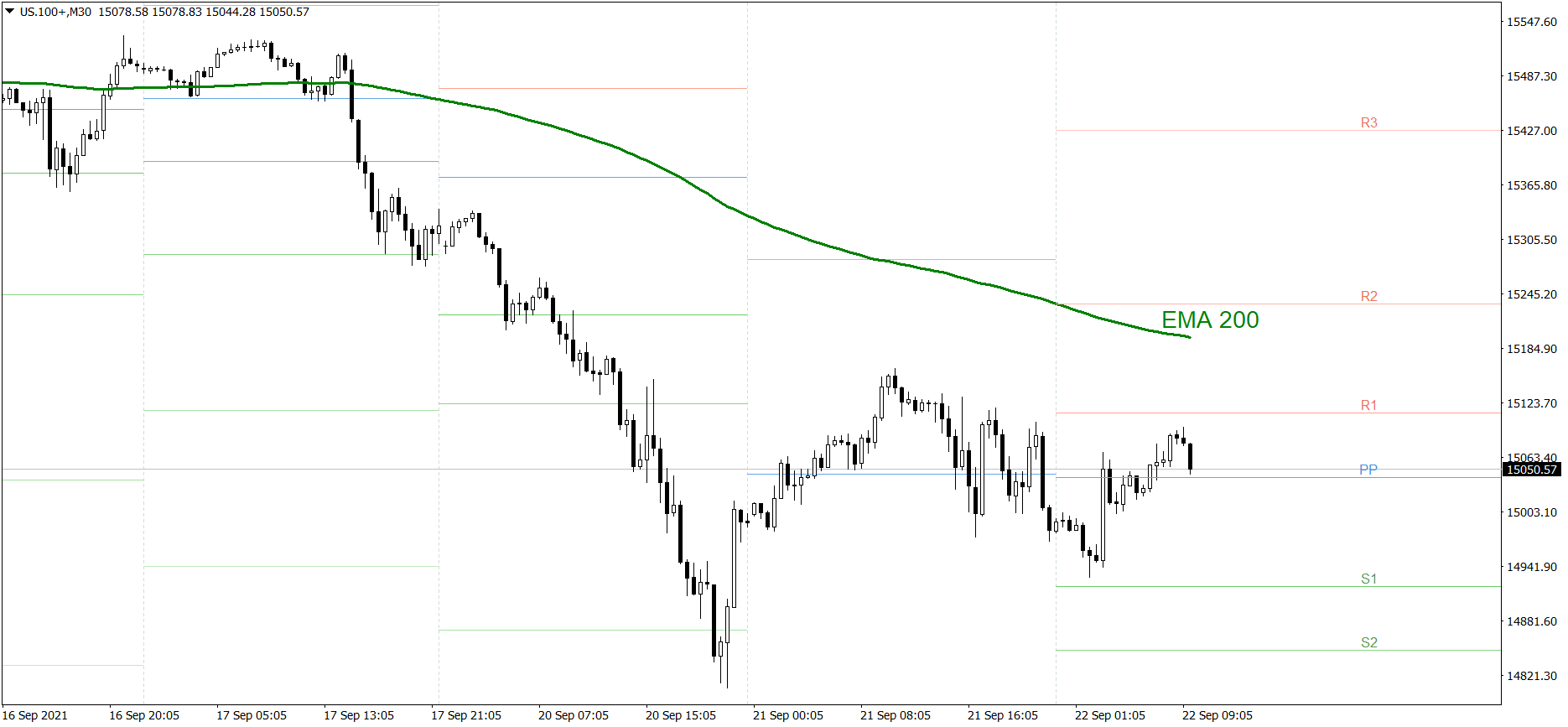

NASDAQ 100

NASDAQ 100 also showed mixed sentiment yesterday. Today the price is rising slowly, though. It’s already above the Pivot Point and 15000. If the buyers continue generating sufficient demand, the price might rise above the R1 resistance level today. But if the bears counterattack, the price could drop below the S1 support level.

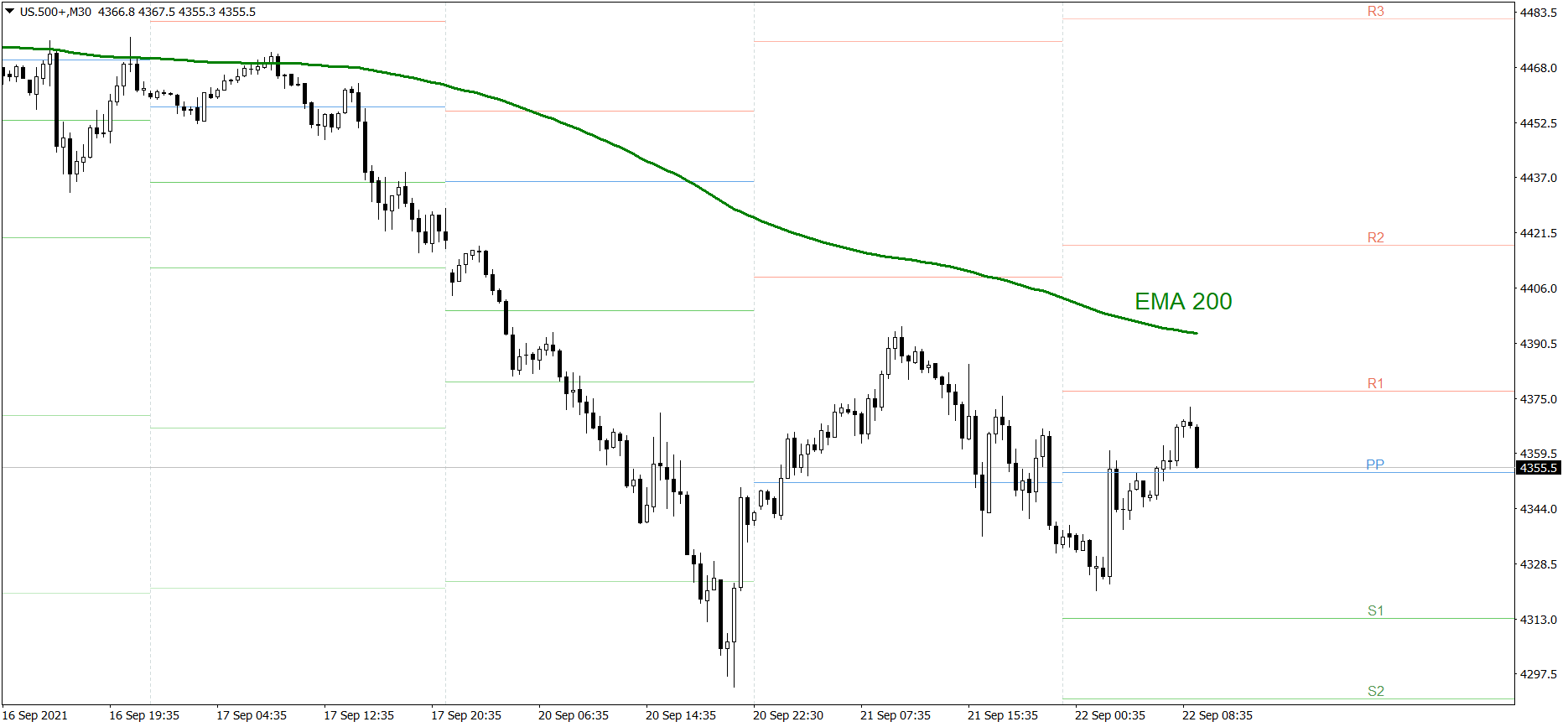

Dow Jones Industrial Average

The DJIA index showed mixed sentiment yesterday as well. Today the price is rising slowly, though. It’s already above the Pivot Point. If the buyers continue generating sufficient demand, the price might rise above the R1 resistance level today. But if the bears counterattack, the price could drop to the S1 support level.