Yesterday the American indices performed differently. The S&P 500 and the Dow Jones Industrial Average managed to rise, but the NASDAQ 100 dropped. Today, the NASDAQ 100 is showing mixed sentiment, but the other two indices are going down. From the data front, the Philadelphia Fed manufacturing index in October and existing home sales in September will be published. Anyway, let’s start the analysis, S&P 500 first:

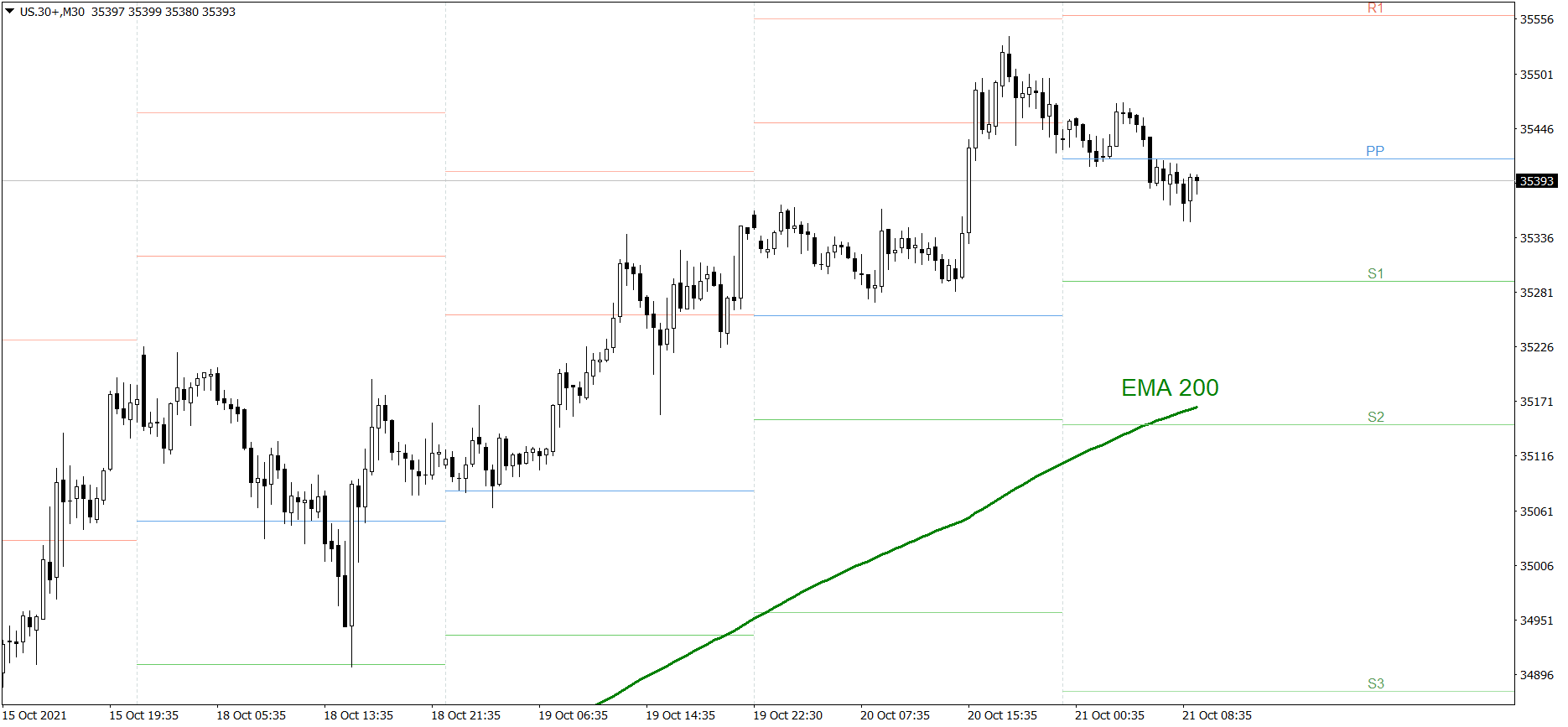

S&P 500

The S&P 500 rose a bit yesterday. The price finished the session above 4520, slightly below the R1 resistance level. However, it is going down a bit today. The price is already below the Pivot Point. If the buyers don’t generate some serious appetite soon, the price could even fall below 4500 and reach the S2 support level today. But if they do, the price might rise to the R1.

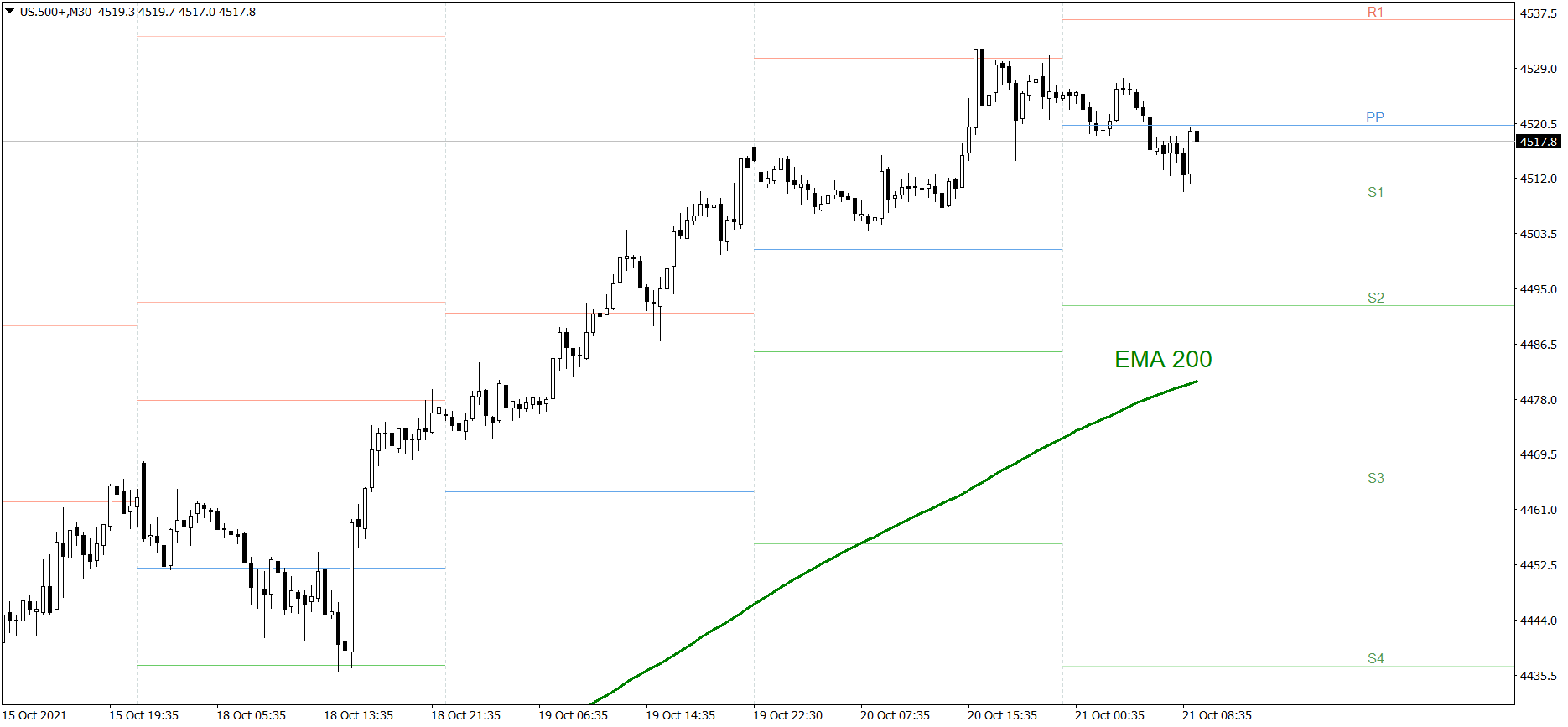

NASDAQ 100

NASDAQ 100 was the weakest one yesterday. The price dropped a bit and finished the session below the Pivot Point, slightly above 15350. Today it is showing mixed sentiment. If the buyers take control over the market, the price might rise above the R1 resistance level today. But if the bears show their strength, the price could fall to the S2 support level and the EMA 200.

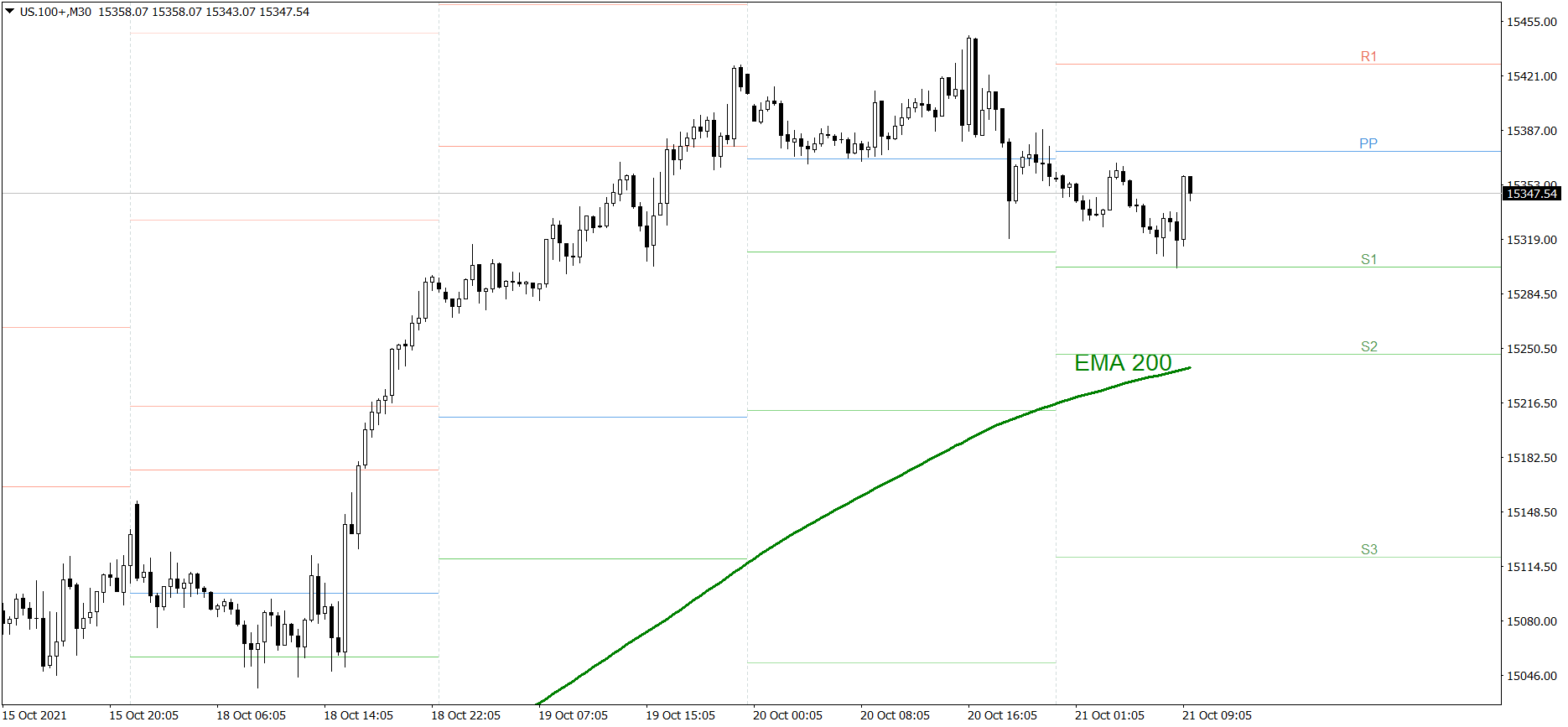

Dow Jones Industrial Average

The DJIA index managed to rise yesterday. The price finished the session a little below the R1 resistance level. However, it is going down a bit today. The price is already below the Pivot Point. If the buyers don’t generate some serious appetite soon, the price could drop below the S1 support level today. But if they do, the price might rise above 35500 and reach today’s R1.