Yesterday the American indices showed mixed sentiment. However, all three of them are going down today. From the data front, the Philadelphia Fed manufacturing index in February will be published. Anyway, let’s move on to the analysis, S&P 500 first:

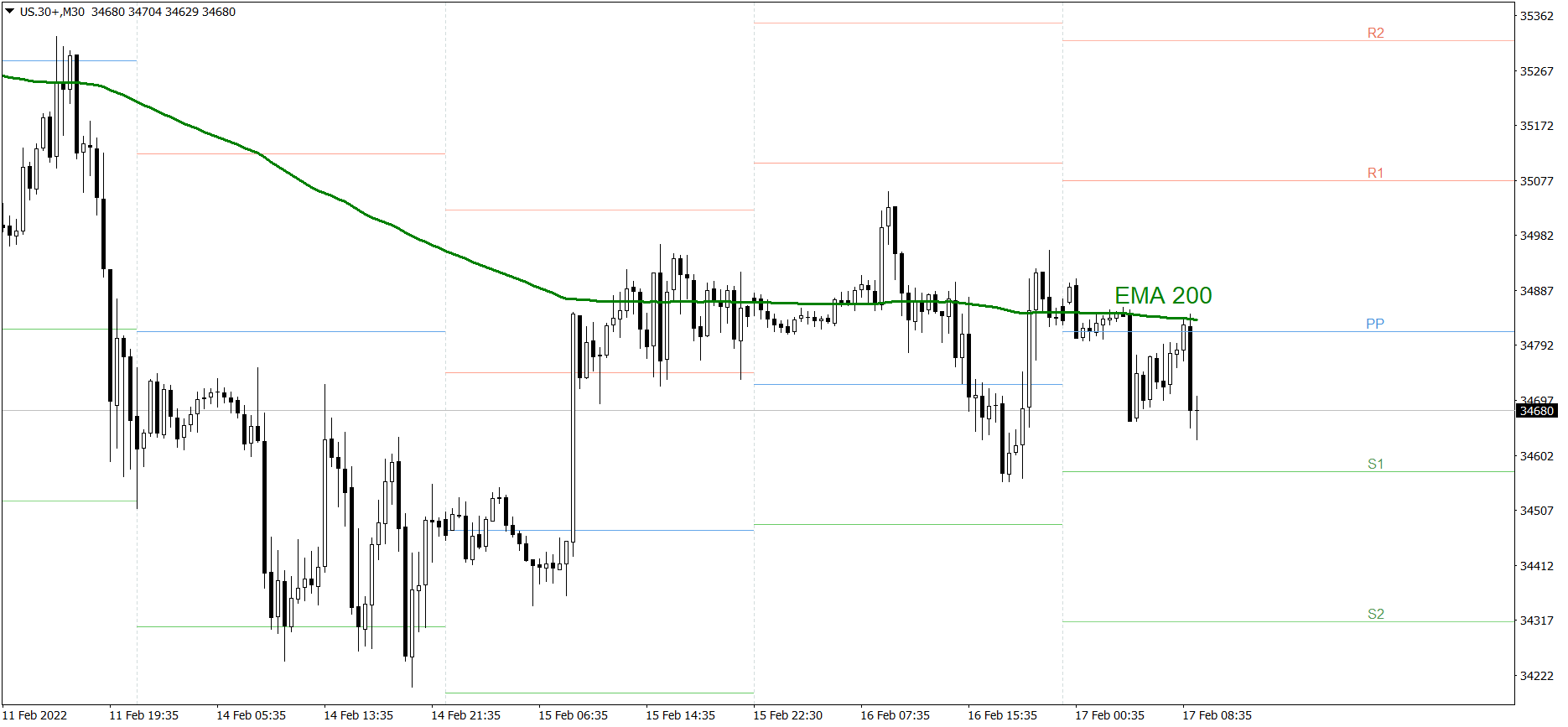

S&P 500

The S&P 500 showed mixed sentiment yesterday. The price finished the session a little below 4470. However, it is going down today. If the buyers don’t generate some serious appetite soon, the price could drop below today’s S1 support level and 4430. But if they do, the price might return above the EMA 200 and the Pivot Point.

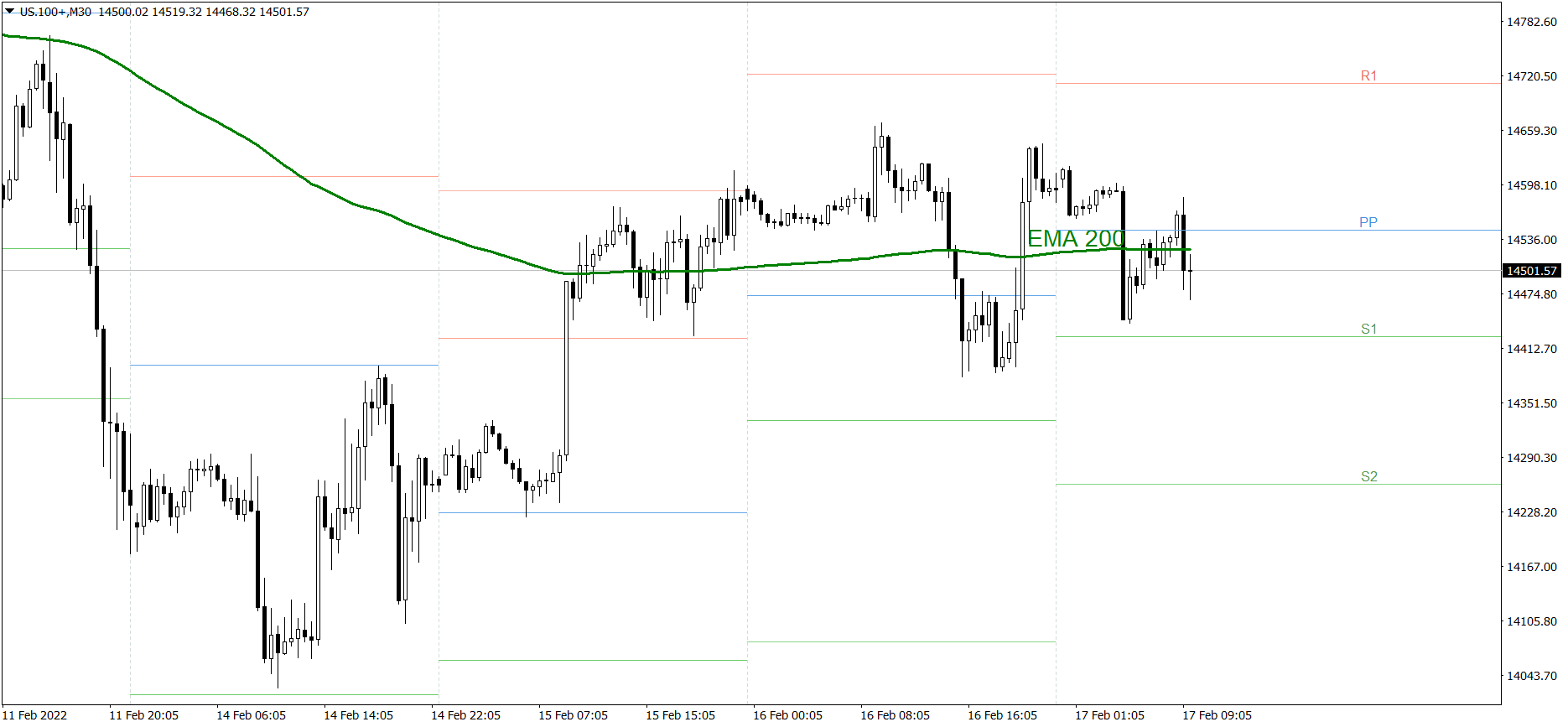

NASDAQ 100

NASDAQ 100 also showed mixed sentiment yesterday. The price finished the session exactly at 14600. However, it is going down today. If the buyers don’t generate some serious appetite soon, the price could drop below today’s S1 support level and 14400. But if they do, the price might rise above 14600.

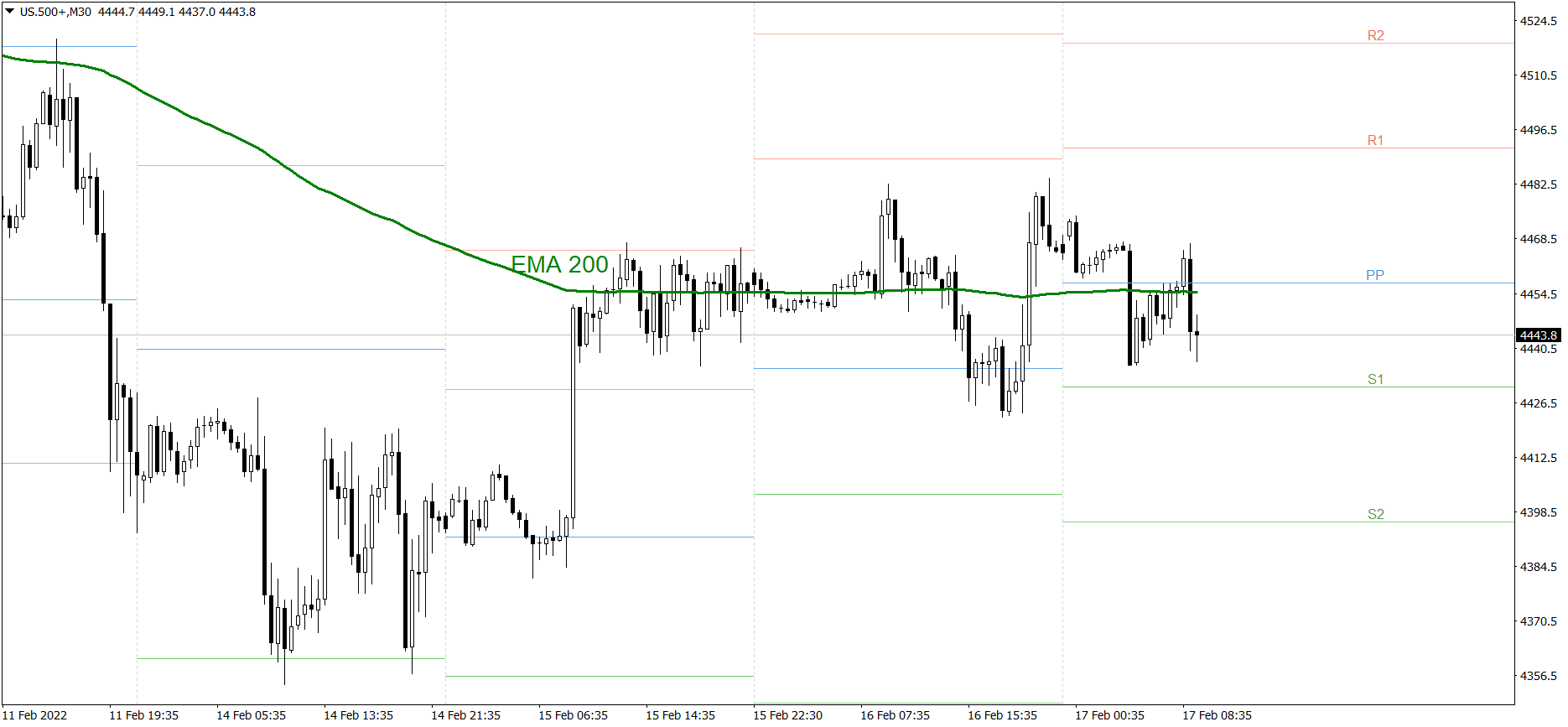

Dow Jones Industrial Average

The DJIA index showed mixed sentiment yesterday as well. The price finished the session exactly at the EMA 200. However, it is going down today. If the buyers don’t generate some serious appetite soon, the price could drop below today’s S1 support level and reach 34500. But if they do, the price might rise above the EMA 200.