Yesterday all three American indices finally managed to rise. However, they are going down today. From the data front, retail sales in August and Philadelphia Fed manufacturing index in September will be published. Anyway, let’s move on to the analysis, S&P 500 first:

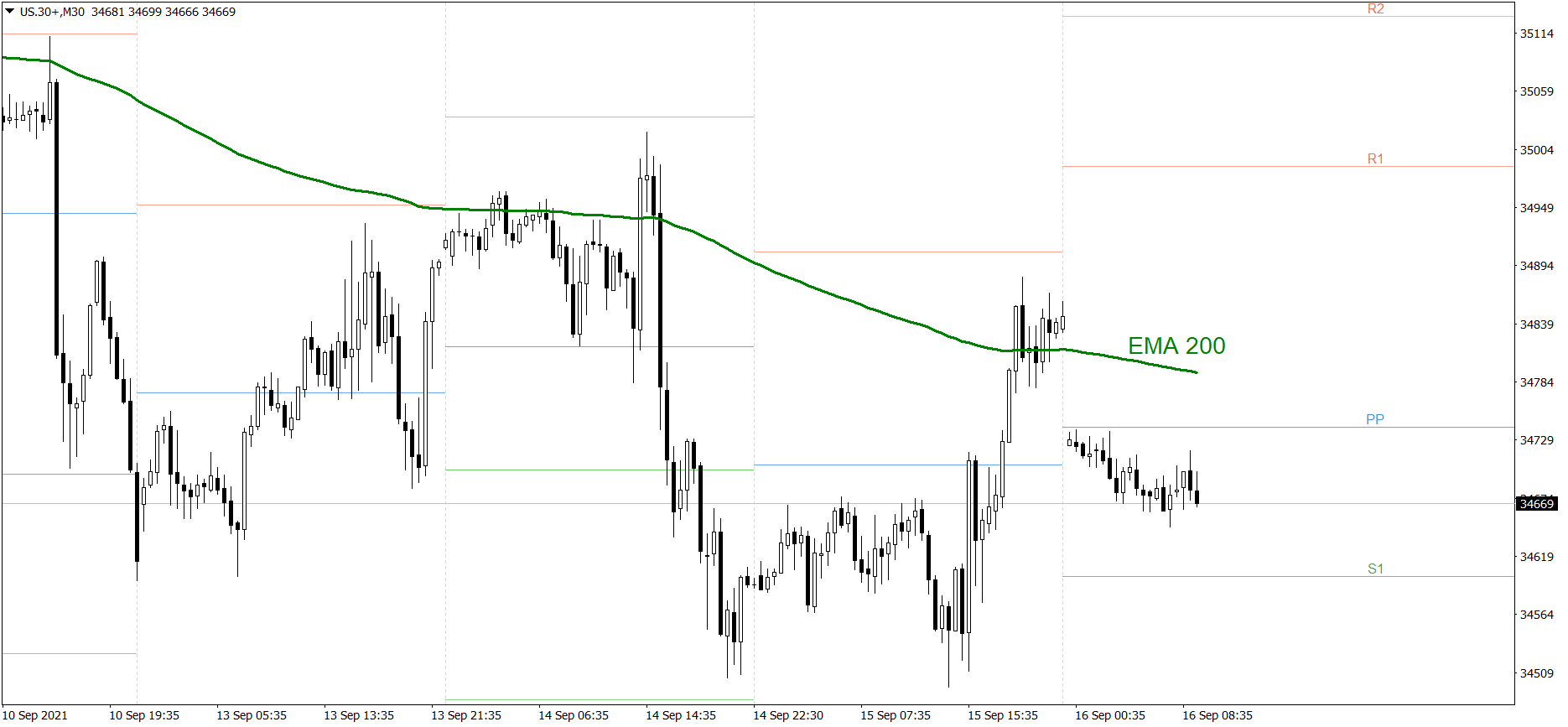

S&P 500

Yesterday was a great bullish session. The S&P 500 rose significantly and finished the day above the R1 resistance level. However, the price is going down today. Right now the bulls are trying to defend the Pivot Point. If they do it successfully, the price might return above the EMA 200. But if they fail, the price could drop below the S1 support level.

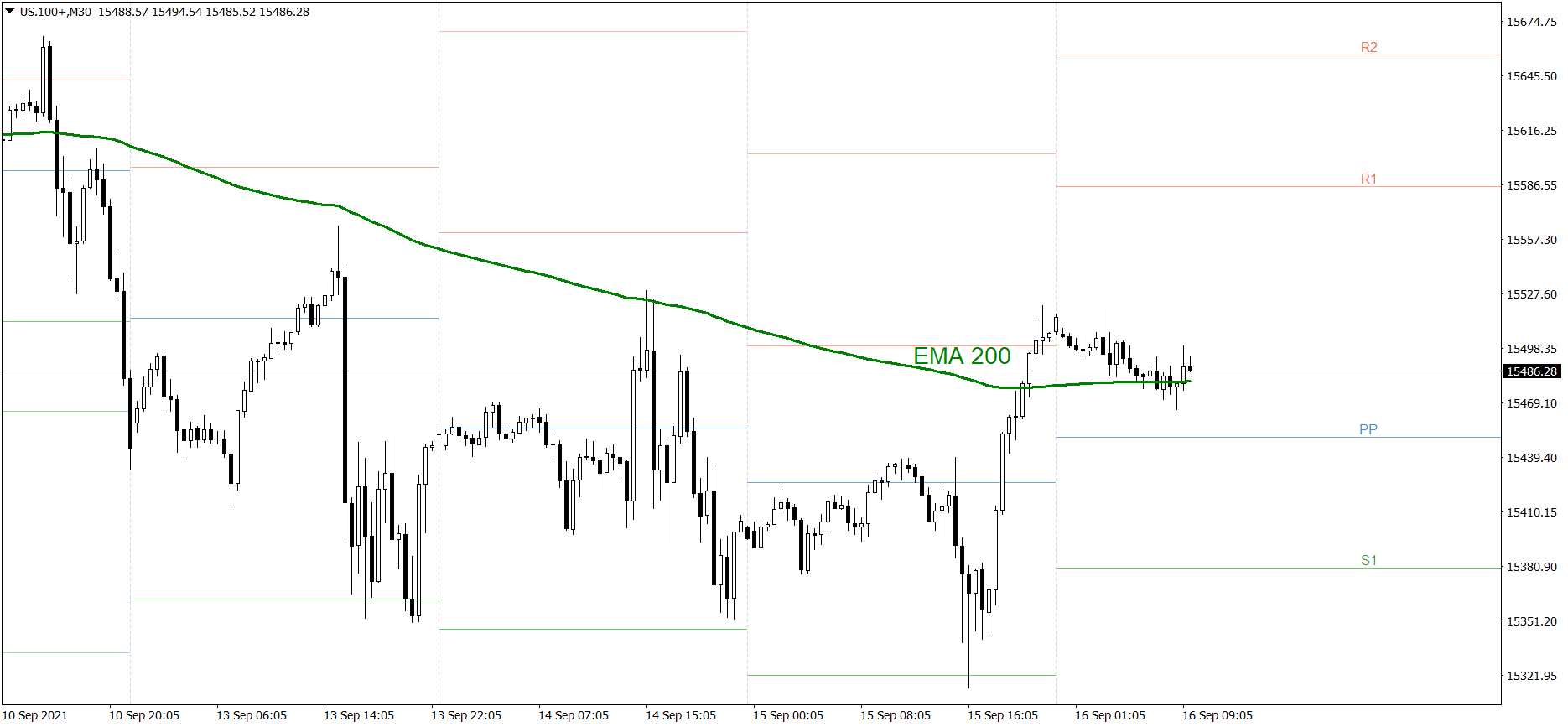

NASDAQ 100

NASDAQ 100 also rose significantly yesterday. The price finished the session above the R1 resistance level. Today, it is going down a bit, but the volatility is really low. Right now the bulls are trying to defend the EMA 200. If they do it successfully, the price might even reach the R1 today. But if they fail, the price could drop to the S1 support level.

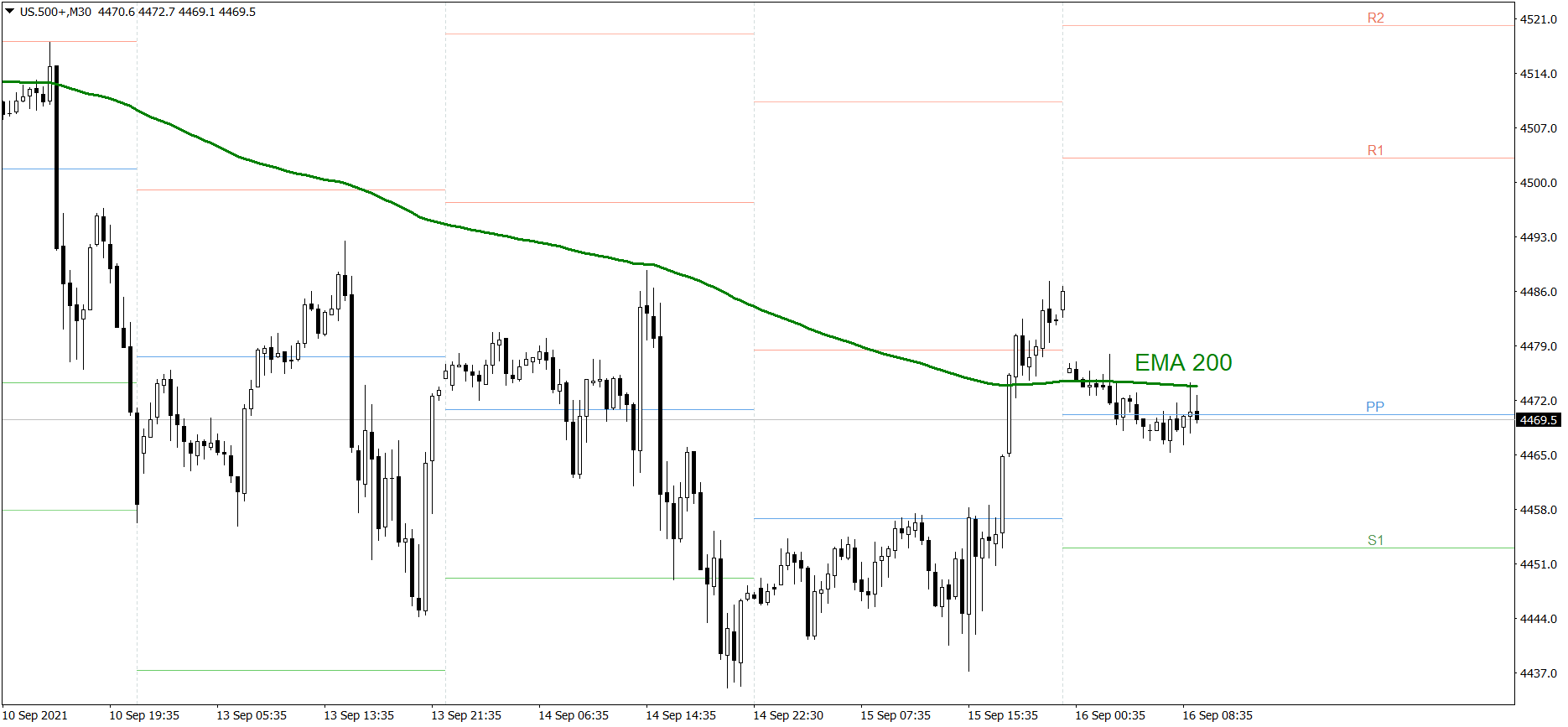

Dow Jones Industrial Average

The DJIA index went up yesterday as well. The price finished the session above the EMA 200. However, it is falling significantly today. If the buyers don’t generate some serious appetite, the price could drop below the S1 support level. But if they do, the price might return above the Pivot Point or even reach the EMA 200.