The American indices dropped heavily yesterday. Today, all three of them are showing mixed sentiment. From the data front, retail sales and core retail sales in December will be published. Anyway, let’s move on to the analysis, S&P 500 first:

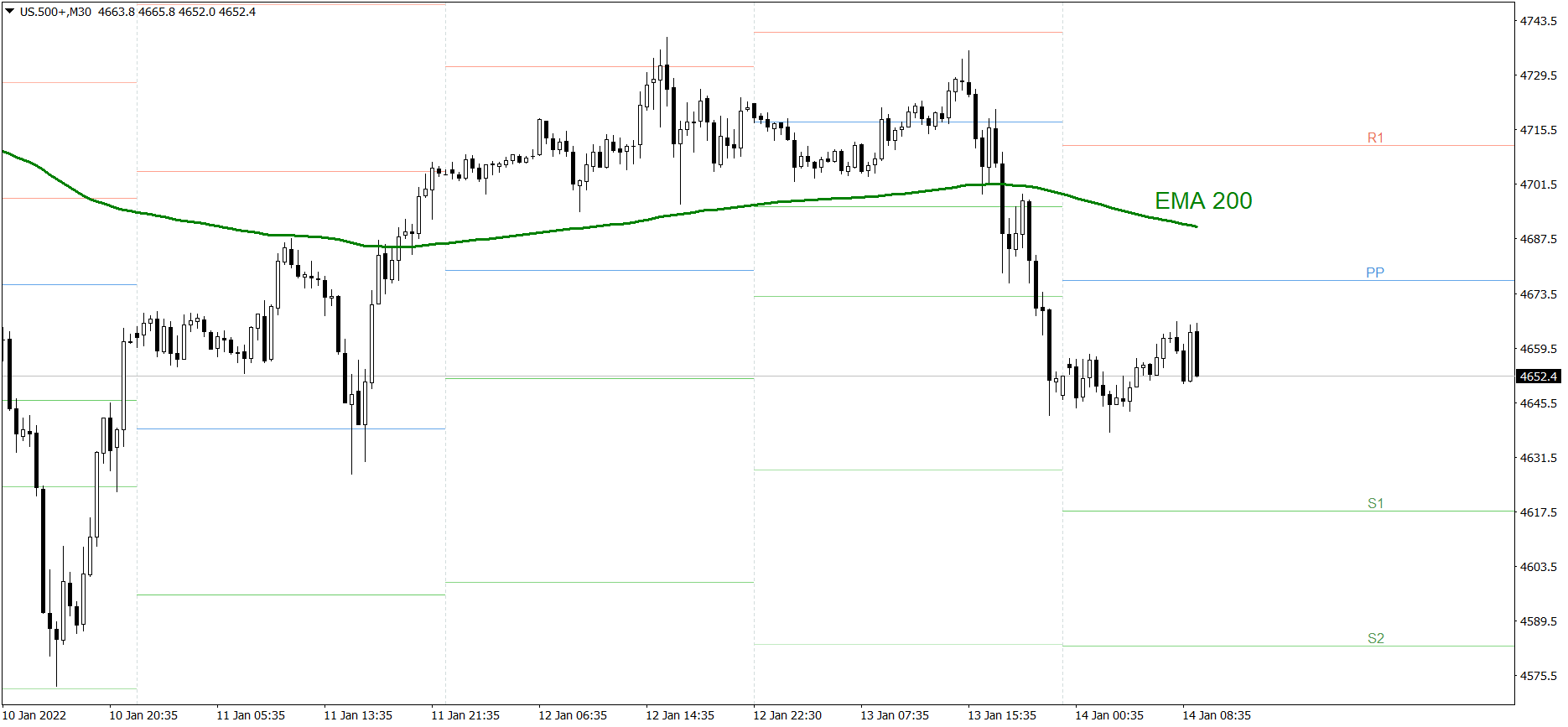

S&P 500

The S&P 500 dropped heavily yesterday. The price finished the session significantly below the S2 support level, slightly above 4650. Today, it is showing mixed sentiment. If the buyers take control over the market, the price might rise above the Pivot Point and reach 4680 today. But if the bears show their strength once again, the price could go down to today’s S1.

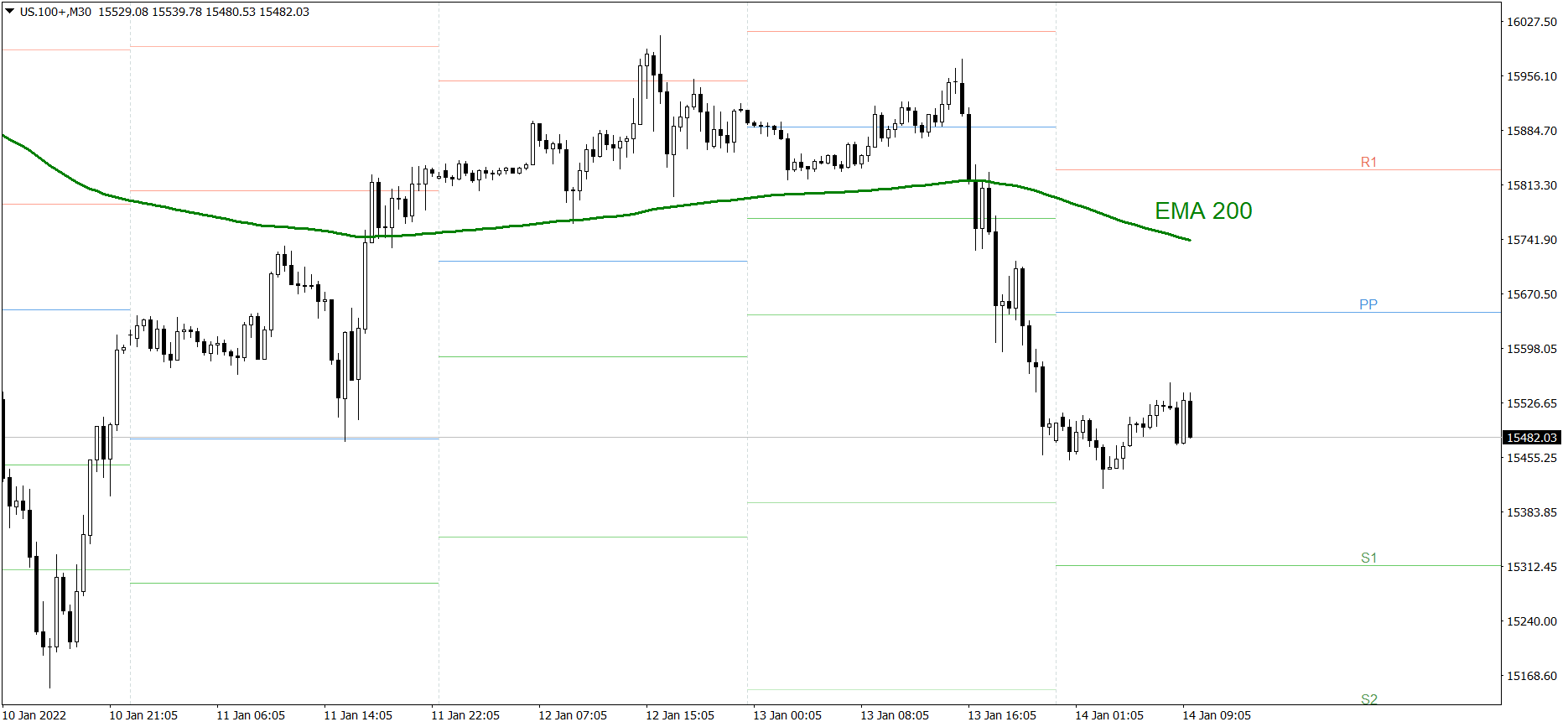

NASDAQ 100

NASDAQ 100 also dropped heavily yesterday. The price finished the session significantly below the S2 support level, exactly at 15500. Today, it is showing mixed sentiment. If the buyers take control over the market, the price might rise above the Pivot Point and reach 15700 today. But if the bears show their strength once again, the price could go down to today’s S1 and reach 15300.

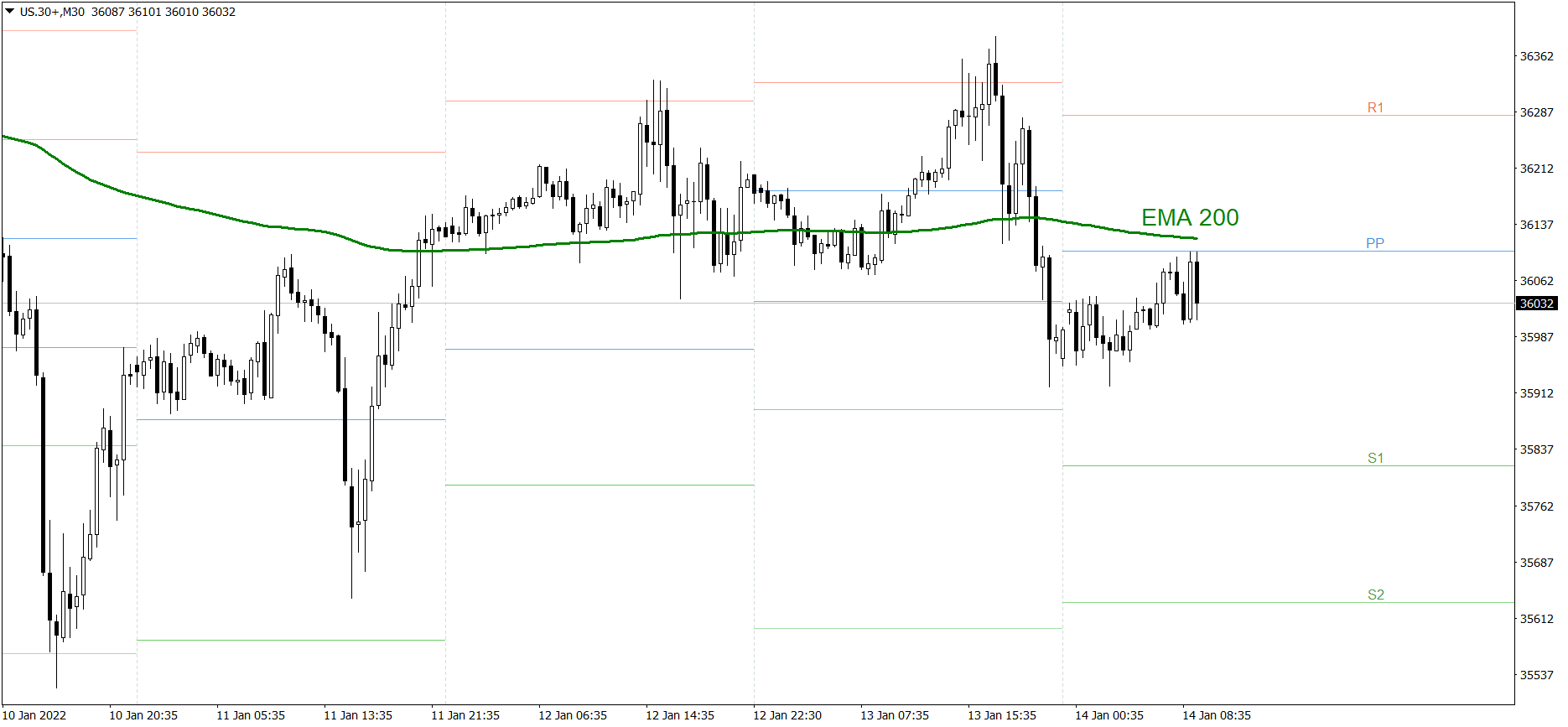

Dow Jones Industrial Average

The DJIA index wasn’t as weak as the other two indices yesterday. However, the price still went down significantly and finished the session below the S1 support level, at 36000. Today, it is showing mixed sentiment. If the buyers take control over the market, the price might rise above the EMA 200 and even reach the R1 resistance level. But if the bears show their strength once again, the price could go down to today’s S1 and reach 35800.