Yesterday the American indices dropped significantly. Today, all three of them are falling even more. From the data front, the JOLTs job openings in August will be published. Anyway, let’s move on to the analysis, S&P 500 first:

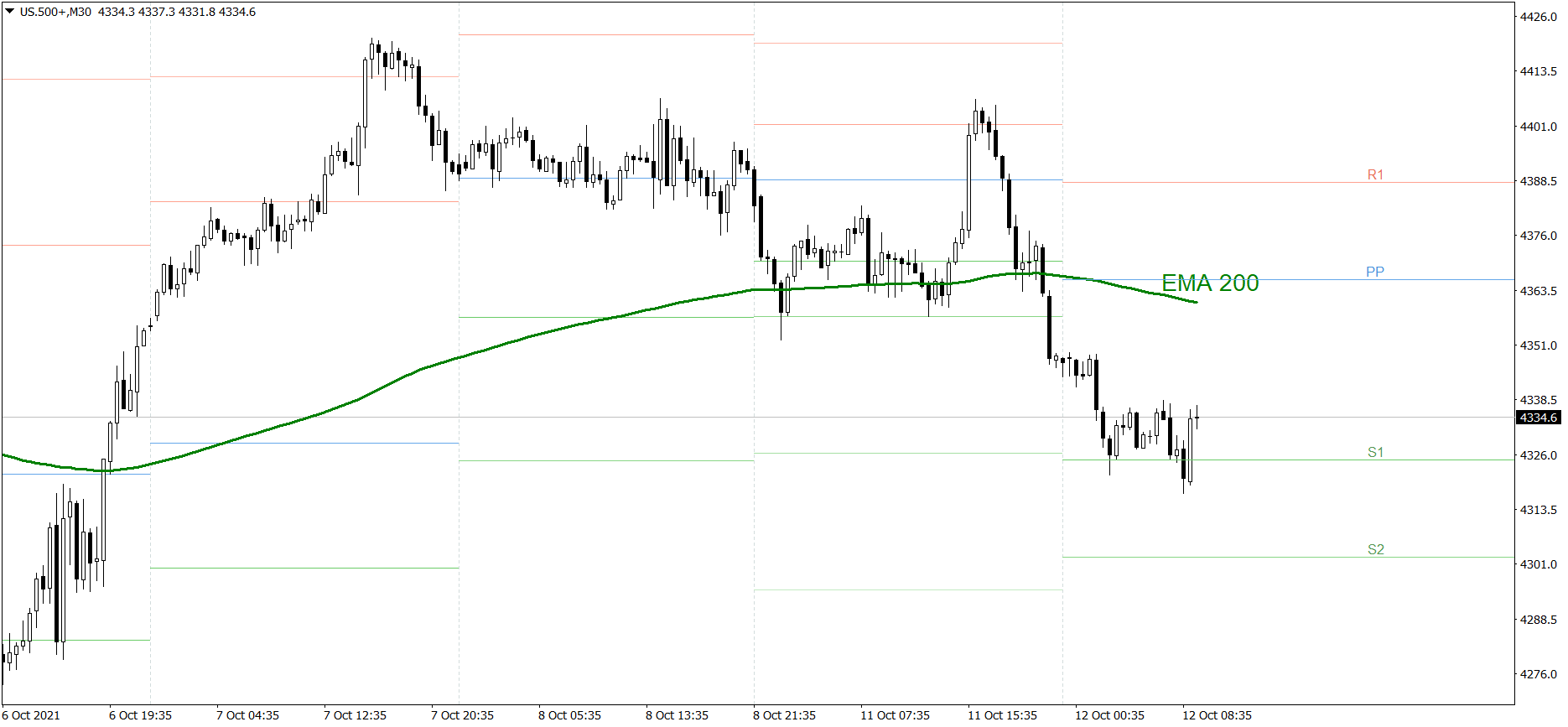

S&P 500

Yesterday was a really volatile session. First the S&P 500 dropped below the EMA 200, then it rose above the R1 resistance level and reached 4400. However, in the afternoon the price went down deeply and finished the session below the S2 support level and 4350. Today it is falling even more. If the buyers don’t generate some serious appetite soon, the price could drop to the S2 and 4300 today. But if they do, the price might reach the EMA 200 and the Pivot Point.

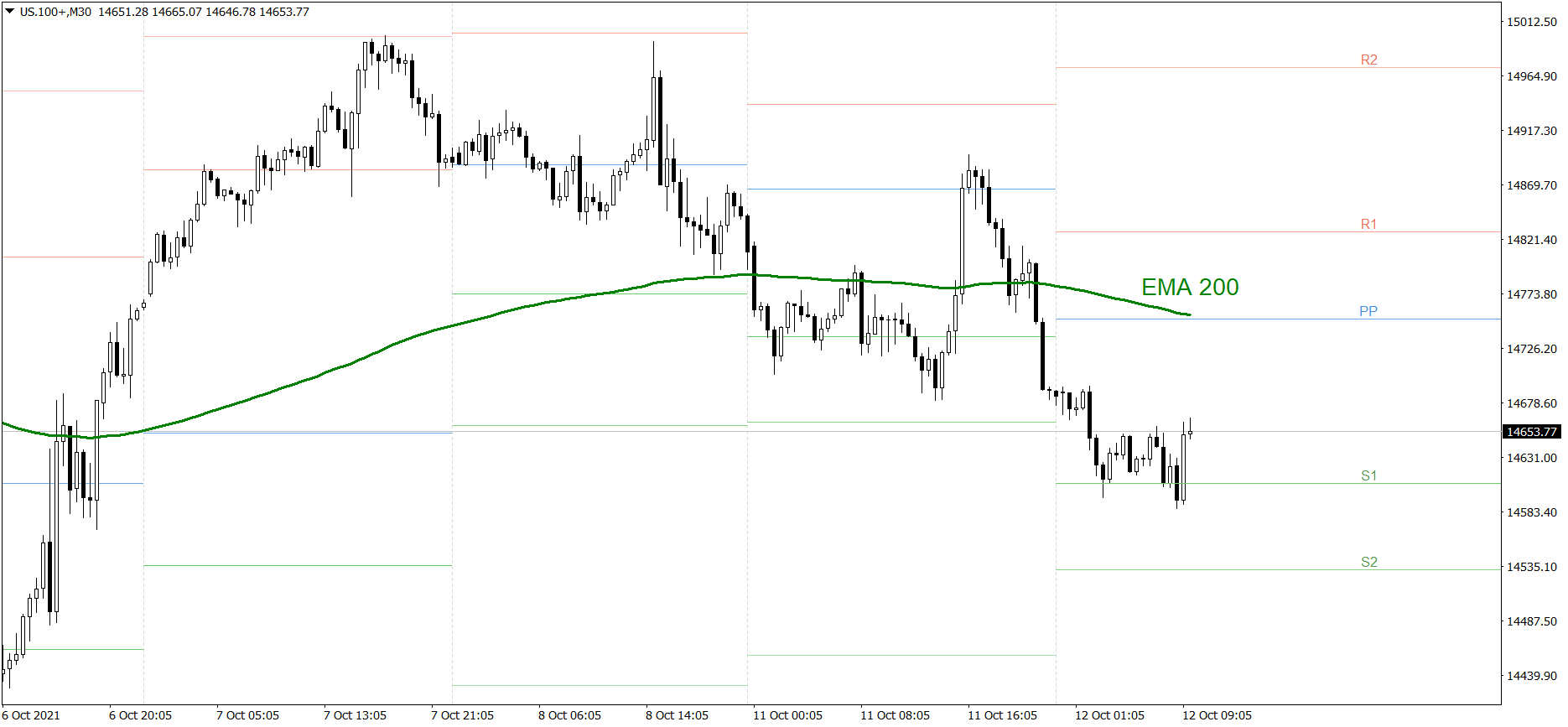

NASDAQ 100

NASDAQ 100 also went down yesterday. The price finished the session below 14700, slightly above the S2 support level. Today it is falling even more. If the buyers don’t generate some serious appetite soon, the price could drop to the S2 today. But if they do, the price might reach the EMA 200 and the Pivot Point.

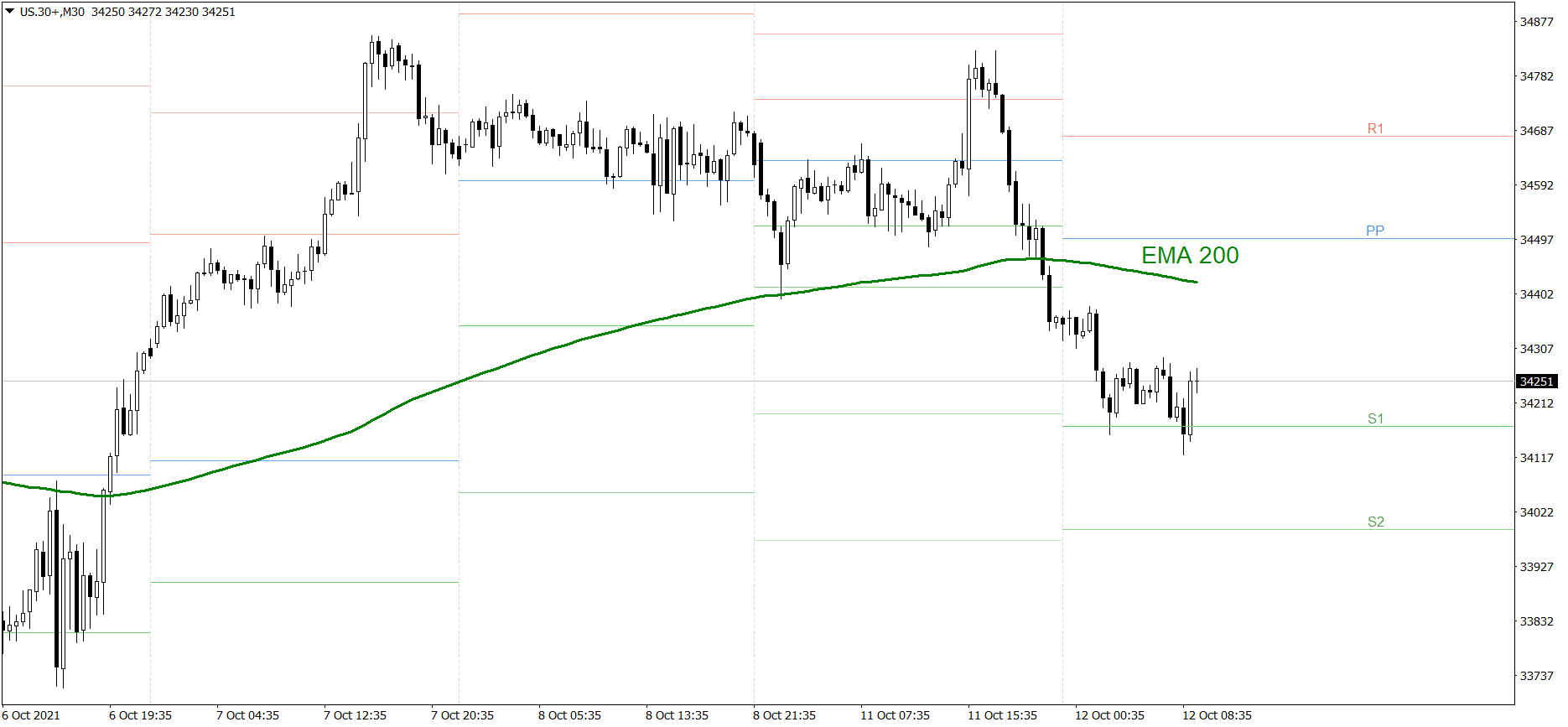

Dow Jones Industrial Average

The DJIA index showed some real volatility yesterday as well. First the price tested the S2 support level, then it rose above the R1 resistance level. However, in the afternoon the price went down deeply and finished the session below the S2. Today it is falling even more. If the buyers don’t generate some serious appetite soon, the price could drop to the S2, below 34000. But if they do, the price might reach the EMA 200 today.