On Friday all three American indices went down once again. However, they are rising today. What can they do next? Let’s try to answer that question in an analysis, S&P 500 first:

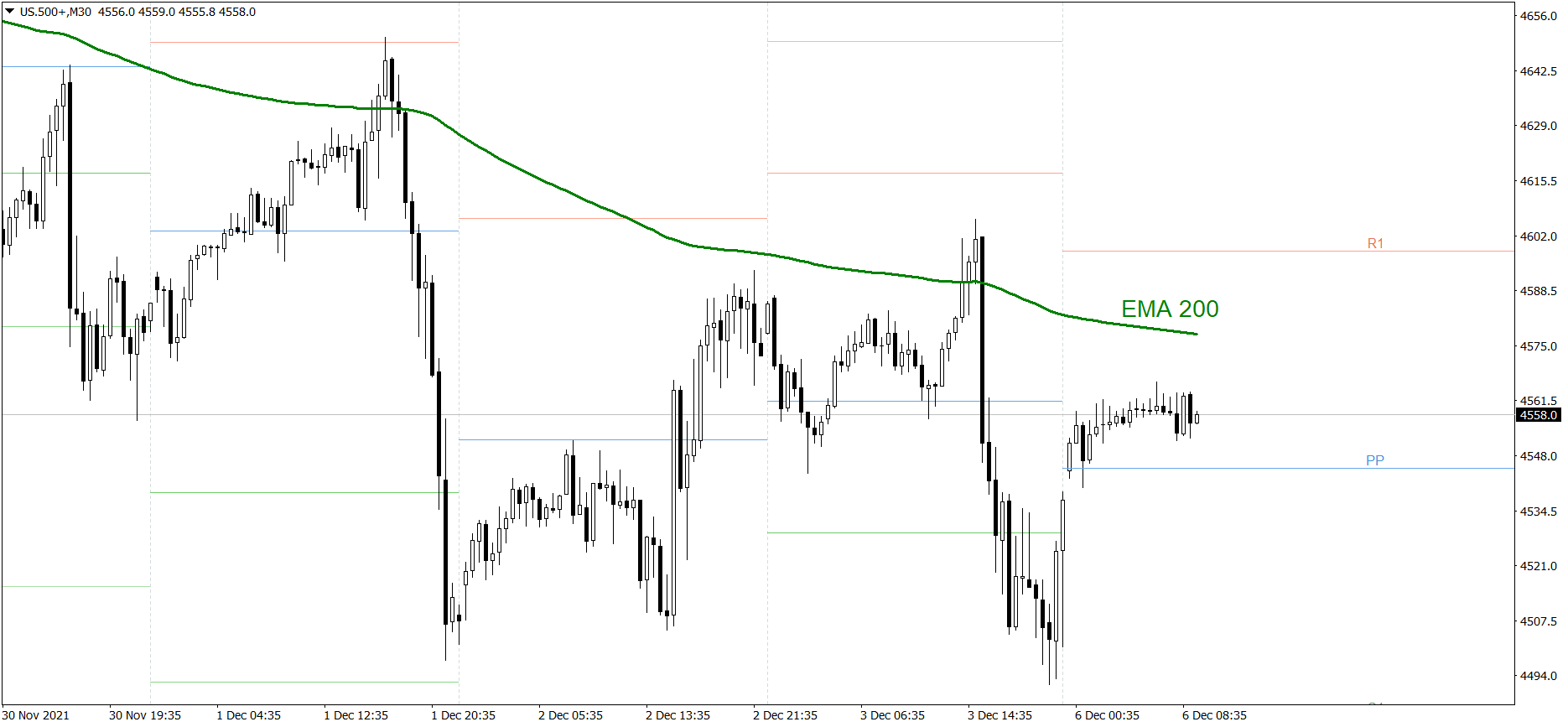

S&P 500

Friday was another bearish session last week. The S&P 500 dropped significantly and finished the last session of the week slightly above the S1 support level, a little below 4540. However, it opened 7 pips higher after the weekend and has been rising a bit since then. If the buyers continue generating sufficient demand, the price might rise above the EMA 200 today. But if the bears counterattack, the price could fall below the Pivot Point.

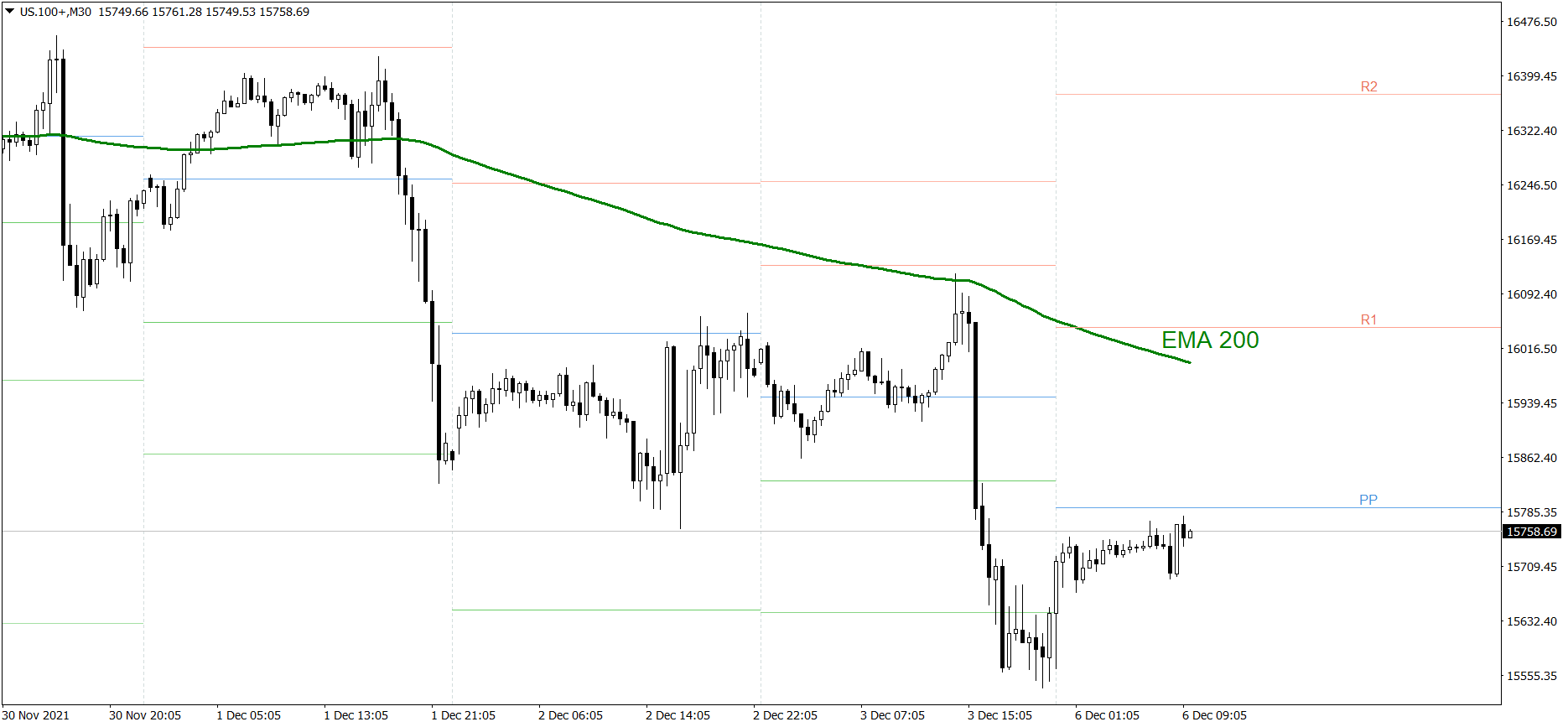

NASDAQ 100

NASDAQ 100 was the weakest one on Friday. The price finished the last session of the week slightly above the S2 support level and 15700. However, it is rising slowly today. If the buyers continue generating sufficient demand, the price might even reach 16000 and the EMA 200 today. But if the bears counterattack, the price could fall below 15500.

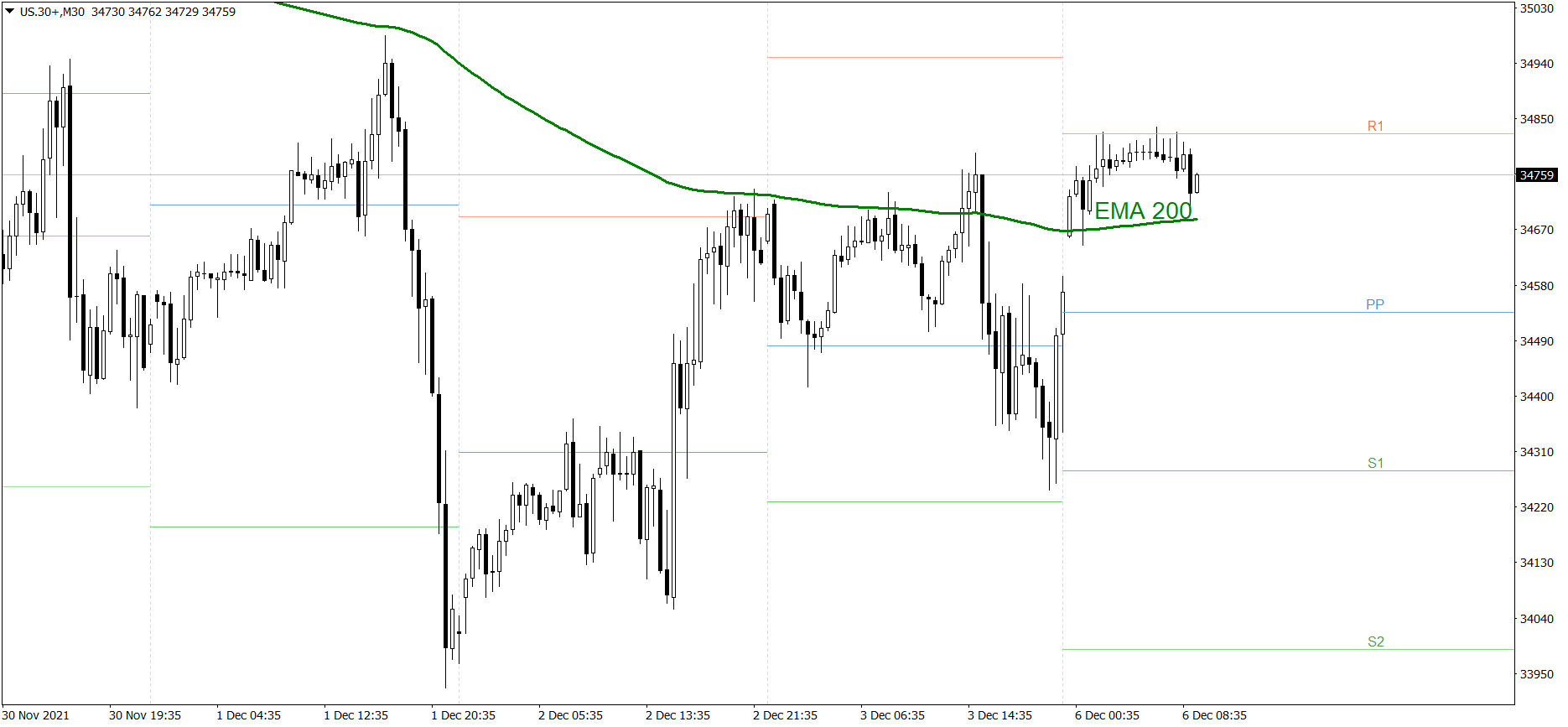

Dow Jones Industrial Average

The DJIA index wasn’t as weak as the other two indices on Friday. The price dropped a bit, but it finished the last session of the week above the Pivot Point. Moreover, after the weekend it opened 90 pips higher and has been slowly rising since then. If the buyers continue generating sufficient demand, the price might rise high above the R1 resistance level and even reach 35000. However, if the bears counterattack, the price could fall to the Pivot Point.