Yesterday was a really volatile session. In the end the S&P 500 and the NASDAQ 100 rose significantly but the Dow Jones Industrial Average went down. Today all three American indices are rising, though. From the data front, the U.S. Federal Open Market Committee (FOMC) minutes from the last meeting will be published. Anyway, let’s start the analysis, S&P 500 first:

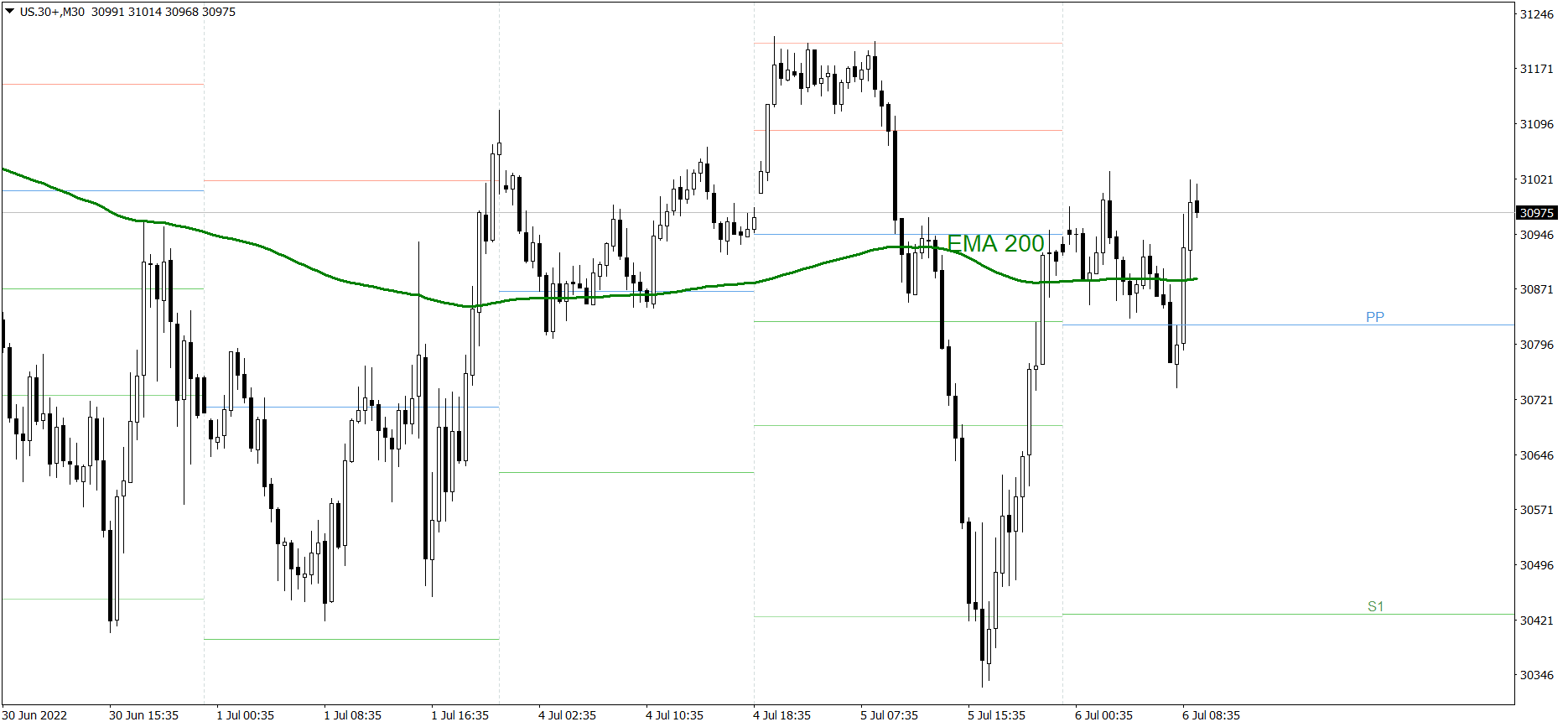

S&P 500

Yesterday was a really volatile session. First the S&P 500 rose above the R2 resistance level. Then it dropped heavily and tested the S3 support level. After that, in the afternoon, it went up once again and finished the session slightly above the R1 and 3830. Today it is rising even more. If the buyers continue generating firm demand, the price might even reach 3860. But if the bears counterattack, the price could fall below 3820.

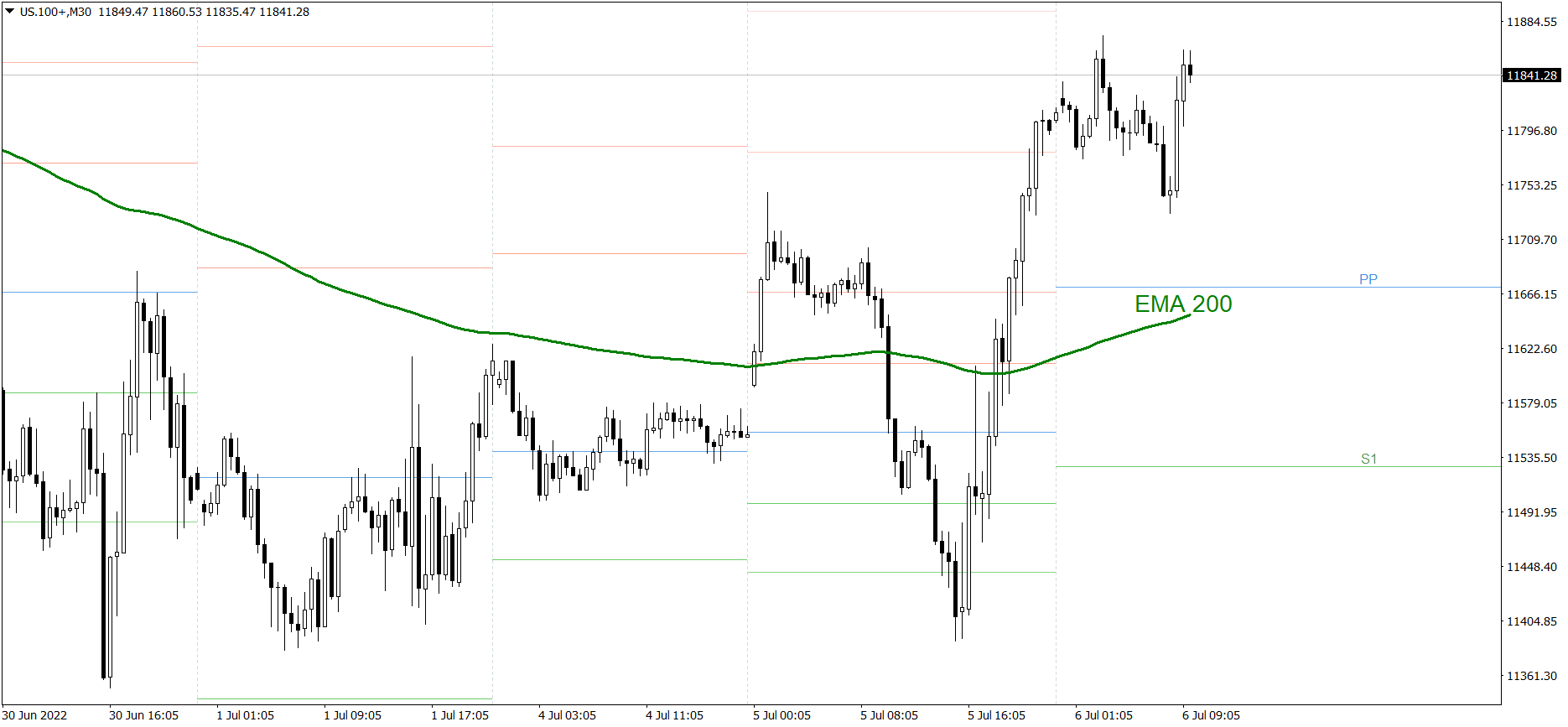

NASDAQ 100

NASDAQ 100 also was really volatile yesterday. First the price rose above the R2 resistance level. Then it dropped below the S2 support level. After that, in the afternoon, it went up strongly once again and finished the session above the R3, at 11810. Today it is rising even more. If the buyers continue generating firm demand, the price might reach 11900 today. But if the bears counterattack, the price could fall below 11750.

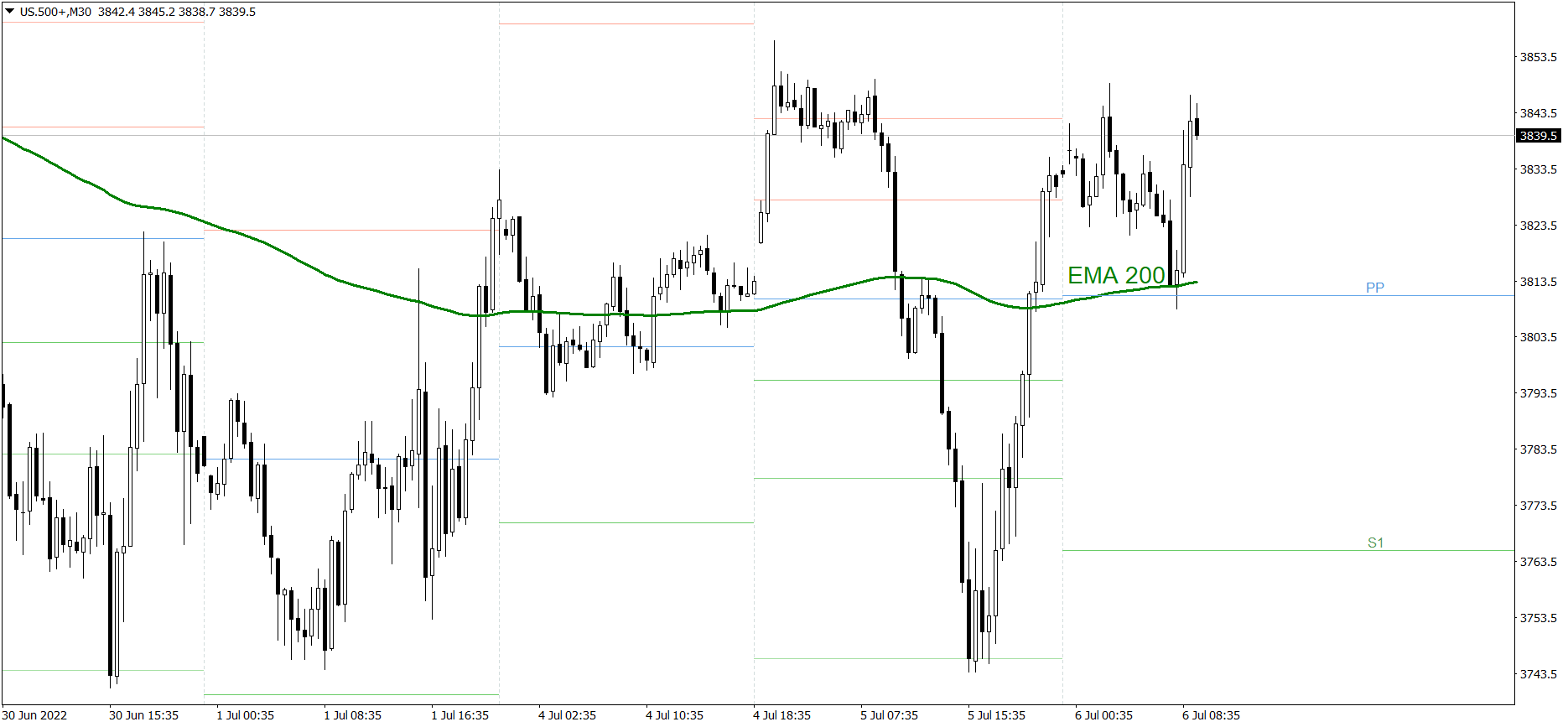

Dow Jones Industrial Average

The DJIA index was really volatile yesterday as well. First the price rose significantly and tested the R2 resistance level. Then it dropped deeply, below the S3 support level. After that, in the late afternoon, the price went up once again, but it only managed to finish the session a little below the Pivot Point, slightly above 30900. However, it is rising today. If the buyers continue generating firm demand, the price might reach 31200 today. But if the bears counterattack, the price could fall below the Pivot Point and 30800.