Yesterday the American indices performed differently. NASDAQ 100 managed to rise, the Dow Jones Industrial Average went down, and S&P 500 showed mixed sentiment. Today, all three of them are rising, though. From the data front, all eyes will be focused on the nonfarm payrolls and unemployment rate in July. Anyway, let’s start the analysis, S&P 500 first:

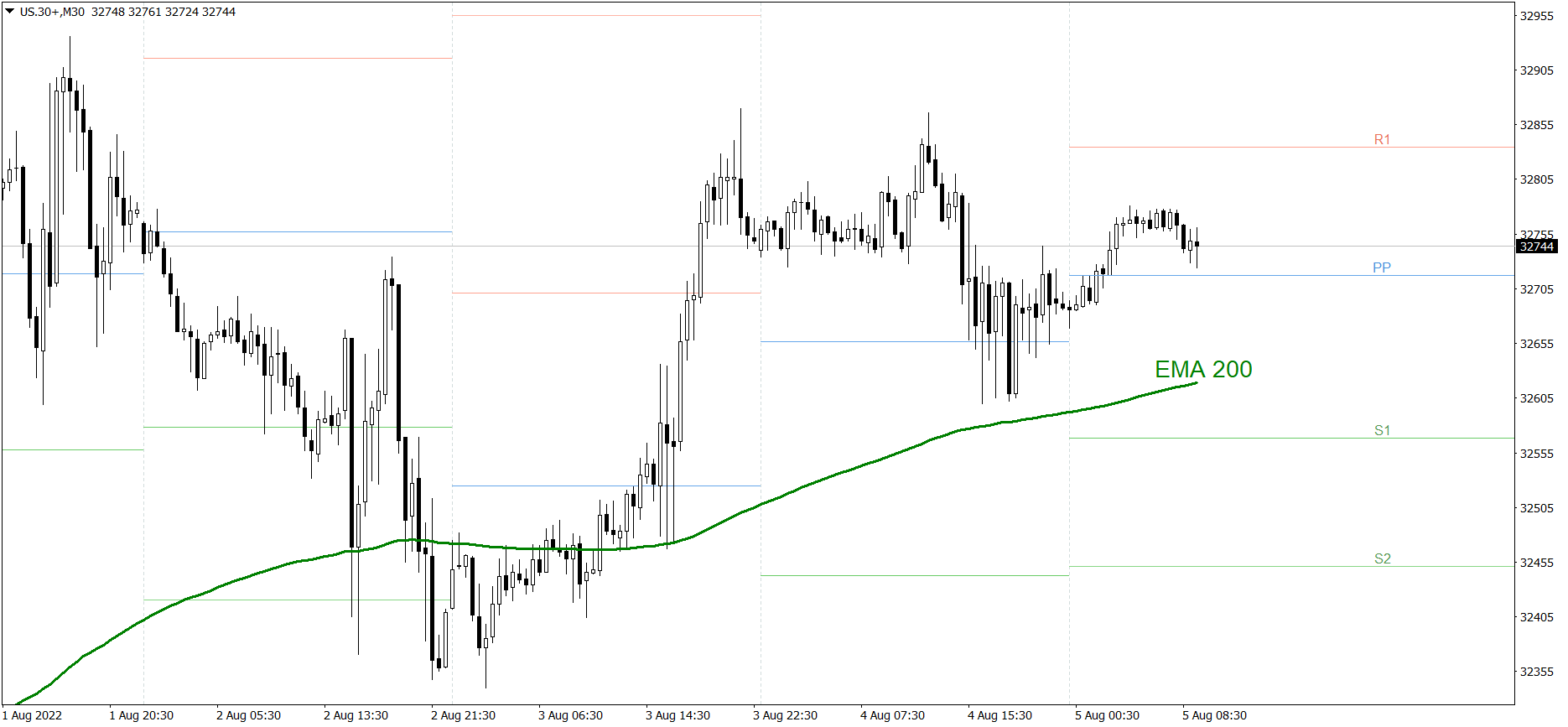

S&P 500

The S&P 500 showed mixed sentiment yesterday. The price finished the session a little above 4150. Today it is rising slowly, though. If the buyers continue generating sufficient demand, the price might go up above 4170 and the R1 resistance level. But if the bears counterattack, the price could drop below 4140.

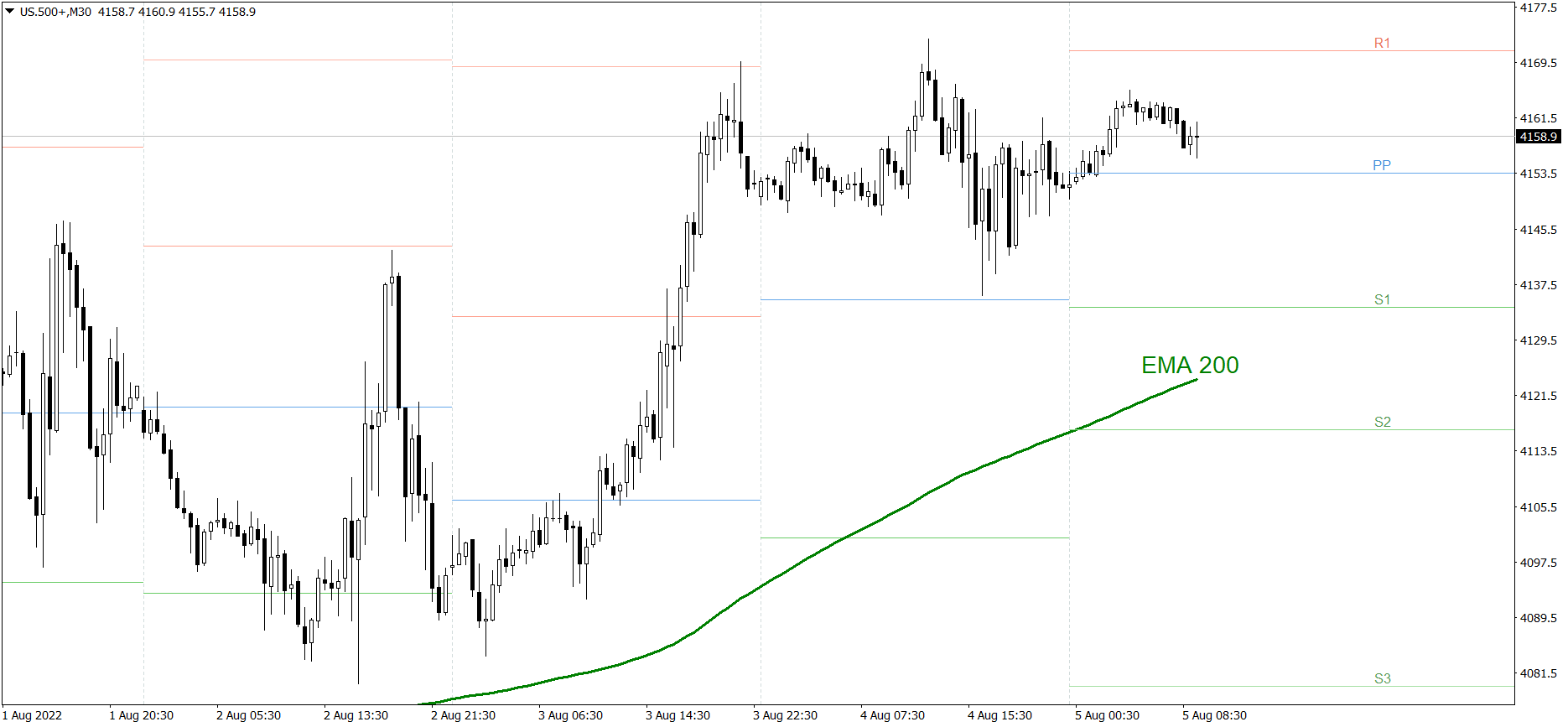

NASDAQ 100

NASDAQ 100 managed to rise yesterday. The price finished the session slightly above 13320. Today it is going up even more. If the buyers continue generating sufficient demand, the price might rise above the R1 resistance level and 13400. But if the bears counterattack, the price could drop below 13300 and reach the Pivot Point.

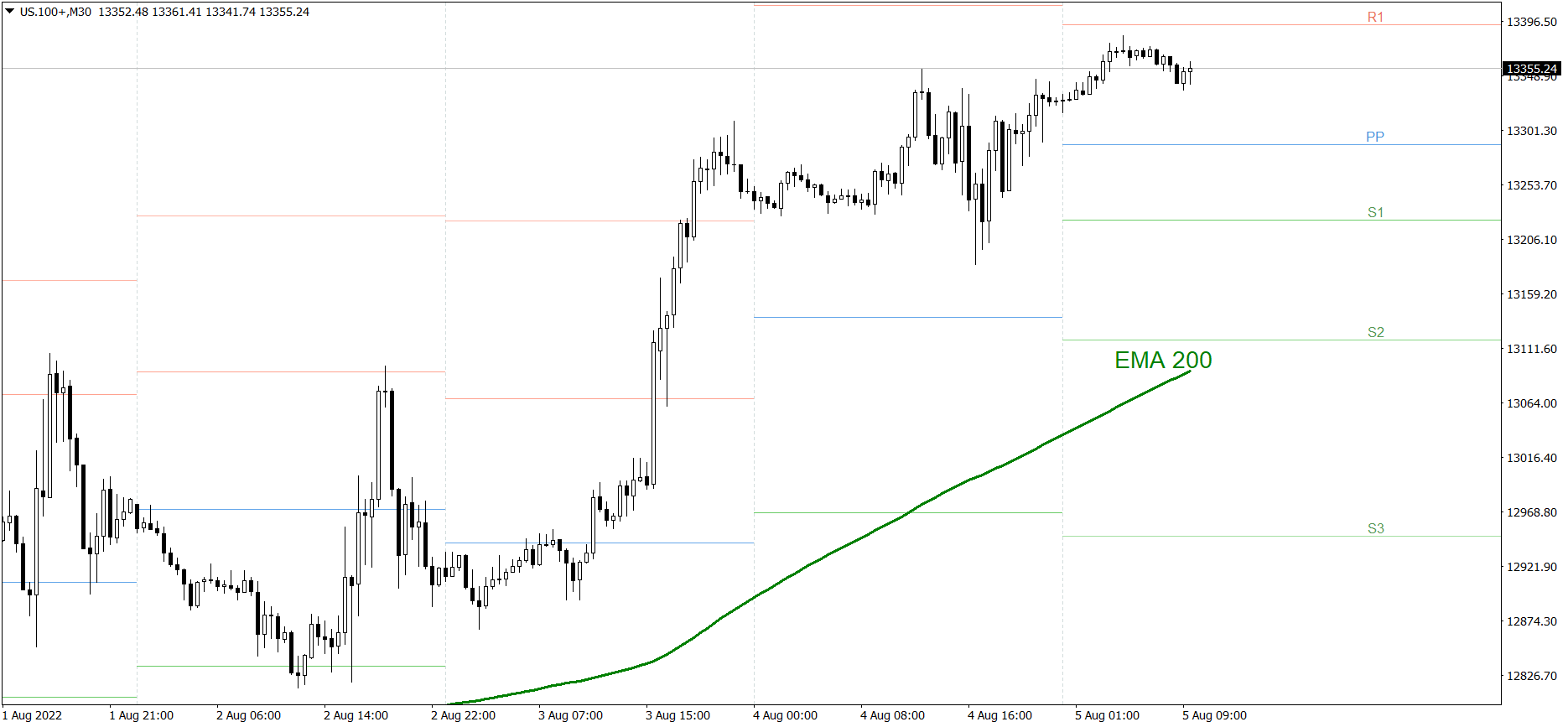

Dow Jones Industrial Average

The DJIA index went down yesterday. The price finished the session slightly above the Pivot Point and 32700. However, it is rising slowly today. If the buyers continue generating sufficient demand, the price might go up above 32800 and even reach the R1 resistance level. But if the bears counterattack, the price could drop to the EMA 200.