Yesterday was a great session for the American indices. All three of them rose strongly and set their new all-time highs. Today they are slowly going up, but the volatility is rather low. From the data front, many important publications will be released today, such as the ADP nonfarm employment change and ISM non-manufacturing PMI, both in October. Anyway, let’s start the analysis, S&P 500 first:

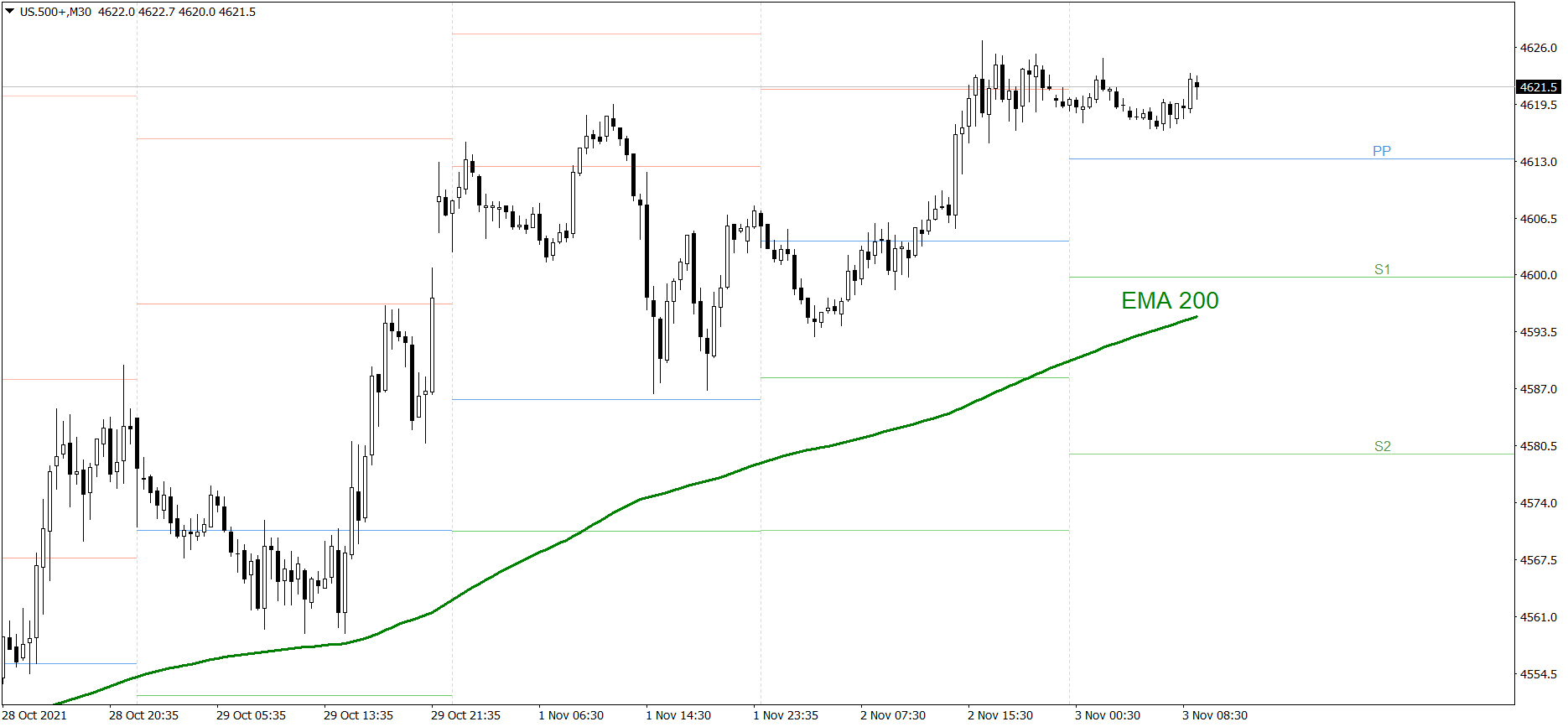

S&P 500

Yesterday was a good bullish session. The S&P 500 rose significantly, set the new all-time high and finished the session a little below the R1 resistance level. Today it is slowly going up, but the volatility is rather low. If the buyers continue generating sufficient demand, the price might rise above 4230 today. But If the bears counterattack, the price could drop below the Pivot Point.

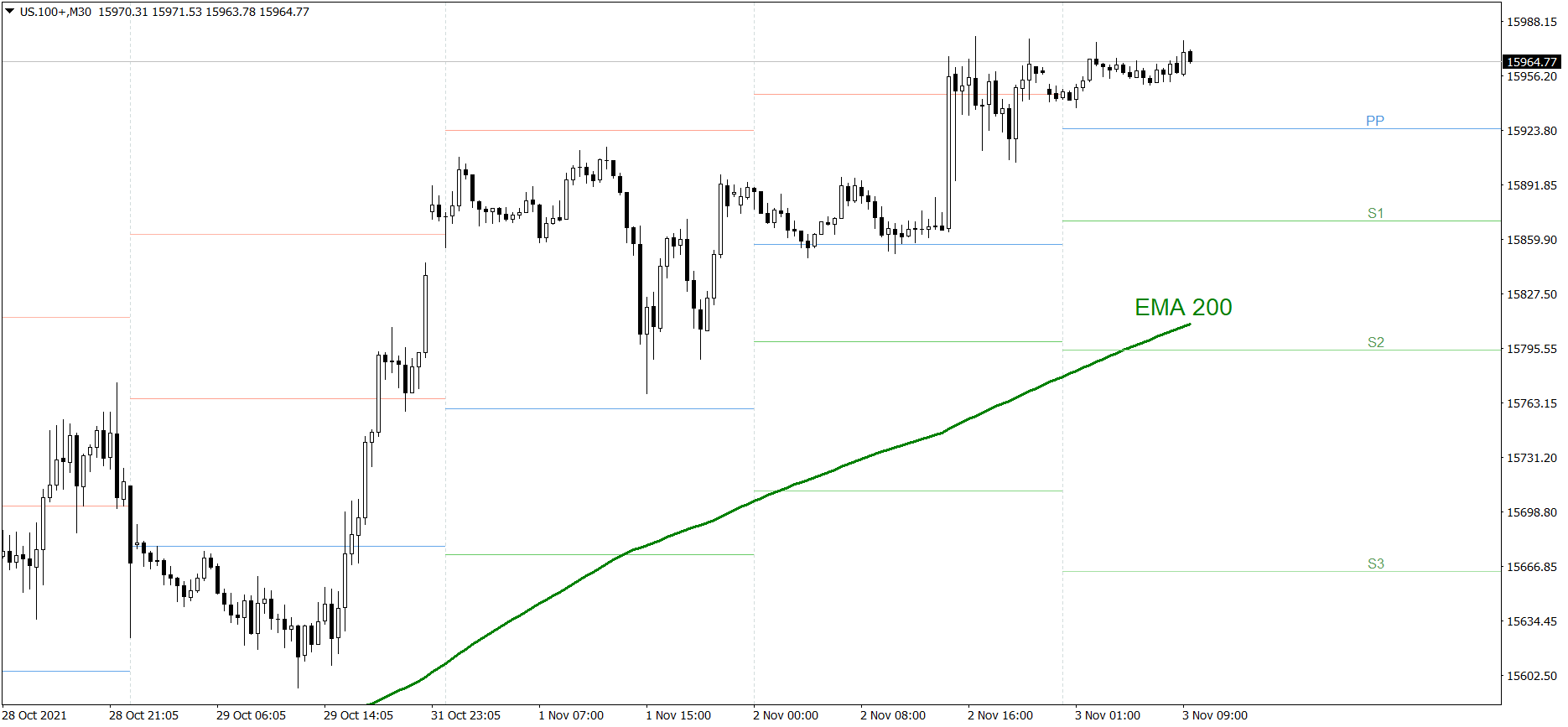

NASDAQ 100

NASDAQ 100 also rose significantly yesterday. The price set the new all-time high and finished the session at the R1 resistance level. Today it is slowly going up, but the volatility is rather low. If the buyers continue generating sufficient demand, the price might rise above 16000 today. But If the bears counterattack, the price could drop below the Pivot Point.

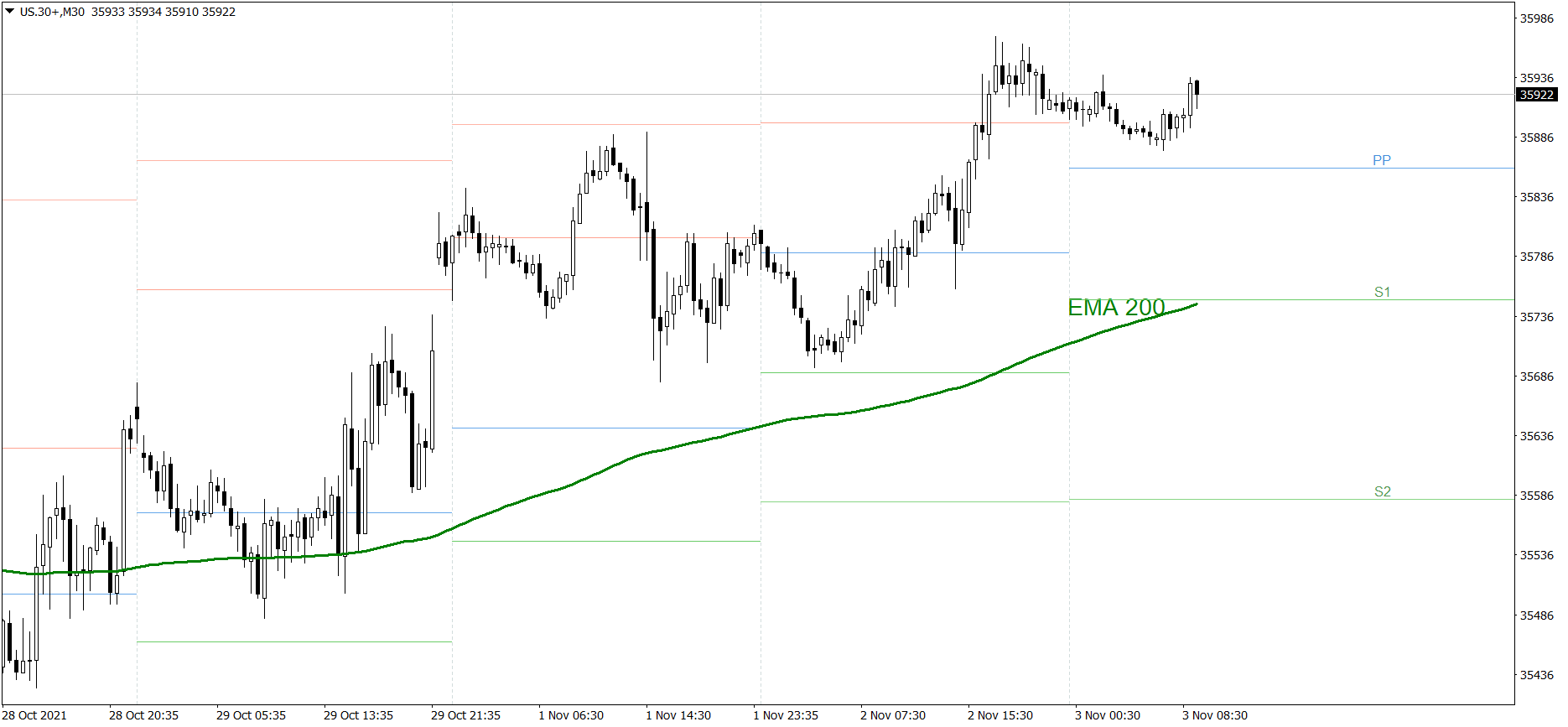

Dow Jones Industrial Average

The DJIA index rose significantly yesterday as well. The price set the new all-time high and finished the session above the R1 resistance level. Today it is slowly going up, but the volatility is rather low. If the buyers continue generating sufficient demand, the price might rise above 36000 today. But If the bears counterattack, the price could drop below the Pivot Point.