On Friday the American indices went down. However, after the weekend they opened the first session in a new year significantly higher and have been rising slowly since then. From the data front, the manufacturing PMI in December will be published. Anyway, let’s move on to the analysis, S&P 500 first:

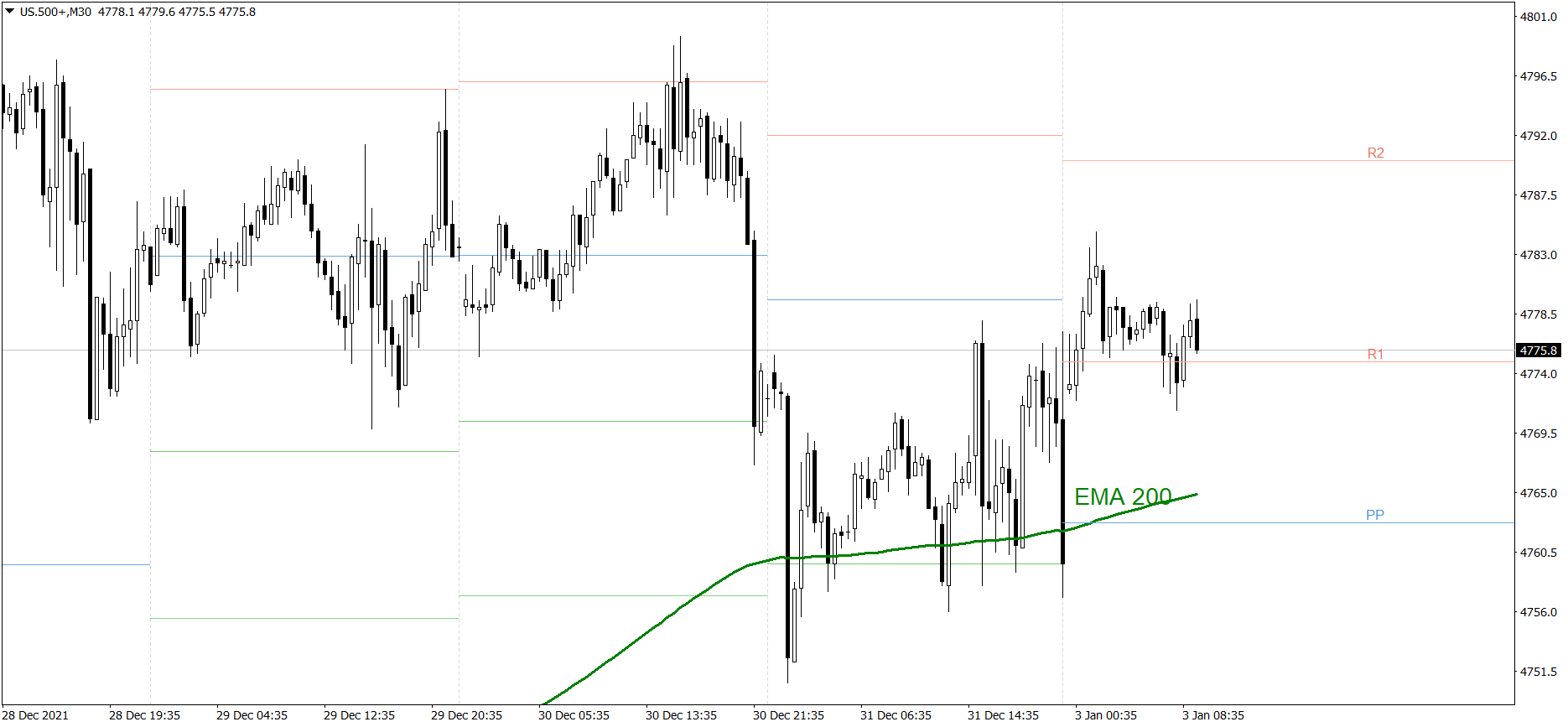

S&P 500

The S&P 500 went down on Friday. The price finished the last session of the year at the S1 support level, at 4760. However, after the weekend it opened 13 pips higher and has been rising slowly since then. Right now the price is above the R1 resistance level. If the buyers continue generating sufficient demand, the price might reach the R2 and 4790 today. But if the bears counterattack, the price could drop to the EMA 200.

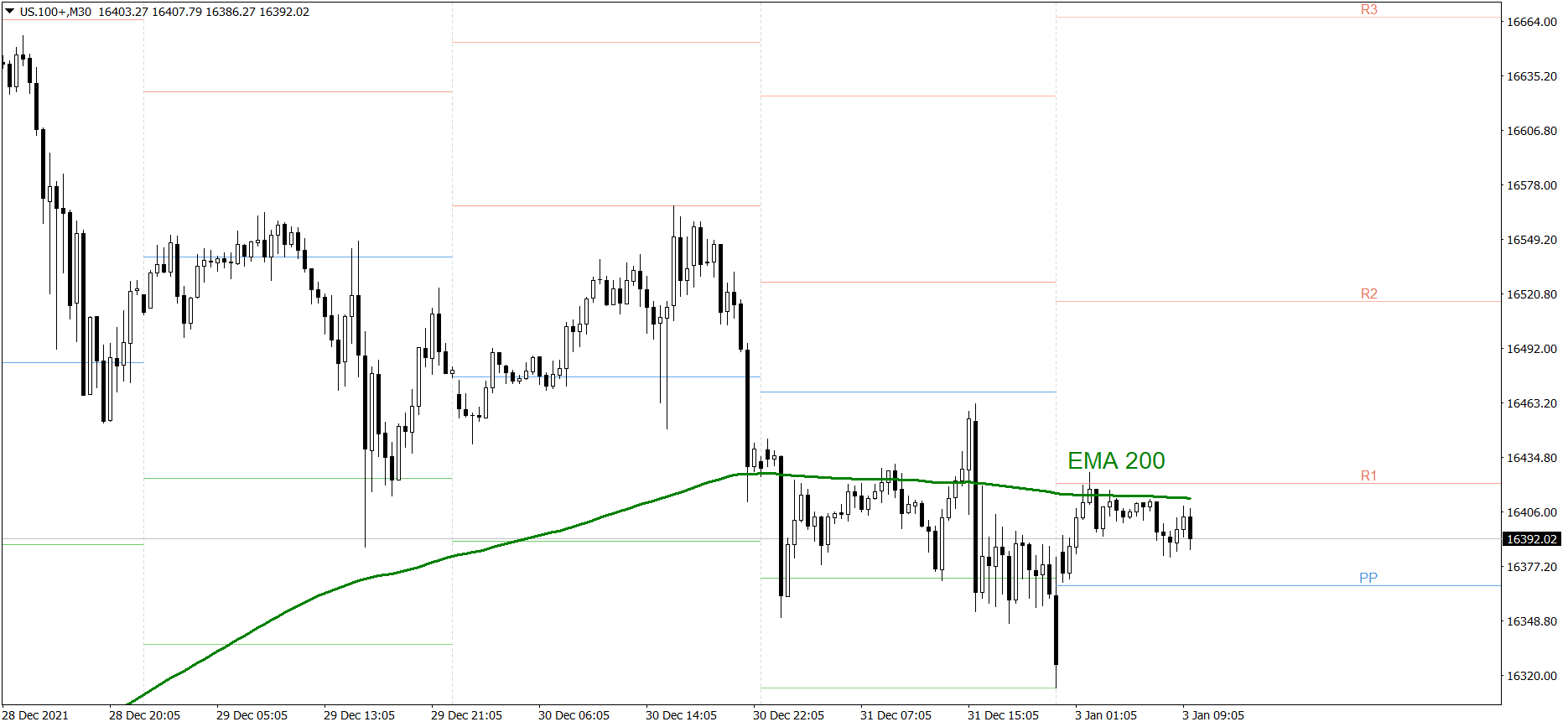

NASDAQ 100

NASDAQ 100 dropped deeply on Friday. The price finished the last session of the year a little above the S2 support level and 16320. However, after the weekend it opened 60 pips higher and has been rising slowly since then. If the buyers continue generating sufficient demand, the price might rise above the R1 resistance level and the EMA 200 today. But if the bears counterattack, the price could drop below 16350.

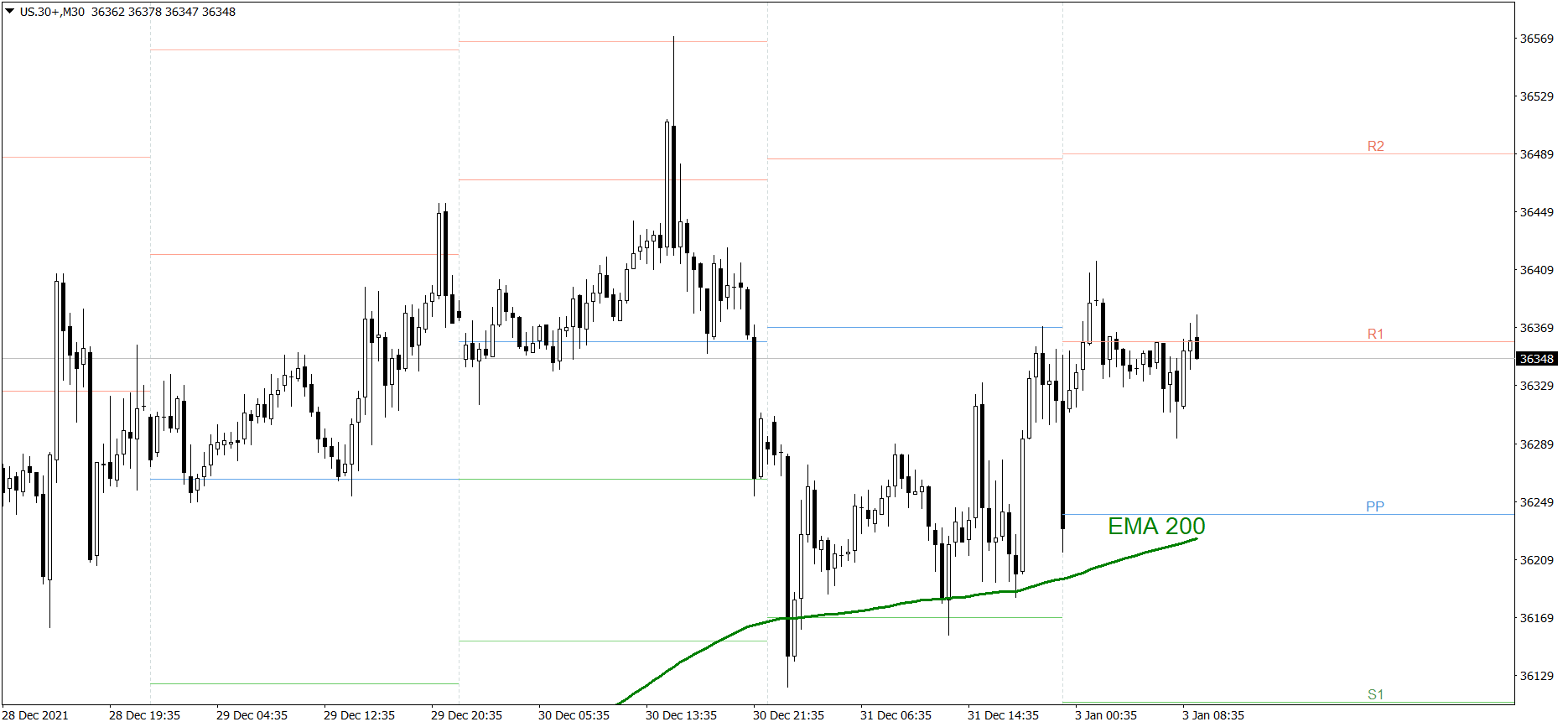

Dow Jones Industrial Average

The DJIA index went down a bit on Friday as well. The price finished the last session of the year slightly above 16300. However, after the weekend it opened 80 pips higher and has been rising slowly since then. Right now the bulls are attacking the R1 resistance level. If they do it successfully, the price might rise above 36450 today. But if they fail, the price could drop to the Pivot Point.