Yesterday the American indices showed mixed sentiment. Today all three of them are going down slowly. From the data front, all eyes will be focused on the nonfarm payrolls and unemployment rate in August. Anyway, let’s move on to the analysis, S&P 500 first:

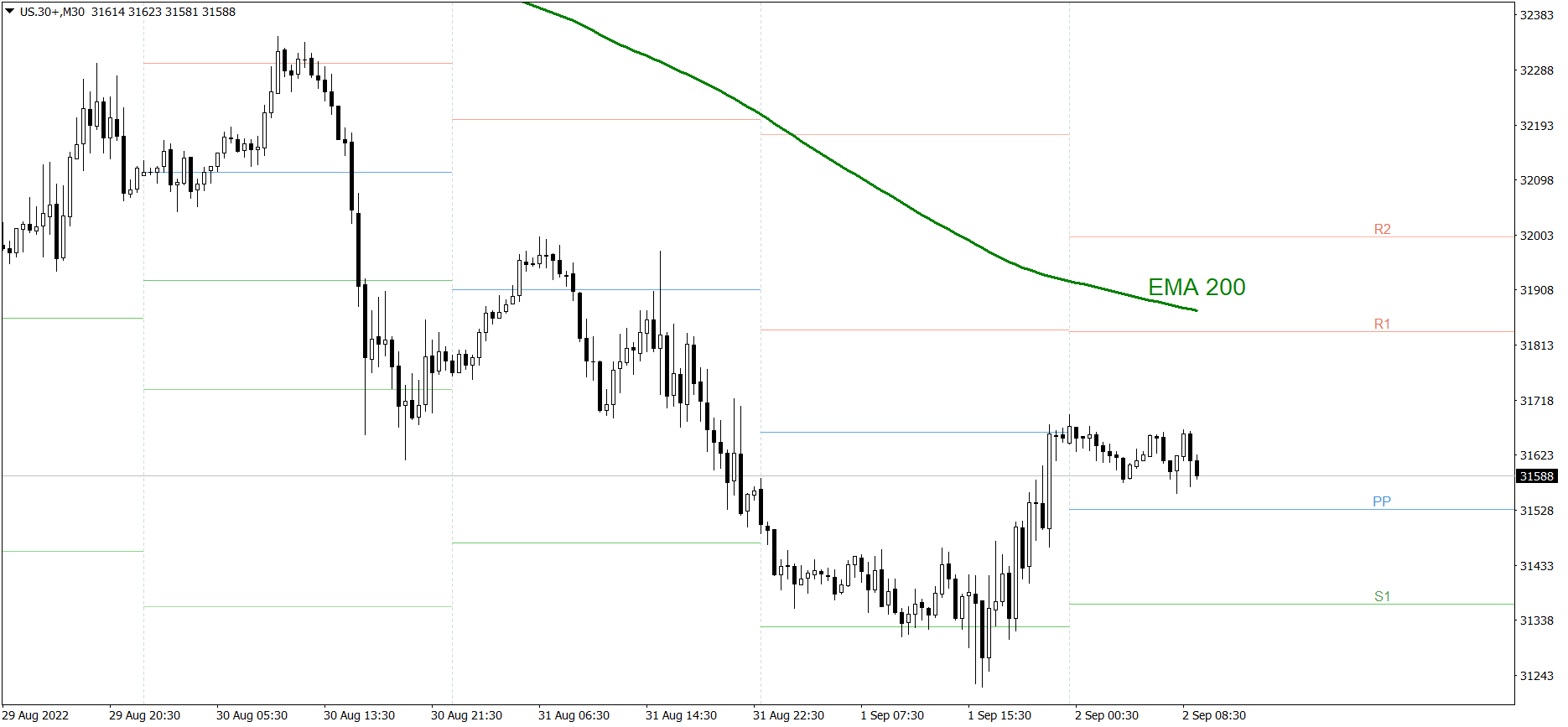

S&P 500

Yesterday was a really interesting session. First the S&P 500 dropped significantly below the S1 support level. Then, in the evening, it rose strongly and finished the session a little below the Pivot Point and 3970. Today it is going down slowly, though. If the buyers don’t generate some serious appetite soon, the price could fall below 3950 and the Pivot Point. But if they do, the price might rise above 3980 today.

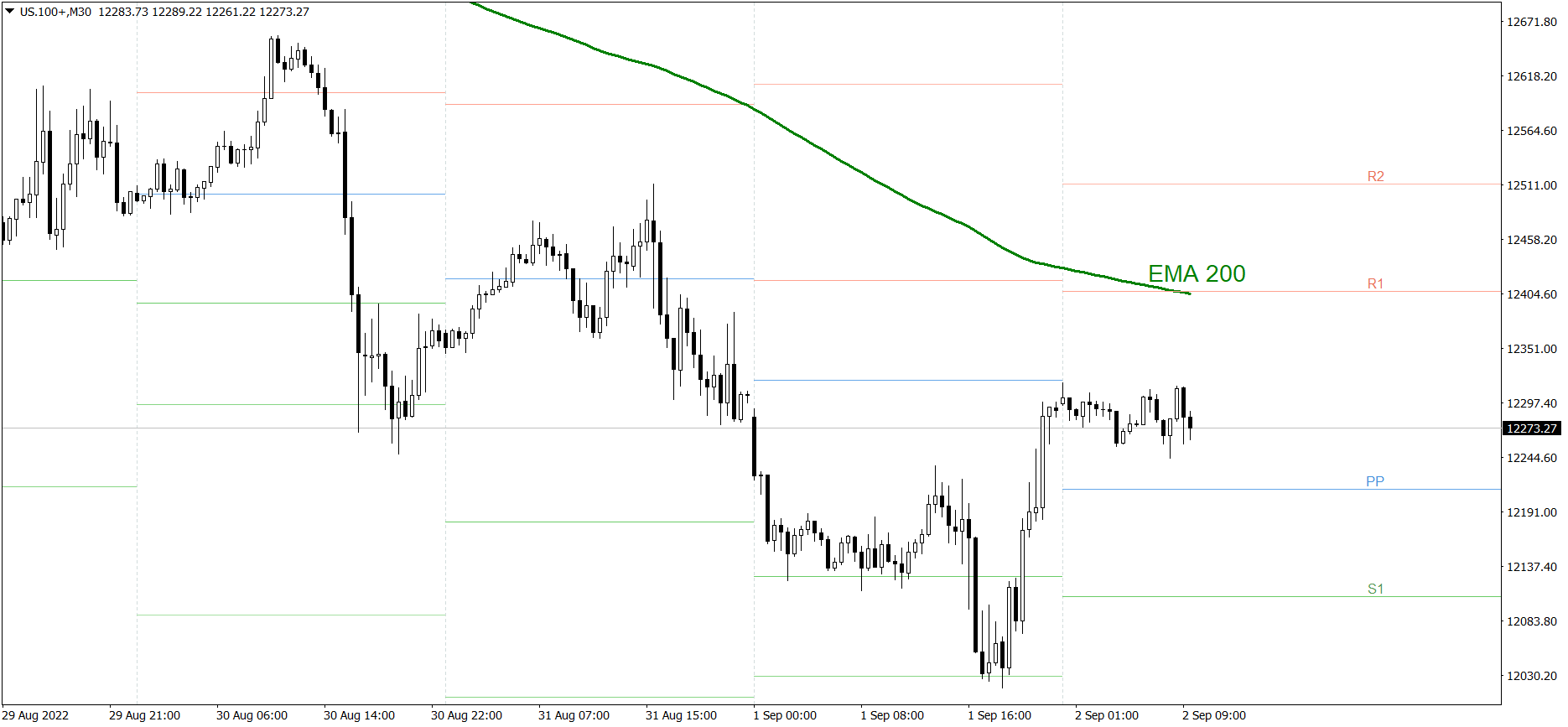

NASDAQ 100

NASDAQ 100 was also really volatile yesterday. First the price dropped to the S2 support level. Then, in the evening, it rose strongly and finished the session a little below the Pivot Point and 12300. Today it is going down slowly, though. If the buyers don’t generate some serious appetite soon, the price could fall below the Pivot Point and 12200. But if they do, the price might reach the R1 resistance level, the EMA 200 and 12400.

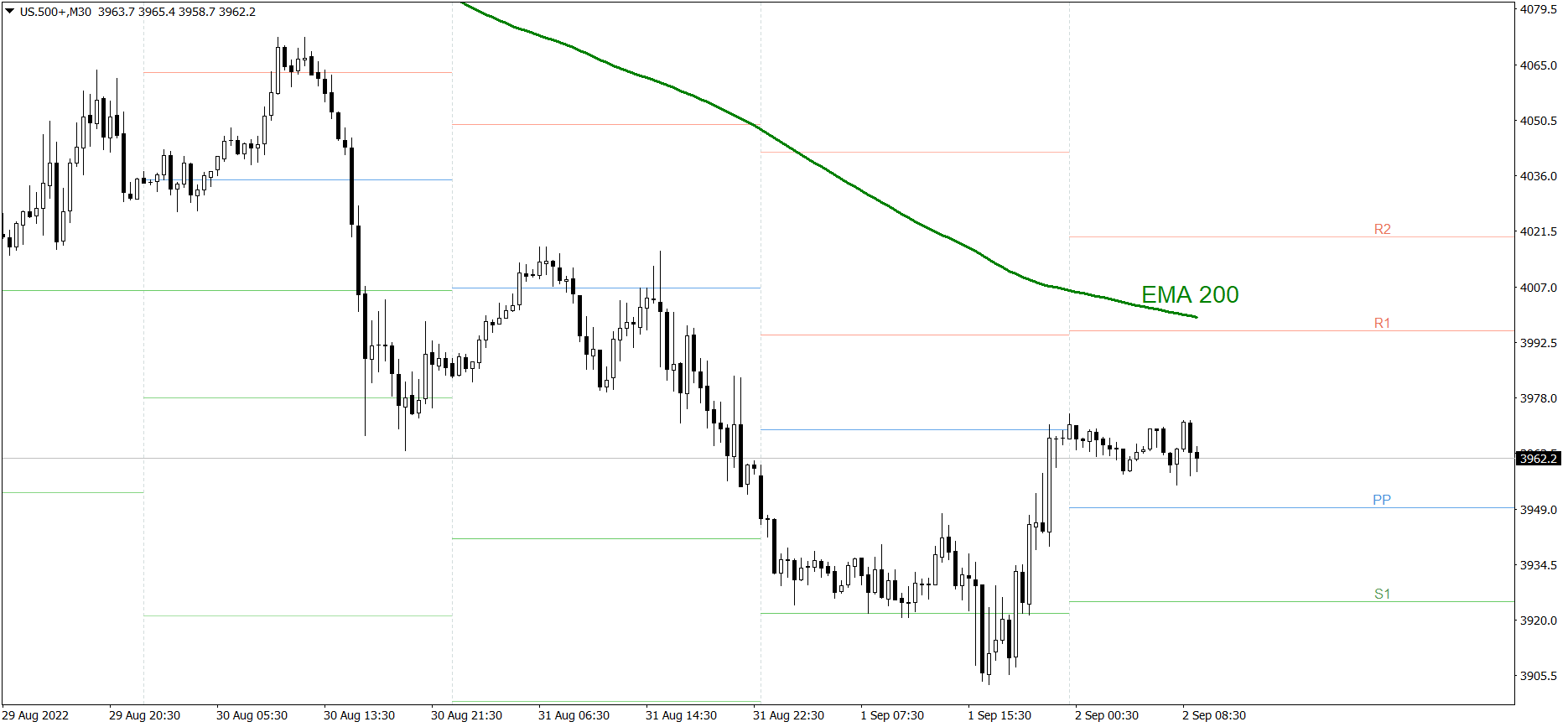

Dow Jones Industrial Average

The DJIA index showed mixed sentiment yesterday as well. First the price dropped below the S1 support level. Then, in the afternoon, it rose strongly and finished the session a little below the Pivot Point. Today it is going down slowly, though. If the buyers don’t generate some serious appetite soon, the price could fall below the Pivot Point and 31500. But if they do, the price might reach 31800.