Yesterday, the American indices performed differently. The Dow Jones Industrial Average rose above the R2 resistance level and set the new all-time high, the S&P 500 went up significantly, but the NASDAQ 100 only showed mixed sentiment. Today, all three of them are rising strongly, though. From the data front, weekly initial jobless claims and JOLTs job openings will be published today in the US. Anyway, let’s start the analysis, S&P 500 first:

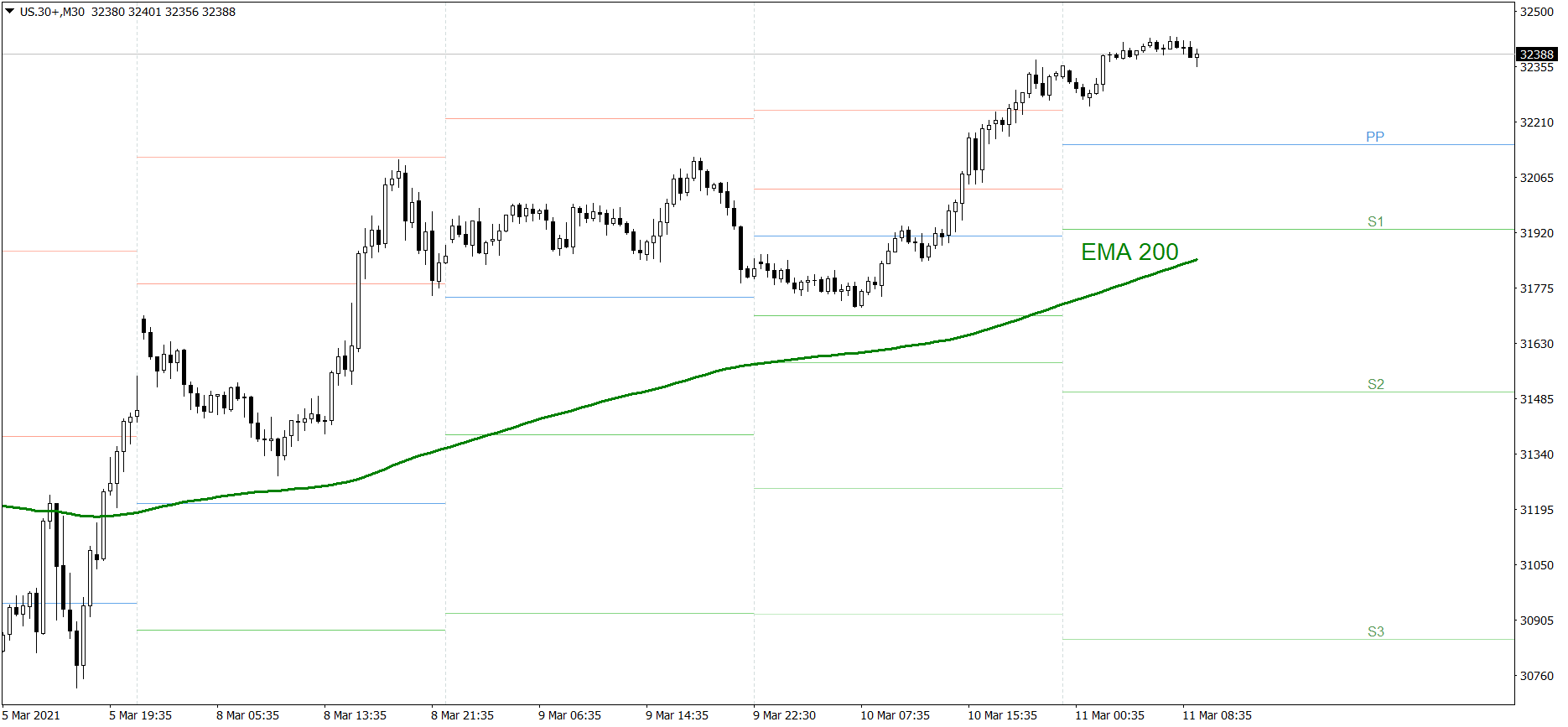

S&P 500

That was another good, bullish session for the S&P 500. The price rose significantly and finished the day at the R1 resistance level. Today, it is rising even more. If the buyers continue generating firm demand, the price should also reach the R1 today. But if the bears counterattack, the price could drop to the Pivot Point.

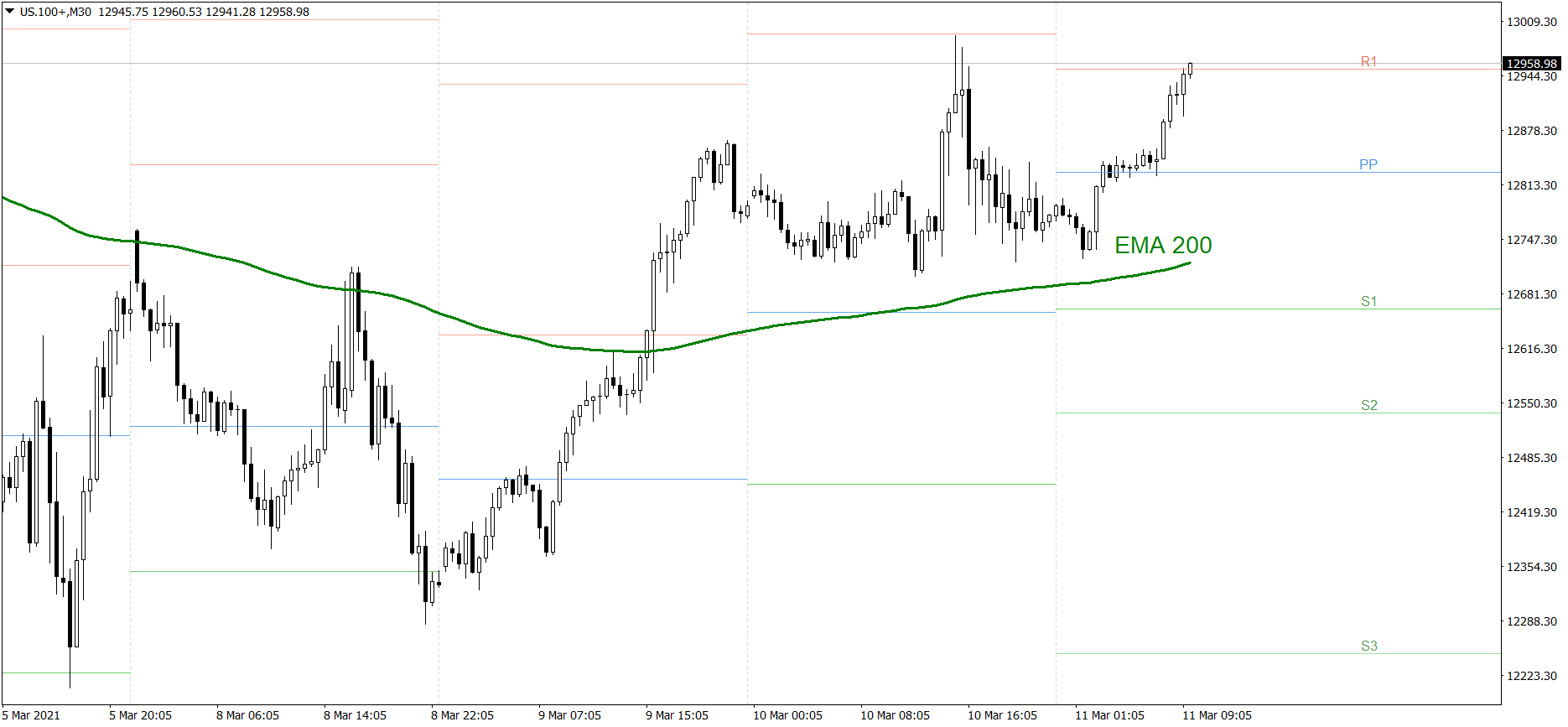

NASDAQ 100

NASDAQ 100 showed mixed sentiment yesterday. Although the price tested the R1 resistance level at the start of the American trading session, it dropped later in the afternoon. Today, the price is rising strongly. It’s already above today’s R1. If the buyers continue generating firm demand, the price might rise above 13000 pretty soon. But if the bears counterattack, the price could fall to the Pivot Point.

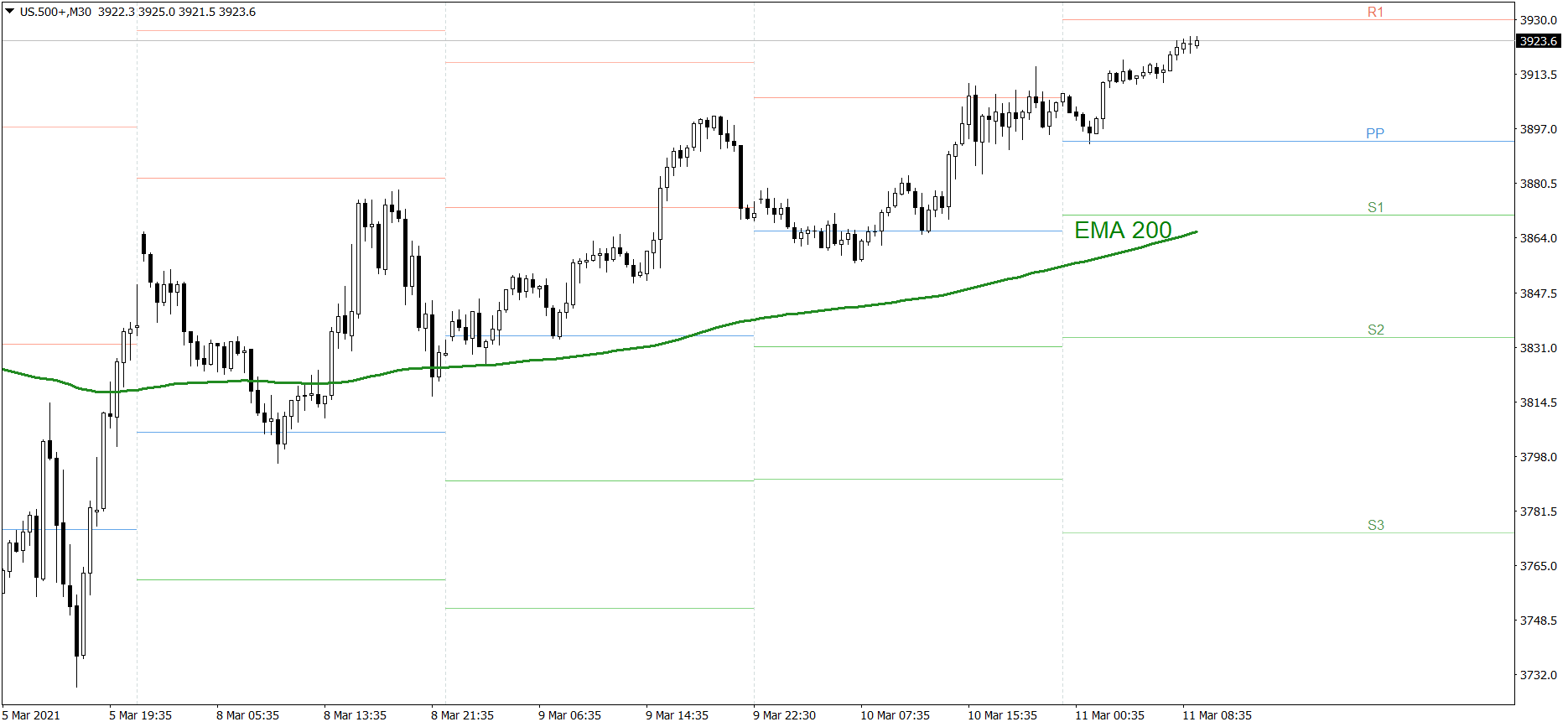

Dow Jones Industrial Average

The DJIA index was definitely the strongest one yesterday. The price rose above the R2 resistance level and set the new all-time high. During today’s Asian trading session, it went up even more, but this morning the DJIA index doesn’t seem to be as strong as the S&P 500 or the NASDAQ 100. That said, if the bulls continue generating sufficient demand, the price might even reach 32500 today. But if the bears counterattack, the price could drop to the Pivot Point.