Yesterday the American indices showed mixed sentiment. The volatility was low as well. In consequence, all three of them finished the day very close to the Pivot Point. However, they are rising strongly today. How far can they go? Let’s try to answer that question in an analysis. S&P 500 first:

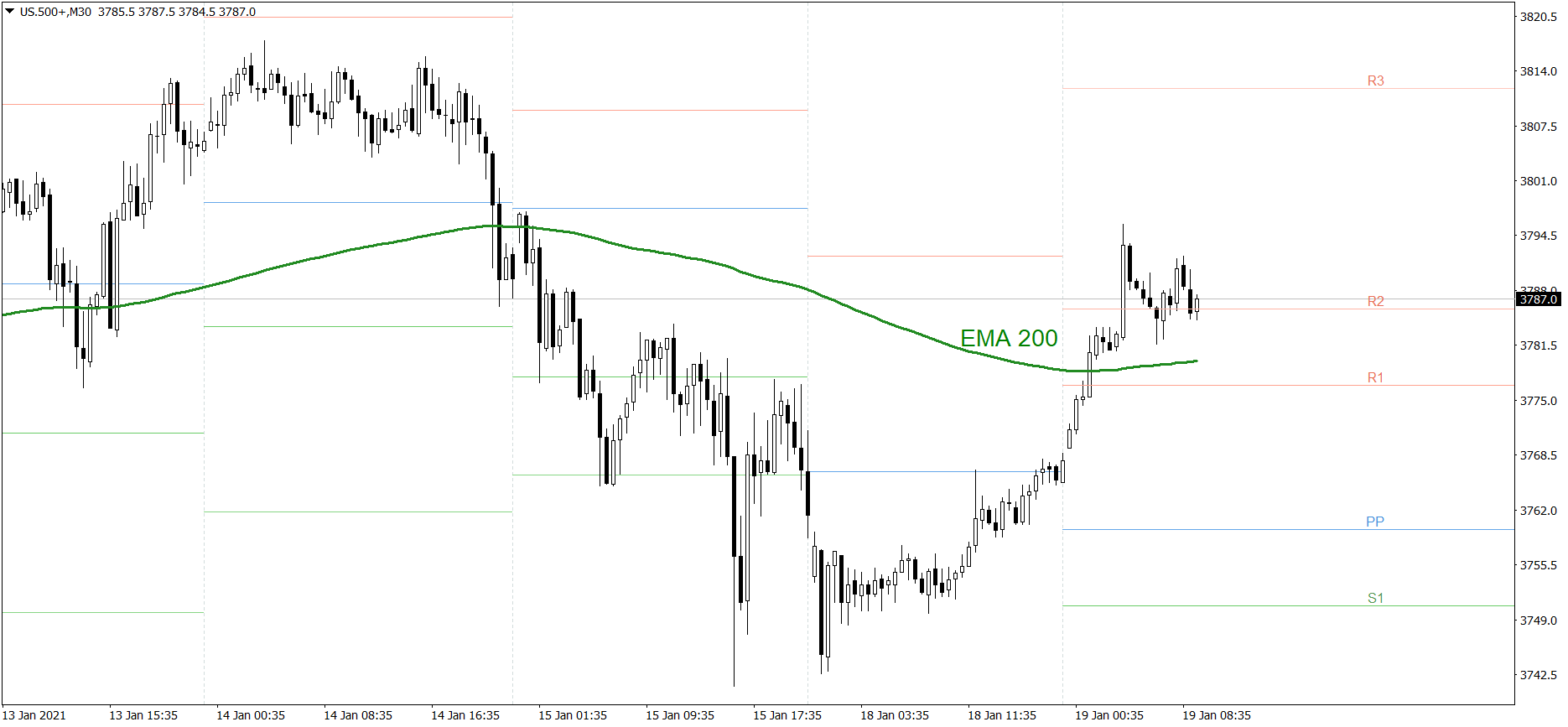

S&P 500

The S&P 500 showed mixed sentiment yesterday. The price opened significantly lower after the weekend, but then it started rising. In the end, it finished the day on the Pivot Point. Today, the price is going up at a much faster pace, though. Right now it is above the R2 resistance level. If the buyers continue generating strong demand, the price might even reach the R3 today. But if the bears counterattack, the price could drop below the R1.

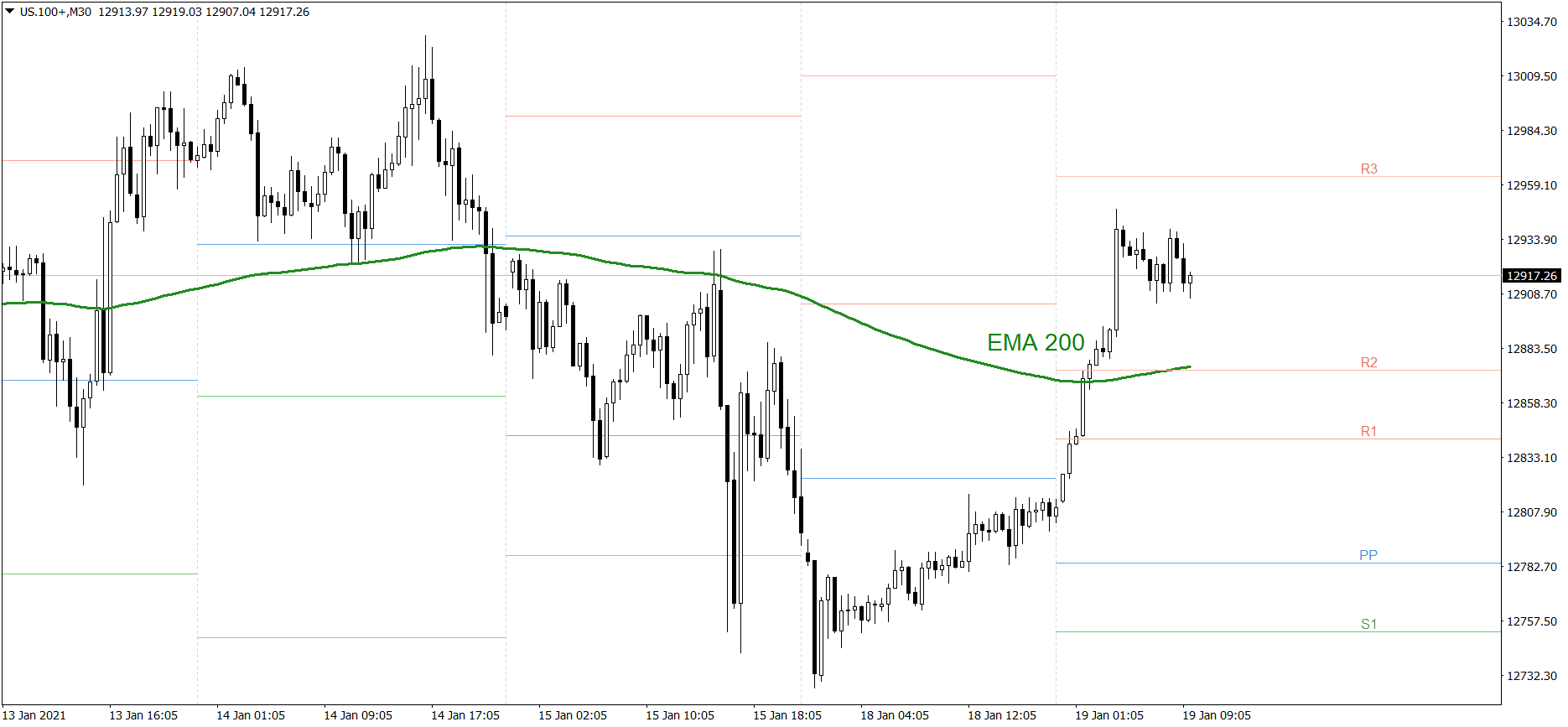

NASDAQ 100

NASDAQ 100 also showed mixed sentiment yesterday. The price opened a bit lower after the weekend, but then it started rising. In the end, it finished the day close to the Pivot Point. Today, the price is going up at a much faster pace, though. Right now it is above the R2 resistance level. If the buyers continue generating strong demand, the price might not only attack the R3, but even reach 13000 today. However if the bears counterattack, the price could drop below the EMA 200.

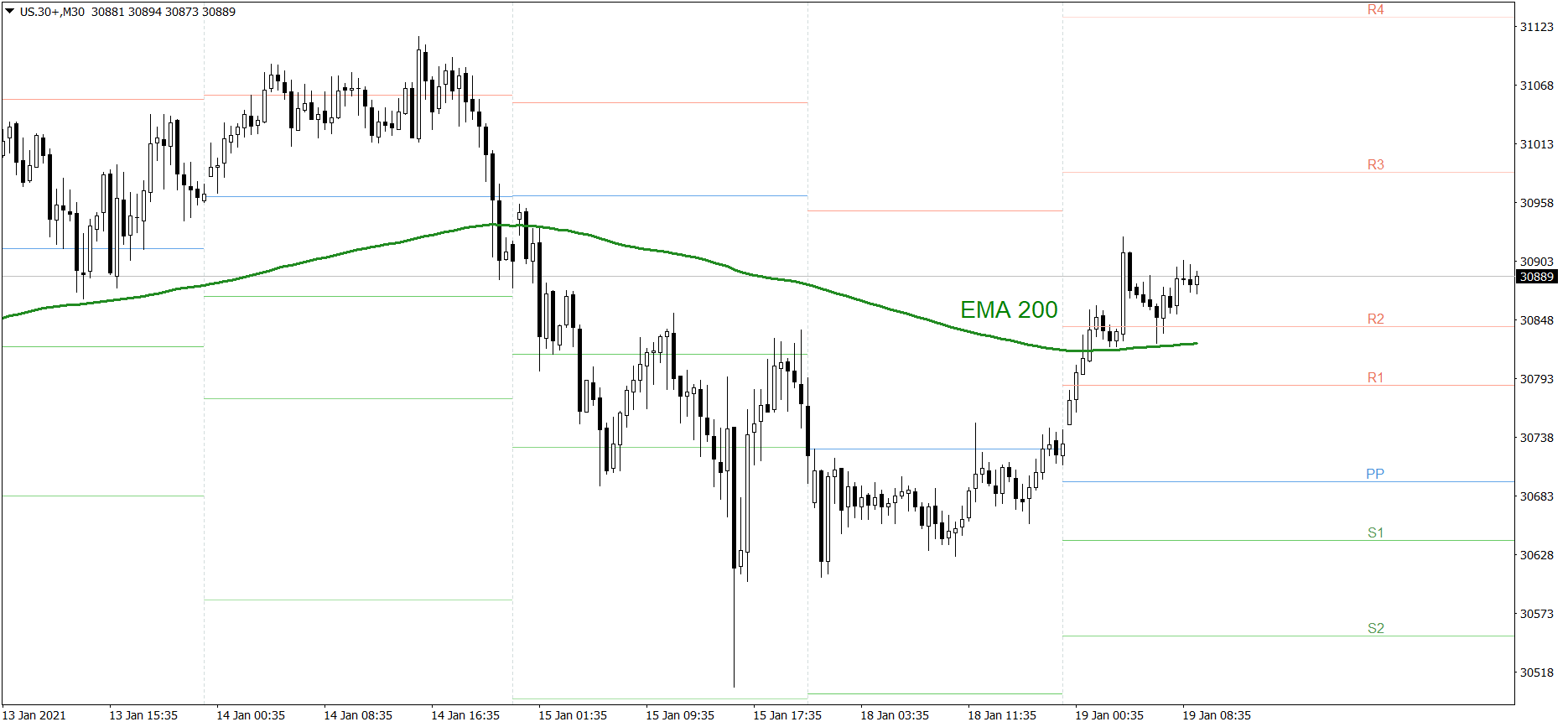

Dow Jones Industrial Average

The DJIA index showed mixed sentiment yesterday as well. The price opened significantly lower after the weekend, but then it started rising. In the end, it finished the day on the Pivot Point. Today, the price is going up at a much faster pace, though. Right now it is above the R2 resistance level. If the buyers continue generating strong demand, the price might even attack the R3 today. But if the bears counterattack, the price could drop below the R1.