Yesterday, the American market was closed, because of the national holiday – Memorial Day. However, the indices dropped significantly. Surprisingly, they opened higher today, and they have been rising strongly since then. From the data front, manufacturing PMI in May will be published. Anyway, let’s start the analysis, S&P 500 first:

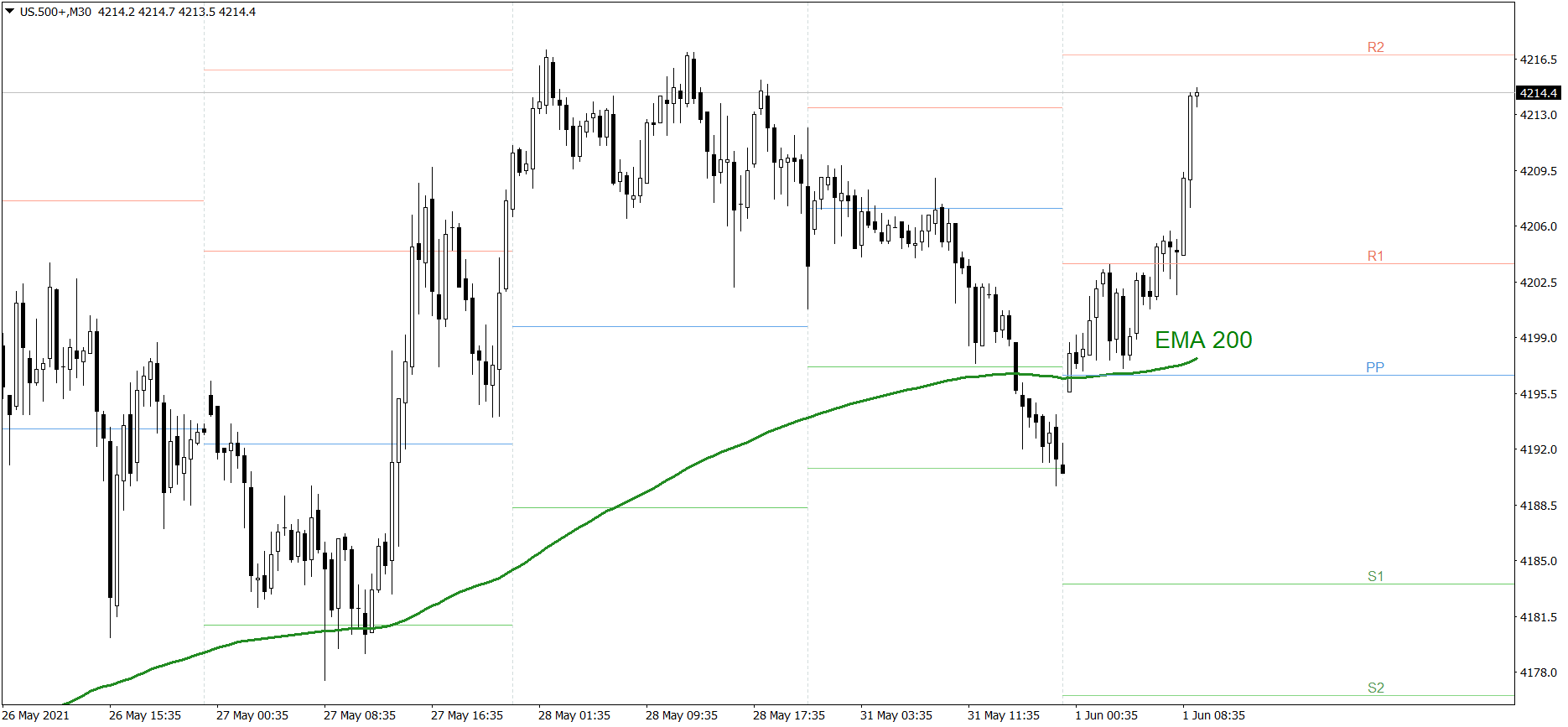

S&P 500

The S&P 500 dropped deeply yesterday. The price finished the day at the S2 support level. However, it opened 5 pips higher today and has been rising strongly since then. Right now the price is getting close to the R2 resistance level. If the buyers continue generating firm demand, the price might successfully attack that level and stay above it for the rest of the day. But if the bears counterattack, the price could fall to the R1.

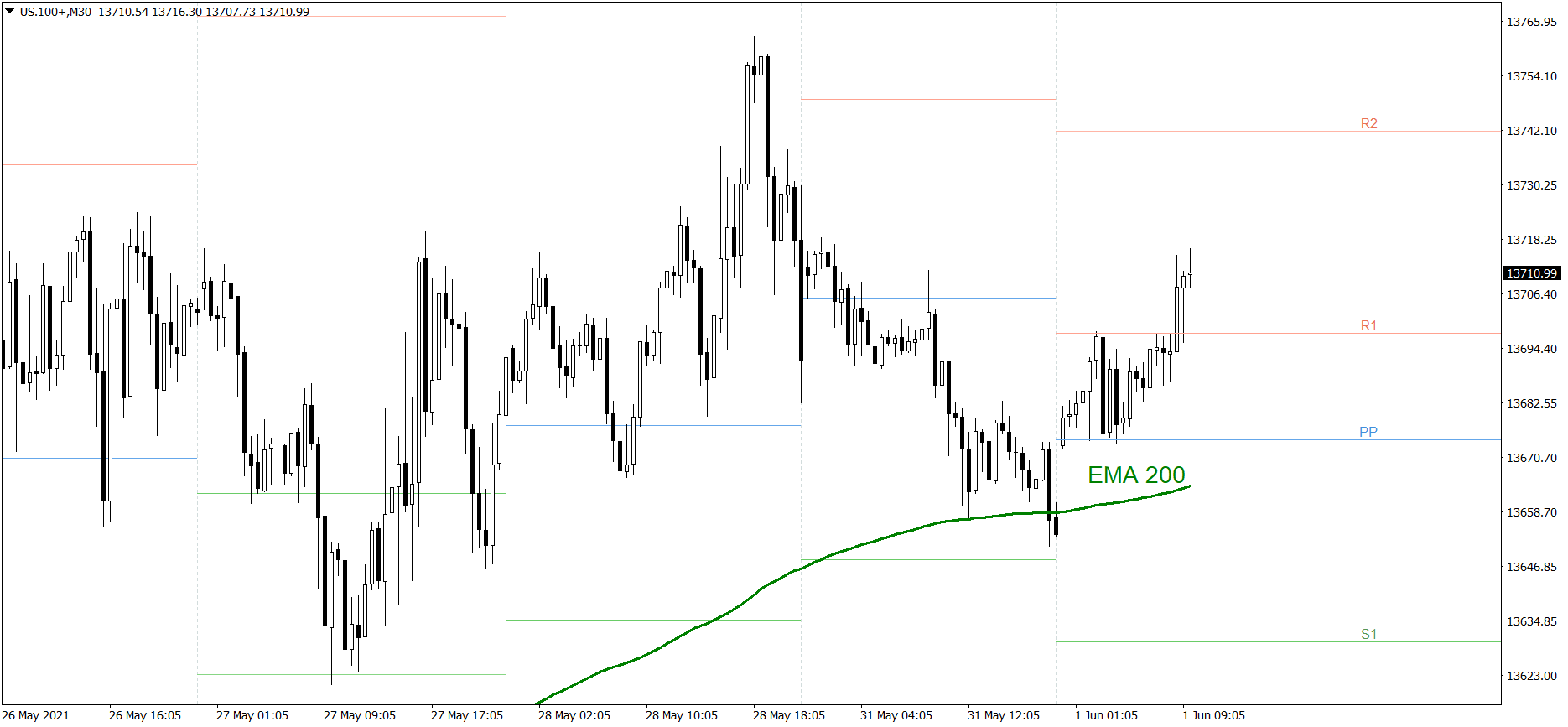

NASDAQ 100

NASDAQ 100 also dropped significantly yesterday. The price finished the day a little below the EMA 200. However, it opened 20 pips higher today and has been rising strongly since then. Right now, the price is above the R1 resistance level and 13700. If the buyers continue generating firm demand, the price might even rise above the R2. But if the bears counterattack, the price could fall to the Pivot Point.

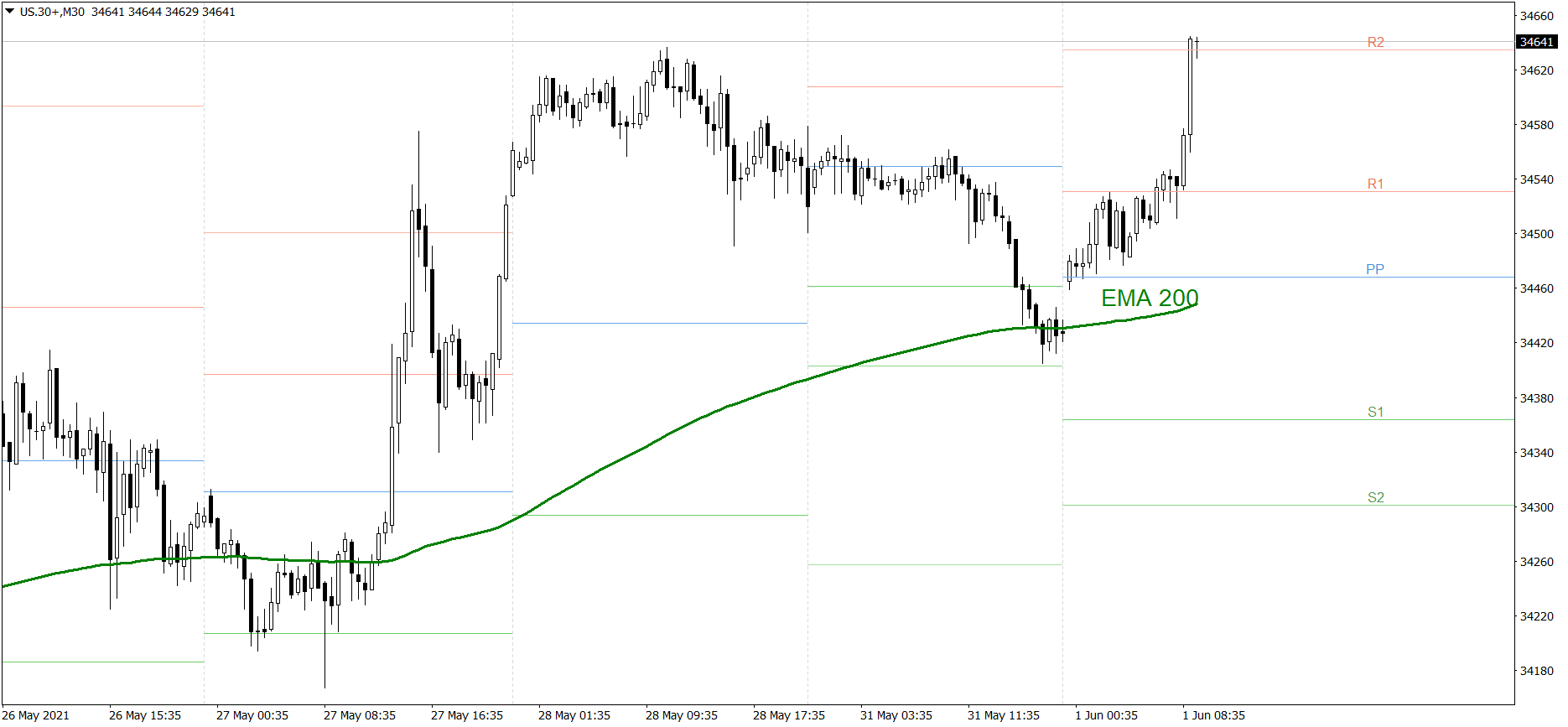

Dow Jones Industrial Average

The DJIA index dropped heavily yesterday as well. The price finished the day significantly below the S1 support level, at the EMA 200. However, it opened 38 pips higher today and has been rising strongly since then. Right now it is above the R2 resistance level. If the buyers continue generating firm demand, the price might rise above 34750 today. But if the bears counterattack, the price could fall to the R1.