Yesterday, both EURUSD and GBPUSD showed mixed sentiment and the volatility was quite low. However, both currency pairs are going down today. From the data front, the Bank of England will decide on monetary policy today. It is expected to acknowledge increasing risks for the UK economy after recent deterioration in economic data, namely December retail sales which were a huge miss. There is a risk that BoE could hint at the possibility of negative interest rates to counter slowdown. Anyway, let’s start the analysis:

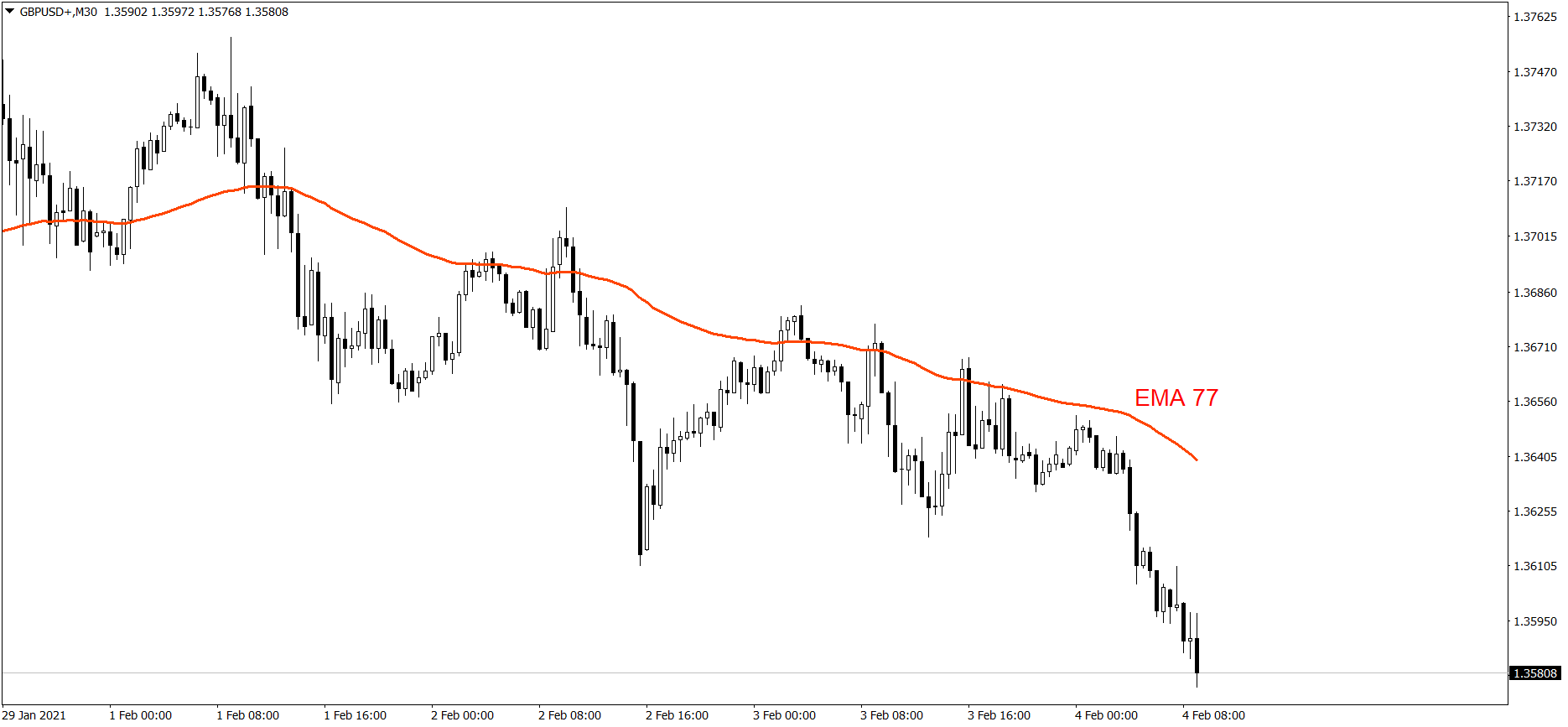

EURUSD

Yesterday, the EURUSD showed mixed sentiment and the volatility was rather low. The price didn’t really change after that session. However, the price is going down today. Right now it is below 1.20. If the buyers don’t generate some serious appetite pretty soon and return above the S1 support level, the price could drop much lower.

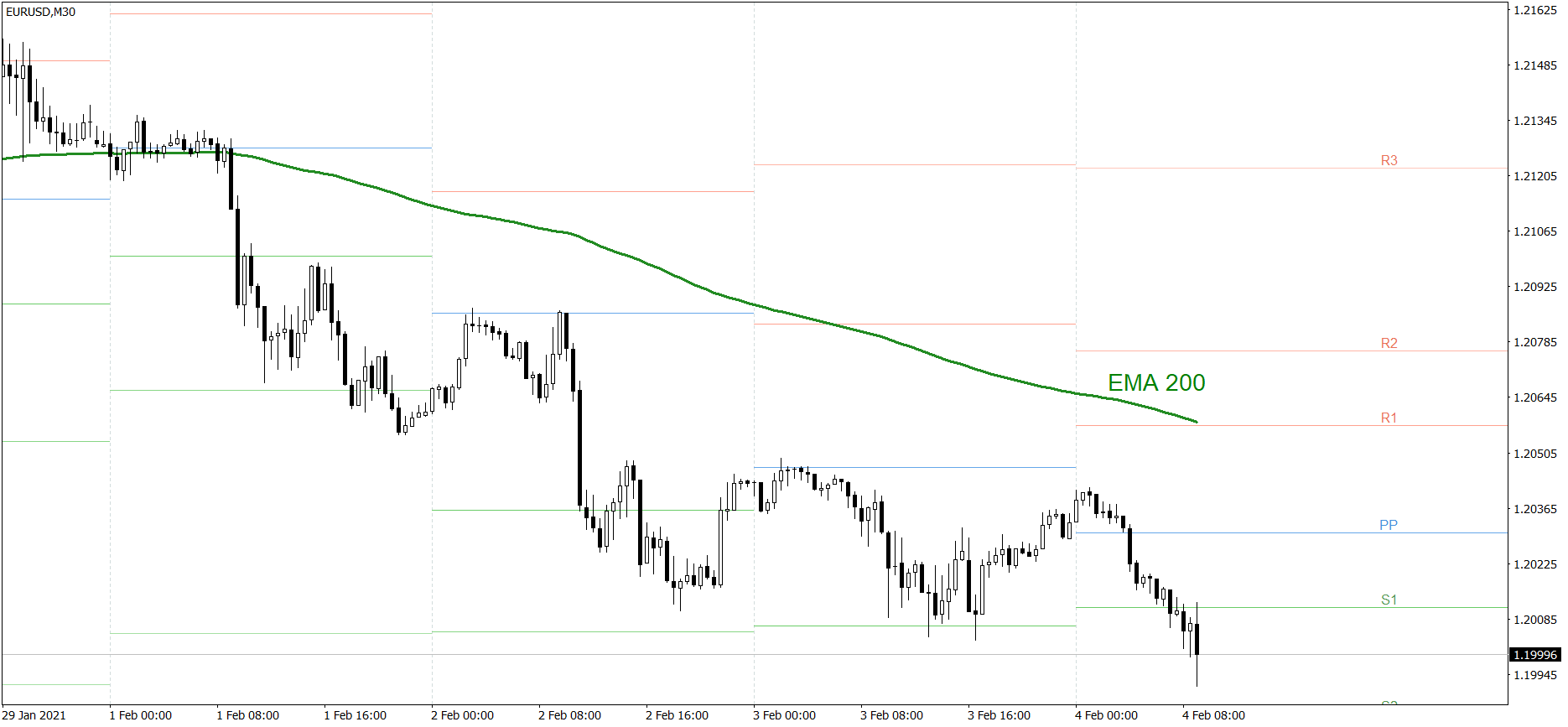

GBPUSD

The GBPUSD went down a little yesterday. The bulls tried to beat the EMA 77 several times, but the bears were stronger. Today, they are counterattacking and the price is going down heavily. Right now it is below 1.36. If the buyers don’t generate enough appetite pretty soon, the price could fall to 1.355 or even lower. Buf if they do, the price might rise and test the EMA 77 once more.