Yesterday the S&P 500 and the NASDAQ 100 went down, but the Dow Jones Industrial Average showed mixed sentiment. Today, the NASDAQ 100 is falling even more, but the S&P 500 and the DJIA index are showing mixed sentiment. From the data front, the CPI and core CPI in April will be published. Anyway, let’s move on to the analysis, S&P 500 first:

S&P 500

The S&P 500 dropped heavily yesterday. The price started going down significantly in the morning. In consequence, it finished the session below the S1 support level and the EMA 200, slightly above 4130.

During today’s Asian trading session, the price was rising a bit. However, at the beginning of the European trading session, it started falling significantly. If the buyers don’t generate some serious appetite soon, the price could drop below today’s S1 and reach 4120 today. But if they do, the price might go up above the Pivot Point and 4140.

NASDAQ 100

NASDAQ 100 also dropped heavily yesterday. The price started going down significantly in the morning. In consequence, it finished the session slightly below the S1 support level, at 13260.

During today’s Asian trading session, the price was rising a bit. However, at the beginning of the European trading session, it started falling significantly. The price is already below the EMA 200. If the buyers don’t generate some serious appetite soon, the price could drop below today’s S1 and even reach 13200 today. But if they do, the price might return above the EMA 200 and reach the Pivot Point.

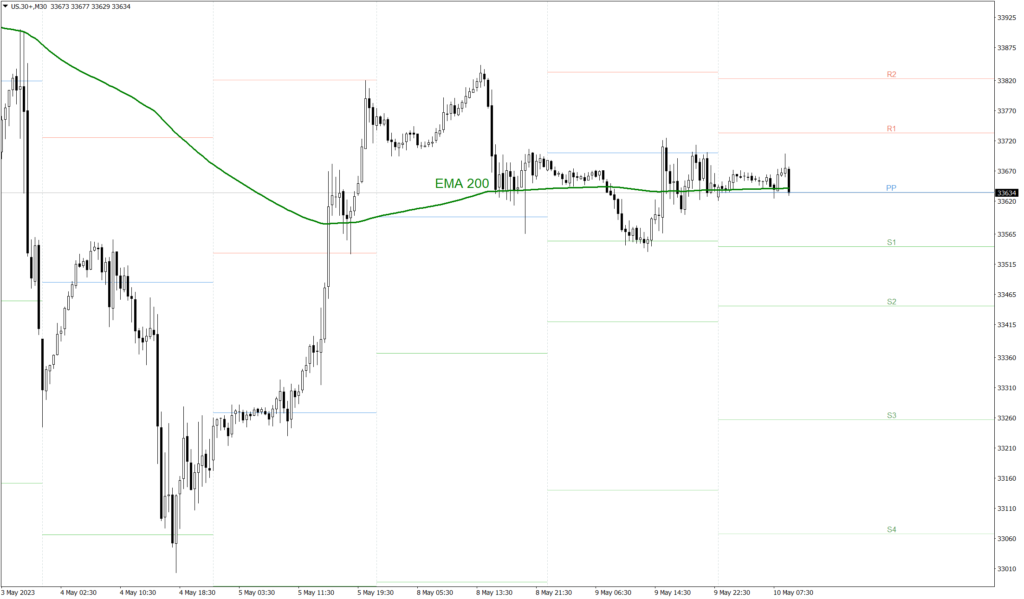

Dow Jones Industrial Average

The Dow Jones Industrial Average wasn’t as weak as the other two indices yesterday. First, the price started going down significantly in the morning. Then, at noon, it reached the S1 support level. After that, the price started rising. At the beginning of the American trading session, it even reached the Pivot Point. During the next hours the price was showing mixed sentiment, though. In consequence, the DJIA index finished the session a little above the EMA 200, slightly below 33650.

During today’s Asian trading session, the price was rising a bit. However, at the beginning of the European trading session, it started falling. Right now the bulls are trying to defend the EMA 200 and the Pivot Point. If they do it successfully, the price might bounce above 33700 and even reach the R1 resistance level today. But if they fail, the price could drop below 33600 and reach today’s S1.