Yesterday the American indices performed differently. The S&P 500 and the Dow Jones Industrial Average dropped heavily, but the NASDAQ 100 managed to rise. Today all three of them are showing mixed sentiment and the volatility is rather low. From the data front, pending home sales in September will be published. Anyway, let’s start the analysis, S&P 500 first:

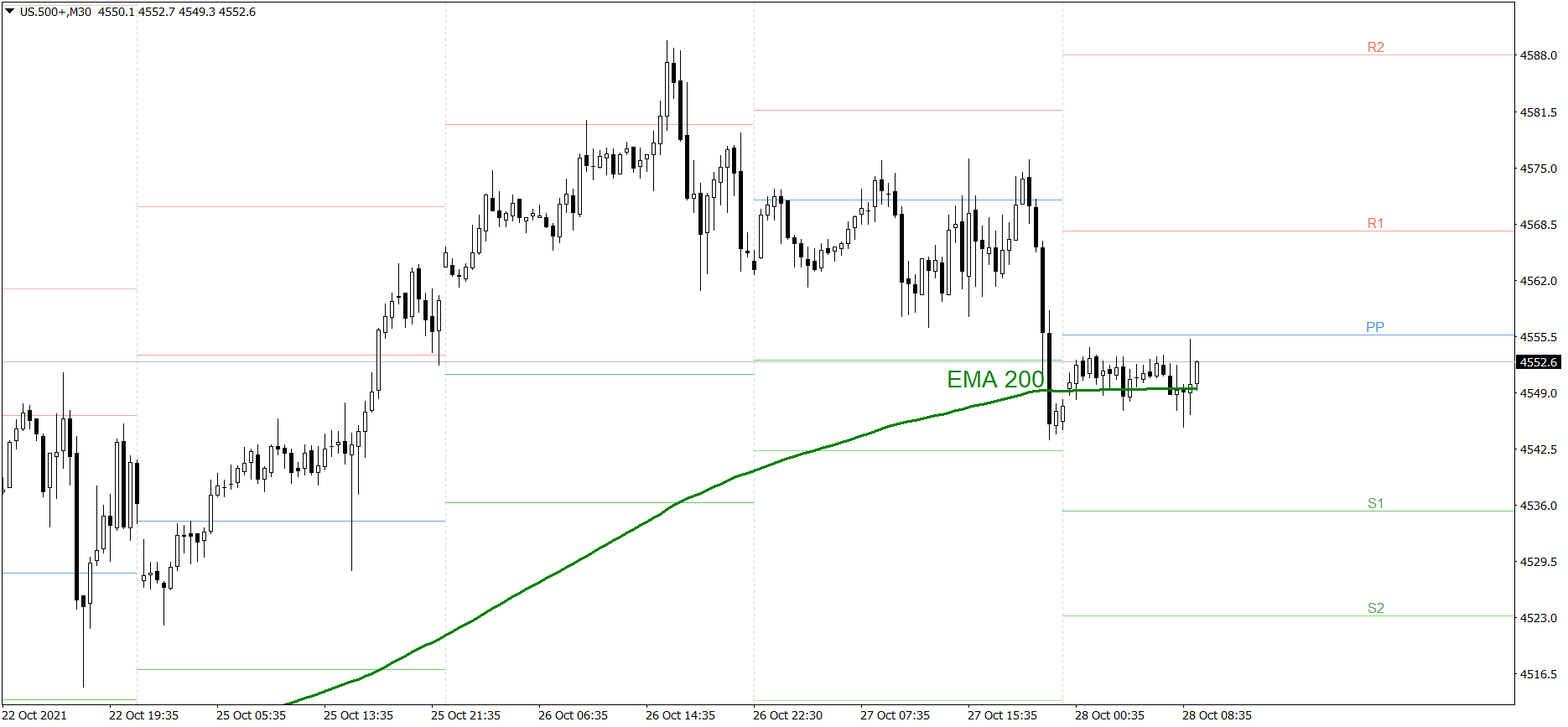

S&P 500

Yesterday the S&P 500 dropped significantly. The price finished the session below the S1 support level, at 4550. Today it is showing mixed sentiment and the volatility is rather low. If the bulls take control over the market, the price might rise above the R1 resistance level. But if the bears show their strength once again, the price could fall below 4540 and reach the S1.

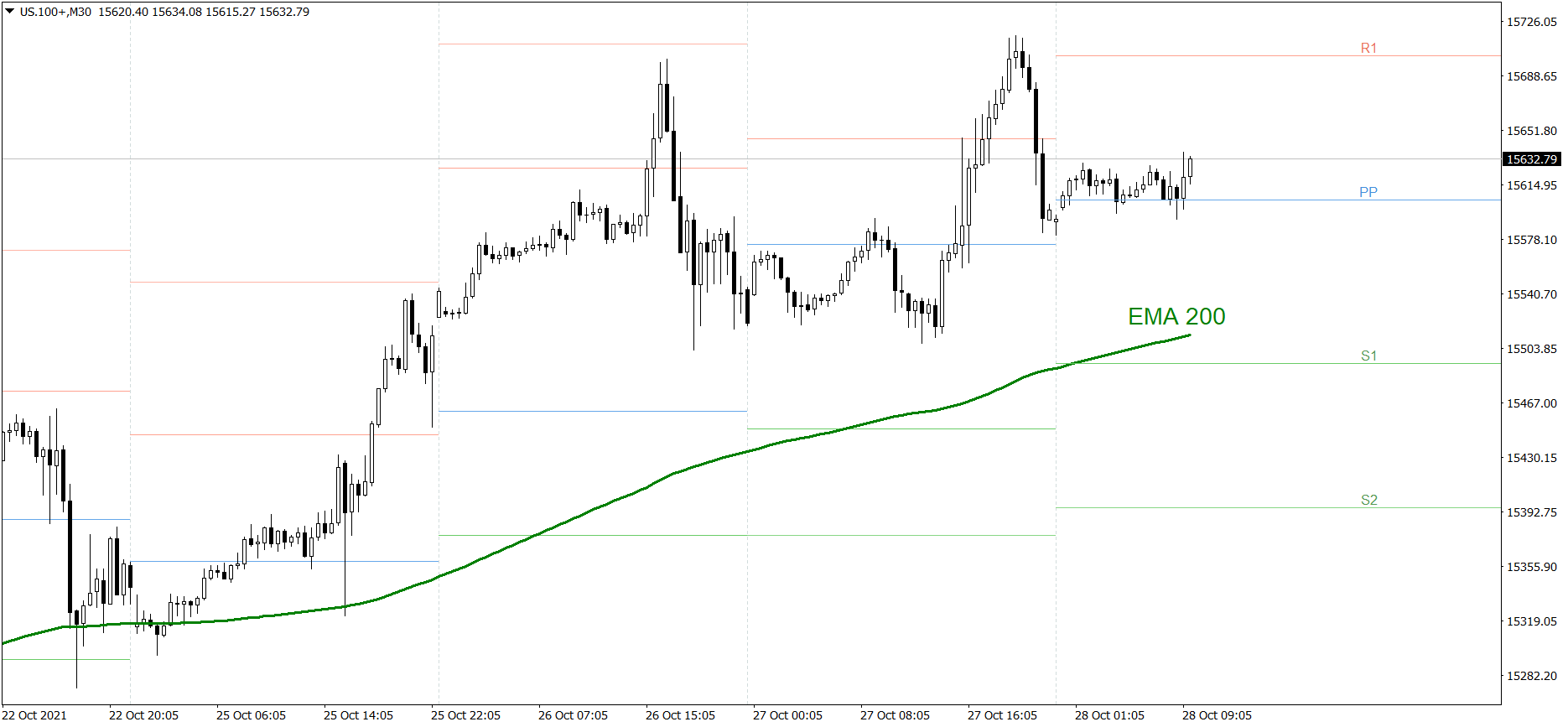

NASDAQ 100

NASDAQ 100 was the strongest one yesterday. The price rose high above and even set the new all-time high, but in the evening it dropped and finished the session at 15590, slightly above the Pivot Point. Today the price is rising slowly, but the volatility is rather low. If the buyers continue generating sufficient demand, the price might go up above today’s R1 and set the new all-time high. But if the bears show their strength, the price could fall to the EMA 200.

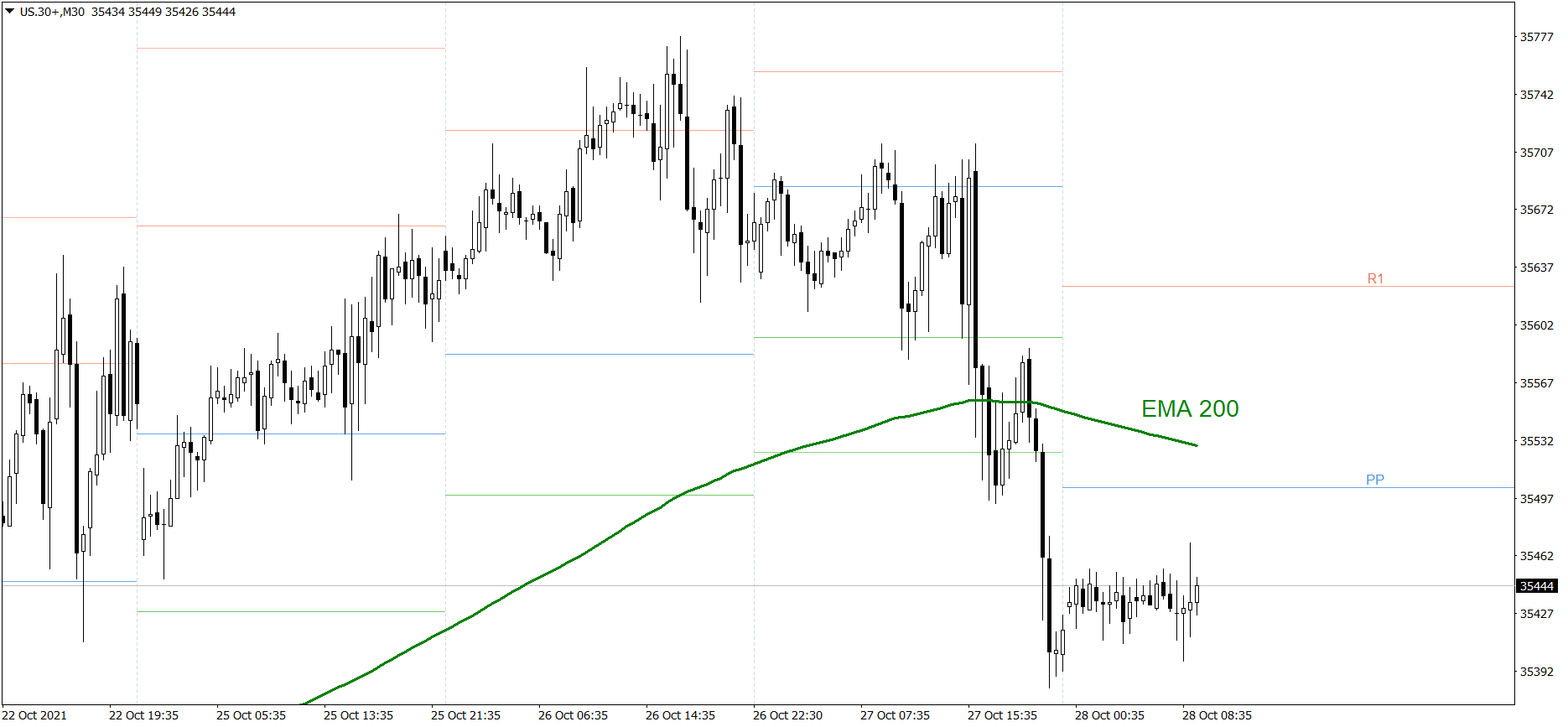

Dow Jones Industrial Average

The DJIA index was the weakest one yesterday. The price dropped heavily and finished the session significantly below the S2 support level, at 35430. Today it is showing mixed sentiment and the volatility is rather low. If the bulls take control over the market, the price might reach the EMA 200. But if the bears show their strength, the price could fall to 35000.