Yesterday the American indices performed differently. The S&P 500 and the Dow Jones Industrial Average showed mixed sentiment, but the NASDAQ 100 went down. Today all three of them are showing mixed sentiment and the volatility is rather low, though. What can they do next? Let’s try to answer that question in an analysis, S&P 500 first:

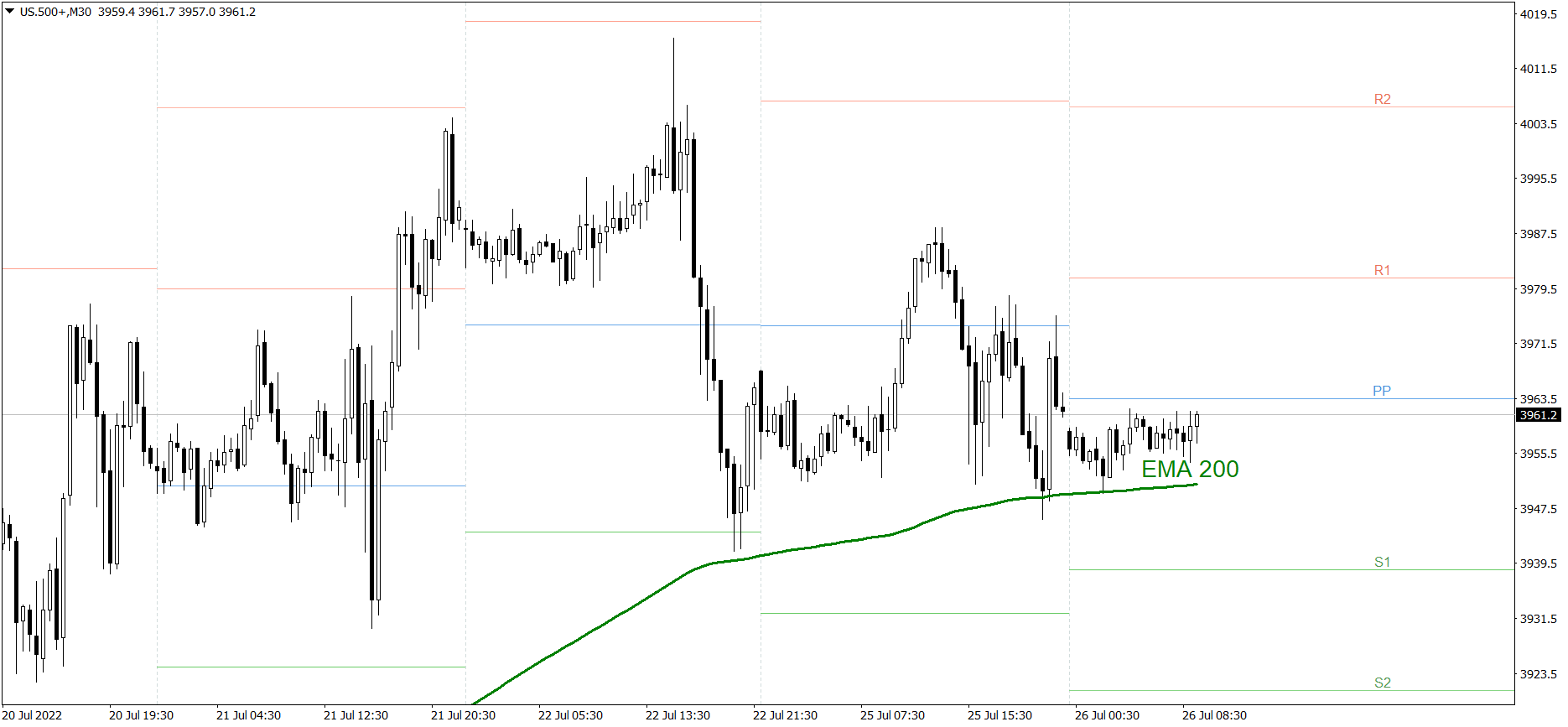

S&P 500

The S&P 500 showed mixed sentiment yesterday. The price finished the session at 3960. Today, still nothing really happens. The price is showing mixed sentiment and the volatility is really low. If the buyers take control over the market, the price might even reach the R1 resistance level and 3980 today. But if the bears show their strength, the price could drop below 3940 and reach the S1 support level.

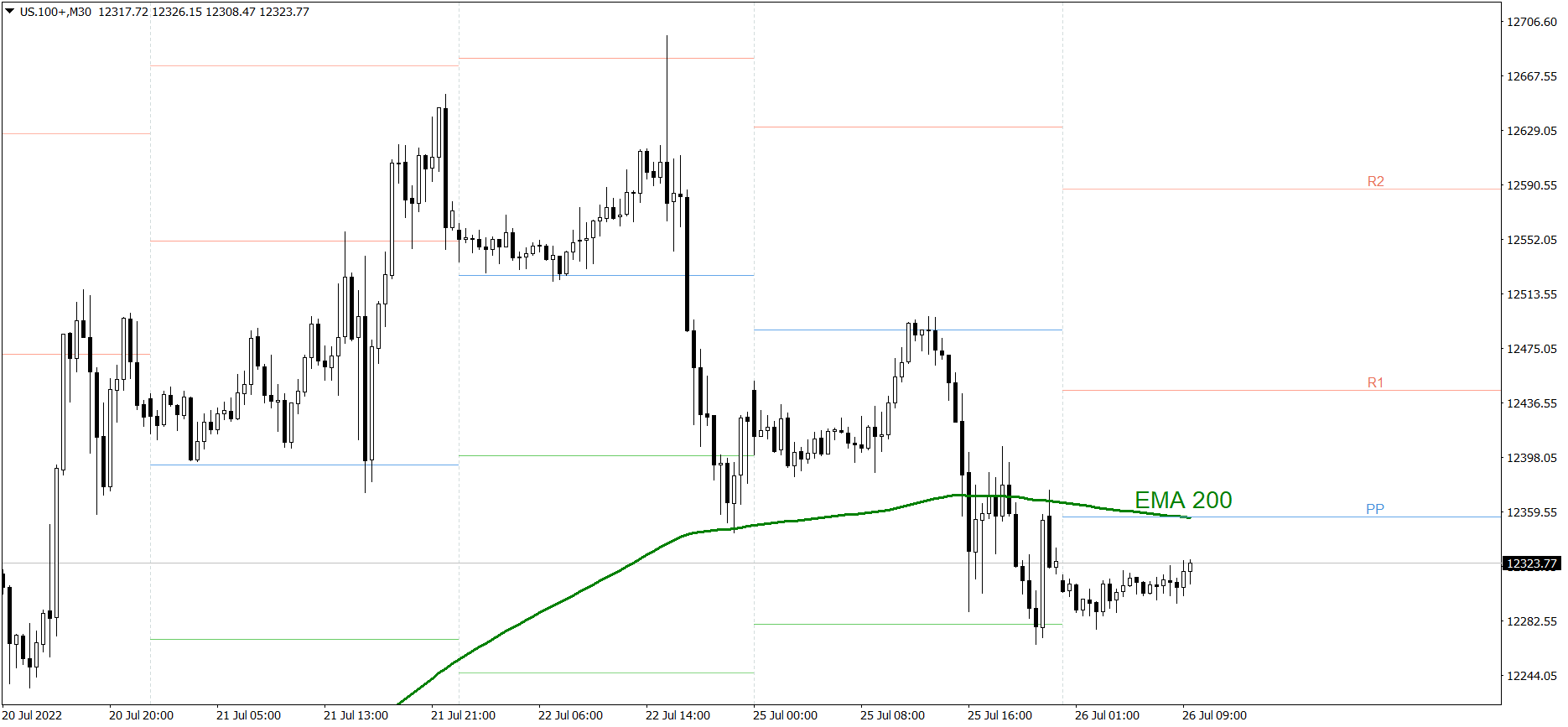

NASDAQ 100

NASDAQ 100 went down yesterday. The price finished the session slightly above 12320. Today it is showing mixed sentiment and the volatility is really low. If the buyers take control over the market, the price might rise above the Pivot Point and the EMA 200, and reach 12400. But if the bears show their strength once again, the price could drop below 12250.

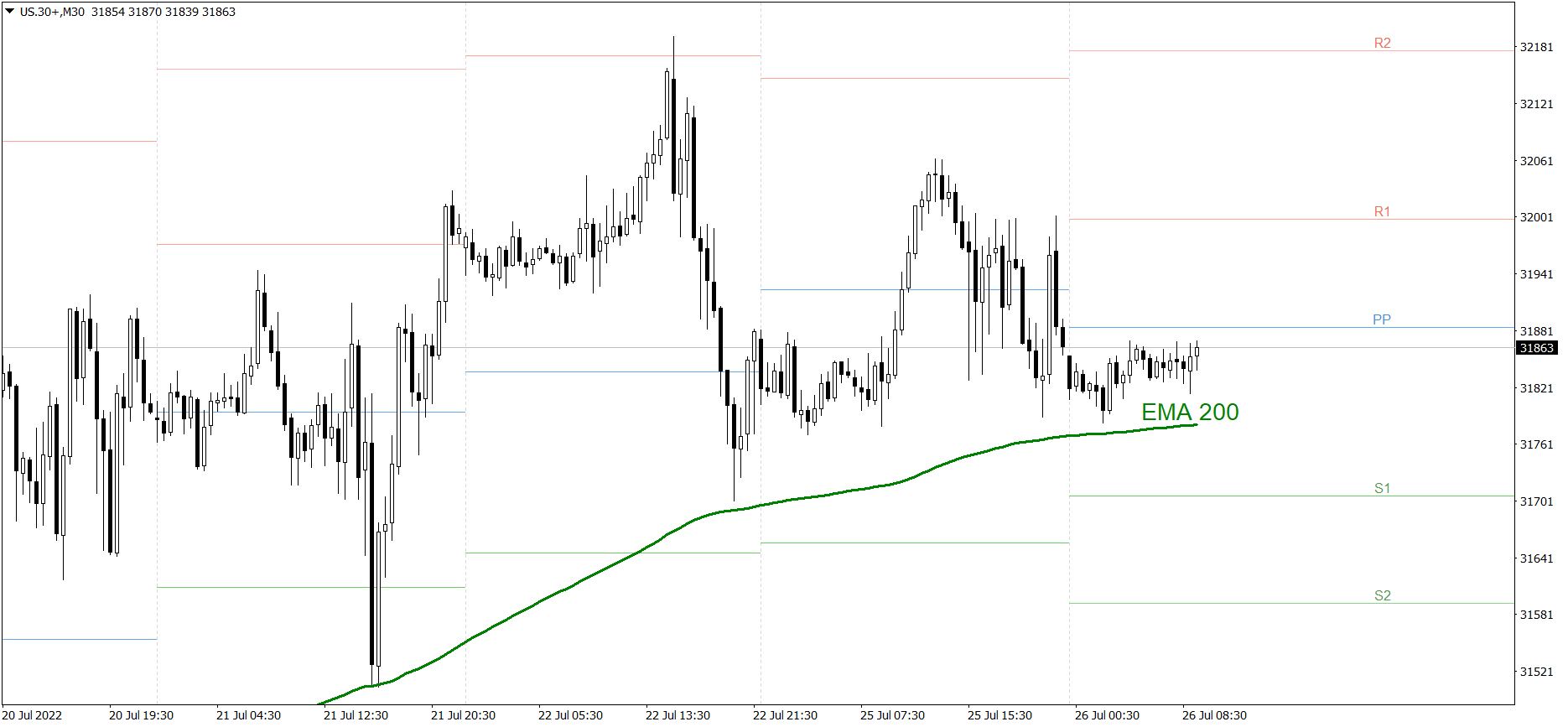

Dow Jones Industrial Average

The DJIA index showed mixed sentiment yesterday. The price finished the session below the Pivot Point and 31900. Today, still nothing really happens. The price is showing mixed sentiment and the volatility is really low. If the buyers take control over the market, the price might even reach the R1 resistance level and 32000. But if the bears show their strength, the price could drop to the S1 support level and 31700.