Yesterday the American indices showed mixed sentiment. Today all three of them are still showing mixed sentiment and the volatility is rather low. What can they do next? Let’s try to answer that question in an analysis, S&P 500 first:

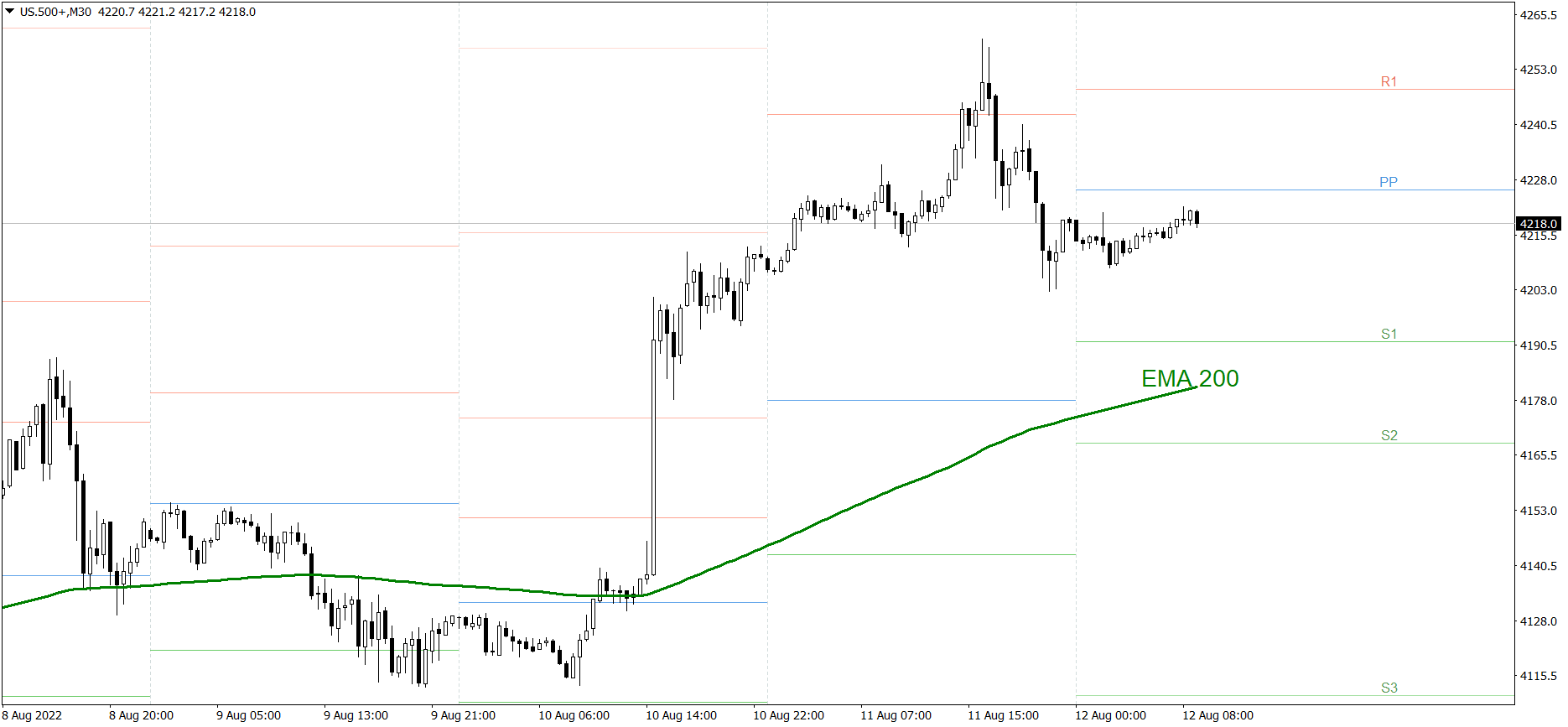

S&P 500

Yesterday the S&P 500 showed mixed sentiment. First the price rose above the R1 resistance level and 4250. Then it dropped and finished the session a little below 4220. Today the price is still showing mixed sentiment and the volatility is rather low. If the buyers take control over the market, the price might reach 4240 today. But if the bears show their strength, the price could fall below 4200.

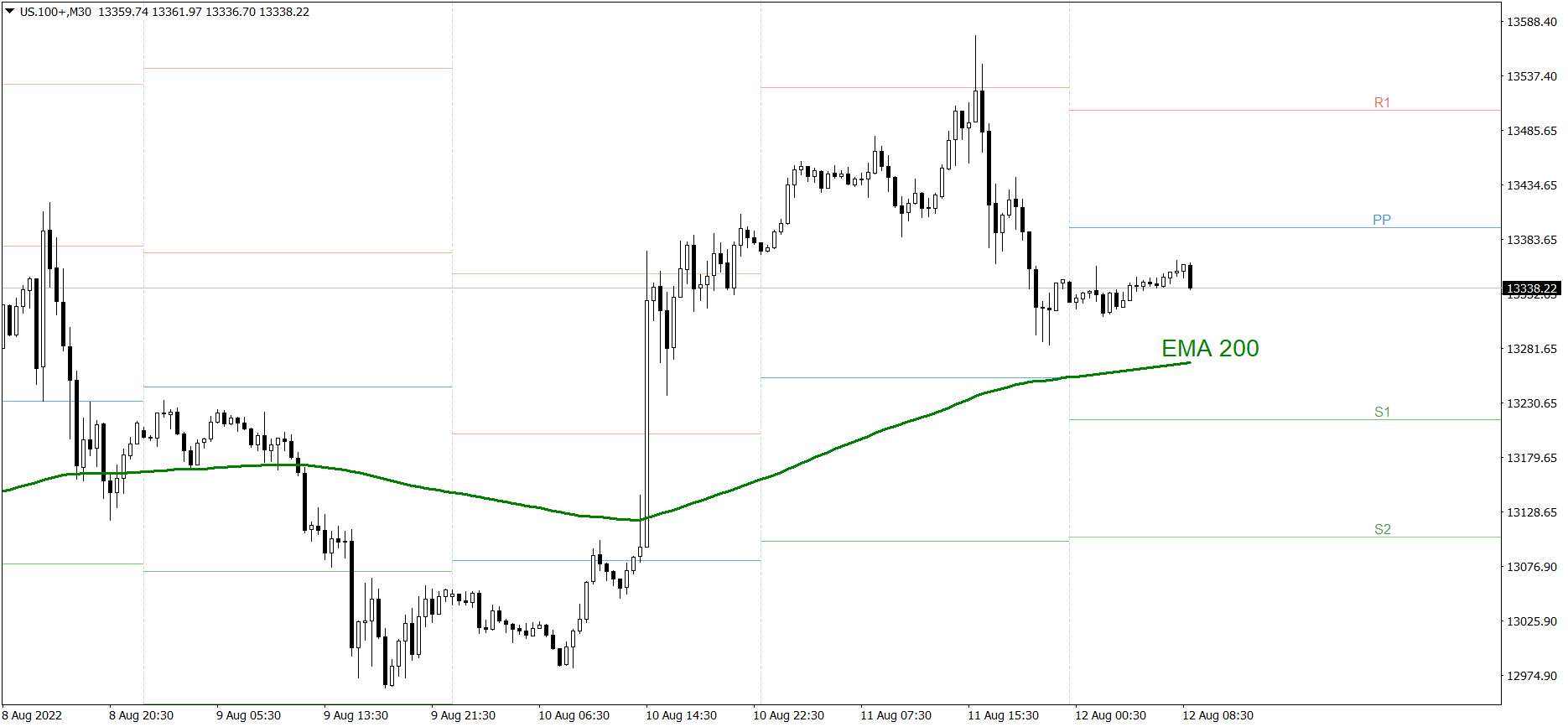

NASDAQ 100

NASDAQ 100 also showed mixed sentiment yesterday. First the price rose significantly and tested the R1 resistance level. Then it dropped heavily and finished the session slightly below 13350. Today the price is still showing mixed sentiment and the volatility is rather low. If the buyers take control over the market, the price might go up above the Pivot Point and reach 13400 today. But if the bears show their strength, the price could fall below the EMA 200 and reach 13250.

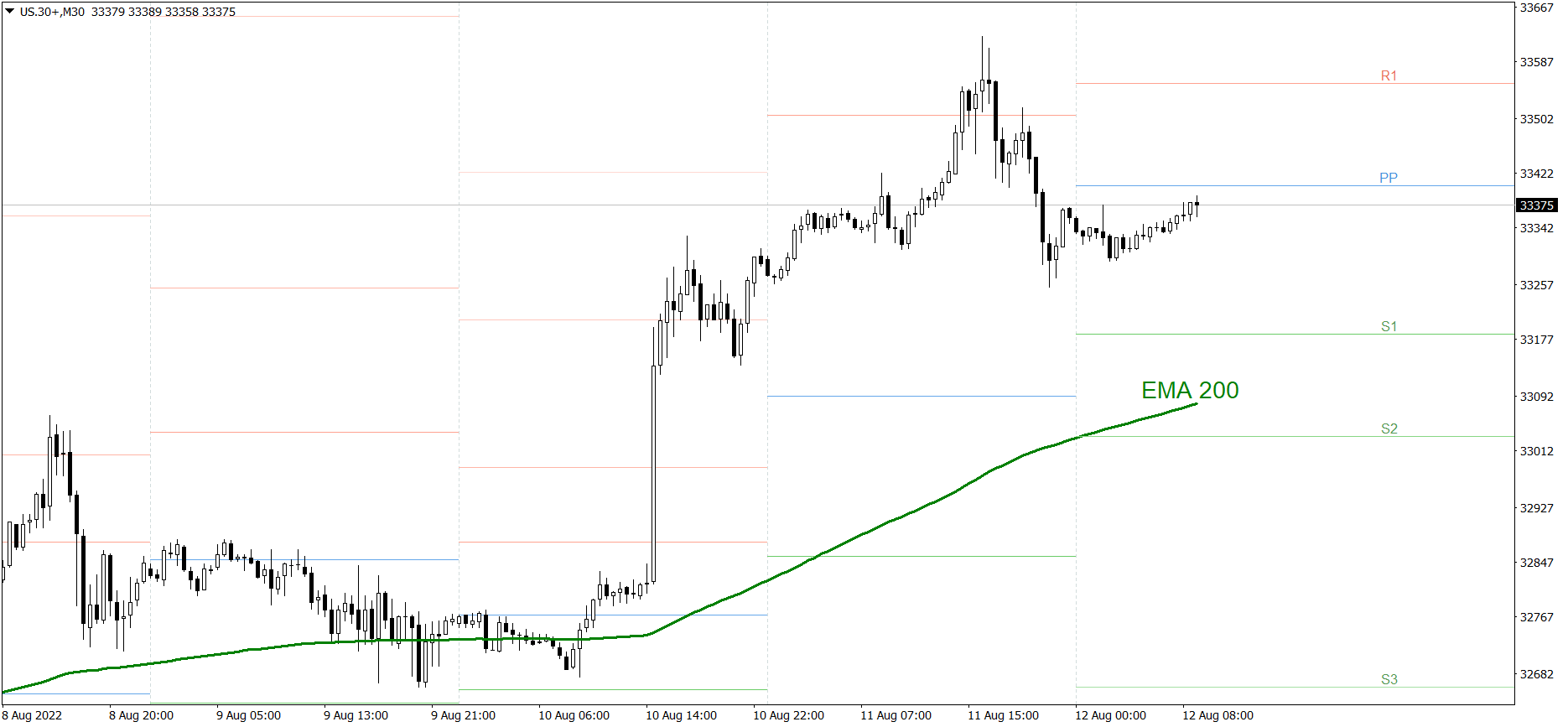

Dow Jones Industrial Average

The DJIA index showed mixed sentiment yesterday as well. First the price rose above the R1 resistance level and 33600. Then it dropped and finished the session a little above 33350. Today the price is still showing mixed sentiment and the volatility is rather low. If the buyers take control over the market, the price might go up above 33500 today. But if the bears show their strength, the price could fall below 33250.