Yesterday the American indices performed differently. The S&P 500 and NASDAQ 100 went down, but the Dow Jones Industrial Average showed mixed sentiment. Today they are going down even more. From the data front, the nonfarm payrolls and unemployment rate in February will be published. Anyway, let’s start the analysis, S&P 500 first:

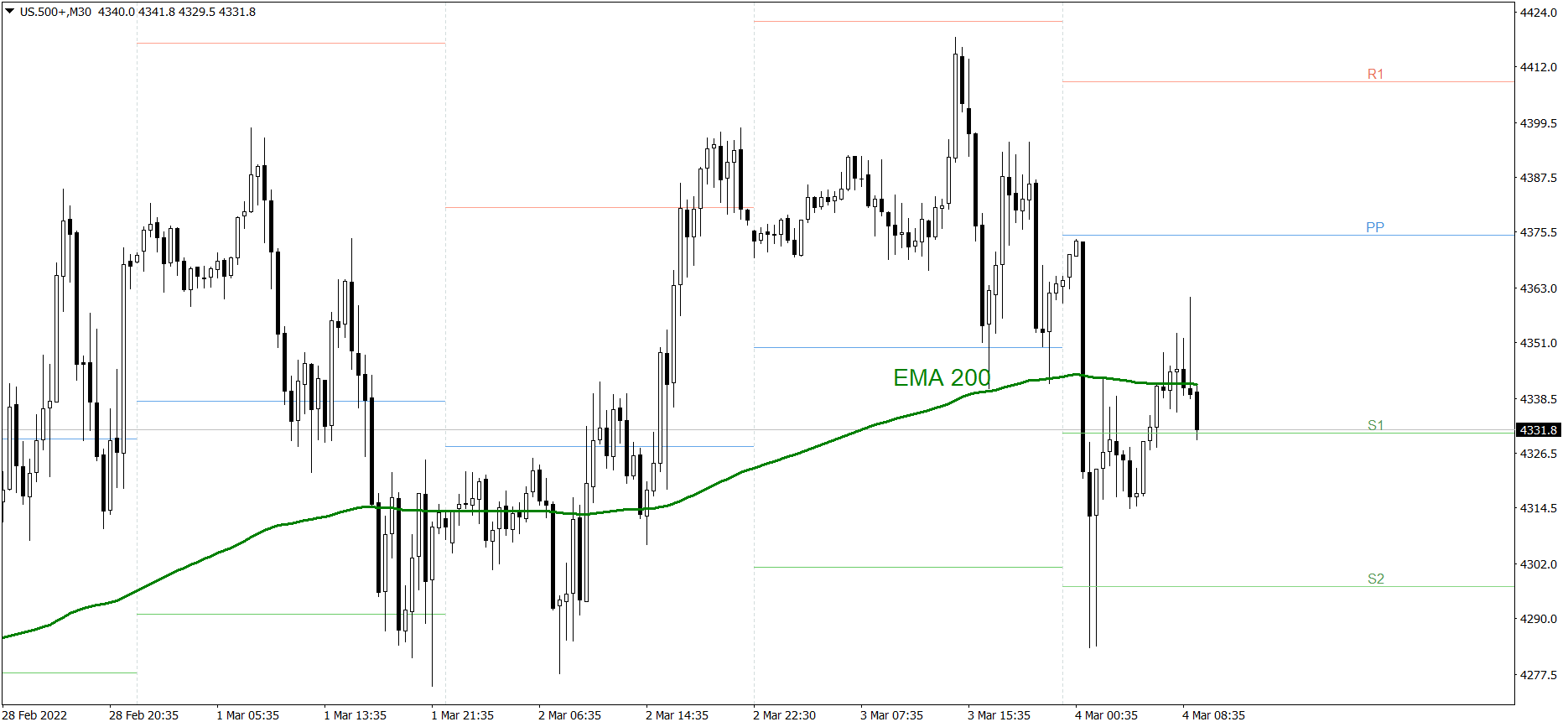

S&P 500

The S&P 500 dropped a bit yesterday. The price finished the session slightly above 4360. During the first hours of today’s Asian trading session it went down below the S2 support level and 4280. Then it managed to rise above the EMA 200, but this morning it started falling once again. Right now the bulls are trying to defend today’s S1. If they do it successfully, the price might bounce and reach 4350. But if they fail, the price could return below today’s S2 and 4300.

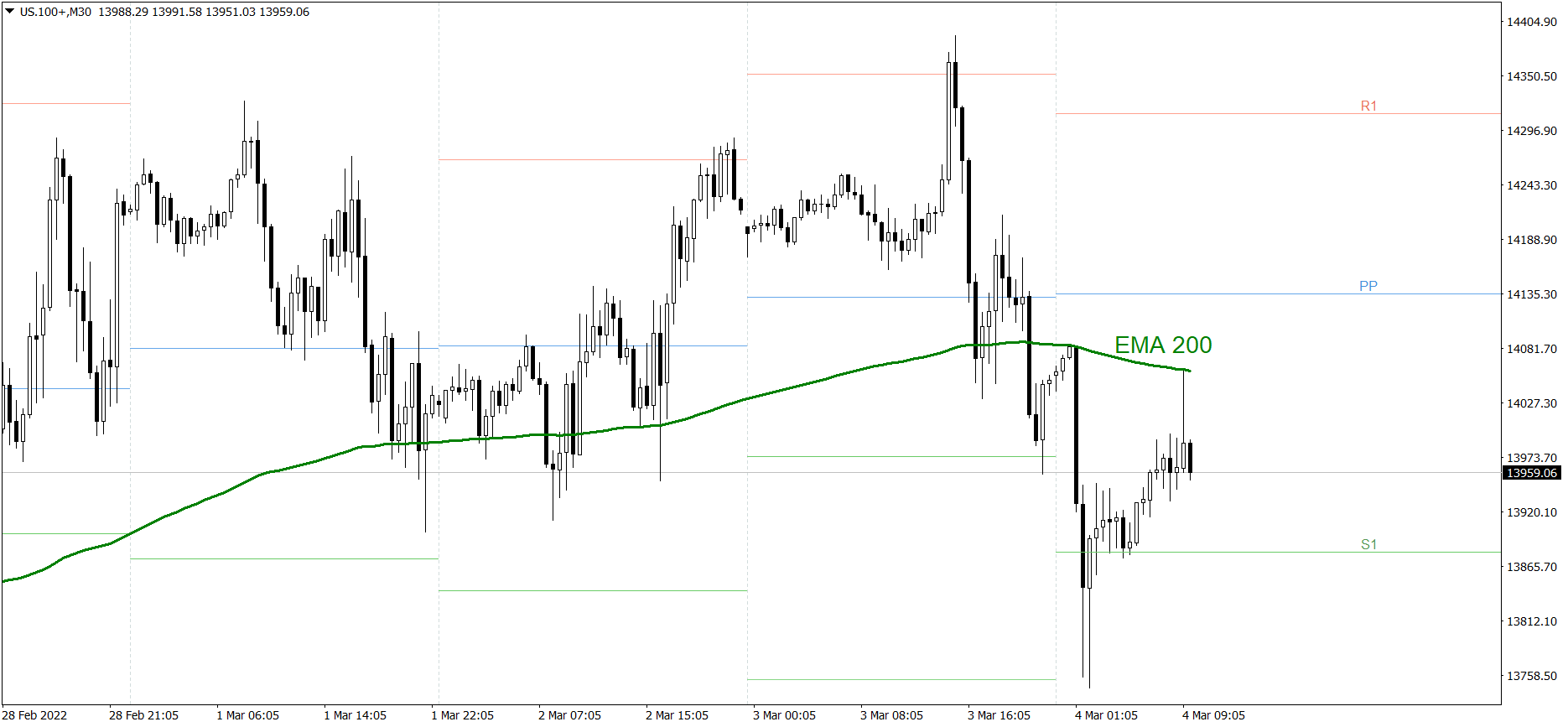

NASDAQ 100

NASDAQ 100 was the weakest one yesterday. The price dropped significantly and finished the session below the EMA 200, slightly above 14050. Today it is going down even more. The price is already near 13950. If the buyers don’t generate some serious appetite soon, the price could fall below the S1 support level today and even reach 13800. But if they do, the price might rise above the EMA 200 and reach 14100.

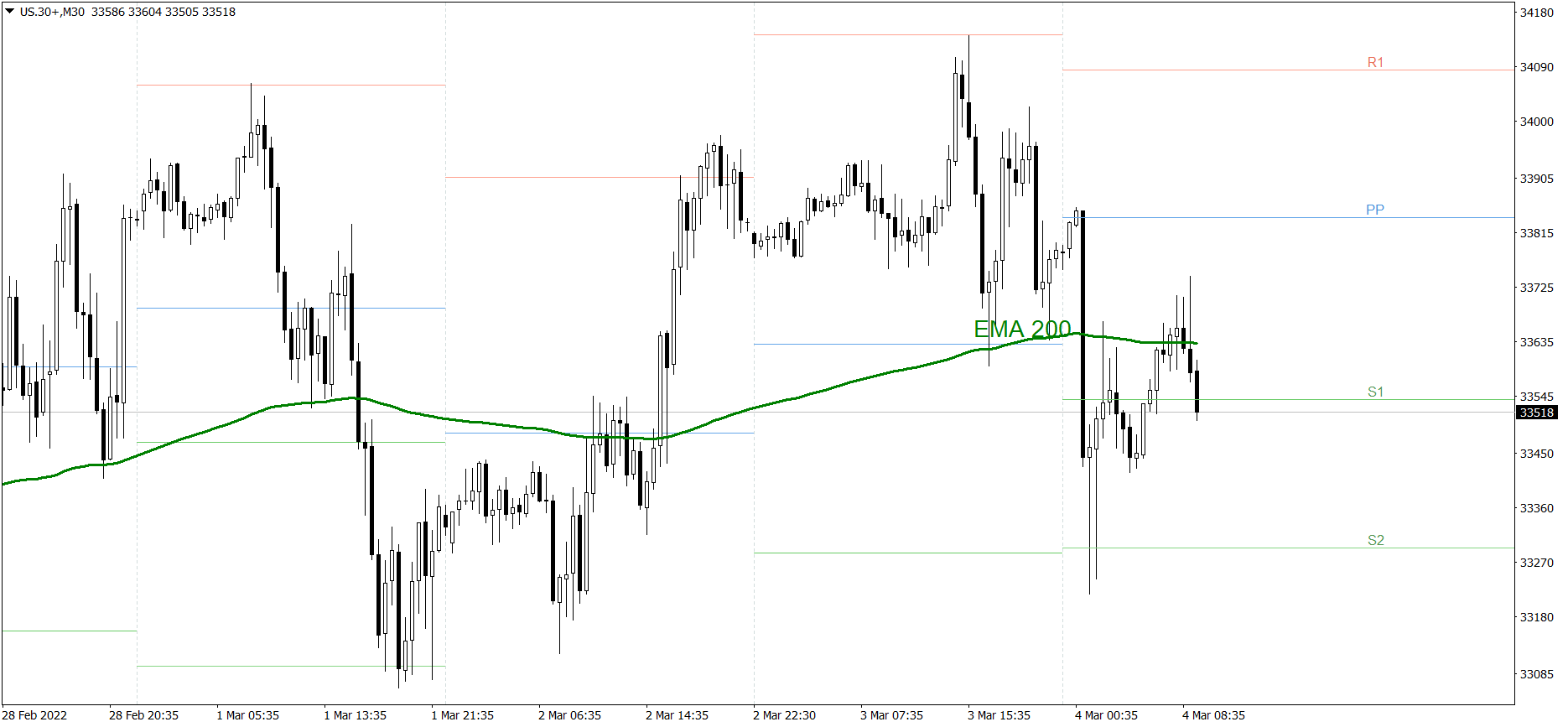

Dow Jones Industrial Average

The DJIA index was the strongest one yesterday. The price showed mixed sentiment and finished the session slightly below 13800. During the first hours of today’s Asian trading session it went down below the S2 support level. Then it managed to rise above the EMA 200, but this morning it started falling once again. Right now the bulls are trying to defend today’s S1. If they do it successfully, the price might bounce and reach 33700. But if they fail, the price could return below today’s S2 and reach 33200.