Yesterday, the EURUSD showed mixed sentiment and the GBPUSD dropped significantly. Today, the EURUSD is still showing mixed sentiment, but the GBPUSD is rising. From the data front, all eyes will be focused on the Fed meeting. There is some disagreement in the market as to whether there will be hints of an earlier slowdown in QE or not. Heightened inflation in May and actions by other central banks suggest that the Fed should use hawkish rhetoric, but the weak labor market report for two months in a row is a strong counterargument. Anyway, let’s start the analysis:

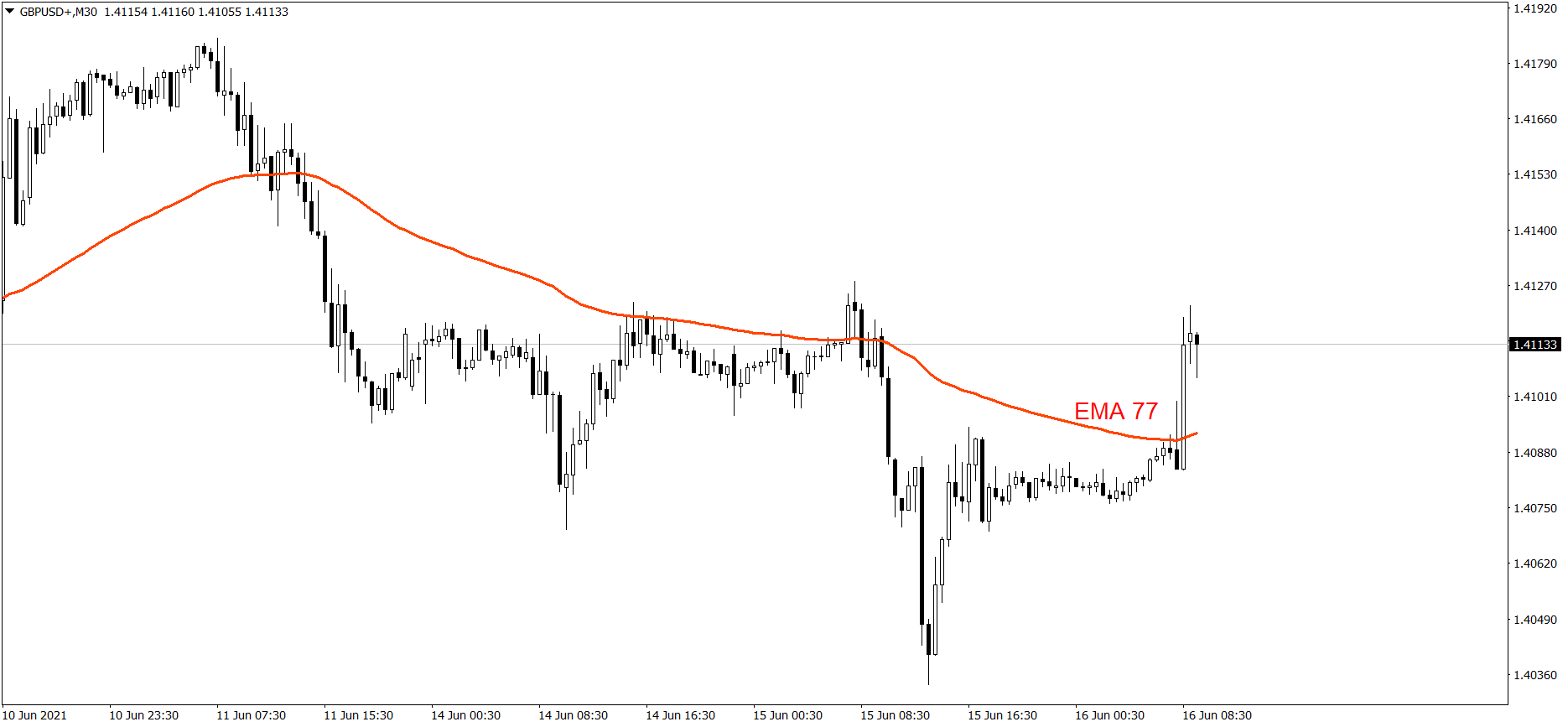

EURUSD

The EURUSD showed mixed sentiment yesterday. The bulls weren’t strong enough to stay above the R1 resistance level and the EMA 200. Today, still nothing really changes. Volatility is not increased and the price is close to the Pivot Point. If the buyers take control over the market, the price might reach the R1 resistance level today. But if the bears show their strength, the price could drop to the S1 support level.

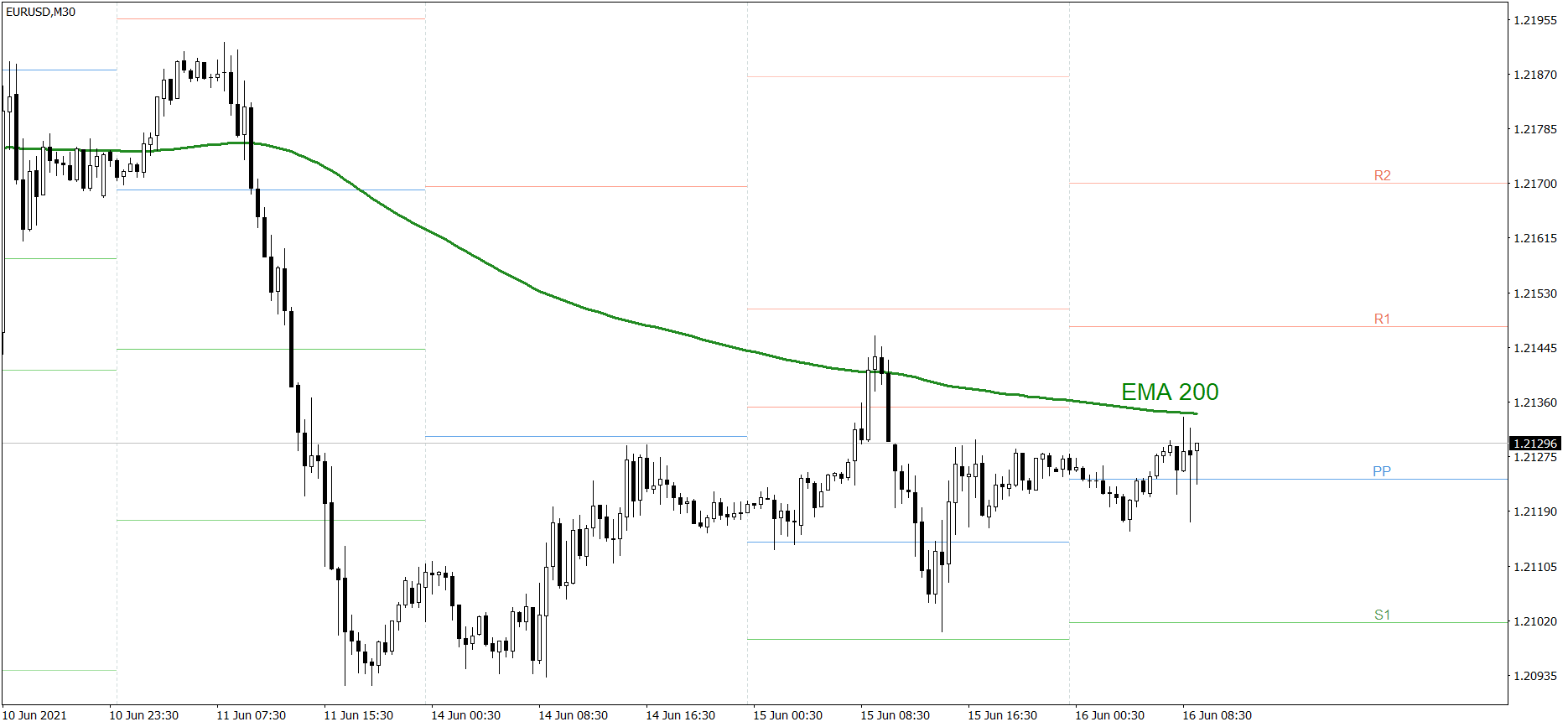

GBPUSD

The GBPUSD dropped significantly yesterday. The price finished the session at 1.408. However, it is rising today. The GBPUSD is already above the EMA 77 and 1.41. If the buyers continue generating firm demand, the price might reach 1.415 today. But if the bears counterattack, the price could return below the EMA 77 and 1.41.