Yesterday the American indices performed differently. The S&P 500 and the NASDAQ 100 rose strongly and set their new all-time highs, but the Dow Jones Industrial Average slightly dropped. Today all three of them are showing mixed sentiment and the volatility is rather low. From the data front, all eyes will be focused on nonfarm payrolls and the unemployment rate in October. Anyway, let’s start the analysis, S&P 500 first:

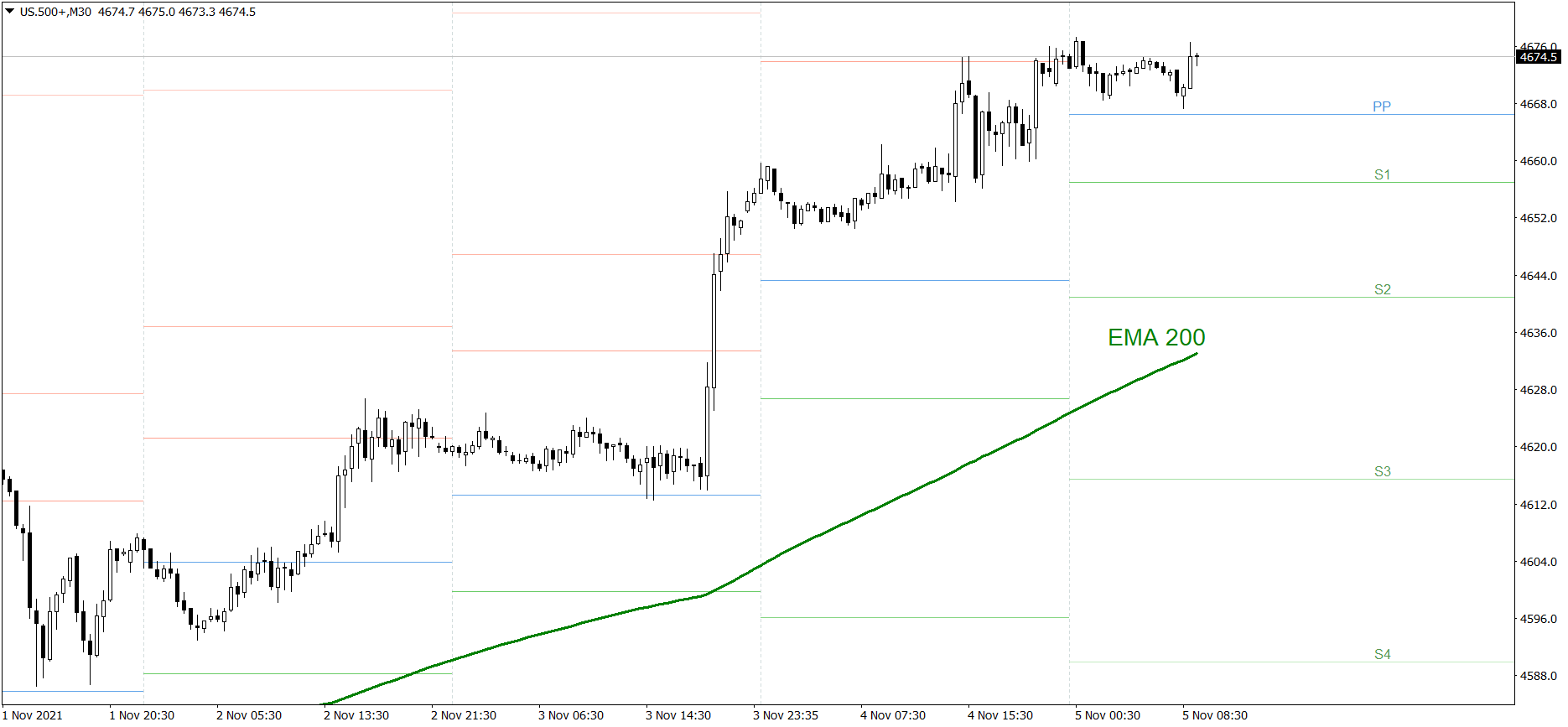

S&P 500

Yesterday was another good bullish session. The S&P 500 rose significantly, set the new all-time high and finished the session at the R1 resistance level. Today the price is showing mixed sentiment and the volatility is rather low. If the bulls show their strength once again, the price might reach 4690 today. But if the bears take control over the market, the price could drop to the S1 support level.

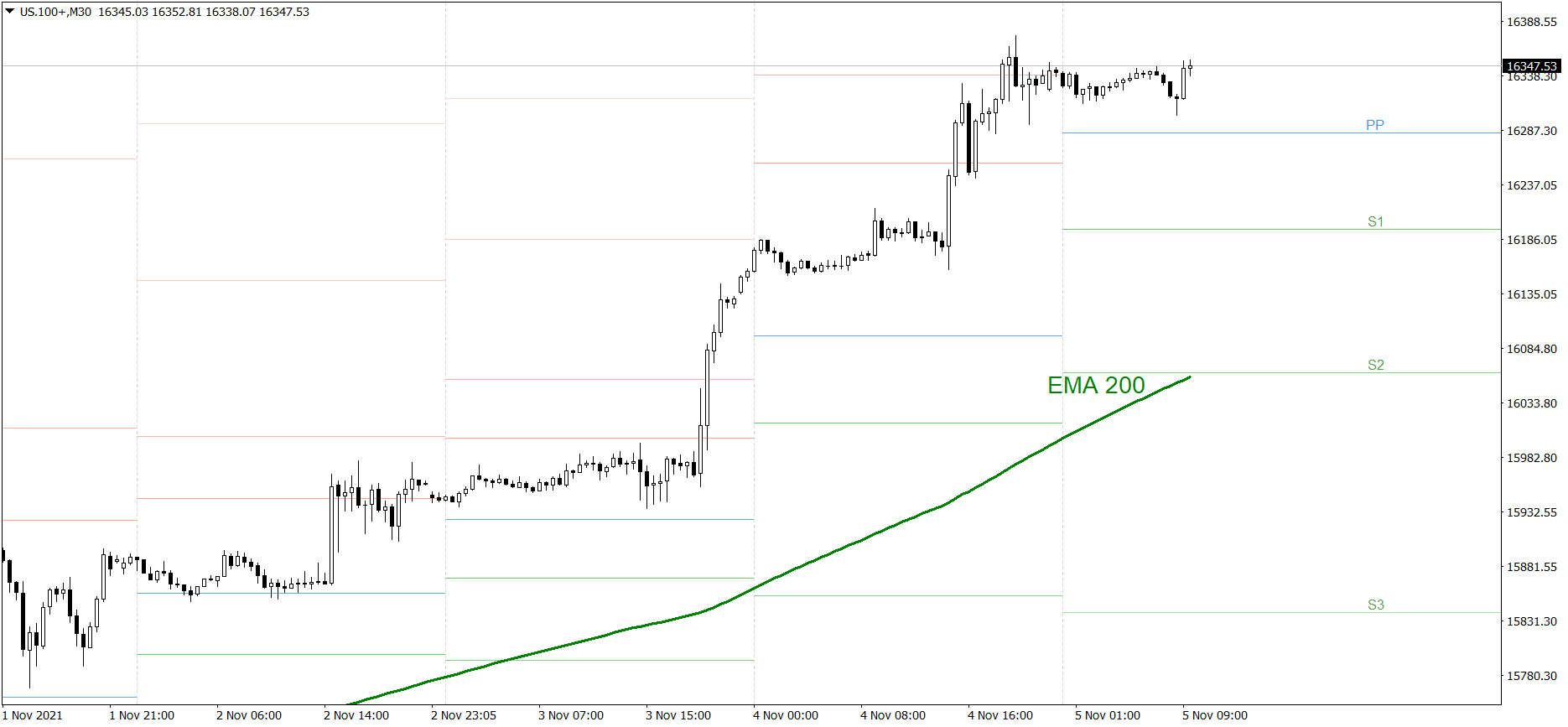

NASDAQ 100

NASDAQ 100 was the strongest one yesterday. The price set the new all-time high and finished the session at the R2 resistance level, a little below 16350. Today it is showing mixed sentiment and the volatility is rather low. If the bulls show their strength once again, the price might reach 16500 today. But if the bears take control over the market, the price could drop to the S1 support level.

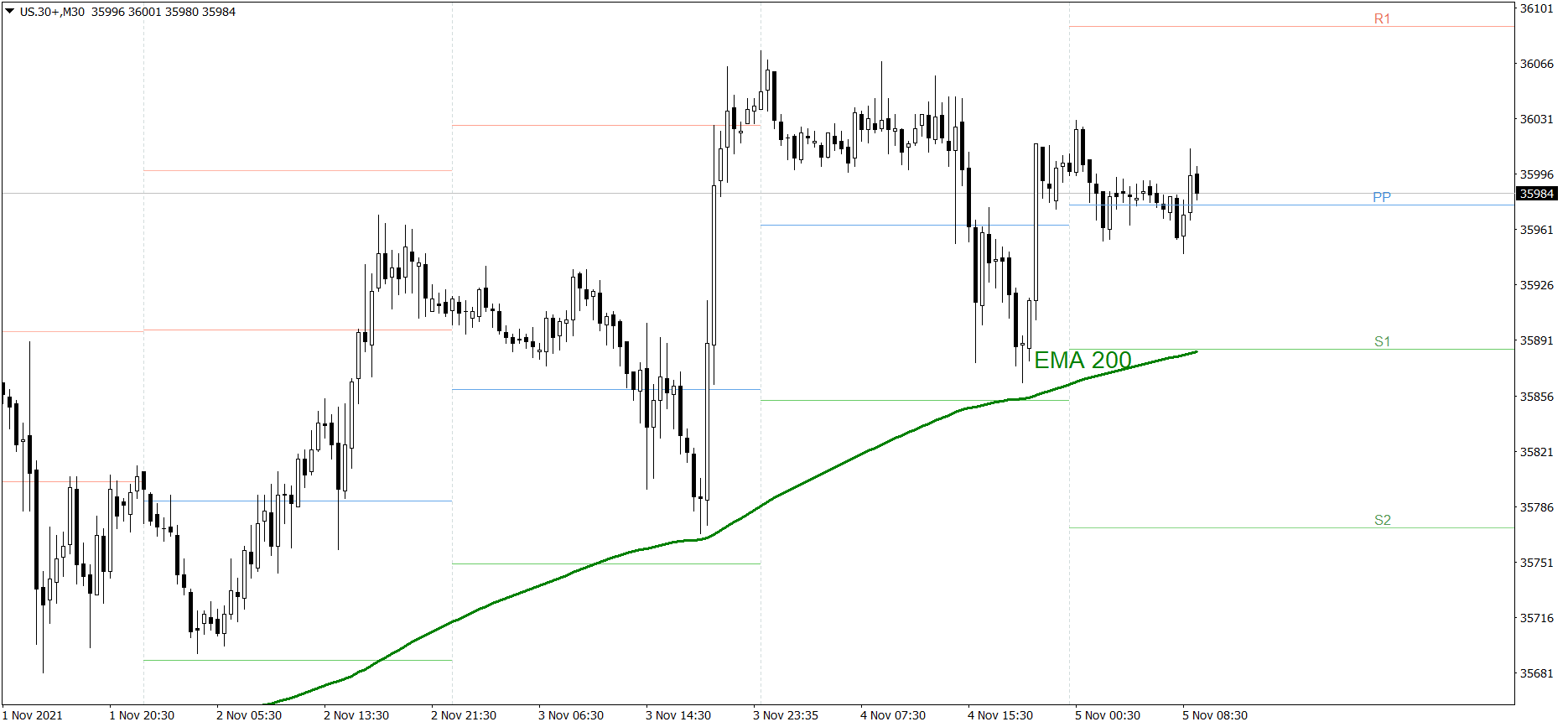

Dow Jones Industrial Average

The DJIA index was the weakest one yesterday. The price showed mixed sentiment and finished the session at 36000. Today it is still showing mixed sentiment. Right now the price is slightly above the Pivot Point. If the bulls show their strength, the price might set the new all-time high and reach the R1 resistance level today. But if the bears take control over the market, the price could drop to the S1 support level.