Yesterday was a bearish session. All three American indices dropped and finished the session below their S1 support levels. Today they are showing mixed sentiment. From the data front, building permits in July and FOMC meeting minutes will be published. Anyway, let’s start the analysis, S&P 500 first:

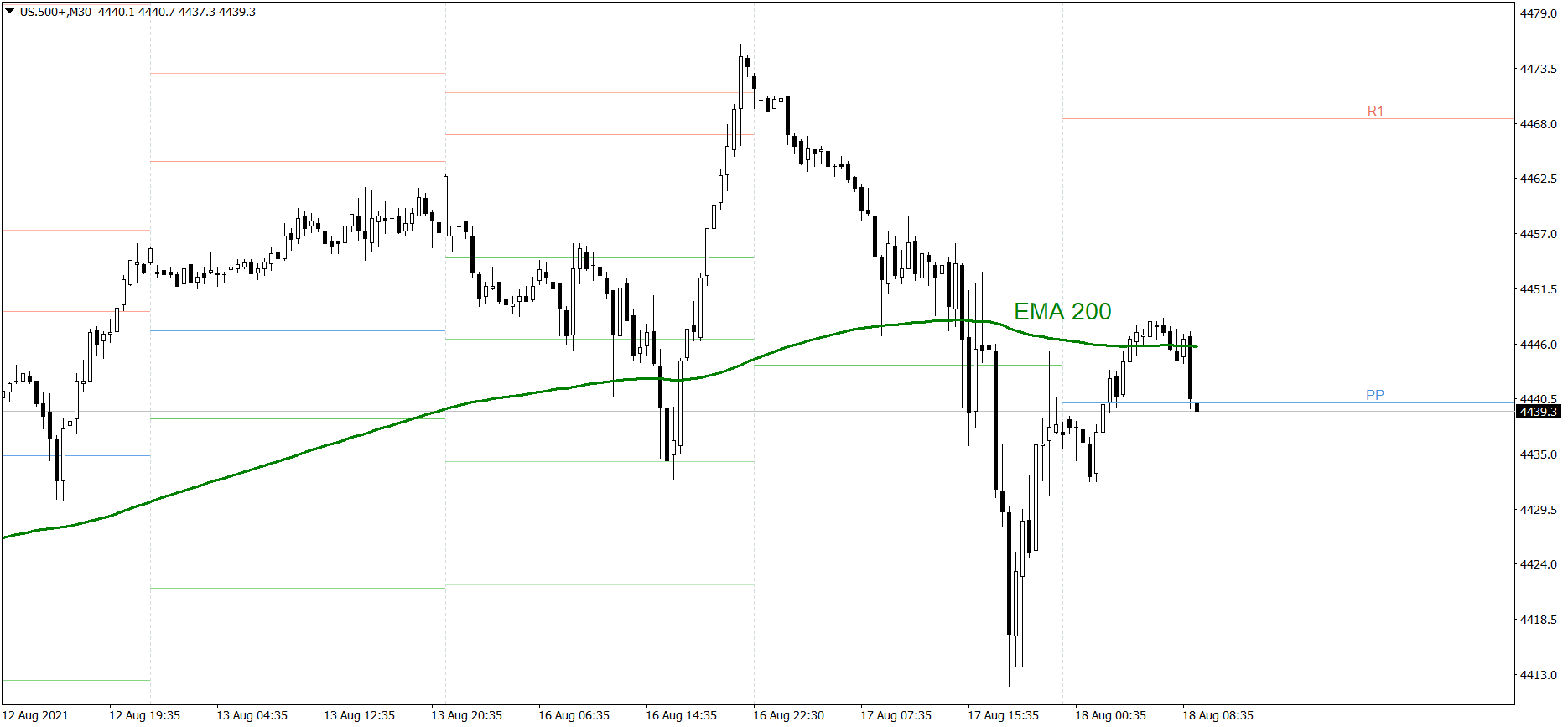

S&P 500

After setting the new all-time high on Monday, the S&P 500 dropped significantly yesterday. The price finished the session below the S1 support level and 4440. Today it is showing mixed sentiment. Right now the bulls are trying to defend the Pivot Point. If they do it successfully, the price might rise above the EMA 200 and 4450. But if they fail, the price could fall below 4420.

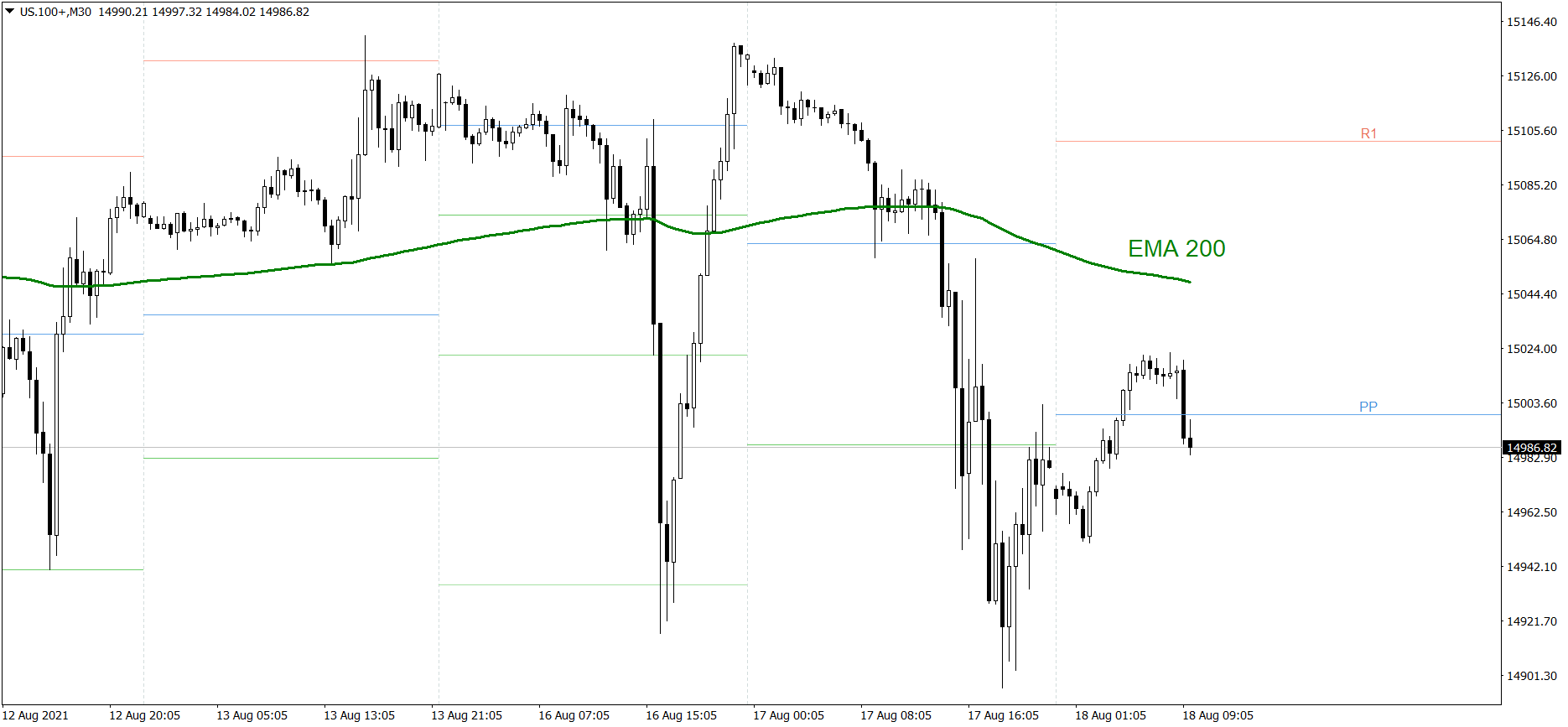

NASDAQ 100

NASDAQ 100 also dropped heavily yesterday. The price finished the session below the S1 support level and 15000. Today it is showing mixed sentiment. First the price went up, but this morning it dropped below the Pivot Point and 15000. If the buyers don’t generate some serious appetite soon, the price could even fall to 14900 today. But if they do, the price might rise above the EMA 200.

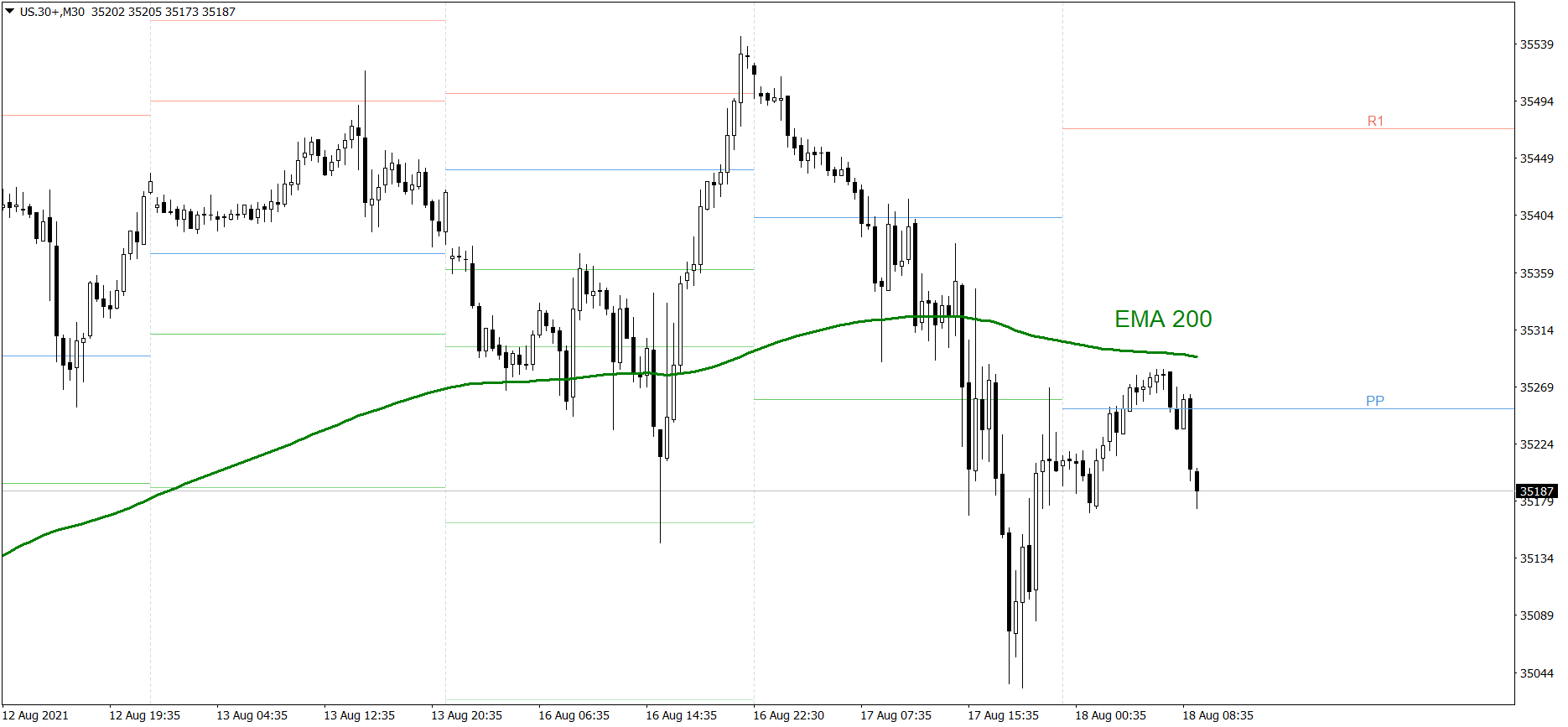

Dow Jones Industrial Average

After setting the new all-time high on Monday, the DJIA index dropped deeply yesterday as well. The price finished the session below the S1 support level. Today it is showing mixed sentiment. First the price went up, but this morning it dropped below the Pivot Point. If the buyers don’t generate some serious appetite soon, the price could even fall below 35000 today. But if they do, the price might rise above the EMA 200