On Friday the American indices showed mixed sentiment and the volatility wasn’t really high. The S&P 500 and NASDAQ 100 slightly went down and the Dow Jones Industrial Average was a little stronger. Today all three American indices are falling heavily. How far can they go? Let’s try to answer that question in an analysis, S&P 500 first:

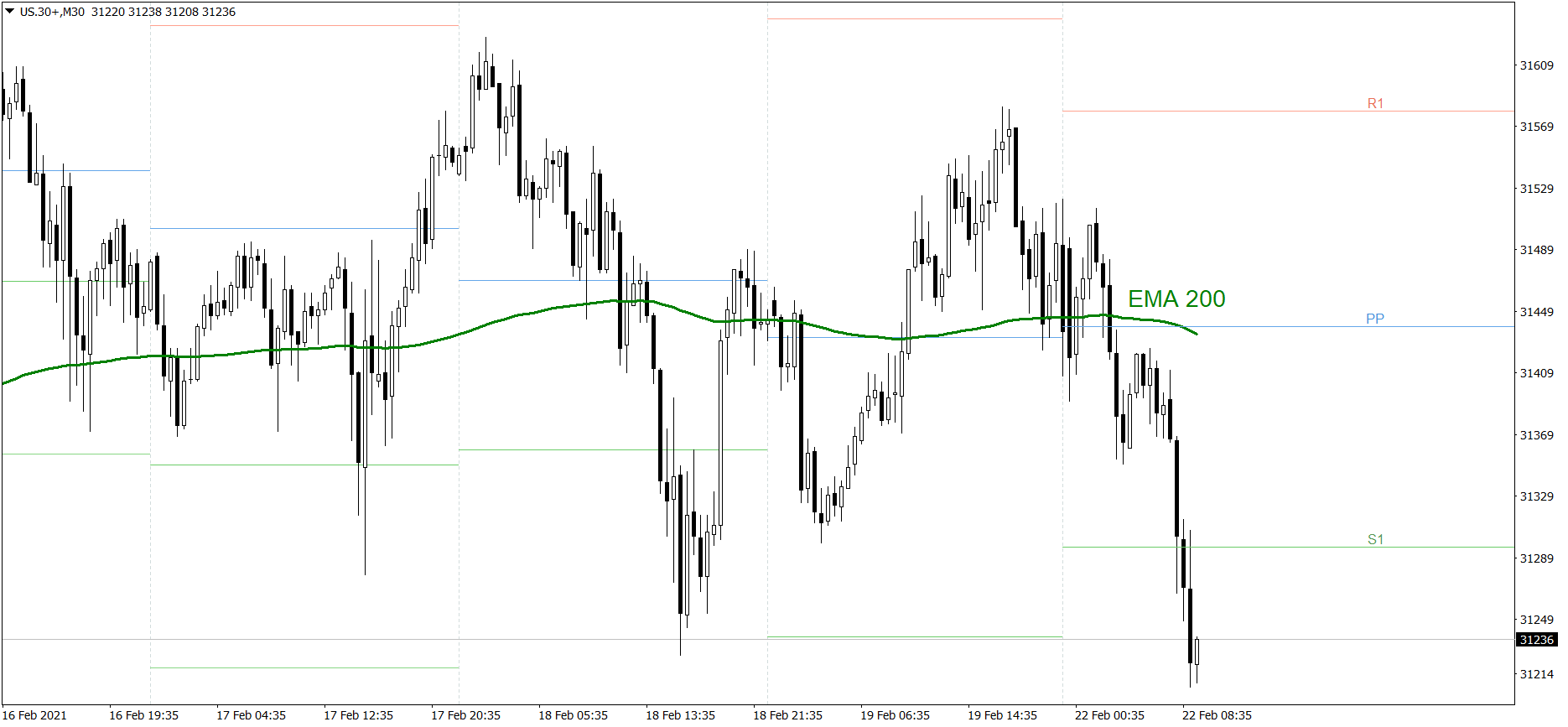

S&P 500

The S&P 500 showed mixed sentiment on Friday and the volatility was rather low. It managed to finish the week above 3900. However, the price is falling heavily today. Right now it is at the S2 support level. If the bulls don’t generate sufficient appetite there, the price could drop to 3850. But if they do, the price might return above the S1.

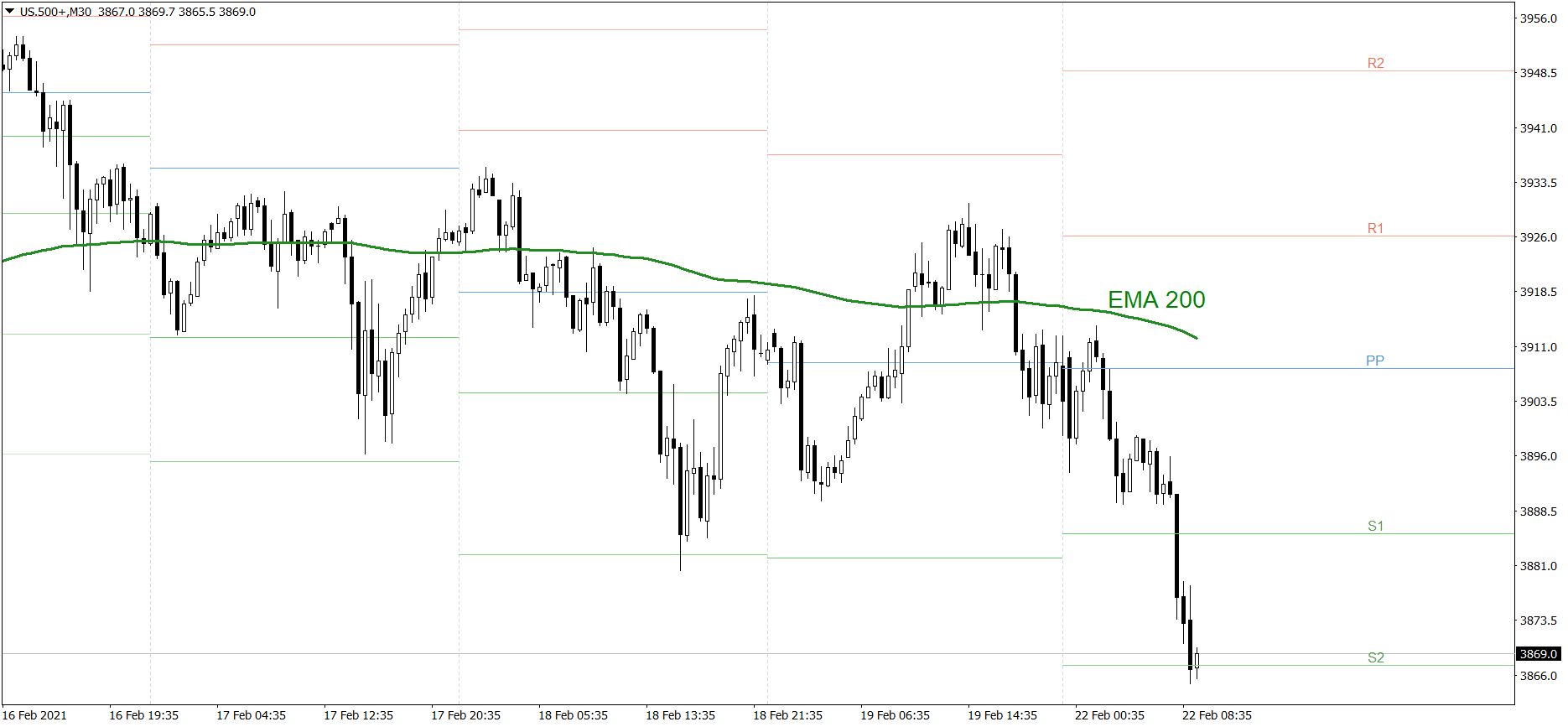

NASDAQ 100

NASDAQ 100 also showed mixed sentiment yesterday. The price finished the week slightly below 13600. However, the price is falling heavily today. Right now the bulls are trying to generate some appetite and defend 13400. If they do it successfully, the price might rise above the S1 support level. But if the bears still show their strength, the price could even test 13300 today.

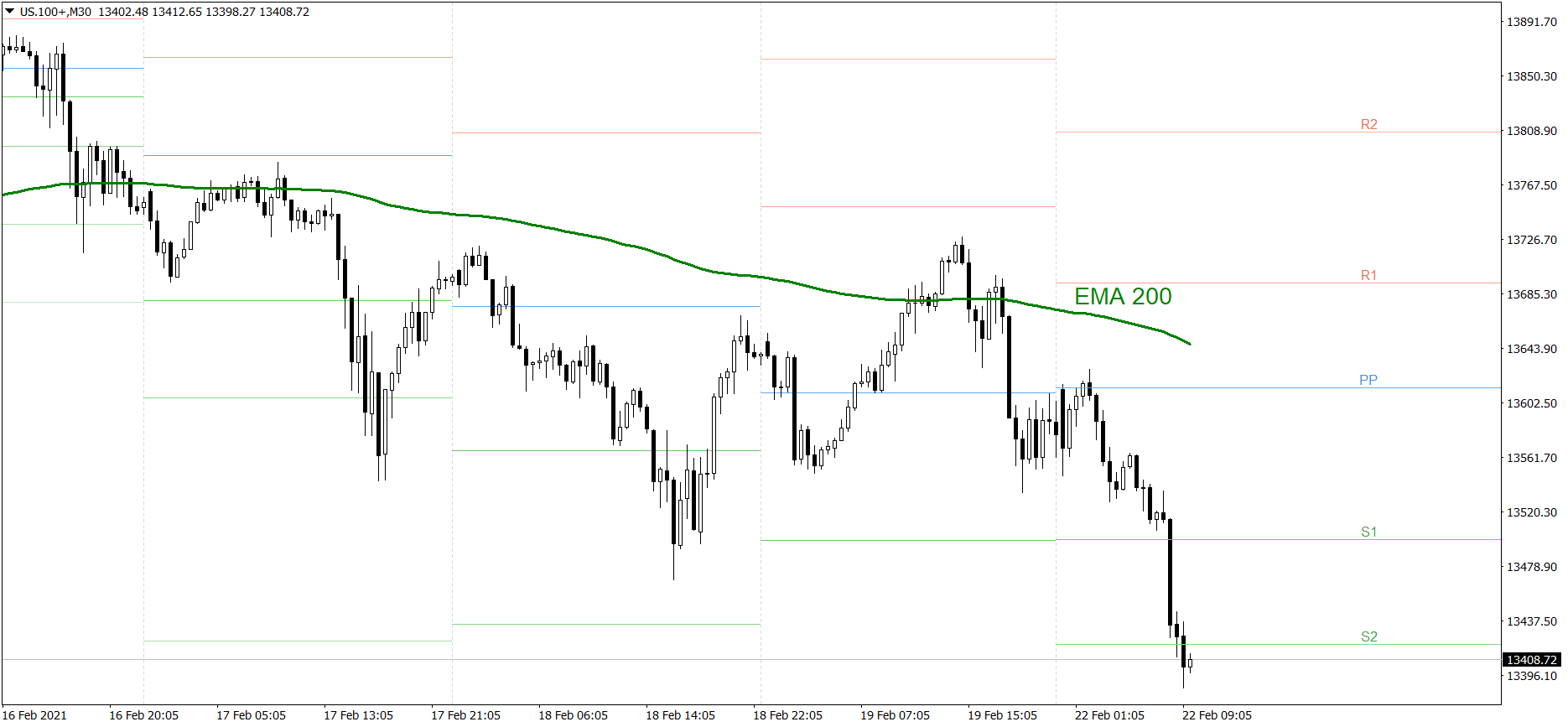

Dow Jones Industrial Average

The DJIA index showed mixed sentiment on Friday. It was a bit stronger than the others and finished the week at the EMA 200. However, the price is falling heavily today. If the bulls don’t generate sufficient appetite pretty soon, the price could drop below 31000 today. But if they do, the price might return above the S1 support level.